07 May Weekly Forecast and Opportunities Report- 5 up hits highs

Click the SRP Logo to learn more about our Track Record, read some sample alerts and reports, and more! Consider joining our Swing Trade and Forecast service with Daily morning pre market reports, text messaging for Entry and Exit, ongoing advice, and forecasts plus 24/7 access to our Chief Strategist! As low as $58 per month!

The Weekly Forecast and Opportunities Report:

This week we cover the following:

- Updated Major Wave 3 views for SP 500

- Small cap sector analysis for daily and weekly views using IWM ETF

- Gold drops more than expected, updated chart views

- Biotech Sector analysis using XBI ETF and LABU swing trade results

- Sectors to consider for long term growth and stocks within to focus on

- Tipping Point Stocks

- 15 plus Swing Trade Ideas on our Focus List

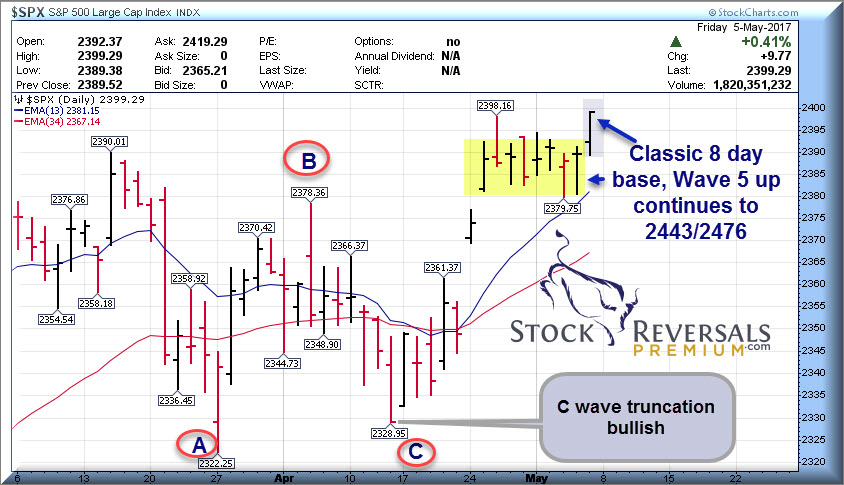

Wave 5 up of Major Wave 3 continues and this time to closing highs so far. We had patterned out a projected 2443 low end 2nd quarter target for Major Wave 3 to complete and two weeks ago updated that to add in 2476 as another target to watch on the upside.

We update the Daily and Weekly views below:

The daily chart shows the ABC pattern of Intermediate Wave 4. These 4th waves tend to be relatively shallow as compared to a 2nd wave correction pattern. We had projected 2326 weeks before the bottom hit at 2323. We had a bounce B wave rally which was a Fibonacci retracement of the 2401-2323 A wave, then a C wave which was just a tad higher on the final low than the A wave. We call that a “truncated” wave, which means it ended a bit shallower than normal. These can portend or confirm a Bullish new uptrend.

We are now continuing in Intermediate Wave 5 and our target is 2443-2476. A nice 8 day consolidation led to the Friday rally.

Weekly Views updated below: The Wave patterns could not be more obvious

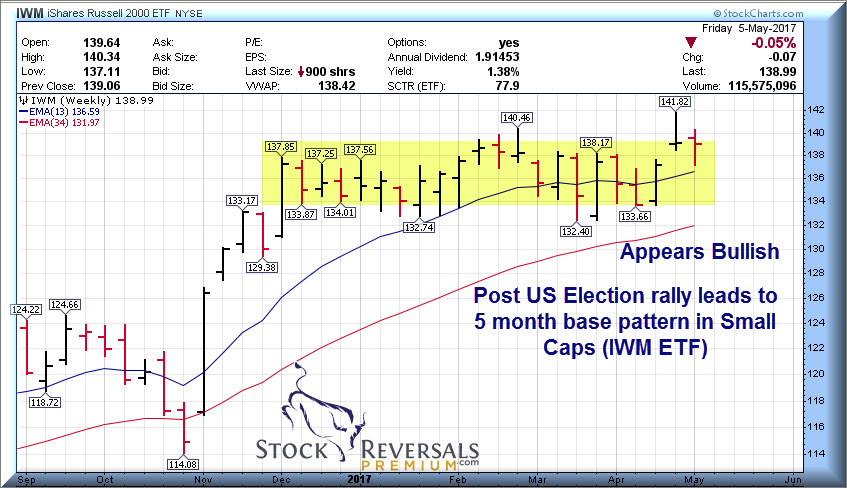

Small Cap Update: IWM ETF

Using the IWM ETF as our proxy, we can see a 5 month base pattern that followed the massive spike after the US Presidential Election. This looks poised to break out as Major Wave 3 of Primary Wave 5 continues

Weekly chart below shows 5 month base:

Daily chart shows recent pullback and reversal after the Post IRS Tax deadline rally:

Biotech Update- XBI ETF/LABU 3x ETF

At SRP we often trade using 3x ETF securities like LABU. We closed this swing out for 17% gains on the back half of the trade this past week as we sensed a “C wave” high in the XBI. For now, this continues to consolidate with that 72-73 area being overhead. As we exited LABU just over $53 it then dropped to $48 in the next few days.

