26 Nov Weekly Stock Trading Advisory Report

StockReversals.com Members get an exclusive 30% coupon offer to join our SRP Swing Trade subscription service

Stockreversalspremium.com – Swing Trade service with SMS E-Mail and Post Alerts for entry and exit plus morning pre market updates every day!

Tippingpointstocks.com– Growth Stocks with 50-200% upside

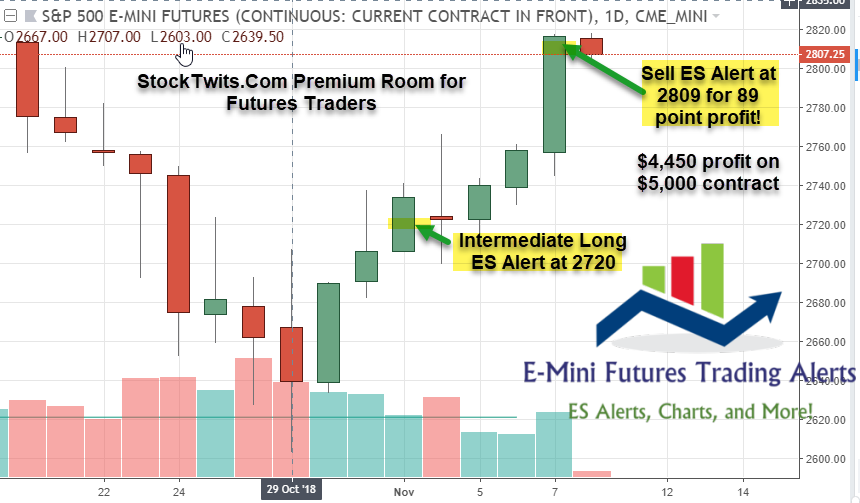

E-Mini Future Trading Service– Hosted on Stocktwits.com and launched in October 2018. This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Already up 77% net after 4 weeks since launch, join for $50 a month! Premium Futures Trading Room

FREE STOCK TRADING IDEAS AND MARKET TREND FORECASTS WEEKLY REPORT

Weekly Forecasts and Swing Trading Ideas Report: November 25th

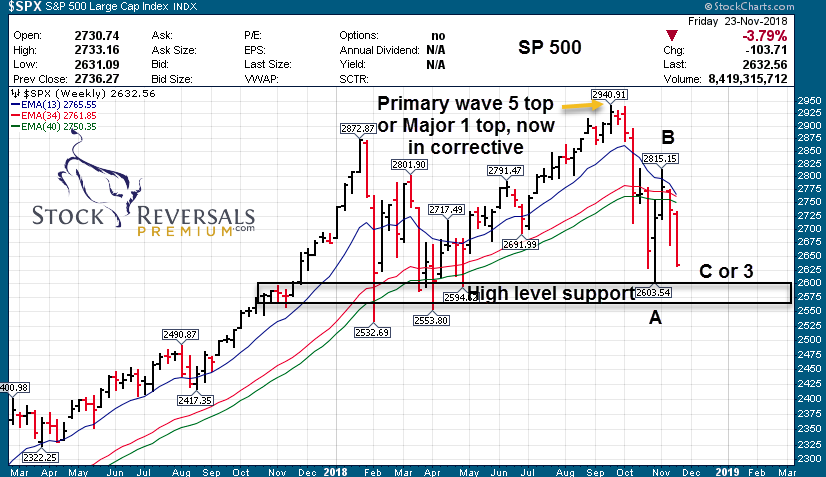

For the week ending Nov 23rd, indices continued their downward trend into Thanksgiving week to close Friday’s shortened day near the lows for the week. The SP 500 finished the week down -3.8%, with the Russell 2000 down -2.5%, Nasdaq 100 down -5.0%, and the Dow down -4.4%. The upside B wave we projected has failed. This looks like an obvious C wave down now or Wave 3. We are currently in Mercury Retrograde window from Nov 17 – Dec 6, and we expected to see twists and turns. Generally the midpoint of this window provides a possible turn which would fall Monday or Tuesday.

At this point, we are looking for a retest of October lows at 2603 at a minimum, which would represent a perfect A=C off the Nov 7th high, completing the larger double bottom correction off the Oct highs. However, if the SP 500 breaks 2603 decisively, then we may be in a larger 3rd wave of C targeting 2513 and ultimately 2458.

