Swing Trading with a twist- Stocks and 3x ETF’s

At The Market Analysts Group, LLC we focus on Human Behavioral patterns along with Fundamentals and Technical’s to identify Swing Trade candidates for our members. We look for opportunities with low risk and high upside within reasonable holding periods of days to weeks.

Stock And ETF Research – Advisory Service

Members of our Stockreversalspremium.com subscription service are exposed to both Stock and ETF trading using methods that are much different than traditional traders use. This includes how we enter, how we exit, and how we set our stop loss points and our projections. Our advisory service gives members specific guidance on proper transaction execution while our research points them to the right stocks or funds to trade.

What makes us different?

Stock Swing Trading Methods: Fundamentals and Technical’s both!

We believe that just swing trading based purely on chart patterns alone has too much inherent risk involved. After we see a chart or sector we like, then we go to work. If the chart looks great and appears ready for a breakout, then we start the process of analyzing all of the details of the business. Instead, we focus on the fundamental analysis of the business and drill down hard

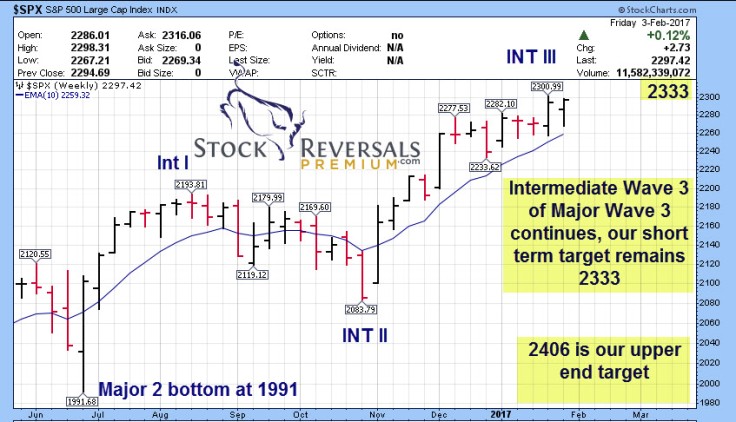

Contrarian Analysis + Elliot Wave Theory + Fibonacci + Our Indicators

- Much of our work is contrarian in nature, so we are also looking for a stock that has based for a multiple week period, already had a correction recently, and is ready to move back into Bull mode. Also for sectors that are about to come back into favor.

- When reviewing a stock for a Swing Trade, we look at management, product Lines, balance Sheets, profit Margins, the competitive landscape, catalysts, share structures and more. If we like those areas and we also like the chart and the sector, then it makes our “Watch List”.

- Once on the Watch List, we share that with Members and then update it during the week. We usually dig a bit deeper and discard more names and then pick 1-3 Swing Trade positions to alert each week.

- We then apply our own Fibonacci and Elliott Wave pattern analysis to the chart pattern, in addition to traditional TA indicators that most traders use. If it all lines up, then we issue a Swing Trade Alert based on market conditions and timing. These include a full post, charts, analysis and entry and exit advice.

- We usually take 1/2 off the table on a position as it is rising to lock in gains, then try to ride the remainder 1/2 for higher returns. This reduces our risk and keeps our gain potential intact.

- When it’s time to sell, we use our “Burning Match” method to determine when to exit.

These methodologies has allowed us to have a near 80% Swing Trade profitability success rate over hundreds of closed out trades since inception.

3x ETF Swing Trade Methods:

We take our proprietary Elliott Wave and Behavioral based forecast models and then apply them to sectors to come up with 3x Leveraged Bull or Bear ETF swing trades. We have a history of over 80% success rate with these types of trades, and when executed correctly they offer lower risk with high upside in short windows of time.

First we drill down into a sector such as Biotechnology or Precious Metals. We review the Elliott Wave Pattern and analysis of the charts for XBI ETF in the Biotech trading area for example. If the sector has been out of favor or has gone through a corrective pattern we like, then we begin to search for confirmations of a new or nearing up trend. We identify Fibonacci pivots for swing entry areas, and then we lay out the entry ranges to buy and the ranges we expect to exit.