29 Dec Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of December 29th

This Week:

- 2020 Themes and Ideas

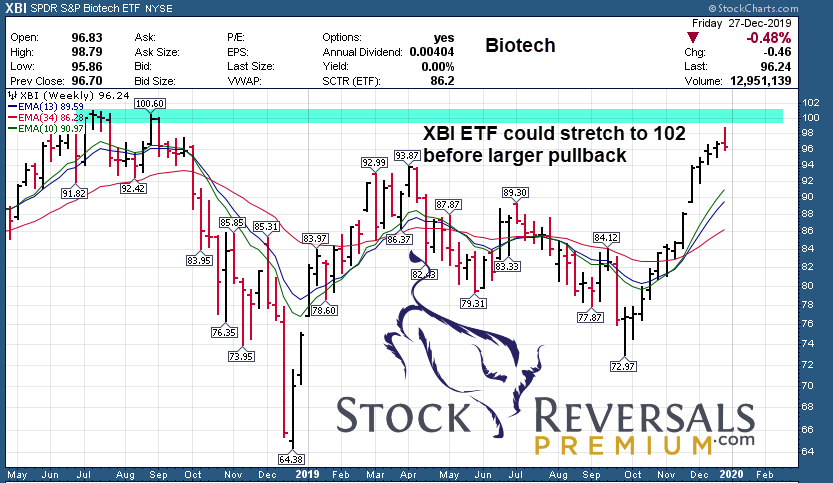

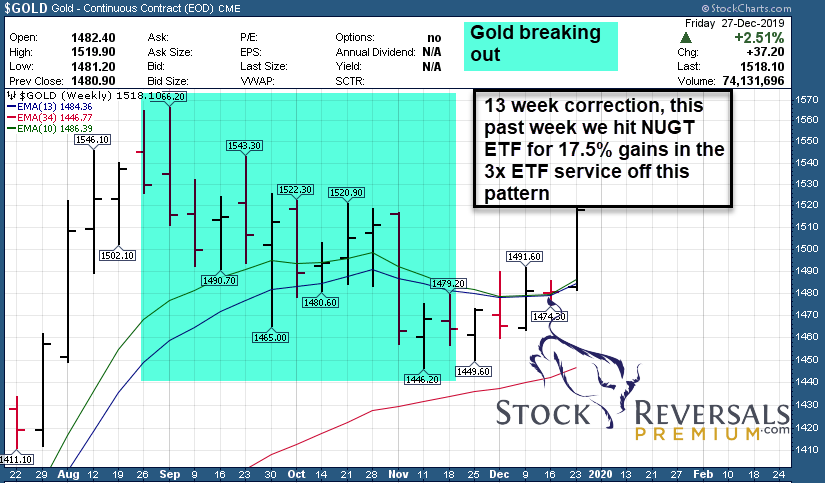

- Biotech and GOLD Chart updates and notes

- SP 500 Short and Long Term forecast updates

- Swing Trade ideas list… usually several winners each week

Recent results and notes: Stocks and ETF Trading Results

Took 1/2 position gains of 12% on CDLX and riding several positions for remainder 1/2 after taking profits on the front half of those trades at 8% or so. Looking to add some new swing positions this week. We have closed 12 of our last 13 trades for profits.

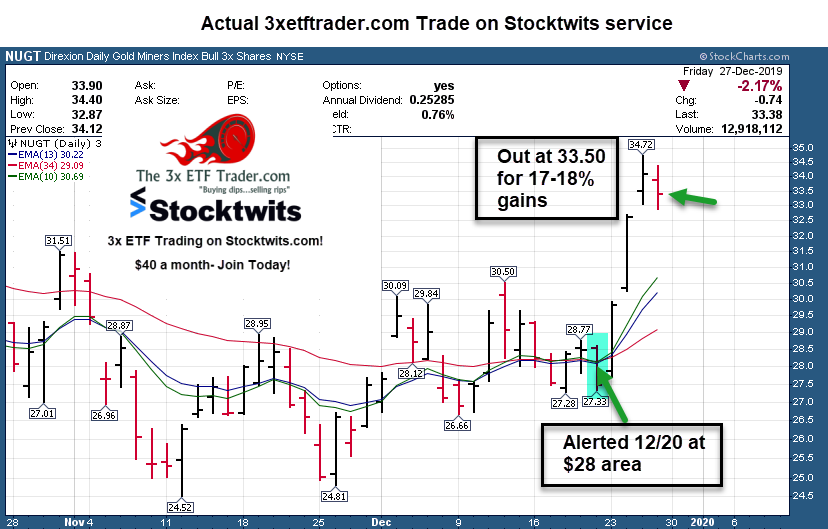

ETF Service: We closed out TNA for 7.5% final gains on Friday as well as NUGT ETF for 17.5% 5 day gains on Friday this past week. We have hit 8 of 9 trades for profits of 8-17% since early November.

