24 Feb Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of Feb 24th

This Week:

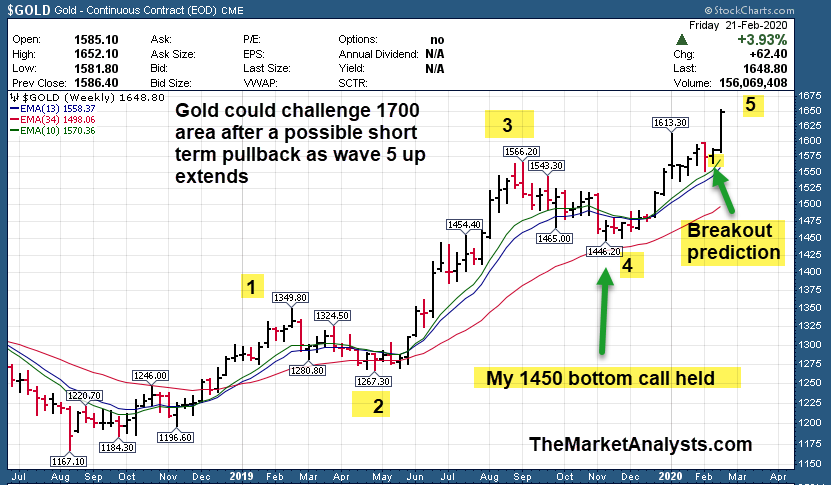

- Updated Gold weekly chart and Targets

- SP 500 daily and weekly Banister Wave charts updated with notes

- CNN Fear Gauge updated

- Swing Trade ideas

Recent results and notes: Stock ,ETF , and SP 500 Futures Swing Trading Results

Got a huge pop in PING and sold it for 13-15% gains. We did not issue any new alerts this past week due to market short term toppy conditions. Closed NUGT ETF trade for 16% Gains early last week (Gold related) in ETF service. Closed a 30 point SP 500 Futures trade for 25% 1 day gains in Futures services. Took a loss on SOXL on Friday in 3x ETF service.

3x ETF Service on Stocktwits.com : Track Record is online, join for just $40 a month and pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

Futures Services: Auto-Trade platform at ESALERTS.Com or join the Trading Room and do it yourself with my alerts on Stocktwits.com

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Was targeting 3400 area initially, we hit 3393 which is enough for a top of Wave 5 of Intermediate 3. This 5th and final wave targets 3395-3515 ranges, I will update my members daily. See updated chart, watching 3325 for now as initial pullback support. Wave 5 could still extend to 3480 area if this area holds. A break of 3325 targets 3140 or 3190 zones for Intermediate 4

Long Term: (Wave 3 of Intermediate 3 of Major 3).

- The long term Primary Wave 5 up from Feb 2016 lows continues

- Now in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. This Major 3 has 5 intermediate waves, and we are in Intermediate 3 which is very bullish, but in the last stages of it, aka Wave 5 of Int 3.

- Intermediate 3 is made up of 5 full waves, we are working on the 5th wave overall, having completed the 3rd of 5 of 3, recently the 4th of 5 of 3, and now in 5 of 5 of 3 to complete the Int 3 move. See weekly chart. We may have topped out this past week. Targets are 3140-3190

Long Term View: Int 3 of Major 3 underway since 2728, 3400 minimal target to complete targeting 3395-3515 zones hit this past week, watching 3325 area for now as support. Possible to still see 3480 depending on near term action… or we topped and Intermediate wave 4 has begun, a 5-6% likely correction. If we break 3325 look for 3140 or 3190 area for Int 4 bottom zone projection.

Intermediate Wave 4 MAY have started from 3393… 34 week EMA is climbing at 3120, so 3140 is very possible for wave 4 bottom zone

Short Term View: Wave 4 bottoms at 3214, Wave 5 to near 3400 completed?

Wave 5 up of Int 3 underway from 3214 low. 3395-3515 the zone we are monitoring. So far hit the 3395 low end zone this past week. 3325 initial pullback support, if that breaks Intermediate 4 is underway in my opinion, and 3140 to 3190 are likely targets for a bottom.

Market Notes and Indicator Charts:

Still working on overall Intermediate Wave 3 of Major Wave 3, this is called a 3rd of a 3rd and hence the powerful bull trend over last several months. Once this completes, we will have an Intermediate Wave 4 correction pattern which should last several weeks. This past week we MAY have topped finally in Intermediate Wave 3 from 2728 on the SP 500, but would be a relatively shallow overall wave compared to Intermediate Wave 1. Targets are 3140-3190 for SP 500 on Wave 4.

