05 Apr Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

3x ETF, SP 500 Futures, Market Forecasting, and Stock Swing Trading services via Subscription

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of April 6th

This Week:

- SP 500 and Markets at key inflection points after initial rally hits resistance

- Banister Wave charts showing two potential scenarios

- Commonalities of 1932, 2002, and 2009 Market Bottoms discussed

- A date to watch for a possible Bear cycle official bottom

- Update on Bulls vs Bears in Advisor Surveys- Bulls hit lowest % level in 10 years

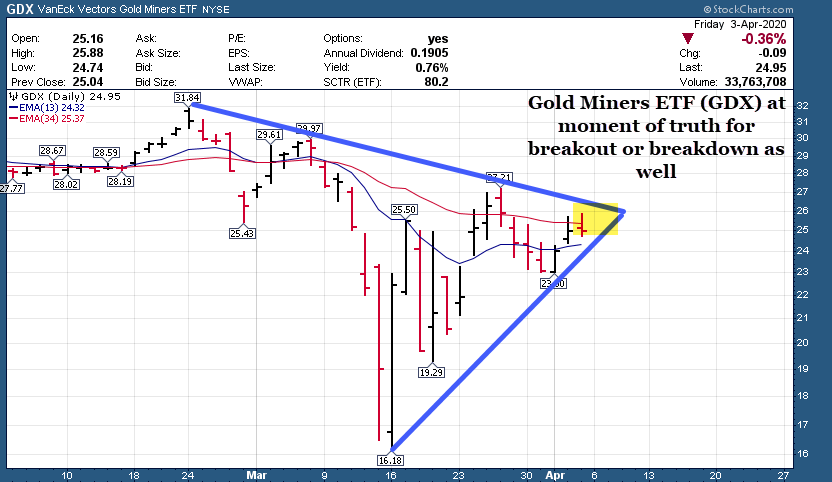

- Gold Miners at key inflection point- GDX ETF Chart Updated

- Coronaconomy Stock notes and Stocks to watch or consider

- Swing Trade Ideas list updated

Recent results and notes: Stock ,ETF , and SP 500 Futures Swing Trading Results

Read up at TheMarketAnalysts.com for all services and Track Records

I believe it’s important for my serious trading members to belong to all of my services in order to benefit and profit from the various environments we find ourselves in, whether Bull or Bear and in all cycles. This past week in the Stock Swing Service we sold out of LK the day before it crashed. We sold out of DOCU for gains before it reversed from the highs a day after our sale, and we alerted a new position on Friday after earnings were out. The 3x ETF service only had one 1/2 size position trade in LABU (Biotech) and we took a loss with the market at indecision point. We had one trade in the SP 500 futures service for a loss and we stayed neutral the rest of the week again waiting for market confirmation from this range. I aim to hit 7 out of 10 trades for profits over a 12 month cycle and have done so for 10 years. All track records are online.

3x ETF Service on Stocktwits.com : $40 a month, Track Record is online, pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Stocktwits SP 500 Futures Service: $50 a month, Join the Trading Room and Follow my SP 500 guidance, Charts, and trade yourself with my alerts on Stocktwits.com

