15 Mar Weekly Wave Forecast and Crash Update Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of March 16th

This Week:

- Near historic crash readings remain relative to prior Bear cycles

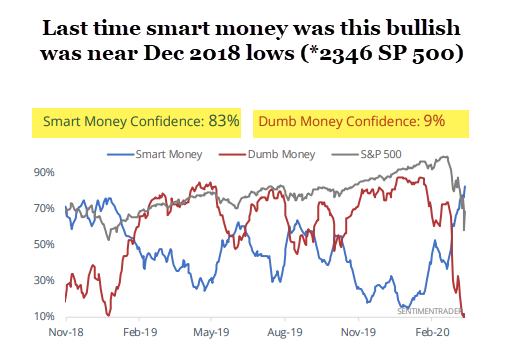

- Smart Money at 10 year highs for bullishness while Dumb money at multi year lows (Bullish)

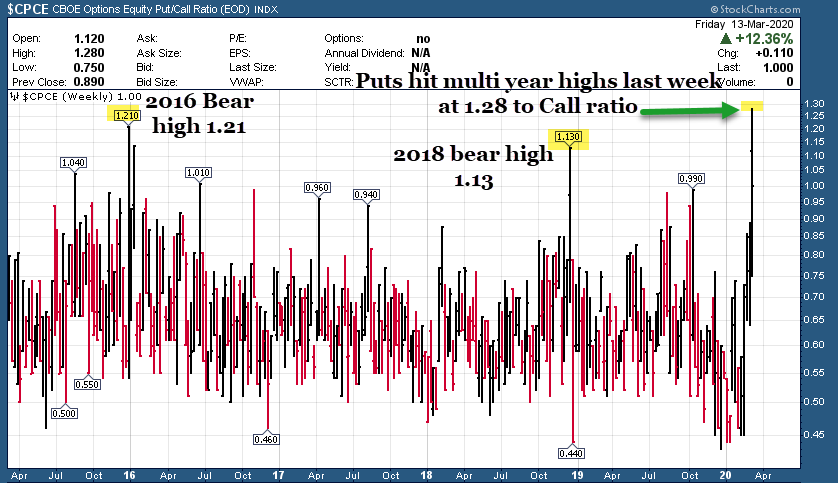

- Put to Call ratios hit higher levels then 2016 and 2018 bear cycle lows this past week (Bullish)

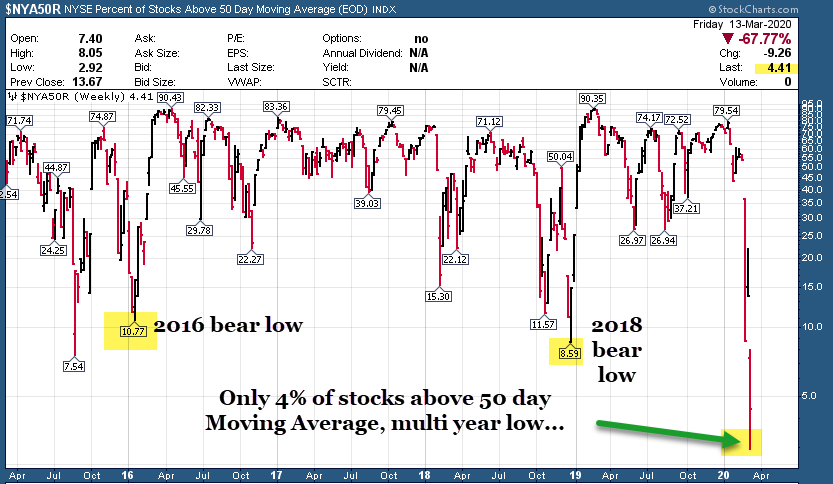

- Only 4% of stocks trading above 50 day MA lines, historic lows or close (Bullish)

- 30% decline in 3 weeks is the fastest on record (Bullish)

- Lots of charts to review that tell the tape

- Market may have one more washout yet (2675 key support)

- List of 14 names for Swing Trade ideas in current environment plus charts

Recent results and notes: Stock ,ETF , and SP 500 Futures Swing Trading Results

We laid low in the SRP Swing Trade service for yet another week staying in cash, waiting for dust to settle a bit. SP 500 futures also keeping low profile while providing daily guidance to members. 3x ETF service closed nice gains on SPXL early in week and took loss on LABU, then stayed 100% in cash last few days while dust settles.

