04 Jun Weekly Forecasts and Trade Ideas Report- Time for small caps?

This past week the SP 500 and NASDAQ hit new highs. We have been forecasting a 2443 SP 500 target for the 2nd quarter of 2017 since March 29th. This was our “low-end” target based on our Forecast Models using our Elliott Wave based projections. We have a 2476 target that would be ideal.

Take a moment to Opt In for our Free Stock research and Market Forecasts here: Name and E-mail only, and we do not share your information with any other entity.

[Recent winners given to SR Members in reports: STRP up 500% in 21 months from Research Report. TRVG up 70% in 8 weeks from Post IPO Base report, SHOP up 230% from 2016 long term stock report and more!]

Also, last week we suggested that the Small Caps may start to out perform going forward after going sideways for 25 weeks or so, and we saw a nice spike move in the Russell 2000 near the end of the week.

The SP 500 is on a 10 day rally, so this could run out of gas perhaps by end of day Wednesday this week. 2443 and 2476 are key to watch for pivot tops.

Some charts below: SP 500 weekly with Wave labels, Daily as part of Int 5 of Major 3, and the IWM ETF

So as we approach an interim high potential in the markets, its a good idea to keep an eye on some target zones and prepare for the potential of a Major Wave 4 correction pattern. Once this begins we will work off the high bulllish sentiment and high water mark levels in a normal correction. We will keep you posted as this Major Wave 3 works towards the finish line.

GOLD update: 1303 target for a swing on deck

Gold broke out of a small bullish triangle pattern we pointed out a few weeks back and we came up with a 1300-1303 target for a swing upwards. This past week Gold ran to the upside closing around 1281

Biotech Update: ABC Correction ends

XBI ETF dropped hard in a C wave and washed most traders out, then a huge rebound into the end of the week as we approach the annual ASCO conference. Normally this sector will rally up into the conference each year, but this year the action has been sideways to choppy. We had put out a 73-74 XBI Target a few weeks ago but its been volatile along the way for sure.

Market Notes:

Investment Advisor Surveys: Bulls down to 50% from a high of 58% a few weeks ago. Bears still only 19%

Chip stocks continue to out perform

Small caps trying to re-take the lead they gave up 6 months ago, Mid Caps also popped this past week

Gold working to possible 1300-1303 pivot rally point

Post IPO Base trading: Swing Trading and Longer Term Holding both

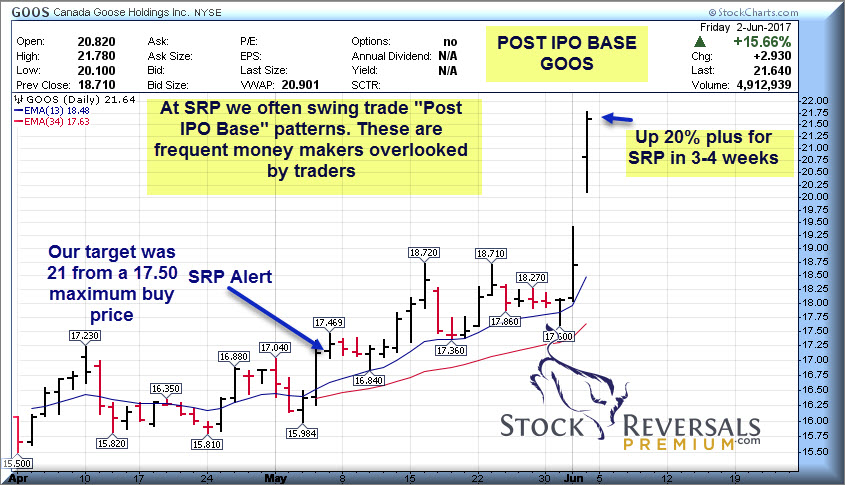

One of our favorite Swing Trade set ups is what we call the “Post IPO Base” pattern. We wait several weeks after a recent IPO so that the trading action can establish a pattern and the crowd of investors loses interest. Once they have lost interest, we start to dig into the fundamentals, share structure, ownership, management, products and more. Assuming we like those elements, we start looking for a set up base pattern wise.

