12 Mar Weekly Forecast and Opportunities Report- 14 Ideas

Weekly Forecast and Opportunities- Wave 4 correction continues?

If you are not yet Opted In as a Stockreversals.com Member, consider getting on board today. Are you ready for something different? Forecasts, Trade Ideas, Long Term Growth Stock reports, and more.

Sign Up with Name and E-mail, we do not share your E-mail address with any entity.

SMALL CAPS UNDER PRESSURE?

SP 500 IN NORMAL CORRECTIVE ACTION SO FAR

UPDATES ON OIL, GOLD, BIOTECH

POST IPO BASE THOUGHTS AND NOTES

14 FRESH SWING TRADE IDEAS

UPDATES ON MARKET MEASURES, SENTIMENT AND MORE

The markets continue to quietly work off the interim highs of Major Wave 3 from the US Presidential Election lows in November. We had forecasted a 2406 topping area well in advance and the high so far was 2401. The reaction since then has been a shallow wave down to about 2357 towards what may be an A wave bottom, and now a B wave bounce to the upside is underway. We are patterning 2383 as a key line in the sand for the SP 500 Index in terms of resistance. If the Index is able to take 2383 out with authority we may rally all the way to 2401 or even 2406 before another corrective pattern.

The bottom line though is this recent pullback action was projected in our forecast models and 2326 is still a possible low end pivot target to keep an eye on in the days and few weeks ahead.

This coming week is also week 18 of a common 18 week cycle movement, something to keep in mind.

IWM ETF AND SP 500 CHARTS BELOW:

Small caps vis a vis the IWM ETF below broke down from a 13 week base. We are not that concerned right this minute and a target of 130 wont surprise us for IWM in the period ahead, something to watch though.

SP 500: KEEP EYES ON 2383 RESISTANCE FOR POSSIBLE B WAVE HIGH AND 2326 AS LOW END WAVE 4 TARGET POTENTIAL

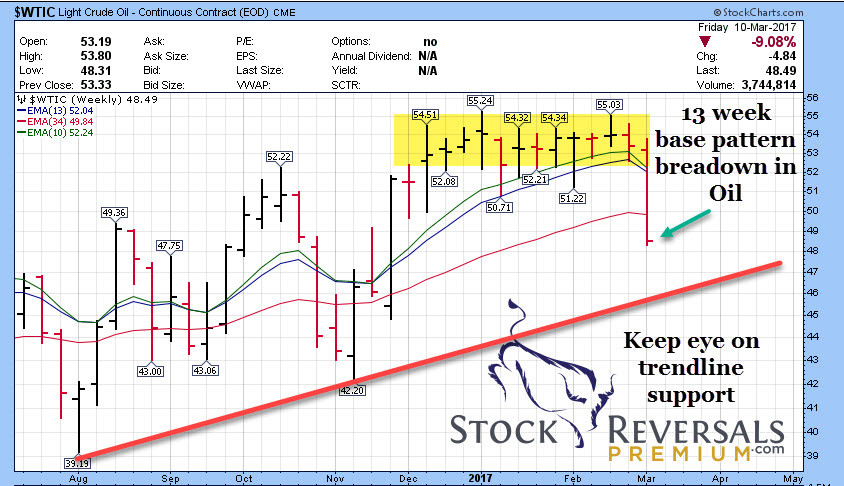

OIL- BROKE DOWN ON THE WEEK 13 CONSOLIDATION WINDOW PERIOD. 13 WEEK PATTERNS OFTEN PRECEED A CHANGE IN DIRECTION

We expected a pattern shift on the 13 week base last week and it was to the downside. Keep an eye on the rough uptrend line from $47 are as new support per the chart below. We continue on the sidelines for Energy stocks and ETFs

GOLD- 1177 IS CURRENT PIVOT, BUT THE BOTTOM THIS PAST WEEK WAS 50% RETRACEMENT OF RECENT RALLY TO HIGHS

We had thought Gold was going to continue higher a few weeks ago but we were wrong. A current 5% position though in NUGT rallied up nicely on Friday to $8 area and has not yet stopped us out though it got close. This recent pullback to 1194 interestingly was a 50% retracement of 1124-1264, so now a B wave up and maybe another pullback to 1177-1180 area would not shock us, but near term some further upside looks good for counter trend rally

BIOTECH- REMAINS STRONG, ONE OF TOP SECTORS YEAR TO DATE. BROKE OUT OF TRIANGLE FEW WEEKS AGO

We had projected a pullback to the 69 area on XBI ETF in a recent forecast report. This hit at 69.19 this past week and then bounced upwards. SRP is long LABU again with a stop in place. We see potentially massive upside in the weeks ahead.

