13 Nov Weekly Trading Ideas and Forecasts Report

Publishers of Stockreversals.com (Opt in Free)

Stockreversalspremium.com a Swing Trade and Forecast Advisory service

TippingPointStocks.com a Long Term growth stock advisory service aiming for 50-200% gains per position! Just launched October 4th 2017! Join now at Charter Member Rates!

If not yet a Stock Reversals Member, opt in free today to get our free reports and intra-week updates!

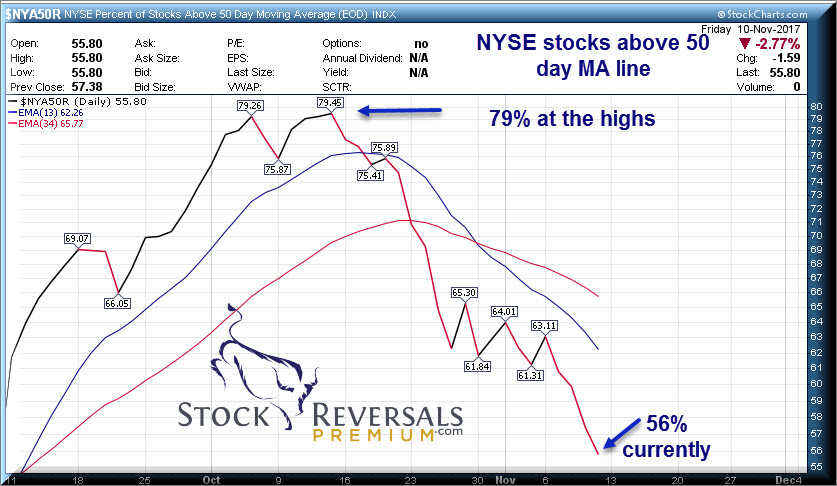

We finally got a few cracks in the armor of the markets as the large cap stocks began to pull back off the all time highs. We had presented some evidence to our SRP Members early last week in the Morning Report that the NYSE stocks indicator we use was weakening, and underneath the large cap indexes there was some damage. We have seen an uptrend high of 2597 so far on the SP 500 and our longstanding target for a rally high has been 2608.

Keep an eye on the 13 day EMA line support and the 34 day below that if it falls

Right now the percentage of NYSE stocks above their 50 day moving average line has dropped from 79% in Mid October to 56%, a tell tale sign of damage underneath. At the last major market low in August of this year the reading was 39%, so still room here possibly for more downside ahead. The low of November 2016 was 22%!

IWM ETF Update: Small caps also correcting

After a torrid run up, we have seen the IWM ETF pulling back. Keep your eyes on the 144.25 area give or take 20-30 cents for important support on this pullback

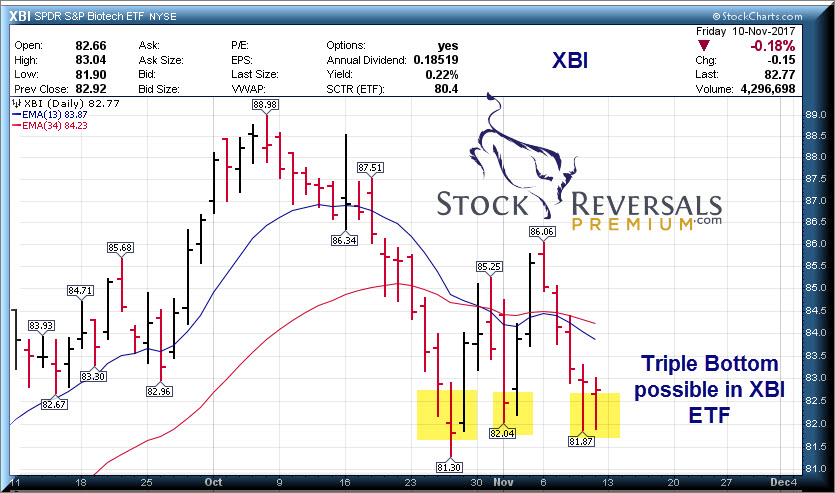

XBI ETF Update: Biotech has also taken a back seat after a huge run up.

Keep an eye on this possible triple bottom area in the chart, 81 area would be key to hold

Market Notes:

The percentage of Bullish Advisors is still running hot at 64% vs only 14% or Bears, historically very high.

The NYSE short interest indicator has been declining, which to us is bearish not bullish (Contrarily).

Past weeks winners off our Swing Trade Ideas list: COHR up 19%, PLNT up 12%, MNST up 6% GDOT up 13%

Losers: TTD- whacked for 17%

Swing Trade Ideas List:

Each week we put together a list of both POST IPO Base ideas and Swing Trade ideas. We often pull one or two off this list for actual alerts after further review. We provide this for our members to add to their ideas and also outside of our actual alerts. Last week big winners COHR up 19%, GDOT up 13%, PLNT up 12%, MNST up 6%

This weeks list a bit smaller as we are seeing less opportunity currently:

Post IPO Base Ideas:

JAG- Jagged Peak Energy, 8 months base near highs

WTTR- 7 month base for water solutions provider for Oil and Gas industry

RYB- 7 week base for this Chinese education provider

Swing Trade Ideas: 8 this week

ICHR- 5 week corrective base, PE 12, Semiconductor Equipment Fluids provider

YY- 7 week base, Chinese Online social media provider, PE 16, EPS due 11/14

CTRL- 6 week corrective base, software for the connected home, PE 29, earnings already out

AEIS- 7 week corrective base, holding the 10 week line. Profit taking normal, solar products

ON- 2 weeks tight base near the highs for On Semiconductor, maker of DSP Chips and more. PE 20

FIVE- 7 weeks tight base, PE 40, growth 67% in the last quarter for $5 and below store chain

MOD- 2 week base near highs. Thermal Management Systems for various industries. PE 17

CY- 4 week base breakout, system on a chip maker

SRP Update:

This past week we closed out OSTK for 31% gains, NTNX for 19% gains and IOTS for 9-12% Gains!

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analyst)

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com