07 Jan Weekly Stock Trading Advisory Report

StockReversals.com Members get an exclusive 30% coupon offer to join our SRP Swing Trade subscription service.

Stockreversalspremium.com – Swing Trade service with SMS E-Mail and Post Alerts for entry and exit plus morning pre market updates every day!

Tippingpointstocks.com– Growth Stocks with 50-200% upside

E-Mini Future Trading Service – Hosted on Stocktwits.com and launched in October 2018. This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. Join for $50 a month!

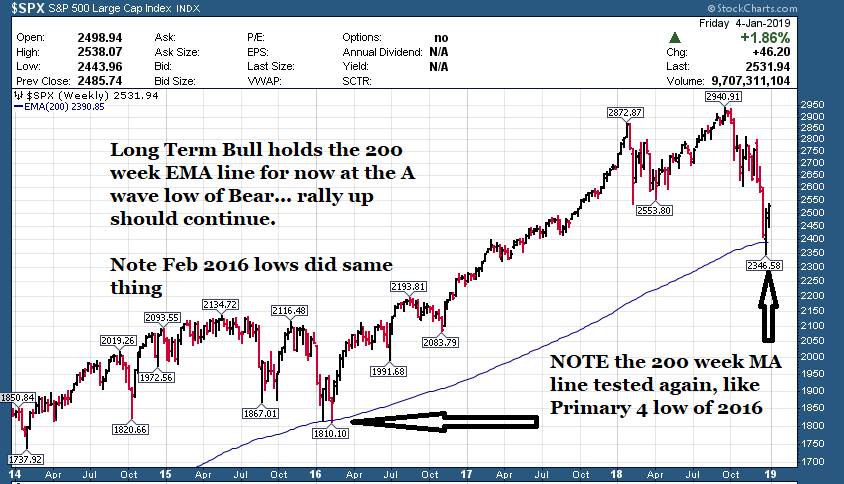

Market Analysis – B wave higher is path of least resistance, targets 2575, 2620, 2715

200 Week EMA line holds like Feb 2016 lows!

For the week ending Jan 4th, indices rallied to close the deficit from being down double digits year to date in mid Dec to only down single digits by year end – a small consolation for a very wild and volatile year.

Last week was a good start to undo some of the technical damage done to stocks in the month of December. As we said, we define a Bear Market as when the preponderance of stocks are trading below their 50 day moving averages.

| Week ending 12/28: | |

| SP 500 | +1.9% |

| Russell 2000 | +3.2% |

| Nasdaq 100 | +2.2% |

| Dow Jones 30 | +1.6% |

The SP 500 was down -6.2% for 2018.

We still maintain that Interim A wave bottomed at 2346, and are currently in the midst of C of Interim B wave targeting 2620 (A = C off 2346 lows) up to 2717.

Notice, we have had 10 year cycle crashes occur pretty predictably since as far back as we can remember. See 1987, 1998, 2008, 2018.

We also note that almost every major blue chip tech stock like Apple, Netflix, Amazon etc all came down to their 200 week MA lines, along with the SP 500 and every other major index both in the US and around the world for that matter. This would be normal Bear cycle bottoming type activity within a long term uptrend if those lines end up holding later on.

What’s also interesting to note is how crude oil tends to lead major market inflection points by 10 years. Chart included at bottom. Crude oil tops in 1990, 1997, 2000, 2008 preceded SP 500 tops in 2000, 2007, 2010, 2018.

SP 500 Charts: Interim B wave in progress, targeting 2600-20, 2715

Biotech (XBI) Chart:

SP 500 / Crude Oil Correlation (credit for idea goes to Tom McClellan):

Bottom Line:

We are in an Interim Wave B up from the ABC – A to 2346 on SP 500. We should work our way towards 2572 and 2620 resistance soon as a first test, but some back filling of last 2 weeks’ rally could take place first, given the market is up +8% off the lows. There will continue to be large weekly volatility in Q1 2019.

That said, we see lots of opportunities in 2019 to make money in a more volatile market!

Swing Trade Candidates: Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts. We have 16 names this week.

PLNT – Up 4+% last week, and working on new highs. New Year’s resolutions could add an expected boost in revenues going into Q1. Company franchises and operates fitness centers under the Planet Fitness name.

CIEN – new 52 week high close, looking at a breakout soon. Company provides network hardware, software, and services that support the transport, switching, aggregation, service delivery, and management of video, data, and voice traffic on communications networks worldwide.

ZS – off and on our list for weeks now and looking ready to break out of the 8 month post IPO base. This could see new ATHs soon. Company operates as a cloud security company worldwide.

AYX – off and on our list over the past month or so, and looks to be ready to run in an ascending base breakout to tackle new highs. Company operates a self-service data analytics software platform that enables organizations to enhance business outcomes and the productivity of their business analysts.

TME – post IPO base building, with decent swings the past few weeks. Thinking a run back to 14.60 or higher is coming. Company operates an online music entertainment platform that provides online music and music-centric social entertainment services in China.

TEAM – Smaller cup and handle formation and the 13/34 emas are stacked bullishly. Company designs, develops, licenses, and maintains various software products worldwide.

HZNP – Strong relief rally in biotech the past 2 weeks. Stock could make a run at 22 to start. Company focuses on researching, developing, and commercializing medicines that address unmet treatment needs for rare and rheumatic diseases in the United States and internationally.

URGN – Weekly chart looks amazing, consolidating for months and now breaking up good volume. 54-57 next up. Company focuses on developing novel therapies for urological pathologies.

MTCH – Stock looks like it wants to head to fill gap up around 48. Looking good with inverse H&S pattern. Company provides dating products through its Websites and applications in 42 languages approximately in 190 countries.

TREX – industrials look ready to move. EMAs pinching, so looking for a pop to 70-75 region. Company manufactures and distributes wood/plastic composite products.

FTDR – been our our list for a few weeks now. Post IPO consolidation, now that it’s in the gap, with 13/34 crossover any day now. Still heading to 13 wma, around 29. After that, we’re looking at a run towards 30 IPO level at least. Company provides home service plans to homeowners.

BJ – stock up 4.5% last week, continuing to form a bottom here off the post IPO decline to the IPO gap. Above 23.50 could really get going. Company operates as a warehouse club on the East Coast of the United States.

VKTX – double inside day, looking for breakout of recent consolidation, target 9-9.5. Company focuses on the development of novel therapies for metabolic and endocrine disorders.

DOCU – Post IPO base pattern forming since last spring, setting up for a run back to 48-50 level bigger picture. Company provides cloud based transaction products and services in the United States.

AVLR – stock up 4% last week, starting to round a bit on a post IPO bottom. Close above 13wma gets the stock moving. This looks like some serious consolidation here and could be looking for a move back to 40-44. Company provides transaction tax compliance cloud-based solutions worldwide.

REZI – Now triple bottom, and continue to view this as accumulation on the lows here. May need a few more weeks, but keep on your watchlist. Look for a break above 22 to see a move to 23-25. Company provides critical residential comfort and security solutions.

E-Mini Future Trading Service – Hosted on Stocktwits.com and launched in October 2018. This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. Join for $50 a month!

We took a 16% one day gain Friday on our most recent trade. A small SP 500 move can yield big gains in short order. In this case, we shorted the SP 500 for profits.