Are you ready to try something different? Would you like less risk and higher returns on a consistent basis with your trades? Market forecasts that keep you ahead of the curve at every turn? Read up and join us at StockReversalsPremium.com

MARKET NOTES: SENTIMENT CORRECTING ON SCHEDULE, OIL, ECONOMIC OPTIMISM

Sentiment has cooled off during this Intermediate Wave 4 correction off the highs.

Investment Advisors: 57% Bulls in Investment Advisory Surveys and 17% Bears, down from a 63% reading last week.

Retail investors: Bullish % is at 30.00%, compared to 37.91% last week and 32.02% last year. This is lower than the long term average of 38.38%.

Leading sectors: Biotechnology, Chips, Electronics, Computers, Banks

Weakness: Oil, Energy, Gold, Retail

Oil dropped 9% this past week as frac production rises and inventories build to 10 year highs. Many of the small to mid size drillers re-financed via debt and or equity offerings in the past 6-12 months and must produce as much as they can to meet debt requirements. This is causing more supply than is needed to meed demand.

Economic Optimism Index remains near 12 year highs

TRADING IDEAS AND STRATEGY: TRADING THE POST IPO BASE PATTERNS

– TTD RECENT SAMPLE AND TRVG CURRENT

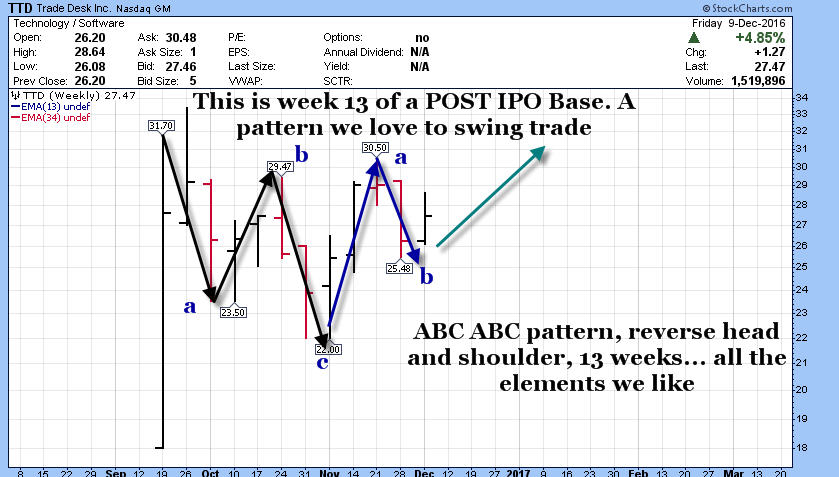

POST IPO Base patterns– One of our favorite Swing Trade and Intermediate Growth ideas for SRP Members is to review recent IPO’s and wait for base patterns and or corrective patterns to develop. These can often be found with 8 and 13 week chart patterns. The key is always fundamentals, valuation, product lines, share structure and more as well obviously. Assuming we like those elements, then we look for stocks that have built a base and have investors asleep at the switch.

A recent sample being TTD- The Trade Desk, they specialize in Online Advertising management.

