27 Jan Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of Jan 27th 2020

This Week:

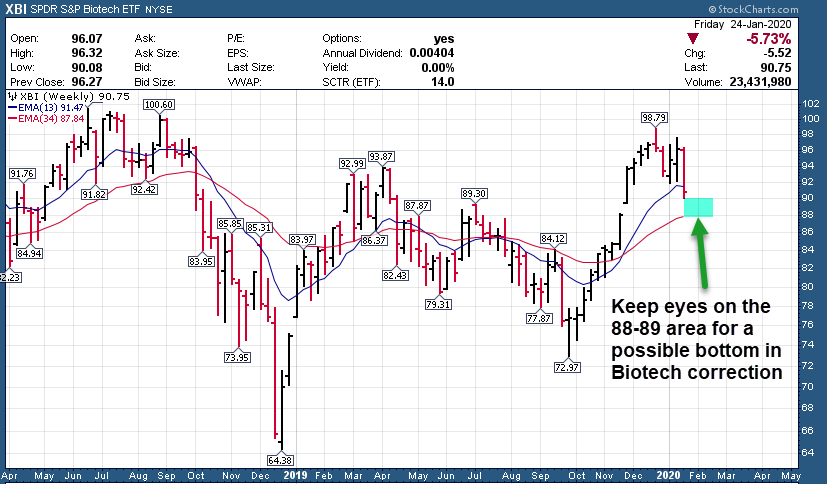

- Biotech weekly chart update and pivot to watch on pullback

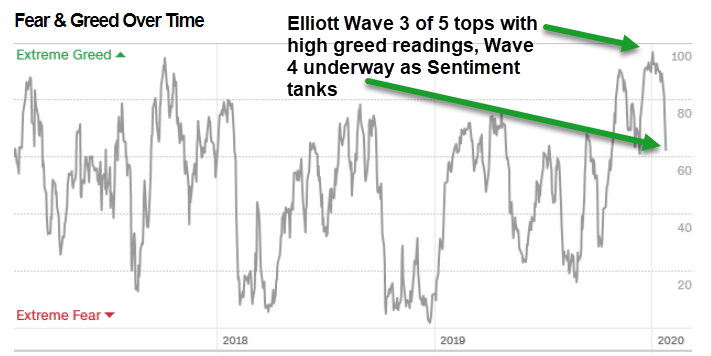

- Fear and Greed chart and notes update

- Wave 4 underway?

- SP 500 updated charts long term and short term wave counts

- Swing Trade ideas and more!

Recent results and notes: Stocks and ETF Trading Results

This past week we took gains in a few positions late in the week to lock down gains. RDFN for 27% gains on final 1/2 of the position and STNE for 10% on the front half and 7-8% on the final 1/2. Leaves us with just a few positions open as we watch the near term market action for Wave 4 and prepare for our next trades.

3x ETF Service on Stocktwits.com : Took another position in NUGT (Gold Stocks) are up smartly on Friday with a 5.8% move while the market corrected. we have hit 10 of our last 13 trades for profits Consider joining!!

20% off for my SRP Members… launched in September on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

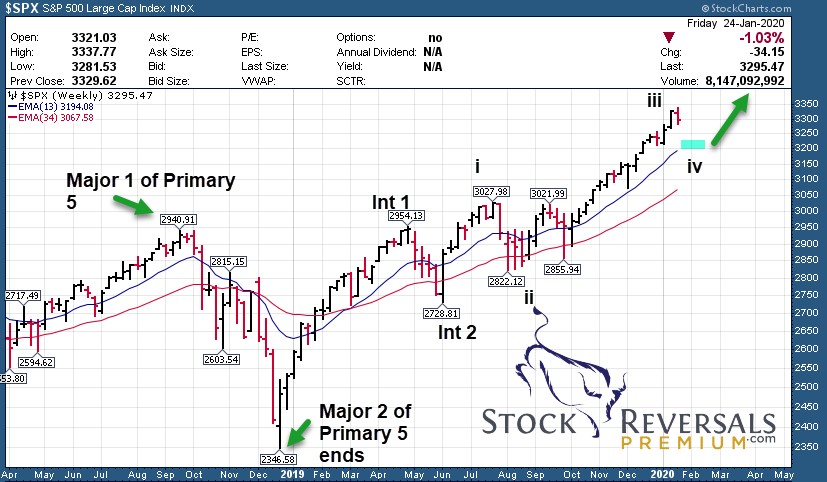

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Appears the 5th wave of the 5 wave move up completed around 3337 and Wave 4 is underway. Watching 3215 area for now. Once done we should have a 5th wave up to all time highs.

Long Term: (Wave 3 of Intermediate 3 of Major 3).

- The long term Primary Wave 5 up from Feb 2016 lows continues

- Now in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. This Major 3 has 5 intermediate waves, and we are in Intermediate 3 which is very bullish.

