28 Dec 2021 Market Forecasts and Investing Ideas Report

2021 MARKET FORECAST AND IDEAS

Dec 27 2020:

Time for my Annual list of ideas and forecasts for the next year. Last year my list was pretty spot on as I mentioned Bitcoin recapturing favor with investors, Lithium Stocks taking off, Inflation coming back, Energy stocks doing well, Biotech leading the way and Gold returning to favor amongst other themes.

The market is pretty toppy right now, sentiment is running at extremes not seen in many years across the board. The number of daily transactions at Ameritrade is over 300% higher than a year ago. SPAC’s are all the rage and tend to come at market tops, as weak companies duck the IPO process and insiders benefit. Chip stocks have been surging with no end in sight, and weak companies are going public and trading at absurd valuations. Its 1999 all over again, and this could continue for awhile, or not… subscribers will be kept up to date on a daily and weekly basis, as things can change on a dime. Last year we were 80-95% in cash during the bulk of the Corona based market crash and then stepped on the gas right on the day of the market bottom which I called on Twitter and elsewhere.

Some ideas for 2021: (Updated in my services as the year goes on, but it’s fun to speculate in advance of the coming calendar year)

Keep in mind some of these are a bit extended (Biotech, Bitcoin, Bitcoin Miners) as we go into late 2020, make sure to follow my services for advice and more as each week we will see developments.

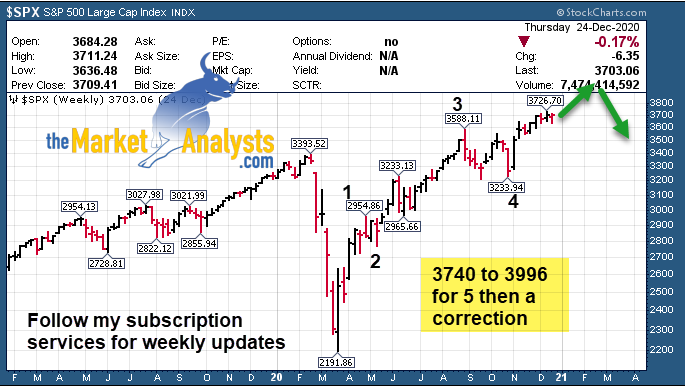

Stock Market: SP 500 stalls out near 4000, pulls back 12-14%, then rallies again to all time highs as high as 5,000 in 2021. Near term going into January 2021 speculation is running rampant. This is a bit like late 1999 into early 2000 when the NASDAQ finally peaked on March 9th and then crashed. Be selective and use judgement, trade and take profits and avoid too much greed if possible at this stage.

Biotech although extended near term (XBI ETF Could top around around 158, 151 now) over the course of 2021 it should continue to do well following a correction. The advances in DNA, Cell Editing, Artificial Intelligence, Drug Delivery Technologies, Vaccines, mRNA technologies and more is ushering in a new Golden era for this sector. Key stock picking should also pay dividends.

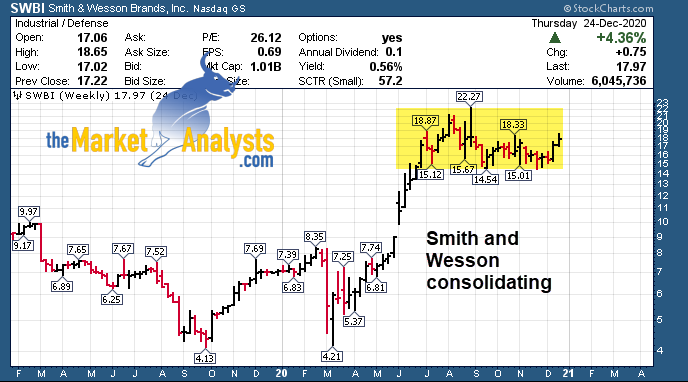

Guns are in high demand, and Smith and Wesson is one contrarian idea (SWBI) and on the weekly chart it is starting to curl back up, currently around $18 a share

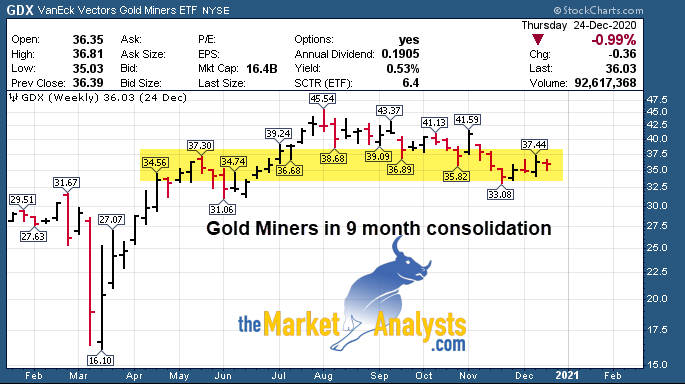

Gold and Gold Miners– Gold at $1883, should soar past 2100 highs of 2020.

