10 Jan Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of January 11th 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

- SP 500 over 3800 and heading to my 3996 Major 5 Target it looks like (Chart weekly)

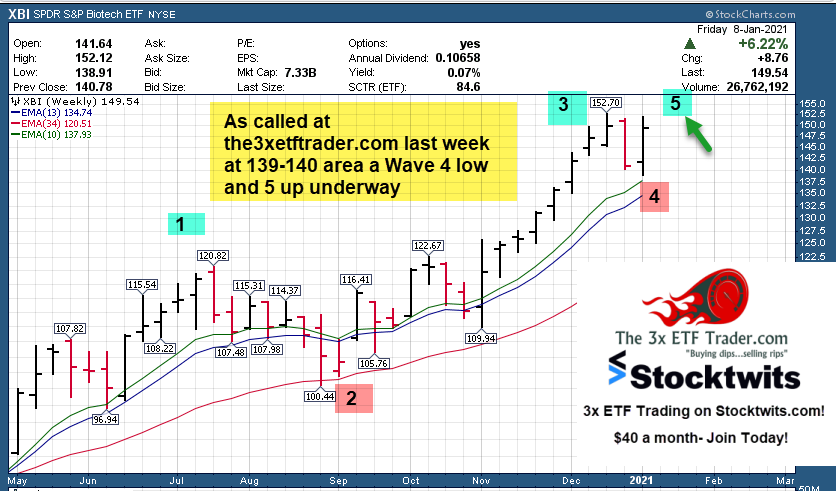

- XBI ETF bottoms out in Wave 4, Wave 5 underway to highs (3x ETF Trade LABU this past week, Chart)

- MARA play rallies 150% this past week, Sunday recommendation last week, and SRP Trade!!

- GOLD takes a nasty hit last week somewhat unexpected (No position)

- TPS Members see explosive move up in ATOM last few weeks (Now a 4 bagger)

- Be on guard for market top as we approach 4,000 area on SP 500

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- SRP Stocks- VIPS 12% gains taken, LOVE 9% gains on 1/2 taken, MARA 100% gains taken

- 3x ETF- 20% gains in a few days on my Biotech based LABU 3x ETF Trade alert (99 to 119)

- ES Futures- Futures guidance remains bullish for 3996 possible

- TPS- Latest stock research recommendation up 100% in 3 weeks. ATOM ripping higher and is now up from $7 recommendation to $27.30, last chance to join, almost sold out

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

The SP 500 continues higher in Major Wave 5 and held that 3650 support line noted here last Sunday in the weekly report. 3996 remains my high upside target for Major 5 that has been published here for 10-11 weeks now. As long as the 34 day EMA line holds on the daily chart, the uptrend is intact.

Biotech was bottoming out in a Wave 4 correction, so in the 3x ETF Trading service I alerted a 10% allocation long position at 97-100 during the week on the very last day of the pullback. It then soared 23% in a few days, that is how fast the 3x ETF trading can go in your favor when you see the behavioral pattern finishing ahead of the next pattern or wave. In this service I focus on Behavioral patterns for various Bull and Bear 3x ETF trades and position members ahead of those moves for big gains on a consistent basis. (See the sample XBI Chart sent to members this week before the big upturn (We used LABU for 3x exposure to XBI ETF)

Gold took a big hit this past week, unexpected and the chart is a bit of a mess right now.

MARA was a huge winner, I noted it on linked in and elsewhere last Sunday that it was a good proxy for Bitcoin investors to use, and it rallied 150% this past week. SRP members had a long position coming into the week and closed the last of it out on Friday for 100% plus gains. A record for a swing trade for us.

The TPS service (Long term tipping point stocks based on my research) is nearly hitting the max number of subscribers (200). We are up a 4 bagger on ATOM since the summer, and have had 6 stocks double or more in last 12 months. New positions coming soon, most recent one is up 100% in 3 weeks. Read up and join soon at tippingpointstocks.com

The market could top out in the next few weeks at 3996 area on SP 500, if we go much above that its an “Extension” wave which happens. Those are tough to forecast, so for now watch that near 4000 zone for a possible top.

My 2021 projections were sent out also at the end of December, be sure to review those if you missed it.

Charts this week , SP 500 Weekly, XBI ETF (Biotech), XBI from 3x ETF Trader

Prediction made on Tuesday morning (Chart from 3x ETF Trader below) played out as xbi rallied hard to 149

Limited to 200 members max, only 9 spots left as of 1/10/21

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. We closed out TBIO for 50 and 80% gains on tranches recently. Added a new position 3 weeks ago already up 100%. Among recent and ongoing winners OTRK, TFFP, PRVB, ATOM and more!

Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

Last week big moves up on LOGI, FUTU (up 41%), STRO, LOVE, INMD, and HOLX off this list.

SRP is long on both LOVE and INMD

Ideas: 14 ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined

ETSY- 4 week base pullback to 10 week line. ETSY Returns to the list

HZO- 3 week corrective base near 52 week highs. Operates 59 retail stores in 16 states selling new and used

recreational boats, pleasure and fishing boats. 2nd week in row on list.

RGEN- 10 week nice consolidation near highs for bioprocessing products specialist for life science customers, 3rd week in a row on the list

AMD- 3rd week in row on the list, 6 week ascending base at 52 week highs. Chip maker is a leader.

CHEG- 3 weeks tight base near highs for online education tools provider

APPS- On and off the list lately, 4 week corrective base near highs for App Developer

TPX- 4 weeks tight pattern near highs for maker of custom mattresses, 3rd week in row on list

SCPL- 7 month breakout possible for spin off from Scientific Games, online gaming etc

YETI- 5 week corrective base after hitting all time highs. Designs, manufactures and marketing innovative and outstanding outdoor products. 2nd week in row on list, we played this at SRP for gains not long ago.

FSLR- 2nd week in row on list, 3 week consolidation near highs. Manufactures and sells solar modules for residential and commercial markets in the U.S., Europe and Asia.

DBX- 3 week corrective pattern after breaking to highs, could reverse back up for storage play

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 7 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! ATOM up 300%!, INMB up 110%, just a few of the recent big winners! Fresh ideas every month.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)