These can lead to explosive gains so we focus on these at SRP often. We set up a max entry price and a range to accumulate, and then an objective for a high price for profit taking. As Swing Traders we are not looking to hold these for months and month, that would be more positional trading or long term investing. We are instead looking to maximize a reasonably short term gain and holding period typically from a few weeks to maybe 7-8 weeks at the most.

A recent sample that spiked up late this past Friday was GOOS. Canada Goose Holdings we identified almost four weeks ago at SRP to our members with an alert. We also identified it a few weeks ago in the weekly report to the public. The fundamentals we loved and we felt since it was a Canadian based company that nobody was paying attention. We got long at 17-17.50 and took profits on Friday on the spike for 20% Swing Gains

Post IPO Base trades should be incorporated into your swing trading: GOOS Chart below

Tipping Point Stocks– Often found off of Post IPO Base Patterns (SHOP, TDOC, TTD recent samples)

For the longer term investor, we are in the development stage of a Tipping Point Stock advisory service. This service will probably debut in late July and be limited to 200 members. A waiting list is forming so let us know if you wish to be on it.

This is where we will build a portfolio one stock at a time up to about 15 stocks using a combination of Post IPO Base research, and also leading edge companies we think are on the verge of a viral move to the upside both in product adoption and stock price movement. (Samples include The Trade Desk TTD, Shopify SHOP, Teladoc TDOC and so forth that we have pointed out early on.)

One good sample of a Tipping Point Stock would be Teladoc. We have covered TDOC at SRP from 19.50 and recently took a nice swing trade gain on it about 4 weeks ago, and it continues higher. Teladoc has been highlighted in the weekly reports multiple times as the healthcare industry transitions to online physician visits to save costs and provide better service.

TDOC is up 68% since our first Post IPO Base alert at 19.50 for example, but definitely a company we would be looking to hold for the longer term:

Weekly Ideas List: 11 Stocks to look into

Each week we briefly highlight 10-18 names and brief notes on companies that have captured our attention and may qualify for a swing trade alert at SRP. Often within 1-4 weeks or so these can turn into nice gainers, so make sure to review our list for candidates.

Some recent winners TTD (Which we are long at SRP), GOOS (We just took gains at SRP) and CTRL which broke out last week after being on our list 3 weeks in a row (Up 11% last week).

This weeks list: A bit smaller as many of the names we have put out last few months have already broken out and are a bit stretched.

NTES- 3 week base pattern, Chinese gaming and wireless services provider, fast growth, PE 18

LOGM- Moving up off a 3 weeks corrective base pattern, on our list a few times. Remote connectivity

BABA- We first alerted Alibaba at 103 area at SRP with a 121 target, it hit that but now in a nice 4 week base

GRUB- 6 week base pattern trying to fend off Facebook and other food delivery competitors

TSM- Taiwan Semi-Conductor not getting enough love in Chip sector, but should soon. 4 week base near highs

MOMO- Wave 4 sentiment correction from 45.95 to 36.50 sets up a great buy for Wave 5 up

ATHM- 4 week base near highs, SRP took gains on this a few weeks ago but still attractive

NVMI- Semiconductor breakout

AEIS- Power conversion, 4 weeks tight base, PE 22, strong growth (On list many times in past)

MGM- On list 3 times recently, broke out this past week, but still attractive

GLW- Also on list frequently. Great fundamentals and solid blue chip.

SRP Swing Trade and Forecast Alert Service: Read up and join today – See what our customers are saying, our full track record, sample alerts and reports and more.

This past week we hit CMCM for 10% gains, GOOS for 20% gains, and entered TTD at 52-53 just naming a few trades.

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – 3/28/17- SRP Member

Check out our swing trade service where we provide research, reports, entry and exit alerts via SMS and Email, plus morning reports, market forecasts daily and more! www.stockreversalspremium.com