Everyone is on the Bitcoin train, but lets not skip past the Gold miners either. Newmont merged with Goldcorp, Barrick had a huge merger and is owned by Warren Buffet, and the number of 2 million ounce Gold discoveries (Economic deposits) has plunged in the past 10 years. In the last bear cycle Gold stocks did very well and they may start a turnaround in early 2021. Some include, GOLD, KGC, NEM, or you can look at the GDX or GDXJ ETF’s. Gold has pulled back to 1775′ area from near 2100 highs and now could start a new advance in 2021.

Bitcoin- (GBTC, Grayscale Bitcoin Trust one way to play.) Already stretched to 26,700 in US Dollars as of this report, but could see 34,000 area in the first quarter of 2021. This is a growing asset class with growing demand and limited supply. Institutions are now coming on board and this is also a play against Fiat currencies and negative interest rates, and nosebleed high debt levels for the US and other countries. Look for Bitcoin be volatile but continue the overall advance in 2021 as it moves mainstream.

Bitcoin miners– Some include MARA, RIOT, HVBTF, and others. MARA just returned to it’s 200 week EMA lines recently which may be some resistance. However, over time these names can can continue to move with the Bitcoin bull market itself. This area I freely admit I would need to do more study on, but a stock sector to watch. Higher risk as well, speculative for sure.

Generic Drug Makers and Pharmaceutical stocks (XPH ETF)- Remember Generic drug stocks being big time growers back in the day? Perhaps they will come out of their bear market with the new Biden administration. A few ideas worth further research include TEVA, the former Mylan Labs (Viatris, VITS), Lupin, Sandoz, Bristol Myers etc. More work also needs to be done here on my end. XPH ETF can be used to avoid stock picking.

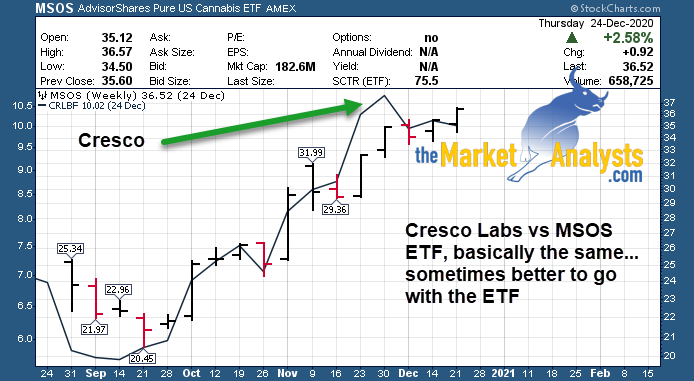

Marijuana Sector: MSOS ETF

We should see more and more states adopt legalization of Cannabis which will continue to drive policy and legislative action. Favorites include Cresco Labs (CRLBF), Canopy Growth (CGC), Green Thumb Industries (GTBIF), MSOS Cannabis US ETF, naming just a few. Focus must remain on management, balance sheet, and branding.

Tipping Point Stocks

– My tippingpointstocks.com service explores companies in the right sectors at the right time, that are undiscovered by Investors and or about to be discovered. We look for top management, good share structures, catalysts, valuation that is attractive, and a looming near term “Tipping Point” for the business and valuation to move strongly to the upside. We look for 50-200% gains in 6-18 months as our objective for each company, and typically rotate 8-12 names during the year depending on performance and the ongoing developments of each company. We had 4 companies in 2020 that more than doubled and recently added a few more fresh names to the portfolio and sold one for 50-80% gains as well. A few from 2020 include OTRK, TFFP, TBIO, PRVB and more that have done very well. Recently I recommended a recent Biotech IPO that has gone overlooked by investors, but not for long. This could be a 4-5 bagger in 2021 and much more in the next few years.