26 Nov Weekly Trade Ideas and Market Forecasts Report

Publishers of Stockreversals.com (Opt in Free)

Stockreversalspremium.com a Swing Trade and Forecast Advisory service. 77% success rate on trades since September 2013 inception.

TippingPointStocks.com a Long Term growth stock advisory service aiming for 50-200% gains per position! Just launched October 4th 2017! Join now at Charter Member Rates! Our most recent buy report already up 47% in two weeks!

All time highs for the indexes as the SP 500 marches towards our long standing projection of 2608 that we came out with about 7 weeks or so ago. This uptrend is strong which we can trace all the way back to the 1810 SP 500 bottom in January 2016. This wave pattern has extended in some respects, and if we get past 2608 we could see 2633 and then as high as 2738 on the SP 500 before the wave completes and leads to a larger corrective wave.

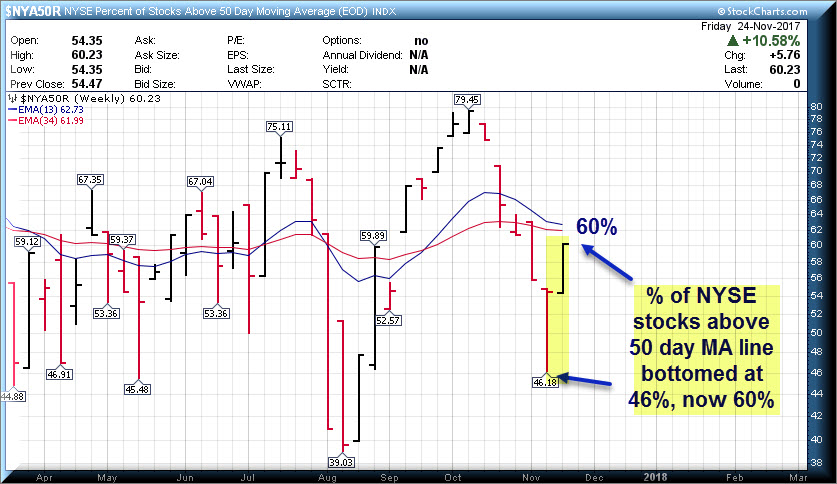

Last week we pointed out multiple bottoming signals such as the percentage of NYSE stocks above the 50 day moving average dropping to only 46%. The CNN Fear and Greed index was stretched on the fear side. Also the Mid Cap index had been consolidating nicely for 7 weeks. This led to a rally up in the indexes and a lot of momentum names moving sharply.

Notably the “Blockchain-Cryptocurrency” craze right now, which is pushing up otherwise questionable companies stock prices to obscene valuation levels. That said, the market is about supply and demand and traders are going to trade as we say. Of note, Riot Blockchain (RIOT) may be one of the most hyped up plays in the market now, be careful for a parabolic peak and crash on that one ahead. Their mailing address is a mailbox in a small town in colorado, recently were a biomed stock and changed their name. The street is full of these crazy stories, just be aware of what they are and what they are not.

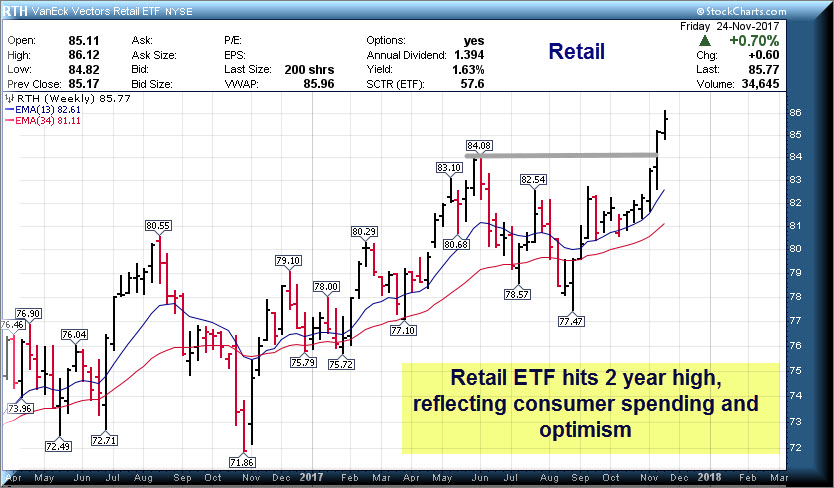

Also of note the Retail stocks are hitting 2 year highs this reflects consumer spending and optimism obviously. The Tech sector remains strong and the NASDAQ had 170 new highs against only 15 new lows on Friday.

A strong swing trading environment is what we have and over the last 7-8 weeks at SRP we have caught quite a few nice gainers and few losers as we have ridden the wave.

