26 Mar Weekly Forecast and Opportunities Report- Thin Air

If you are not yet opted in for our Pivotal stock market forecasts, research reports, and more, make sure to register as a Free Member of Stockreversals.com with your name and e-mail.

Sign Up with Name and E-mail, we do not share your E-mail address with any entity.

Hi Dave,

Thin Air as Wave 4 continues working off Wave 3 sentiment and price highs

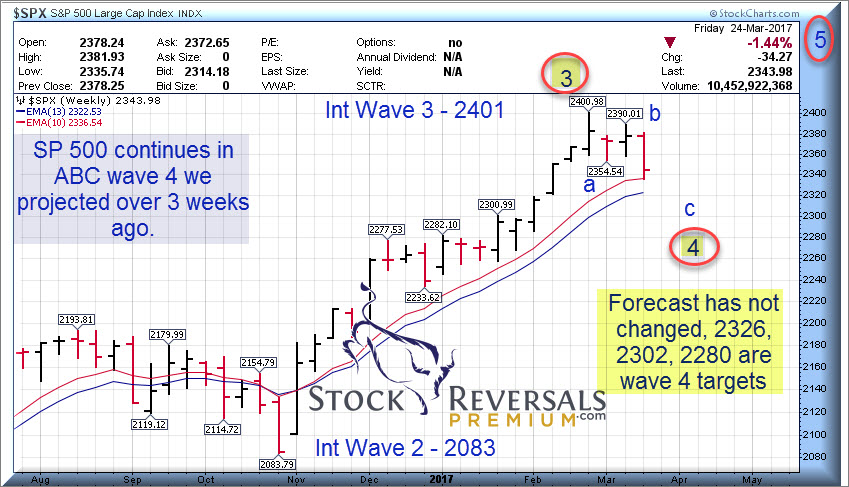

Markets continue to consolidate prior Wave 3 rally highs in a Wave 4 corrective pattern. We are in the C wave of the ABC pattern from 2401 highs on the SP 500 in early March. We called for a 2326 target and so far the low is 2336.

At SRP we continue to consider this a “stock pickers market” this year, as we are in the later stages of the Bull Cycle and therefore an extra eye towards skepticism is a good thing when picking stocks. We closed 1/2 of a swing trade for 20-24% gains on Friday that was only alerted 1 week ago. Alpha can be achieved for sure in this environment but being very picky is a good trait.

The epic 318 point “Wave 3 of 3” rally ended at 2401 on the SP 500 index several weeks ago. Since then we have been working on a normal “Wave 4” corrective pattern in the Small caps, Large Caps, SP 500 and other sub indexes. This is typical behavior and works off the extremes of that powerful 3rd wave up since the US Election.- Dave, Chief Strategist

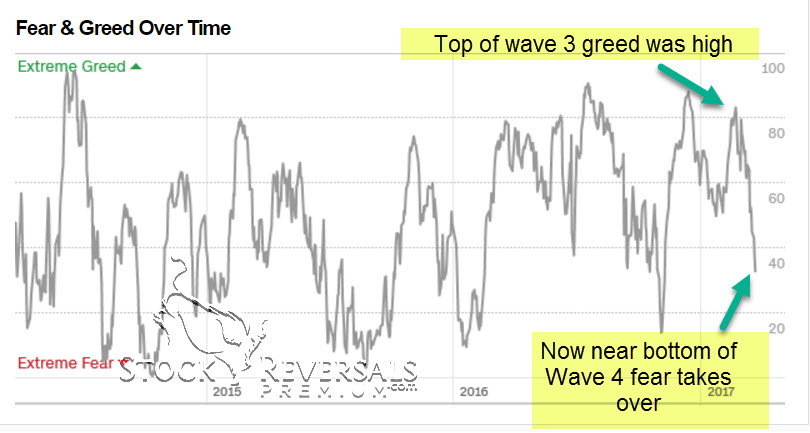

Sentiment gets to very high levels of bullishness at the top of Wave 3, and then as we approach the end of Wave 4 those readings cool off. We are seeing that now, just by viewing the CNN Fear Gauge charts:

Human behavioral patterns never change much, the difficulty is interpreting which type of pattern is at play and how far a corrective wave will go. Therefore, we initially work with what we feel is the minimum downside pattern and our forecast has been 2326 on the SP 500 since the 2401 highs. We had projected 2406 back in late November for a Wave 3 high, and got within 5 points because it was a typical 3rd of a 3rd powerful rally.