3x ETF Service on Stocktwits.com : Track Record is online, join for just $40 a month and pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

SP 500 Futures Services: Auto-Trade platform at ESALERTS.Com or join the Trading Room and do it yourself with my alerts on Stocktwits.com

General Market Summary:

We got the re-test of the lows and then some last week. Instead of belaboring all the points everyone has already read about the nature of this decline, I again will post up multiple charts to tell the story for me.

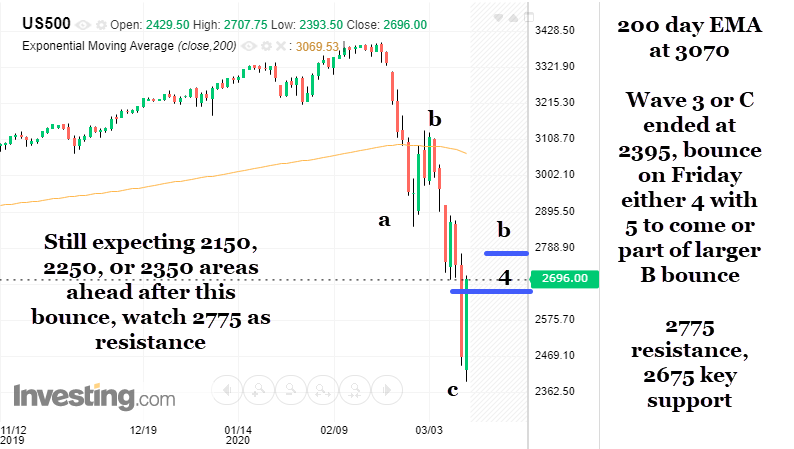

Bottom line is we could get one more washout to 2150, 2250, 2350 zones on the SP 500 as more and more bad news comes in. Normally with these historic crash readings I would be standing on my head being super bullish, however we are in a Black Swan event territory here and its hard to say we have price bottomed just yet.

Futures will begin trading at 6pm EST on Sunday night, so you can check those to see how the early sentiment is acting after lots of closures worldwide over the weekend. 2775 is the upside resistance, 2675 key support, below that we could fall all the way to 2150-2350 zones.

A few notes of optimism:

Smart Money readings from The Sentiment Trader are showing 83% Bulls, and the Dumb Money has crashed to just 9% Bulls. This is a contrarian bullish signal

The NYSE Short interest ratio has dropped to a 5 year low of .49, it was running at a hot read of 5 a few months ago, meaning lots of bets on a down market did pay off, but right now those bets are closing out which could be read as bullish depending on your viewpoint

One more area I would like to see adjust is the percentage of Investment Advisors being Bearish, its only 23%. This is super low and a final bottom in the market would come with this I think above 40%. The % of bulls has dropped to 36% from 55% a few months ago, but the Bears are not coming out of the woods in enough droves to help drive a final bottom in my opinion.

Like everyone, I’m not sure if we have hit the price lows for this Bear Cycle yet…

Charts tell the story:

% of Stocks above 50 day moving average plunging to 4%, a multi year low. Worst than last two bear lows.

Gold hit the 5th wave peak area I projected a few weeks back at 1700, could plunge to 1375

Weekly read of Put to Call ratio hit multi year highs, worst than last two Bear cycle market lows

NASI ratio at -1002, almost as low as 2018 Bear Cycle Low

ES Futures long term chart shows us just above the 200 week EMA Line at 2671 as of Friday close after plunging during the week to 2395 lows. We rallied 13%.

Huge “Tail” on the Candlestick for this past week at 2395, I had been discussing 2350 possible

Daily 200 day EMA line is at 3070 which would be upside resistance to Bear Rally. Could be a 4th wave high this past Friday with a 5th wave down to lows ahead, or we are trying to bounce up in B… either way, still expect another flush to test recent lows or worse in weeks ahead.

Swing Trading Ideas: 14 names to look into

Several interesting plays for the current economic times to consider this week. I have charts below on those names. These include the following symbols. (We may or may not alert some of these at our SRP service)