Chart updates: SP 500, MDY ETF (Mid Caps), NYA50R (% of NYSE over 50 day EMA), RTH- Retail Holders ETF

A rising tide lifts all boats as they say, we will try to pattern out the uptrend highs and be prepared for the usual corrective pattern that will emerge at some point.

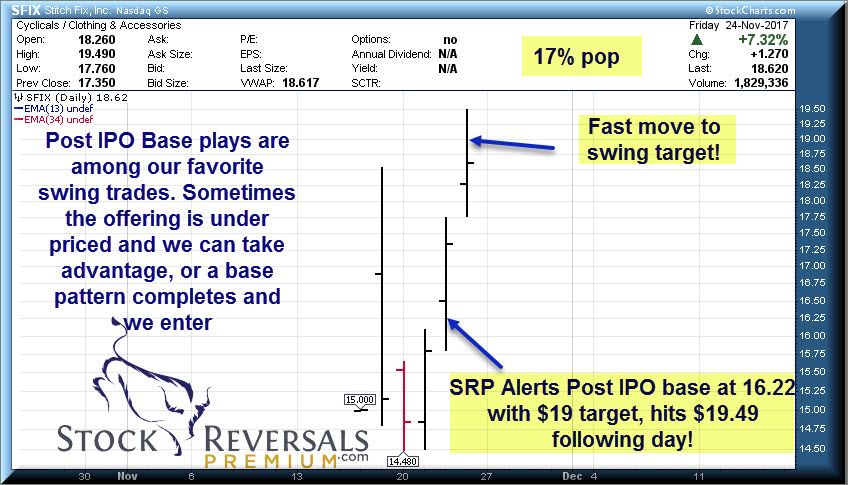

Swing Trading SRP Style: The POST IPO BASE- 17% Gain in 2 days

One of our favorite swing trade techniques is looking for recent IPO base patterns. We research the companies that have recently gone public and assuming we like the valuation and metrics of the business itself, we look for patterns that are emerging in the chart. Sometimes we hit on one that spikes fast after we alert a trade, and this happened this past week with Stitch Fix (SFIX) a recent E-tailer IPO.

The company came public at $15 which was reduced from original $19-$23 pricing levels, and after spiking up on day one it fell back to test the IPO pricing area and even just below. As it bounced back up, we got interested in the base pattern and based on our research felt the stock was undervalued. We alerted the play at $16.22 this week with a $19 target. It hit the target the following day for over 17% gain at one point from the alert price, but we also gave SRP members latitude to pay up to $16.80 per share as well.

The POST IPO base plays work well when there is a draw down or profit taking period after a spike. Also some IPO’s come out of the box slow and you can take advantage of mis-pricing or confusion in the markets.

CONSIDER JOINING US IF YOU ARE NOT YET A MEMBER, 30% OFF OR ONLY $69 MONTHLY USING THIS SIGN UP LINK

SFIX Chart update:

Swing Trade Ideas:

This week we have 14 names for our candidates list along with 3 Post IPO Base names to consider. Often we will draw a few from this weekly list for our SRP Alert to members assuming we have done some further fundamental and chart analysis.

Post IPO Base Plays:

SEND- Recent IPO, company has a digital communication platform

JAG- Jagged Peak Energy we have had on the list numerous times. Permian Basin play, 10 month base

SOGO- 3 weeks base pattern for Chinese Search play

14 Swing Trade Candidates:

FIVE- Often on our list over last many months and now in another 8 week base. Earnings due on Wednesday

CEVA- 7 week ascending base on top of an overall 7 month base. Digital signal processors business, designs/licenses.

EXTR- 8 week base pattern break out. Network Infrastructure provider, an old name that is gaining strength

MOD- 4 week base pattern for Thermal Systems maker for various industries. PE 18

TEAM- 6 week base pattern for Atlassian, project management software leader, high PE Ratio

ICHR- Often on our list over last many months, forming a 9 week overall base. Fluid sub systems for chip equipment makers, PE 13, strong growth.

CTRL- Always on the list it seems, the leader in home automation, installers prefer them. 4 week ascending base

ALRM- 15 week base for alarm.com who is expanding outside security systems for the home, nice corrective action

AEIS- Also often on the list, 8 week corrective base pattern off recent highs. Power conversion/solar products

PETS- 14 week bottoming flat base for Petmed express

BGCP- 8 week corrective base, PE 14, wholesale global broker for finance and real estate

PRAH- 8 week base pattern for outsourced clinical work for biotech/med industries

VEEV- 6 week base pattern, cloud software provider for sales and marketing

GWRE- 12 week base, should break out here shortly. Insurance industry software for P and C companies mostly.

SRP Update:

This past week we closed out WUBA FOR 17% gains, Alerted SFIX for 17% gains, and also an ETF on Friday morning.

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, CEO, Factor LLC (One of the worlds top Commodity Traders and Technical Analysts)

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com