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

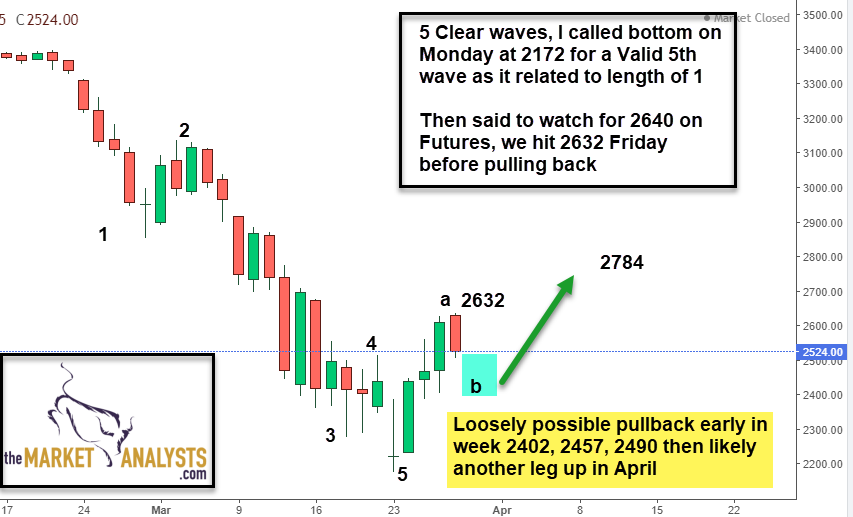

This is what I wrote last Sunday…after expecting a pullback early in the week…

“That takes us to a likely minor B wave from the 2637 SP 500 highs this past Friday down to maybe 2470 area, possibly as low as 2400 area into the early few days of this coming trading week. Obviously I’m spit balling a bit here, but loosely a pullback and then another rally in April is likely taking us up towards 2700 possibly even a bit higher. “

Here is the chart I posted up here last Sunday with the above projection mapped out for reference:

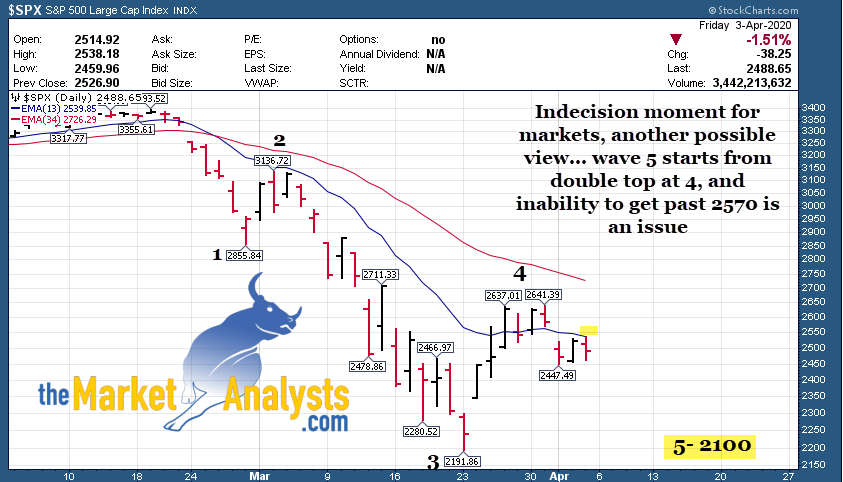

This is an updated Chart on Thursday morning which I sent to SRP Swing Trade Members:

Just a warning to them of a possible double top, we were watching 2565 on the upside, and so far not yet taken out…

What happened was a re-test of the prior highs early in the week, or a possible “Double Top”, then a sharp pullback as expected and we held the 2402/2457 pivot zones (2420 on ES Futures), then bounced a bit Thursday, then pulled back again Friday. Therefore last weeks chart has been correct, but I’m not feeling super inspired on the next leg up just now either.

Which means…

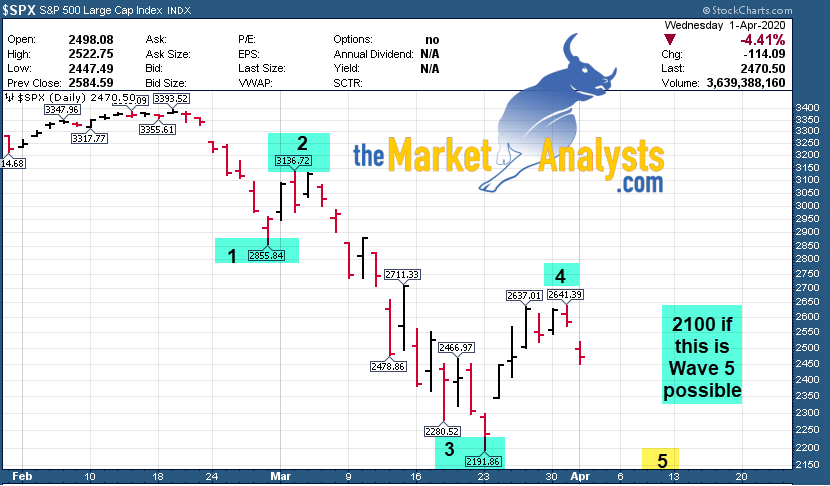

Markets are at a key inflection point!

