26 Dec Weekly Stock Trading Advisory Report

StockReversals.com Members get an exclusive 30% coupon offer to join our SRP Swing Trade subscription service.

Stockreversalspremium.com – Swing Trade service with SMS E-Mail and Post Alerts for entry and exit plus morning pre market updates every day!

Tippingpointstocks.com– Growth Stocks with 50-200% upside

E-Mini Future Trading Service – Hosted on Stocktwits.com and launched in October 2018. This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. Join for $50 a month!

We took a 16% one day gain Friday on our most recent trade. A small SP 500 move can yield big gains in short order. In this case, we shorted the SP 500 for profits.

Recent Trade closed out for 16% gain Dec 14th!

Results: An $800 gain on a $5,000 contract.

Premium Futures Trading Room (Register at stocktwits.com then join off the desktop)

Market Analysis – MASSIVE INTERIM BOTTOM? 2250-2350 likely

For the week ending Dec 21st, indices had one of their strongest down weeks on record – the 8th worst week since 1987. The SP 500 finished the week down -7.0%, the Russell 2000 down -8.4%, Nasdaq 100 down -8.3%, and the Dow down -6.9%. This past week was quadruple witching, where options, futures, etc all have expiration. Generally, this creates lots of volatility, and last week was evidence of that. Most indices have entered or are close to entering bear market status (>-20% declines from their yearly highs).

As we stated last week, until the market broke below 2600 (specifically 2580) for multiple sessions, we’d continue to stay range bound. All of last week’s daily closes were <2580, which represented the Feb and Apr lowest closing levels.

All eyes were on the Fed this past week, who raised the federal funds rate for the fourth time this year to the 2.25 – 2.50% range as the consensus had expected. While their decision to raise was expected, Fed Chairman Powell saying he doesn’t see the central bank changing the pace of its balance sheet runoff precipitated a waterfall decline in the market from his press conference through rest of week.

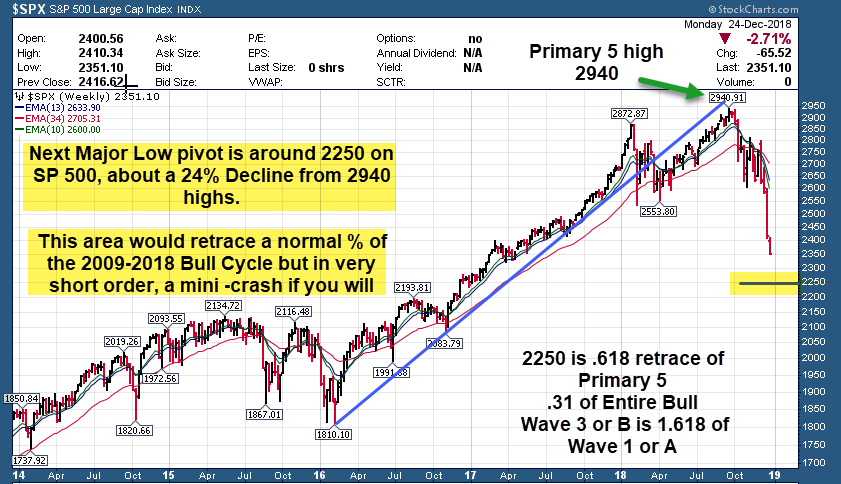

The SP 500 has exceeded 1:1 symmetry with the 337 point decline off 2941 measured from 2800, so next supports are 2383, 2334, and 2254, which represent measured extensions of the A wave decline.

This is clearly bear market price action, and it’s only a matter of time when the selling will subside, and we could see short covering rallies of 8-10% easy.

One possibility is a move to the 2250 area for the SP 500 after the debacle on Christmas Eve shortened trading day. That would represent multiple Fibonacci convergence zones from the 2009 low to the 2018 Bull Cycle highs. Also from the January Primary wave 4 lows of 1810-2940 Wave 5 highs, and finally where C or 3 is a Fibonacci ratio to A or 1 from the 2944 highs.

SP 500 Charts: C wave in progress <2600, extension targets 2383, 2334, 2254

Biotech (XBI) Chart:

$VIX Chart:

Sentiment Charts:

Swing Trade Candidates: Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts. We have 14 names this week.

ZS – Despite the massive selling in SP 500 the past few weeks, this company continues to hold a 6+ month base, in a beautiful post IPO consolidation. Watch for new highs upon break of range. Company operates as a cloud security company worldwide.

FTDR – post IPO consolidation, and if it can get into gap, we’re looking at a run towards 37 at least. Company provides home service plans to homeowners.

SVMK – possible double bottom forming. Consolidation could lead back to 12.50. Company provides survey software products.

PLAN – post IPO ABC consolidation, targeting 27 or downtrend line from all time high. Company provides a cloud-based connected planning platform.

REZI – bad timing for IPO = good opportunity for double bottom and rally; if Nov low holds, look for a move to 23-25. Company provides critical residential comfort and security solutions.

PTE – possible base forming here, and if so look for an attempt at 18. Company operates as a biotechnology and regenerative biomaterials company in the United States.

GSKY – Nice 8 week base pattern here. An attempt back at gap around 10.00 and possible 13wma at 11.00 Company is a technology company, provides point-of-sale financing and payment solutions to merchants, consumers, and banks.

MEDP – Watch price action rest of week. If it closes the week > 47, then 53 should come in short order. Company provides scientifically-driven outsourced clinical development services to the biotechnology, pharmaceutical, and medical device industries worldwide.

PLNT – a past name we’ve highlighted before. Look for possible gap fill ~47.50 but could be double bottom here; Look for quick move back to 52-53. Company franchises and operates fitness centers under the Planet Fitness name.

MTCH – relative strength, despite market bloodbath of late. Inverse H&S pattern, plus looking to rally to underside of gap, possibly filling it from 47.25-50.00. Company provides dating products through its Websites and applications in 42 languages approximately in 190 countries.

UBNT – consolidation back to 34 wma, along with many other stocks in the market. 8 consecutive red days, and a gap fill at 94.33. Bounce here could start to target 101-104. Company develops networking technology for service providers, enterprises, and consumers.

INVA – price consolidating back to the 34wma in an 8 consecutive day selloff; Target back to 16.60-17.00; Company engages in the development and commercialization of bio-pharmaceuticals with a portfolio of respiratory products.

VAPO – post IPO base pattern setting up here. Really beat down past 3 weeks, and could see a sizable rally with closes >16.00. Medical technology company, focuses on the development and commercialization of proprietary Hi-VNI technology products used to treat patients of various ages suffering from respiratory distress worldwide.

ZTO – channel bound for some time here. A move back up to 17.15 would be possible provided price >15.33. Company provides express delivery and other value-added logistics services in China.

E-Mini Future Trading Service – Hosted on Stocktwits.com and launched in October 2018. This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. Join for $50 a month!

We took a 16% one day gain Friday on our most recent trade. A small SP 500 move can yield big gains in short order. In this case, we shorted the SP 500 for profits.

Recent Trade closed out for 16% gain Dec 14th!

Results: An $800 gain on a $5,000 contract.

Premium Futures Trading Room (Register at stocktwits.com then join off the desktop)