20% off for my SRP Members… launched in September on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

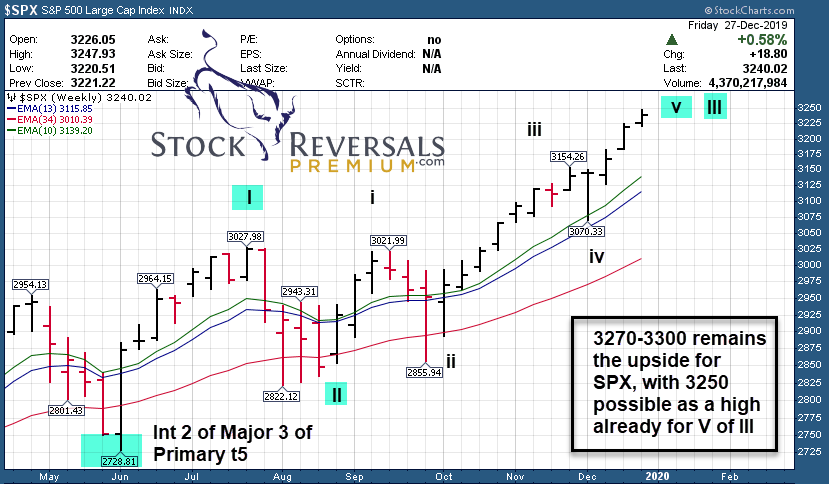

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: In the 3230-3270 zone I have been projecting for a top of wave 5 of 3 of 5 of Int 3… wave 4 correction likely soon. See chart.

Long Term: (Wave 3 of Intermediate 3 of Major 3). The long term Primary Wave 5 up from Feb 2016 lows continues, we are in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. We continue up in Intermediate Wave 3 of Major Wave 3 of Primary 5, this could extend to 3250-3315 area eventually before completed… then Wave 4 of Intermediate 3 likely, guessing Jan/February time frame possible.

Long Term View: Int 3 of Major 3 underway to 3250-3300 area

Right on target, nearing 3250 target which is the low end of this current wave pattern. We will have a larger degree wave 4 coming up soon likely Jan/Feb 2020 to correct this 430 plus point advance. Last week I said to watch 3250 area…3270-3300 possible

Click to Enlarge

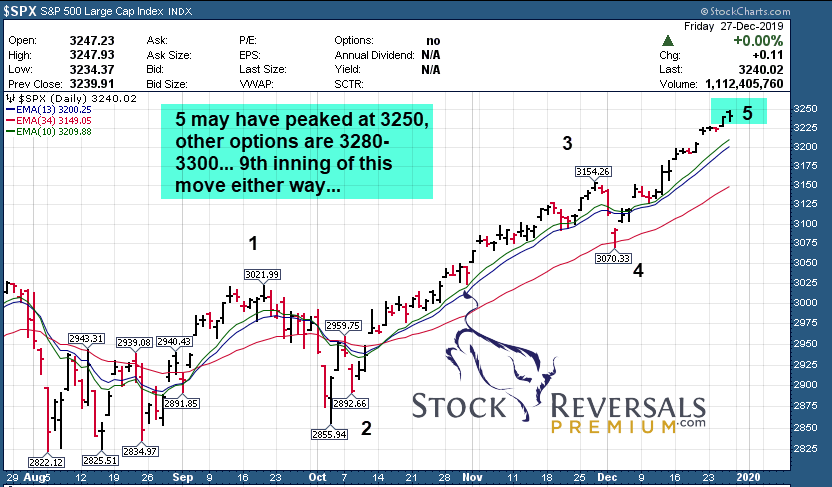

Short Term View: Wave 5 of 3 continues higher

Wave 5 continues of 3 of 5… Looking at 3250 area loosely as possible per the Dec 23 forecast, could wiggle a bit higher but getting close to top, followed by a Wave 4 correction to correct this entire 5 wave advance.

