08 Mar Weekly Wave Forecast and Crash Update Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of March 9th

This Week:

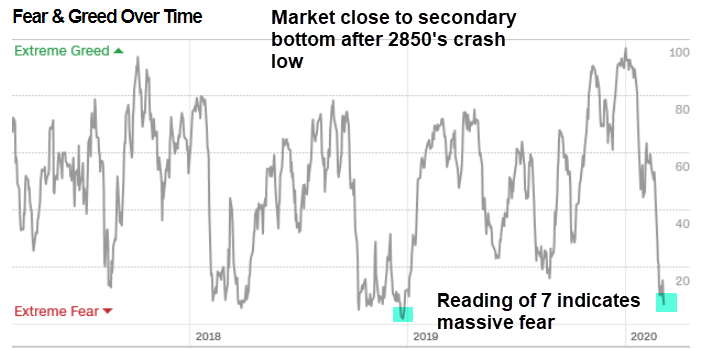

- Fear Gauge update (CNN Readings at extremes)

- Multiple Charts showing massive oversold readings

- Thoughts on status of market plunge and levels to watch

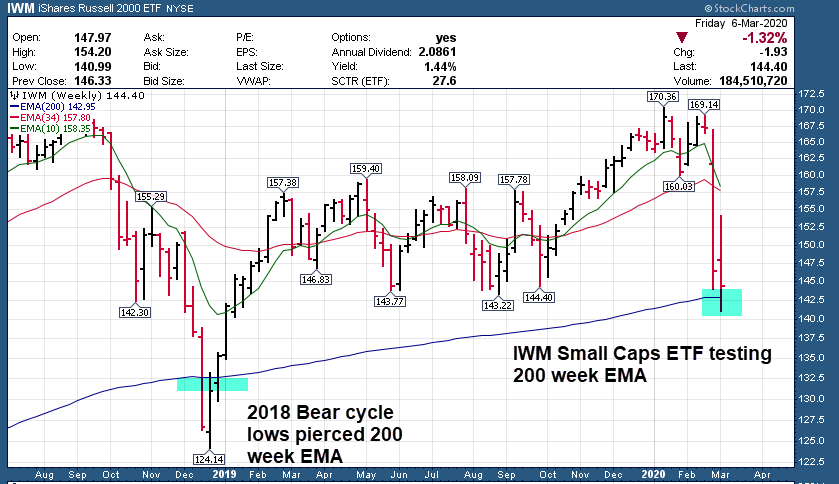

- IWM ETF chart update

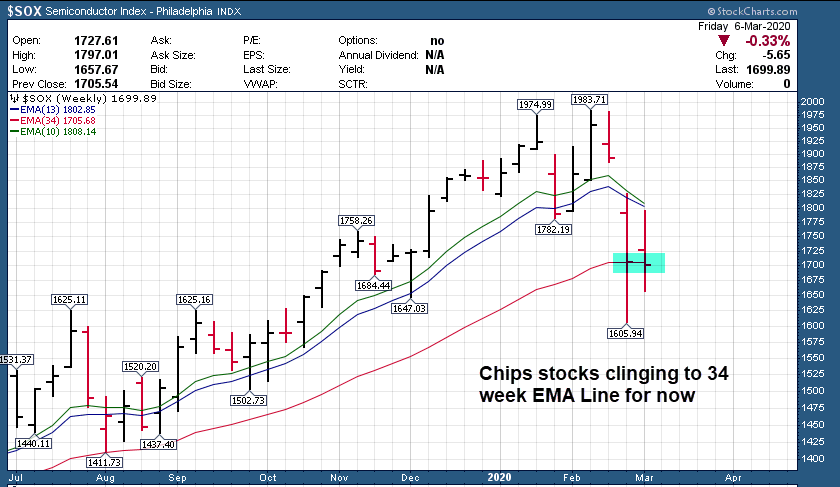

- Chip Stocks chart (SOX ETF) update

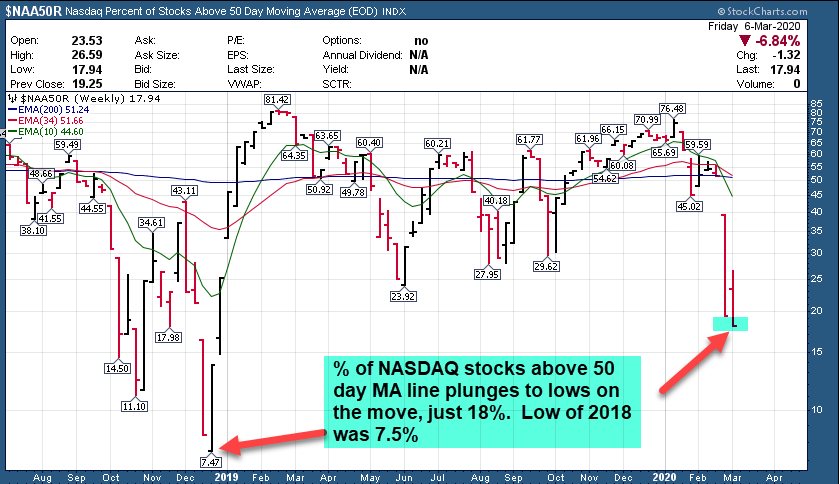

- % of Stocks on NASDAQ above 50 day ma reading update

Recent results and notes: Stock ,ETF , and SP 500 Futures Swing Trading Results

A nice 26% gain on NUGT closed early in the week (Gold Miners 3x BULL) in the 3x service. Initiated a few new positions in the Swing Trade service all of which held up. Futures service made a nice gain on Friday and we are testing some new indicators as well.

