16 Jan Weekly Forecast and Trading Ideas Report – 3x ETF’s and more

- We continue to note that many growth stocks remain in 6-10 week base patterns, and while this occurs we have some sectors like Precious Metals and Miners and Biotech trying to work their way higher.

- We will update those sector charts in this report and have some comments on recent action as well.

- One of the ways to swing trade is with 3x ETF securities like NUGT, LABU and more. We will go over those options a bit in this report as well.

- Each week we list out 12-18 swing trade ideas, and last week once again turned up several big winners. Make sure to review this weeks list to add to your research and ideas watch list that most successful traders use.

The SP 500 index for example is in a 6 week base pattern as we show below. We have pointed out in the last few months that we are in a Major Wave 3 up from the 1991 Major 2 lows. This takes the form of 5 intermediate waves and we are in Intermediate wave 3 that is currently in the 6 week base pattern. We have potential targets at 2285, 2233, and 2406 ahead.

3X ETF Trading – BIOTECH Sample:

At our SRP Swing Trade service, we have started to incorporate a lot more ETF related trading this year partly because of the consolidation patterns and also the Biotech and Precious metals volatility which if timed well on behavioral pivot points can yield strong short term 3x ETF results. These ETF’s are very volatile so great care must be taken on entry and exit planning, something we specialize in at SRP. Most of these short term swing trades are fibonacci and human behavioral pattern based set ups which we have many years of experience in, and yet they are still like wild animals and move fast.

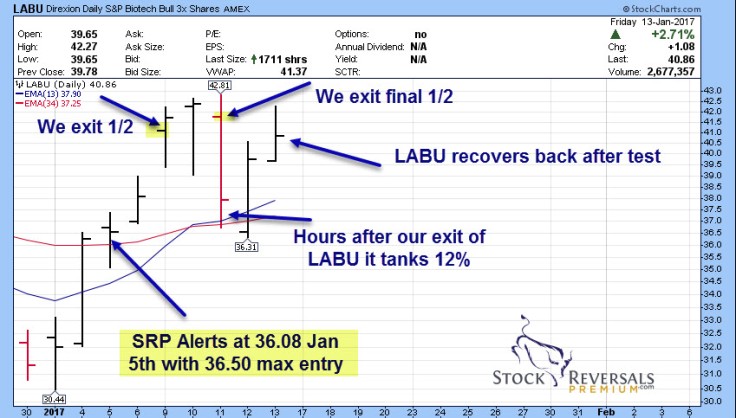

Most recently this worked in the Biotech sector with the LABU ETF which we cashed out of for 12-15% gains inside or 4 trading days or so this past week at SRP, just prior to the Donald Trump induced sell off mid week.

Below we show the anatomy of a recent LABU trade that yielded 12-15% gains, but you can see the extreme movements inside of 4-6 trading days on this 3x ETF below:

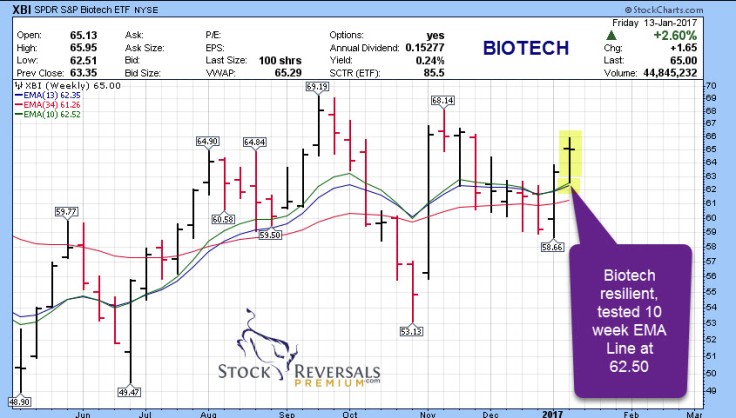

Biotech in the meantime is bucking and kicking but actually forming a possible inverse head and shoulder bullish pattern on the Weekly charts and also a recent series of higher lows which has supported pullbacks. The current pivots we have at 61.45 for key support for XBI ETF, which we use as our baseline for LABU trading

GOLD Update: NUGT trading and more

Another area which we have enjoyed success on is the Precious Metals or Miners sectors for 3x ETF trading. This would include NUGT, DUST, GDXJ, JNUG, JDST and the like. We have mostly worked with NUGT which is the Bull 3x ETF for Gold Miners. We have completed 5 consecutive profitable swing trades on this ETF alone in the last few months, even during the downtrend.

