10 Sep Weekly Market Trend and Stock Trading Ideas Report

StockReversals.com Members get an exclusive 30% coupon offer to join our SRP Swing Trade subscription service

Stockreversalspremium.com – Swing Trade service with SMS E-Mail and Post Alerts for entry and exit plus morning pre market updates every day!

Tippingpointstocks.com– Growth Stocks with 50-200% upside

FREE STOCK TRADING IDEAS AND MARKET TREND FORECASTS WEEKLY REPORT

Weekly Forecasts and Swing Trading Ideas Report: September 9th

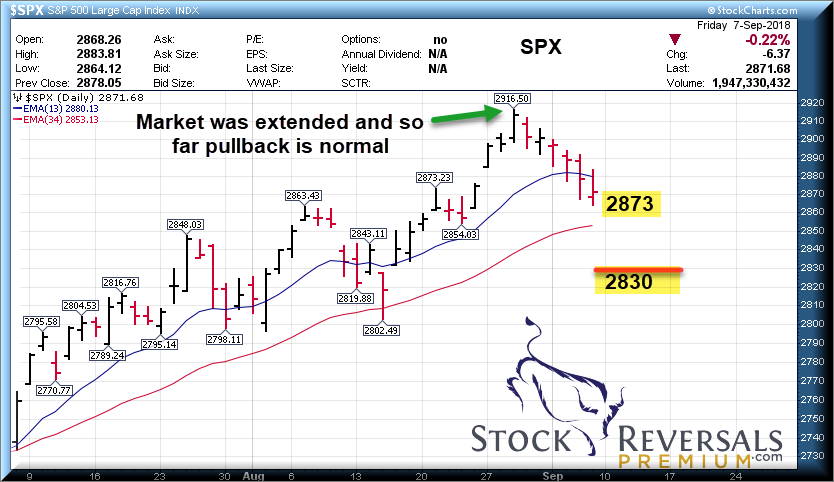

After hitting 2915 the SP 500 has stalled out per our weekend market trend forecast report a week ago. Bull are running at 60% in Investment Advisory surveys vs. 18% for Bears. If we are in Major Wave 5, then 2915 qualifies as a top because Wave 5 was equal to Wave 1 of Primary 5. However, the pullback is fairly normal so far as we have been looking for 2873 as a our support zone for about two weeks now. With that said, the next level of support comes in at 2830 and a break below that would be somewhat troublesome for the markets. Above that and the pullback is relatively normal and shallow. We still see potential for 3020 plus for the SP 500 ahead though for the time being.

SP 500 Daily: 2873 and 2830 supports

XBI ETF:

Biotech sector has pulled back after an extended run up. We ran into 101 resistance zone per our update last weekend, the pullback so far relatively normal.

Swing Trade Ideas:

Each week we provider 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts. This week we have 12.

WWE- 8 Week Base near highs. TV and Pay Per View media company with wrestling focus.

VNOM- 5 week base near highs. Oil and Natural gas Limited Partnership with interests in Permian Basin. On our list often over the last few months, a bit of a late stage base pattern.

MTCH- 5 week base near highs. A current SRP position, close to a breakout. Provider of online dating websites.

MEDP- 6 week base near highs. Outsourced clinical development services. A recent SRP profitable swing position, still looks attractive.

PGTI- 7 week base near highs. Aluminum and Vinyl doors and windows maker. On our list often last several weeks.

MOMO- 15 week sloppy base. Chinese social networking platform with 100 million users. Needs to hold 44 area.

CTRL- 6 week base not far off highs. Volatile stock. Home automation software provider.

PRAH- 6 week base near highs. Clinical Development services to biotech/pharma sector.

UBNT- 18 week base near highs. Manufacturer of Radios, Antennas, Wi-Fi, Networking Equipment etc.

QDEL- 13 week base near highs. Rapid Diagnostic tests for infectious diseases and womens health.

EYE- 5 week base near highs, close to breakout. Manufacturer of eyeglasses and retailer for optical wear.

HMSY- 6 week ascending base near highs. Cost containment and coordination of benefit services.

Stock and ETF Swing Trading and Elliott Wave Forecasts

This past week we booked 8% gains on ROKU and just took 7-8% gains on 1/2 our SAIL position this morning!

72% success rate on all trades since September 2013 inception!

Swing Trade Subscription service with real time buy and sell alerts, full informational posts on each position as alerted, morning pre market reports with updates on the markets and all open positions, 24/5 access to our Chief Strategist, Tutorials and more!