Click to Enlarge

Market Notes and Indicator Charts:

2020 Ideas from Dave Banister, Chief Strategist:

- Inflation comes back in a big way

- Bitcoin could recapture investor attention

- GOLD continues to break to the upside

- Commodities continue to rally

- Energy stocks a strong contrarian play

- Lithium stocks blast off (LTHM one of my favorites)

- Micro Cap stocks lead all sectors/funds for 2020 in performance after 2019 bear cycle lows

- Biotech continues to lead after correction in early 2020, M and A activity continues

- China stocks catch fire for investors as risk on takes over

- SP 500 does work higher for final leg of Primary 5, but muted performance relative to 2019 which came off Dec 24 2018 Bear Cycle Lows

- XBI could stretch a bit higher, but close to interim top (See Chart)

- GOLD Chart update below, breaks out after 13 week base pattern, leads to 17% NUGT Gain for us

- CNN Greed at nosebleed levels

XBI ETF (Biotech) Leading, but soon could correct

Click to Enlarge

GOLD breaking out. We closed a 17% gain last week in the 3x ETF service on Friday

Click to Enlarge

3x ETF NUGT trade on Stocktwits Service. 17% Gain! Read up at The3xETFTrader.com and join!

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Profit Taking Always

No matter how giddy you may feel during a wave 3 powerful move up in the markets, make sure to take some gains on the way up. We always sell 1/2 of any position when up 8% and hold 1/2 with adjusted stops as the stock or ETF moves in our favor. Following disciplined selling programs keeps you level headed in all environments.

Swing Trade Candidates: A list of ideas to consider

This week as usual we have an updated list of some ideas for the intermediate window. We issue official alerts to SRP members via Text and Email and Post and they may or may not come off this list.

Updated 12/29/19 6 new names at top of list, several repeated as well

PCTY- CHART LINK

6 week base, cloud based provider of payroll and human resource functions

CPRT- CHART LINK

6 week tight base near highs. Salvaged Vehicle auction provider as well as Auto Parts consolidator

PFSI- CHART LINK

6 week base near highs. Services and produces residential mortgages

ZTO- CHART LINK

Ascending base out of 3.5 month consolidation. China stocks starting to move. Near 52 week highs. Provides express delivery services in China

PLNT- CHART LINK

5 Week base with chance to re-attack 52 week highs for Planet Fitness

LX- CHART LINK

Fintech chinese company providing loans to higher educated customers. 2 weeks tight base, close to multi-month breakout

EVER- CHART LINK

3rd week in row on list, 8 week base near highs. Online market place for insurance products.NMIH- CHART LINK

8 weeks tight base near highs for this Private Mortgage Insurance provider. 2nd week in row on list

BYD- CHART LINK

6 week base near 52 week highs, gaming, casino etc business. 2nd week in a row on the list.

CDLX- CHART LINK

An SRP alert two weeks ago near 58, now in a 6 week tight base near highs. Develops a purchase intelligence platform for for marketers of debit cards etc. We took 12% gains on 1/2 at SRP near 65, but still looks strong

DOCU- CHART LINK

4 week base near highs. Provides E Signatures solutions for contracts etc. (Docusign) 3rd week in row on list

STNE- CHART LINK

6 week corrective base within an overall 14 week base near highs. Pulled back this past week, 3rd week in a row on list. We played this a few weeks back at SRP for nice gains. FINTECH solutions in Brazil, a Warren Buffett top holding too.

RDFN- CHART LINK

A current SRP position, we took 1/2 gains two weeks ago at 8% or so. Looks ready to spike higher though. 4th week in a row on the list. Nice base pattern near recent multi moth highs.

DT- CHART LINK

6 week POST IPO Corrective pattern. 3rd week in a row on list, still looks good. Develops software intelligence platform to allow customers to modernize and automate IT operations.

SNBR- CHART LINK

11 weeks tight base not far from 52 week highs. Reasonable PE ratio. 579 Retail stores offering sleep number bedding. 6th week in row on the list.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! Use COUPON CODE “Save20forever” (Case sensitive) for 20% off .

We have hit 5 straight trades over last two weeks through 12/1/19 for gains of 8%, 9%, 8% and so far 8% and 7%, pays for itself!!

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

70% success rate since inception September 2013!

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

$40 a month and only $32 using code Save20forever on stocktwits! Consistent profits without single stock risk!

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 10 weeks.

E-Mini Future Trading Service -Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Up over 355 points since Inception late October 2019. Thats a 155% annualized gain!!

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com – Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)