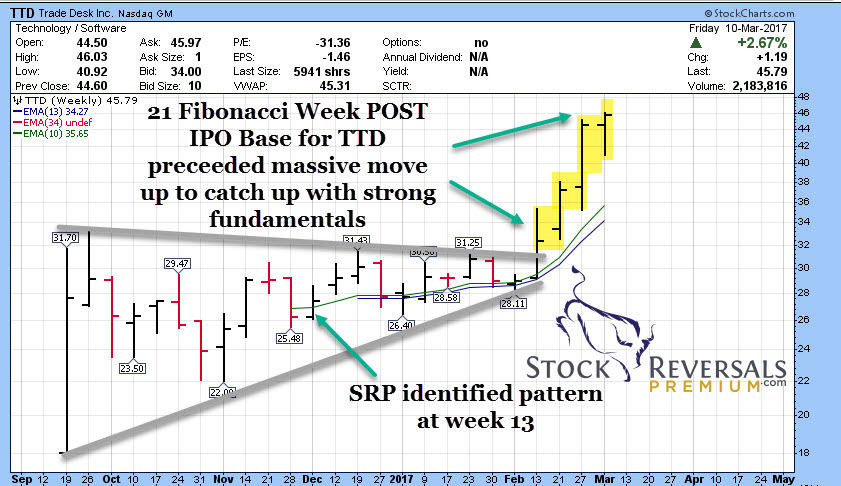

We identified this as a Swing Position several weeks ago near 27 after a 13 week Post IPO Base, as it turned out it continued to base for 8 more weeks but then recently ran up 50%. Sometimes the base patterns outlast our patience, or they continue too long for a swing trade hold. However, they can be great not only for short term breakout swing trades when timed well, but also for longer term investing.

TTD DECEMBER 2016 BASE PATTERN IDENTIFICATION TO SRP MEMBERS

We had targeted $34 out of the $27.50 area for a swing trade originally. The chart below came with the POST IPO Alert showing an abc-ab pattern, and reverse head and shoulder. The stock ended up going on sideways for 8 more weeks and we took gains early. Many weeks later we see a huge move post earnings in the second chart.

BIG MOVE UP POST EARNINGS OUT OF THE 21 WEEK POST IPO BASE

This is one of many examples and we are constantly looking for new opportunities. Newer stocks tend to have much more investor attention and often tighter trading floats in terms of shares available. Some of these require multi-week holding periods.

One that we like right is TRVG– Trivago, the German online hotel booking website in a 13 week Post IPO Base. They are growing organically at a 45% clip, the fastest of all Online travel websites. Investors don’t seem to care much, hence the Post IPO Base develops.

This is a chart we did back on March 3rd for example. The stock has continued to base since closing at 12.48 on Friday, but we see this heading back to the old highs and possibly above going forward. If we are wrong, we put a stop near the market close in place usually to avoid intra-day noise, as in we avoid hard stops in most cases.

Our March 3rd ABC Pattern in Trivago:

SWING TRADE IDEAS: 14 FRESH IDEAS

Each week we like to list out some swing trade/intermediate stock ideas. Last week MOMO led the way with a 15% gain on the week from our list.

These stocks tend to have nice base patterns or recent breakouts and the fundamentals are strong. From this list we drill down with much more analysis and then often pick a few for trades. In either event, this should provide a nice list to work with for readers

BIVV- A spinout of Biotech giant Biogen in January. Hemophilia drugs and future specialty drugs

MRCY- 4 week base pattern for this Defense and Intelligence firm

ESNT- 7 week base pattern for mortgage insurance provider

BEAT- 3 weeks tight pattern for this patient monitoring/cardiac technology company

YRD- Chinese consumer finance firm, may be rebounding and attempting to break out of resistance

PHM- Homebuilders are strong, Pulte Homes at 52 week highs

ATHM- Chinese automobile online service, 4 week base breakout

MBLY- 4 week base pattern, may challenge multi month highs if it can break loose

AEIS- On this list multiple times, Power Conversion products, may finally be breakout out of long base

NTRI- Nutrisystem Diet plan is popular again, may need another week of basing though at highs

TRVG- Post IPO 13 week base, we see possible breakout for this online hotel booking operator

GMS- Interrior construction products are strong

NSP- Ascending 4 week base pattern for Insperity, Payroll, Human Resources etc.

ZAYO- 2nd week on list, 2 weeks base pattern trying to emerge from deeper base. Infrastrucure/Bandwidth