- Intermediate 3 is made up of 5 full waves, we are working on the 3rd wave overall, having completed the 3rd of 5 of 3, now 4 of 5 of 3, then 5 of 5 of 3 to complete the move.

Long Term View: Int 3 of Major 3 underway since 2728

Larger degree Wave 4 of Intermediate 3 of Major 3 of Primary 5 is likely underway finally from 3337 highs of III. Wave 4 targets 3215 for starters.

Click to Enlarge

Short Term View: Wave 5 tops with 4 underway

2822 wave 2 lows top out at 3337 likely for Wave 3. Now wave 4 should correct to 3215 or lower, then a 5th wave up to all time highs.

Market Notes and Indicator Charts:

As I said in this section last Monday on MLK Day, the SP 500 needed to correct in price and sentiment. Running way too hot above the 200 day MA line and 125 day MA lines, not to mention the Greed readings on the CNN Fear/Greed gauge were topping out. One week later we see a crack as the markets finally see profit taking, likely in Wave 4 which already has corrected sentiment quite a bit. Corrections tend to be much faster in a 3rd of a 3rd wave overall advance. CNN Greed index dropped into the low 60’s from 90’s a week ago, and the Put to Call ratio is running very high which is a bullish sign. That said, a few more indicators need to work off bullish sentiment before we can look for a meaningful bottom in this pullback. Overall the long term structure remains very bullish.

- Biotech XBI ETF chart updated, could see the 88-89 area for possible bottom. 9 week overall corrective base pattern. See updated chart

- We are long NUGT ETF in the 3x ETF service, up strong on Friday. Gold looks great still.

- CNN Fear/Greed chart updated with notes

XBI ETF (Biotech) pulling back

Click to Enlarge

3x ETF NUGT trade on Stocktwits Service. We entered yet another NUGT trade this past week, ran up 5.7% on Friday alone! Prior to that a 6% gain taken the week before, on top of 17% gain 3 weeks ago! Read up at The3xETFTrader.com and join!

CNN Fear/Greed Chart

Wave 3 tops out around same time as sentiment reading per last weeks report. Now pulling back with wave 4.

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Don’t hesitate to take profits

Often in our swing trade service we leave money on the table. This is almost be design because its difficult to consistently call tops and bottoms. Instead, we sell 1/2 of a position when we are up 8% or more as a rule of thumb on every trade, with few exceptions. This keeps our ego’s and emotions in check and forces us to take gains. Then we try to ride the remainder portion hopefully higher while moving the stops up along the way. A good example of this recently was a 9 week position we held in RDFN. We sold 1/2 when up about 8-9%, then held for many weeks until Friday, when we finally sold the remainder near highs of the day for 27% gains! Always take some profits as a swing trader on the way up!

Swing Trade Candidates: A list of ideas to consider for both SRP and SR members.

Updated 1/26/2020- Many names off our weekly list have done extremely well, last week INMD up over 8% in a rough market along with HMI up 9% last week.

This is always a good place to start some research. Consider this another “Idea” lab for you as a trader. SRP members get actual alerts in real time on various positions, some may or may not come off this list.

This week as usual we have an updated list of some ideas for the intermediate window in addition to or in concert with open SRP positions and or possibly future trade alerts.

XP- CHART LINK

7 week Post IPO base pattern. Brazilian securities brokerage firm that recently went public. 2nd week in a row on the list, actually popped big last week then pulled back late in week.

STNE- CHART LINK

4 week tight base near 52 week highs. Brazilian Fintech company. We sold out for some decent gains this past week at higher prices at SRP, but still looks attractive here.

PRGS- CHART LINK

Pullback after a breakout attempt a week ago. Provides software development, deployment and platforms for business applications.

LX- CHART LINK

4 week base near recent highs. We played this at SRP a few weeks back for nice gains, and now consolidating nicely again. Popped up last week then pulled back late in week. Innovative personal loan products for the China market. Low PE ratio relative to growth rates.

PING- CHART LINK

6 week Post IPO base near highs. Provides intelligent identity security solutions. 3rd week in a row on list.

CNXN- CHART LINK

13 week base. Provides branded computers, software, solutions etc for consumers and businesses. 2nd week in a row on the list.

DT- CHART LINK

10 week POST IPO Corrective pattern. 7th week in a row on list, still looks good. Develops software intelligence platform to allow customers to modernize and automate IT operations.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! Use COUPON CODE “Save20forever” (Case sensitive) for 20% off .

We have hit 10 of our last 12 trades for profits as of Jan 26th 2020!!

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

70% success rate since inception September 2013!

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

$40 a month and only $32 using code Save20forever on stocktwits! Consistent profits without single stock risk!

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! Micro-Cap and Small Caps stocks are the focus! PRVB a big winner now!

E-Mini Future Trading Service-Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Up over 355 points since Inception late October 2019. Thats a 155% annualized gain!!

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com– Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)