Which brings us to this weekends Chart updates and notes.

With the double top in the 2640 area we had a 38% retrace to the upside of the entire decline from 3393 to 2190. A typical high end 4th wave rally is about a 38% retrace of Waves 1-3, and that is what the SP 500 has done so far. I had projected 2650 as an initial target after the Monday March 29th lows with that in mind.

Later last week I told members of my services that we had to get past 2565 area on the SP 500 to get a move upwards to potentially higher levels (2784). That has not happened yet and I would watch that area as key resistance near term. With Europe peaking out possibly and the US coming into a crescendo for the Virus still, its a mixed bag of optimism vs pessimism.

The other scenario is we already double topped in an ABC up pattern at 2640 area for Wave B with C starting down or Wave 4 with 5 starting down. In either event, a leg down could have already started and I would be watching for 2100 area loosely on the SP 500 ahead. Only a move strongly over 2565 would alter this short term outlook.

Bottom line? Market is in a counter-trend bounce and losing some legs here. The Small Cap (IWM ETF) index is weak after a nice bounce off the March lows.

Intermediately (Weeks), risks remain to the downside barring a major breakthrough in medical technology towards the Virus near term.

Here are the two alternate view charts for this upcoming window and again, keep your eyes on 2565 on SP 500 as key to take out initially. (Normally I try to go with one major view, but we are at a 50-50 indecision point near term)

Members of all services are updated daily with trading advice obviously based on action!

Other Notes: Venus Retrograde and prior crash lows, The Oil Indicator, and Bulls and Bears Ratio

Of interest, several major Bear Market lows have occurred when Venus goes into Retrograde. The last ones being during the Depression in 1932, October of 2002 (Market low with a re-test higher low in March 2003), and March 6th 2009 (3 days prior to the ultimate low). The next date for Venus Retrograde is May 13th, something to watch.