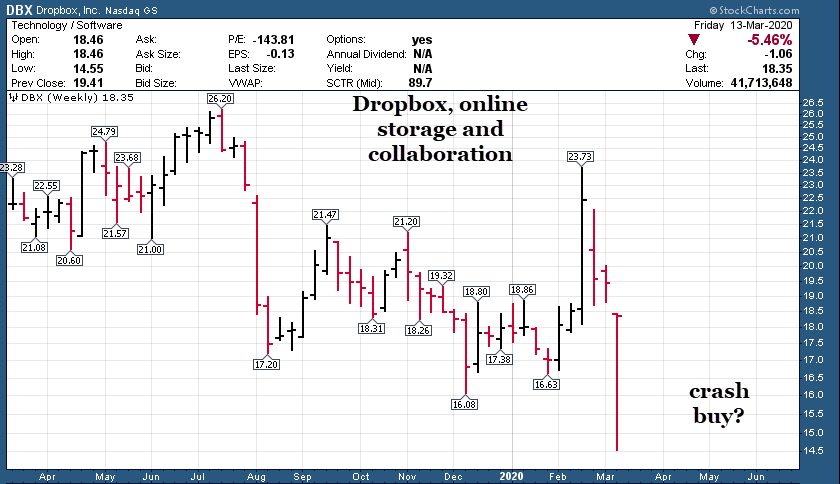

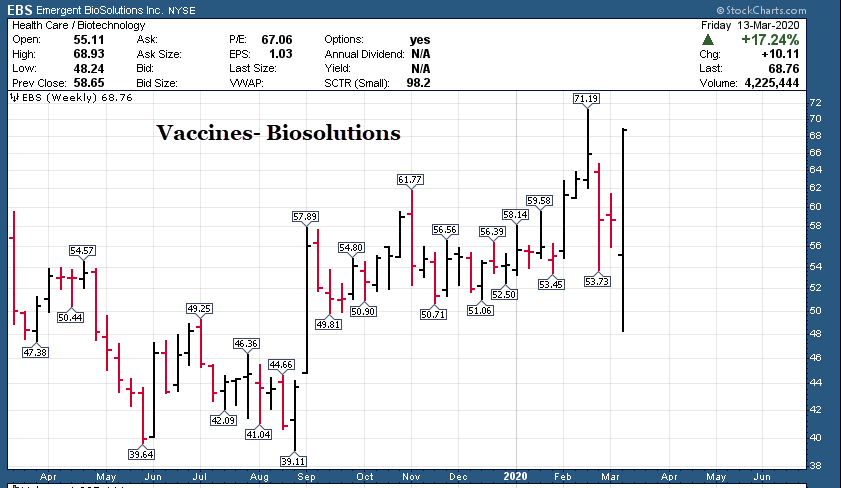

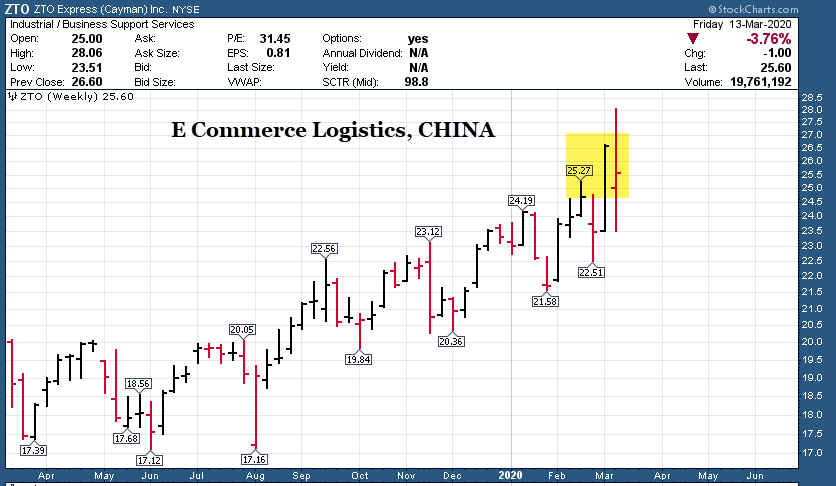

WORK, ZM, CLX, PTON, NFLX, EBS, REGN, ZTO, ZM, RNG, LAKE, DBX, TNK, GSX

A few charts and notes:

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

3x ETF Trading Room (Oct 2019 Debut): The 3x ETF Trader, a service hosted on Stocktwits.com , trading 3x ETF pairs in Bull or Bear movements. Very strong track record since Oct 2019 inception on Stocktwits.com. Just $40 a month!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks!

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

ESAlerts.com – Auto-Trading SP 500 Futures Service

If you do not have time to monitor alerts, enter and exit trades on your own via Stocktwits servivce, we do the trades for you, you sit back and enjoy! Only $339 per 90 days of service, account is set up with a Chicago based trading firm and commission are low! All trades auto-executed based on Dave’s directives to the trading desk!

Re-Launched February 10th 2020 to mimic the Stocktwits Room trades for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)