3x ETF Service on Stocktwits.com : Track Record is online, join for just $40 a month and pull more money from the market bull or bear with my Behavioral based and contrarian approach to 3x ETF trading! We solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits

SP 500 Futures Services: Auto-Trade platform at ESALERTS.Com or join the Trading Room and do it yourself with my alerts on Stocktwits.com

General Market Summary:

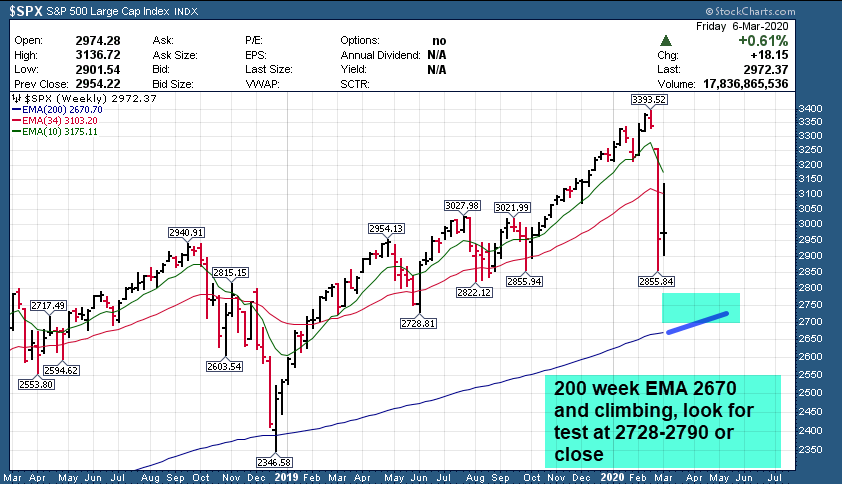

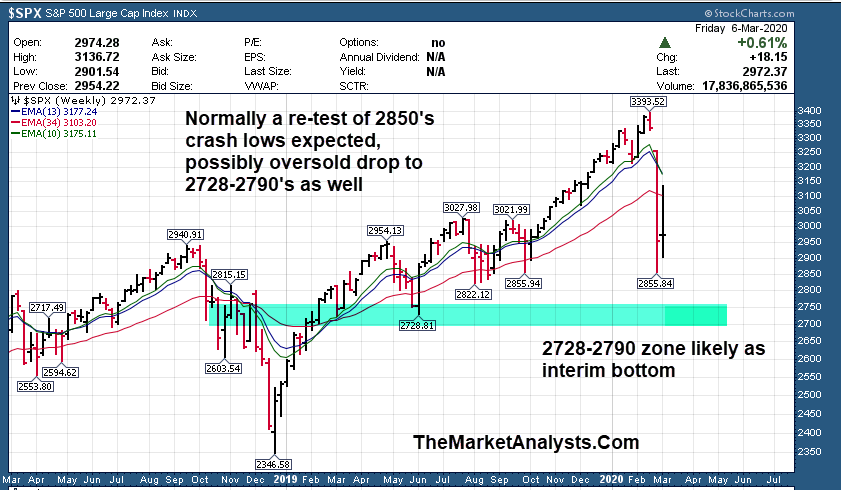

The SP 500 plunged late in the week , then had a short covering bounce into the close of trading Friday, ended up flat for the overall week. Markets are very oversold still, a re-test of 2850’s possible but barring a secondary short term crash, things should stabilize with extremes at 2728 if it turns hard south.

The Market tends to discount about 9 months out, and it’s trying to figure out the economic impact to money flows in the economy, the velocity of money, earnings declines and the fall out and amplitude of the interconnected consumer spending slowdown to corporate earnings and outlooks. Hence, expect continued volatility as its nearly impossible for the market to project a Black Swan outcome.

We are still above the 2850’s crash lows, often a re-test occurs within 1-3 weeks so we will see if that happens this week. Generally speaking an intermediate drop to 2728-2790 in the few months or even weeks ahead would make sense, but not likely straight down either. Markets have huge oversold indicators across the board right now.

Chip stocks and Small Caps at key support levels, key to watch (See charts)

Review all charts and notes. 2850 key to hold, 2728-2790 zone likely at some point. 3090 200 day resistance.

Charts tell the story:

% Of stocks above 50 day moving average at extreme lows, indicating wash out lows here or close

Small Caps testing 200 week EMA line, similar to 2018 lows test

Chip Stocks also testing 34 week EMA Line, trying to hold

CNN Fear gauge at 7, meaning extreme fear readings still in effect, usually near tradeable lows

SP 500 actually up a tad for the week, Intermediately I think we may test 2730’s area

2730-2790 zone likely tested intermediately in my opinion

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 5 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

3x ETF Trading Room (Oct 2019 Debut): The 3x ETF Trader, a service hosted on Stocktwits.com , trading 3x ETF pairs in Bull or Bear movements. Very strong track record since Oct 2019 inception on Stocktwits.com. Just $40 a month!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 6 years of advisory services! Track Record of 2019 and 2020 Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks!

E-Mini Future Trading Service –SP 500 Futures Trading Hosted on Stocktwits.com… Incredible track record since Oct 2018 Inception. Track record online

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

ESAlerts.com – Auto-Trading SP 500 Futures Service

If you do not have time to monitor alerts, enter and exit trades on your own via Stocktwits servivce, we do the trades for you, you sit back and enjoy! Only $339 per 90 days of service, account is set up with a Chicago based trading firm and commission are low! All trades auto-executed based on Dave’s directives to the trading desk!

Re-Launched February 10th 2020 to mimic the Stocktwits Room trades for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)