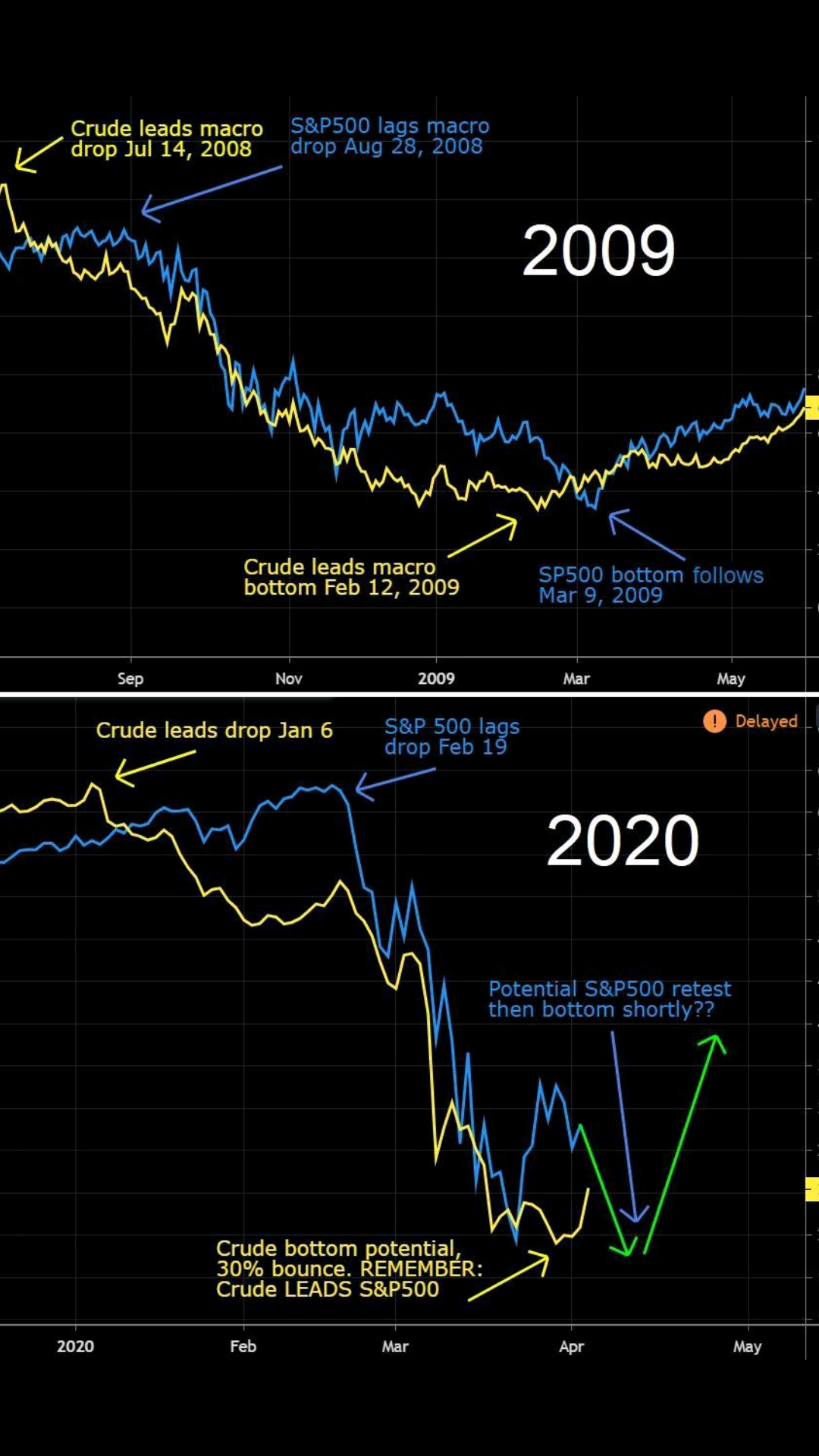

Oil bottomed in the last major crash about a month before the market bottom in March 2009, we are seeing a similar possible pattern now in the SP 500 with Oil rallying last week but with SP 500 possibly needing one more leg down yet.

The Percentage of Investment Advisors who are bullish has tanked to just 31%. This is the lowest reading since the 2009 crash lows, which contrarily is a bullish signal eventually. This is the first time we have seen more Bears in the survey than Bulls in quite some time. Bears pulled back to 36% from 41% last week as we have bounced.

Consider joining my subscription services at TheMarketAnalysts.Com for tradeable ideas and updates daily, and if not you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide updates.

Corona Economy- thinking outside the box

Swing Trading Ideas: I’m calling it the Coronaconomy in terms of thinking of Stock ideas short intermediately. What MAY work in the new environment?

Last week we had multiple winners during the week including DOCU and ZTO. We punched out of rallies in DOCU, ZM, and UBER in the past few weeks at SRP swing service before reversals back to downside. Some of those names may be attractive again now.

Recently winners I highlighted during the hysteria and near market bottom that rallied were Peloton, Netflix, Zoom Video, Uber, Clorox, Docusign and others.

(We may or may not alert some of these ideas below at our SRP service)

CHWY , ZTO, DBX, GMAB, TEAM all repeated from March 30th report

Chewy for pet products, nice pullback post earnings. ZTO for Chinese E commerce delivery and logistics, TEAM for team corporate collaboration, LAKE for protective wear and more…