CNN Fear readings spiked late in week as well, which could argue for one more final push up to 3480 area, but watching 3325 for now, if that breaks 3140-3190 are likely.

GOLD broke out as projected, we pocketed big gains on the 3x ETF NUGT in the 3x ETF service.

- GOLD chart updated, could see 1700 area or higher.

- Biotech hanging in for now, stop is relatively tight on our LABU trade in case it breaks south

- Futures service profiting from all the volatility as well trading E Mini SP 500 futures, we hit for a 30 point win this past week, which is a 25% relative return in 24 hours.

Gold broke out of base pattern as projected, here is updated chart:

Weekly ideas and tips on Swing Trading Success: Adding on Dips, waiting for rips

Nothing wrong with adding to a position on a dip, often those dips are just algo trading and or stops runnning with no news. I often will see a stock have a sudden and sharp pullback out of the blue, only to see it rip higher days later. Just saw this with PING this past week or so, finally after it shook people out the stock ripped higher . We had our stop set only near the close of trading day so we avoided getting washed out under 25, and we sold at 28.40 on the rip for 13-15% gains just prior to the late week reversal. Take those profits, but don’t be afraid to either add on those dips that are shaking traders out of good positions or sit tight. Try not to over react.

Swing Trade Candidates: A list of ideas to consider for both SRP and SR members.

Updated 2/24/20

This is always a good place to start some research. Consider this another “Idea” lab for you as a trader. SRP members get actual alerts in real time on various positions, some may or may not come off this list.

This week as usual we have an updated list of some ideas for the intermediate window in addition to or in concert with open SRP positions and or possibly future trade alerts. Several broke out off this last last week and were removed, others repeated and a few new ones added.

ZTO- CHART LINK

3 week ascending base, still 1/2 long this position at SRP in the swing service. Chinese logistics provider for e commerce, shipping etc.

UCTT- CHART LINK

17 week base, pulled back on Friday with some chip stocks. CMP/Gas delivery for Chip Makers.

STNE- CHART LINK

On and off the list all the time lol. This is Brazilian FinTech company championed by Buffett. Looks good again for a breakout

TW- CHART LINK

Builds electronic over the counter marketplaces for stocks etc. May be breaking out of all time Post IPO base.

LITE- CHART LINK

3 week flag for Optical Communications Provider, looks bullish on this pullback

HUIZ- CHART LINK

2 weeks tight Post IPO base near highs. China Life, Health, P and C company that just went public

GMAB- CHART LINK

Denmark Based anti-cancer therapeutics Biotech. Nice breakout of long term range.

ONEW- CHART LINK

Recent IPO in the retail sector. Operates 63 stores selling new and used recreational boats. 3rd week in a row on report

DDOG- CHART LINK

Recent IPO in 4 week ascending base pattern. Provides SAAS monitoring platform for cloud applications, 2nd week in row on list

BMY- CHART LINK

11 week base near highs for Bristol Myers. Diversified Oncology, Immunoscience, Etc blue chip. 3rd week in row on list.

BRBR- CHART LINK

Pulling back last week when it was on our list, leaving it on as it could break out of a now 14 week Post IPO base pattern. Develops and sells ready to drink protein drinks. 3rd week in a row on report.

EVER- CHART LINK

Clearing house for insurance quotes etc. On and off our list of late. 2nd week in a row on list. Post IPO base near highs.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

NEW!!! The 3x ETF Trader, a service hosted on Stocktwits.com , trading 3x ETF pairs in Bull or Bear movements. Very strong track record since Oct 2019 inception on Stocktwits.com. Just $40 a month! 16% gain hit last week on NUGT!

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! All Trade results updated weekly when closed out, see 2019 and 2020 Track Record

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! PRVB rallying 130% in past 11 weeks

E-Mini Futures Trading Service -Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Up over 500% since inception Oct 2018! Track record online

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. Join for $50 a month! Use Code SAVE20 to save 20% off first month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

If you do not have time to monitor alerts, enter and exit trades on your own via Stocktwits servivce, we do the trades for you, you sit back and enjoy! Only $339 per 90 days of service, account is set up with a Chicago based trading firm and commission are low! All trades auto-executed based on Dave’s directives from the stocktwits futures room direct to the trading desk!

Contact Dave with any questions (Dave@stockreversalspremium.com)