The Small Cap (IWM ETF) and SP 500 charts below show pretty clear A B and now C wave corrective patterns off the wave 3 highs.

Keep your eyes on $130 area on the IWM ETF and initially 2326 on SP 500

Biotech Update:

The XBI ETF has been consolidating prior large gains and this past week pulled back to the 68 area which we had suggested would be possible during the consolidation. Resistance remains at 70-73 area, and we could have one more pullback to the 64-65 area on the XBI ahead if the C wave in the markets drops lower. Just something to be aware of. We are still involved at SRP with a few Biotech/Pharmaceutical related stocks, but our focus is on profitable companies with actual drugs being sold , reasonable PE ratios, good growth rates, and a pipeline… something that can’t be said for many speculative names.

XBI ETF chart below indicates one more sector pullback is possible. For that reason, we are temporarily standing aside on ETF (LABU) type trades until the picture clears up.

Market Notes and More:

- Financial stocks hit this past week as they work off very overbought conditions post US Election

- Many stocks building or resetting bases

- Medical Equipment based sector and small cap stocks have been strong

- SP 500 is near the 50 day moving average line

- Bulls are at 56.7% vs 17.3% in Investment Advisory surveys, still a high ratio of over 3 to 1

Swing Trading tips and strategies:

- We try to find stocks that are not really popular when we are entering, and getting very popular as we exit.

- Focus on fundamentals, not just the chart patterns and you will reduce your loss percentages dramatically

- Pay attention to share structure, very few investors and traders do and it’s important to movement

- Focus on sectors that are leading or emerging and the best stocks within those sectors

- Look for emerging growth companies with new product lines and catalysts that are underfollowed

- Try to buy into a position after a 4-8 week base period has been established already

- Exit or take 1/2 profits on a position when its trending on Stocktwits or going hockey stick style to the upside

- When you are feeling giddy and proud of how smart you are, take some profits off the table

- Look for small cap companies a bit off the radar of traders that have strong fundamentals and reasonable valuations both.

Stock Ideas-Watch List: 13 names to review

At our SRP Swing Trade subscription service we have hit nearly 80% of our Swing Trades closed out over the past 15 months for profits. We do this with careful fundamental research and technical analysis combined, along with sell signals that get us out at the right time. Consider joining us or learning more at Stockreversalspremium.com

Each week we try to come up with 12-18 candidates for Swing Trades and that we can then use to drill down on further into the fundamentals. This past week LITE broke back to the upside and highs after hitting our Watch list last Sunday after having been through a strong pullback. With that said, we alerted two new positions this past week that were outside of our Watch List as they emerged during the week. Make sure to update your list and keep it fresh, removing those names that don’t cut the fundamentals mustard and adding those that are attractive.

CGNX- 4 weeks tight pattern, 80 % profit growth rate recently. Manufactures production automation tools.

VEEV- Cloud based software for Life Sciences industry. Sales up 47% recently, 2 weeks tight base pattern

BEAT- On the list many weeks now, 6 week base pattern, 53% recent EPS Growth, PE 31. Cardiac monitoring and more.

PLAY- Dave and Busters in a 16 week base but up trending now. PE ratio 30, Recent EPS up 108%, 3 week ascending.

AEIS- Multiple weeks on the list , has been trending up but this past week a pullback. Energy conversion devices and an A+ accumulation rating

GPN- Global Payments nearing highs with strong accumulation

SUPN- On the list a few times and an SRP position. Nearing highs, one of the faster growing pharmaceuticals with a Migraine indication starting up soon to boot.

KRNT- Also on the list often lately, digital printing for fabrics and clothing/textiles. Working with Amazon. 11 week base pattern

JD- JD.Com has been on our list off and on, Chinese online e-commerce business. 4 week base nearing highs

GKOS- On our list a few months ago and it blasted upwards. Now again close to another breakout. Glaucoma based injectables

CENTA- 6 week base for Central Pet and Garden, on our list often of late

GTN- 4 week base and nice correction for Gray Television. Broadcasters benefiting from Trump presidency and this was on our list several weeks back.

QIWI- Hitting highs, payment processing and or cashless society plays are strong