A Subscription service of The Market Analysts Group, LLC

Premium E MINI Futures Trading room formerly on Stocktwits.com from October 2018 to January 2024. Stocktwits closed all premium rooms in early 2024 to focus on online trading for members.

We then moved all the members to our new platform on Memberful.com

$59 per month hosted on The3xetftrader.memberful.com starting Jan 2024

Morning Advisory daily with ES charts, SPX charts, and Elliott Wave based and human behavioral patterns incorporated to Alert trade set ups with entry, exit, stop loss, and ongoing advice.

Too busy to trade?

Read up at ESALERTS.COM and Join on Memberful.com platform

*Disclaimer: CFTC RULE 4.41 All Trades below are Hypothetical as we sent instructions and parameters but cant be assured how each person ended up executing on their own outside of the Auto-Trade platform. See disclosure at bottom of page.

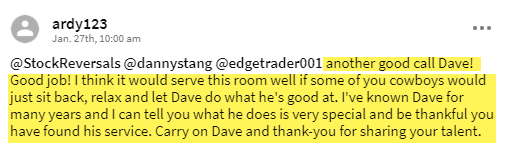

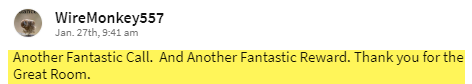

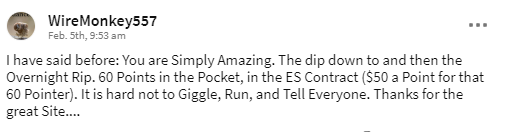

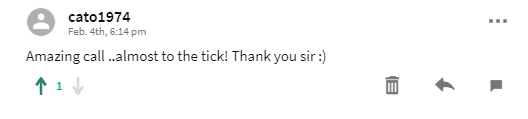

Direct messages from Stocktwits Futures Members:

Trades closed on 3/17/20, 2/11/20, 2/4/20, and 1/27/20

107 Point Gain in 1 day going long ES in two tranches (Sold at 2512, 1 day later hit 2262)

31 Point gain in 24 hours going long ES from 3334 to 3365. We closed it 1 day later for 31 points or 25% gain!

65 Point gain in under 24 hours going long ES from 3237 Limit Buy order, we closed it the next day at 3302 for 65 points!

52 point gain in just over 24 hours shorting the ES as I projected a Wave 4 correction in advance. Entered at 3299 on Friday afternoon and closed at 3247 Monday morning

Trade closed on 11/4/19 for 47 points

Click to Review FAQ Page

*Disclaimer: CFTC RULE 4.41 All Trades below are Hypothetical as we sent instructions and parameters but cant be assured how each person ended up executing on their own outside of the Auto-Trade platform. See disclosure at bottom of page.

Futures trading is speculative, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

Disclaimer: CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

11/27 Closed 25 point gain LONG ES

11/15- 28 point Gain going long (3084-3112) (*7 days)