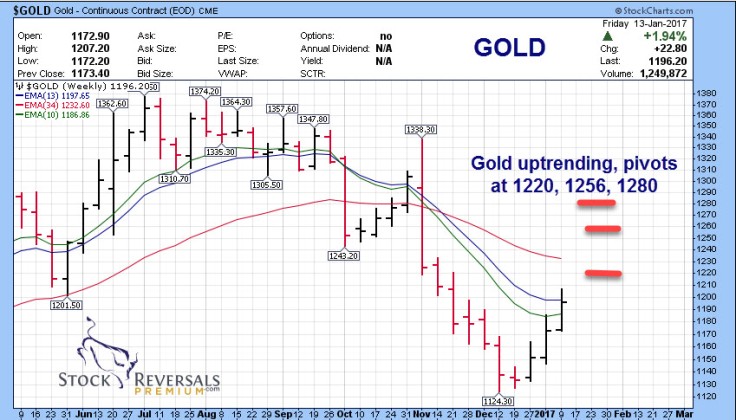

This past week alerting NUGT at 9.30 with a max entry of 9.50 advised and a buy on pullback to 8.85. The 2nd day we had a pullback to 8.80 and then a sharp reversal the next morning to 10.30, a 15% swing inside of 24-48 hours. Again these 3x ETF’s are like bucking broncos but when timed well yield strong results in short periods of time. We think that GOLD can continue to 1220, 1256, even 1280 in the weeks ahead possibly, so one way to play that is riding NUGT at various intervals.

The GOLD chart below shows a recent uptrend and the pivot at 1207 was a short term Fibonacci resistance point this past week. This was followed by a sharp pullback to 1191 area and then a bounce. We would keep an eye on 1183 as key support for GOLD.

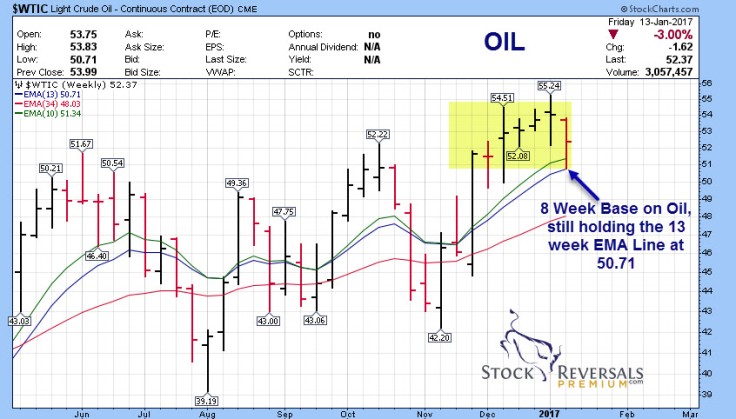

Oil Update:

Oil continues to consolidate in an 8 week base pattern which in turn has forced many Eneryg stocks to consolidate their gains as well. A breakout over 54 could help lift the group.

Trading Base Patterns: Big gains come from being patient

One of the takeaways with Base patterns is if married up with a strong fundamental story and a first or second stage base pattern, they can lead to sudden gains that most traders are not ready for. At SRP we often position ourselves into stocks with base patterns if we feel they are nearing the last 1-2 weeks of that pattern and we expect a breakout in our favor. This can also cause frustration among the less patient investor as well, but often over the course of a calendar year, heady gains and out performance of the indexes with less risk.

When we put together our Swing Trade Candidates list each weekend in this report, it often has many base pattern type ideas. Sometimes they are corrective patterns after a former base, and the base count is reset.

Last week CARB was on the list after a corrective pattern and it soared 15% for example after being left for dead.

In a perfect world a swing trader will identify the base pattern stock or ETF and enter it within days or a week before the breakout, but since that is not always the case the key is to identify the stop loss pivot point that is the most risk reward oriented, avoid the intra-day stops if you can on noise, and be patient for the breakout. – Dave, Chief Strategist

This weeks list is small but we give 6 samples of stocks that fit the mold:

IPHI- 9 week base

ESNT- 6 week base at 10 week support line

BABA- 106 target out of corrective base with uptrend

GRUB- 12 week base pattern, coming up on week 13

UBNT- Long base and has been on our list multiple times, now breaking out

IRWD- Pharmaceutical we like with 10 week base pattern