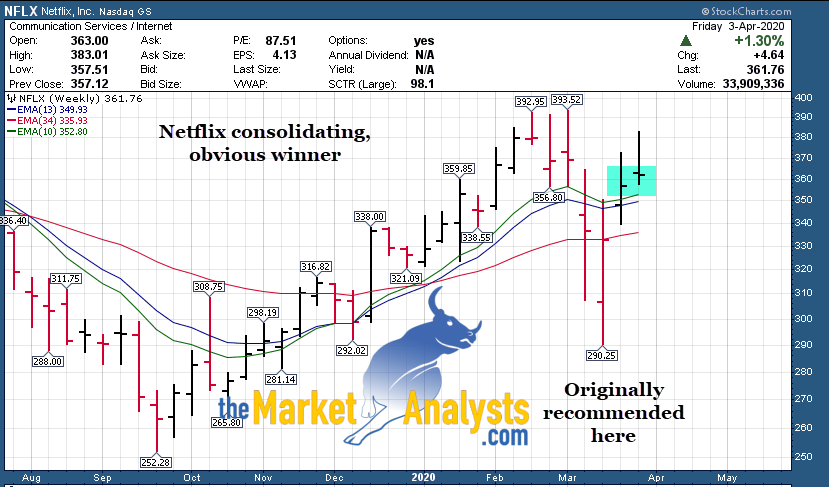

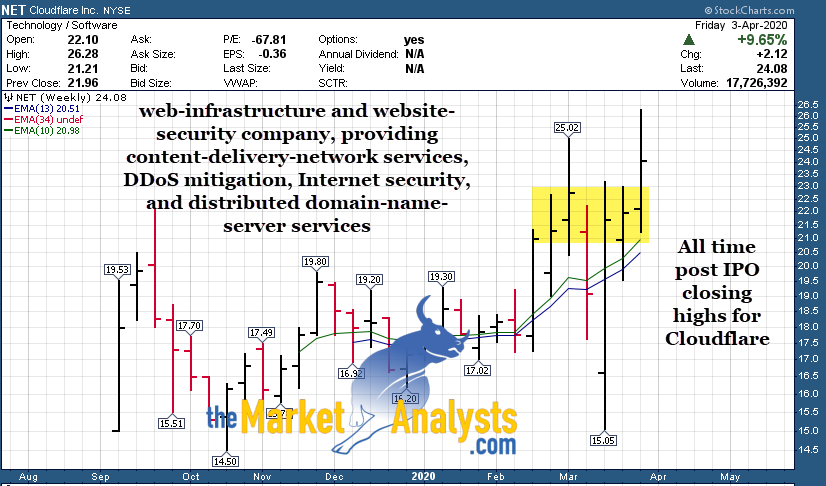

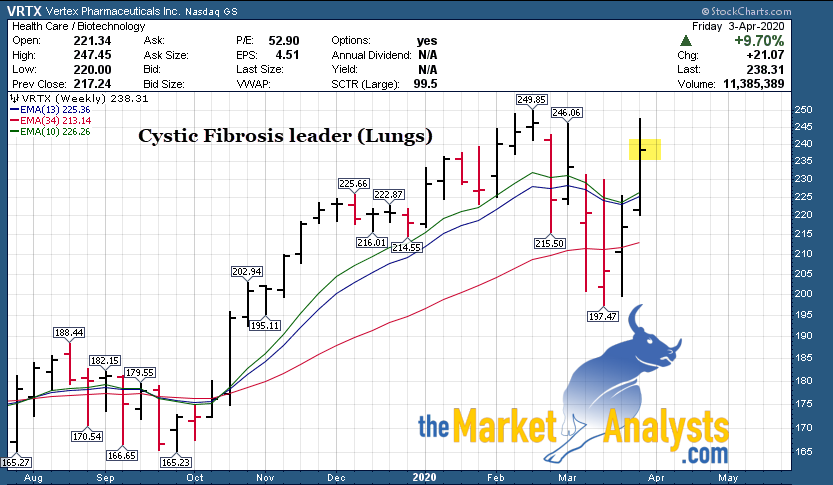

New ideas or returnees include LAKE, GOLD, ZM, VRTX, AUDC, NET, REGN, NFLX, BRBR, GDX (ETF)

A few charts and notes:

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

3x ETF Trading Room (Oct 2019 Debut): The 3x ETF Trader, a service hosted on Stocktwits.com , trading 3x ETF pairs in Bull or Bear movements. Very strong track record since Oct 2019 inception on Stocktwits.com. Just $40 a month!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks!

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

ESAlerts.com – Auto-Trading SP 500 Futures Service

If you do not have time to monitor alerts, enter and exit trades on your own via Stocktwits servivce, we do the trades for you, you sit back and enjoy! Only $339 per 90 days of service, account is set up with a Chicago based trading firm and commission are low! All trades auto-executed based on Dave’s directives to the trading desk!

Re-Launched February 10th 2020 to mimic the Stocktwits Room trades for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)