The current pullback in XBI is a 4th wave or sometimes we call it a “D Wave” We tend to stand aside and look for confirmation of a bottom before acting. Note the 34 day EMA support line and pivot.

LABU Trade Chart

This chart below shows the anatomy of a successful C wave swing trade using LABU 3x Bull ETF. We based this off our XBI patterns and then entered and exited accordingly. When the 53.xx area hit, that was our target, we alerted to take gains.

Take a moment to Opt In for our Free Stock research and Market Forecasts here: Name and E-mail only, and we do not share your information with any other entity.

[Recent winners given to SR Members in reports: STRP up 500% in 21 months from Research Report. TRVG up 45% in 6 weeks from Post IPO Base report, SHOP up 200% from 2016 long term stock report and more!]

Long Term Growth Sectors: Tipping Point Stocks

We are in the midst of preparing now to launch our first new product in 3 1/2 years which will be focused on growth stocks at a tipping point. Expected in the next few months.

The focus will be on companies in strong or emerging technology sectors who are about to see dramatic growth based on trends, products, consumer and or enterprise behavioral shifts and more. Companies that we identified early such as SHOP, MOMO, BLUE, FB, STRP are good examples of Tipping Point Stocks with 100-500% gains on that list from our early research reports and work. Sometimes swing trading alone will miss out on the long term upside potential of companies we really like at The Market Analysts Group, so adding this new service we think will benefit our members who would like to add long term stock investing to their repertoire.

Some sample sectors or areas of Tipping Points now, or frankly that are well into and past the early Tipping Points:

Cashless Society: The movement to non cash methodologies if paying for all goods and services including between friends. This is a huge growth sector and the following companies would be in the mix for long term investing

V- Visa GDOT- Green Dot GPN- Global Payments PYPL- PayPal SQ- Square HAWK- Blackhawk Network QIWI

Digital Media/Advertising: This movement is well into and past the original tipping point in terms of how corporations and small businesses are advertising. The obvious benefactors being Google, Facebook, SnapChat and more. However companies that are benefiting from this Tipping Point are some of the plumbers if you will:

FUEL-Rocket Fuel TTD- The Trade Desk CRTO- Criteo to name a few in the digital advertising servicing area. We identified TTD post IPO around $29, now $40 with a high of $47. FUEL recently at $3.90 with a recent high of $5.70, and CRTO last year at $42 with a recent high of $54.

More details to come on our newest service which will aim for Tipping Point growth stocks looking for 50-200% gains and with holding periods expected of 6-24 months. A rotating portfolio of 15-20 names. We expect to give a healthy discount to Active SRP members and have not yet determined pricing. The service will be limited to 200 members unlike some from other websites which have literally thousands of subscribers trying to get into the same stock at the same time. We will allow people to put their name on a waiting list in the next few weeks.

19 Swing Trade Ideas and Weekly Focus List:

We like to identify a focus list of good ideas for the intermediate period ahead. This list each Sunday are companies with good growth , solid fundamentals, and attractive chart patterns. One of this past weeks big winners was Zillow for example in the booming Real Estate sector.

AMAT- Frequent flier on our list, a leading Chip Equipment maker in an ascending base. Earnings due 5/18

DY- Dycom is benefiting from build out ahead of telecom networks, data centers, and soon the 5G roll out. 3 weeks tight base pattern near highs with earnings due 5/22.

UNVR- Near highs and under strong accumulation. Global chemical and ingredient distributor

RNG- Nearing highs, on our list last week. PE is 60, may need to consolidate some. Corporate Communications

GRUB- Volatile stock to say the least but Grubhub food delivery business continues to grow at 40% plus. Close to a breakout at 46

ATHM- Automobile information content for Chinese consumers. Earnings due 5/10, 2 weeks tight base

MTCH- 32% growth for the online dating service. We called this valuable real estate months ago on Stocktwits. Nearing a breakout

ICHR- Chip equipment maker, Post IPO Base near highs now going on 11 weeks. PE 22 earnings 5/11

WB- The Twitter of China if you will, close to breakout near highs of a long 6 month base pattern.

SODA- 3 weeks tight base for the maker of machines that turn water into soda and other additional products. Earnings due 5/10

GOOS- The Canadian maker of the famous and expensive Goose parka jackets popular with the wealthy and millennials. Recent IPO out of Bain Capital, who by the way have a cost basis of 3 cents per share, wow. 8 week base

PI- RFID chip maker that is rumored to work with Amazon soon, breaking out post earnings or close to breakout

MGM- Two weeks tight pattern at highs for the Gambling king

GLW- Two weeks tight pattern for the glass maker expanding into new lines

DVMT- The trading stock for the EMC/Dell merger if you will, nearing highs, 2 week base

HAWK- Blackhawk networks part of the cashless trend, specializing in Gift cards and more. Insiders buying.

BTU- Post IPO base and Elliott Management is loading up on shares from 24-26 of late

TTD- The Trade Desk helps firms buy and place digital advertising. We first identified a 29 post IPO base, now 40 but looking good to test old 47 highs

VEEV- Cloud based software for sales support and more for Pharmaceuticals/Biotechs, expanding into other sectors