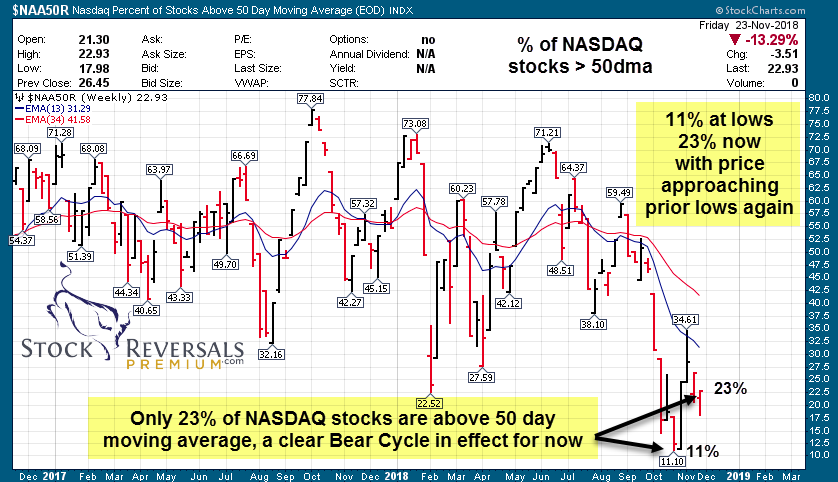

Interestingly, Biotech (XBI) was relatively stronger than all the other indexes, only down -1.8% for the week, and support did not break from the week before. We still like the biotech sector to bounce higher. Notice that the Russell 2000 was the strongest index, and the % of Nasdaq stocks > 50 day moving average has gone from 11% to 23% as price has made new lows. All in all, we’re looking for bottoming action soon in the indexes, and we will wait to see how price reacts at 2600 level.

In our Premium Service, we have maintained average cash of 75-80% in model since early October, except for the rally off the 2603 lows, where we played some great swings.

SP 500 Charts: C wave double bottom, target 2603-2594, or larger wave 3 depending

Biotech (XBI) Chart:

$NAA50R Chart:

Our Premium service continues to be selective in alerting the best stocks, which we may hold only days or weeks at a time. We have a 72% Profitable Trade track record since September 2013 inception!

Here is another recent Post IPO Base Swing winner from last week. For details on what a “Post IPO Base Swing” is, please see the November 18th weekend report here.

POST IPO Base Swing example: YETI for 8% gains

The company went public right during the October market crash and traded well below the IPO price. Our premium subscribers got an opportunity to really buy at a discount due to the beat down market. As projected, the stock completed a move back up to the 18 IPO level within about 2 weeks.

Original alert chart, sent 11/2:

With only an 11-12 day hold time and 8% average gain, $10,000 invested in this trade would have paid for about a whole year’s worth of subscription!

Learn more about becoming a premium member at Stockreversalspremium.com

Swing Trade Candidates: Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts. This week we have 15.

GOOS – inside week following 5 month breakout. Any consolidation above 66-67 a buy for higher. Designs, manufactures, and sells premium outdoor apparel.

TTD – W base pattern forming. Holding gap up from Aug, considering last week’s market declines. Provides a self-service omnichannel software platform that enables clients to purchase and manage data-driven digital advertising campaigns.

INVA – strong accumulation volume, starting to breakout, with 20 target a magnet. Company engages in the development and commercialization of bio-pharmaceuticals, with a portfolio of respiratory products.

BEAT – sector leader in a consolidation off 3 week upthrust off major corrective lows, holding weekly 13ema. Mobile and wireless medical technology company, provides cardiac and mobile blood glucose monitoring (BGM).

INS – earnings winner from a few weeks back, forming a 2 week consolidation. The company designs, develops, and markets a suite of software solutions to accounts receivable businesses, financial institutions, retailers, and processors

LL – worth a shot. Looks like accumulation being bought on the cheap, target 14.50-16.00. Company operates as a multi-channel specialty retailer of hardwood flooring, and hardwood flooring enhancements and accessories.

FND – 3 week base, space looks like it’s getting some accumulation. Company operates as a multi-channel specialty retailer of hard surface flooring and related accessories

PLAY – 10 week consolidation, holding above June earnings peak ~56. Looks good for higher. Company owns and operates entertainment and dining venues for adults and families.

ALLO – Holding above IPO first day close ~25. Looks to be basing with upside back to 30. Clinical stage immuno-oncology company, engages in the research, development, and commercialization of genetically engineered allogeneic T cell therapies for the treatment of cancer (CAR T).

MOMO – Perfect 1:1 symmetry with 38-40 still in play. Basing in a W pattern, provided recent lows hold. Looks like accumulation. Chinese provider of mobile social networking platform.

IQ – looks to be basing on weekly chart. Move back to 23-24 not out of question. Provides online entertainment services under the iQIYI brand name in China. (Similar to Netflix in US)

NBEV – 9 week flag, perfect 1:1 symmetry from Sept high. Can see gap fill at 4.7 all the way to 5.40. Operates as a healthy functional beverage company.

UAA – could be a multi week setup, but nice technical retracement as it attempts to breakout of the 2018 bull flag. Company markets branded performance apparel, footwear, and accessories for men, women, and youth primarily in North America.

HZNP – double inside week after breakout candle. Looking for continuation higher. Biopharmaceutical company, focuses on medicines that address unmet treatment needs for rare and rheumatic diseases.

FN – 2 week flag after power gap up to new 52 week highs. Textbook consolidation and relative strength to market. Provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services