02 Dec Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of December 2nd

Recent results and notes:

After the Holiday shortened trading week, we are looking to add a few positions this week. 3 open positions all in buy ranges and consolidating nicely currently. We closed out a few trades this week, final 1/2 STNE for 11% and Final 1/2 of FLGT for 2-3% after a nice 10-11% plus gain on the front half.

20% off for my SRP Members on the New 3x ETF Trading service. It launched just recently on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Potential to 3180-3220 over next several weeks. Still in the overall wave 3 up, no wave 4 correction confirmed yet.

Long Term: (Wave 3 of Intermediate 3 of Major 3). The long term Primary Wave 5 up from Feb 2016 lows continues, we are in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. We continue up in Intermediate Wave 3 of Major Wave 3 of Primary 5, this could extend to 3270-3350 area eventually before completed… see updated chart

Long Term View: Int 3 of Major 3 underway to over 3200 likely

Bullish pattern continues to prove itself, we have maintained our long term bullish view all during the recent few months of volatility. See updated notes on chart.

Click to Enlarge

Short Term View: Wave 3 continues higher

Continuing higher from 2820/2855 area in this overall Wave 3 up. 3180-3220 possible on this leg. We hit the 3120-3150 zone I projected two weeks ago, so we will see if this can stretch higher before a 4th wave pullback of sorts.

Click to Enlarge

Market Notes and Indicator Charts:

- Fear and Greed index back up to 78 from 69 reading last weekend.

- Biotech continues amazing surge, XBI ETF looks due to pullback soon here, running near parabolic

- Market could consolidate and or pullback some to work off sentiment

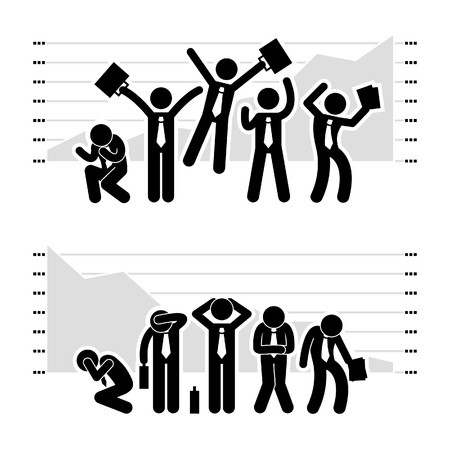

Weekly ideas and tips on Swing Trading Success: Forcing yourself to buy and or sell at extremes

Force yourself to sell as well as force yourself to buy. What does that mean? There are emotional extremes in the market both on the upside and the downside. Usually when everyone is in fear mode, you have to push the accumulate/buy buttons during those final stages of downside, as much as it hurts. On the flip side, when everyone is high fiving each other at the water cooler about how smart they are, which is right about now, make sure you are also forcing yourself to sell some positions or reduce them and bank profits. We are in a powerful Wave 3 up, actually a rare 3rd of a 3rd of a 3rd, and hence the exuberance. We will try to keep tracking the likely interim highs on the SP 500 at SRP which will help clue us in on when to pull back and be patient and more conservative. Take those gains along the way, or more your stops up as your positions rises and or use a trailing stop.

Swing Trade Candidates: A list of ideas to consider

Off last weeks list we had INCY up 6% and DT up 9.8% as the top winners. Some of these positions take a few weeks to move, and many we never alert at SRP but we like a list of ideas to keep our eyes on.

This week we have an updated list of some ideas for the intermediate window. We issue official alerts to SRP members via Text and Email and Post and they may or may not come off this list.

Updated 12/1/2019

SEDG- CHART LINK

17 Week base overall, supplier of DC Optimizer inverters to solar industry

EDU- CHART LINK

6 week base near highs for Chinese Education provider. We had this on the list weeks back and it broke out, but now building another base.

CARG- CHART LINK

3 Weeks tight base, online automotive marketplace provider.

VGR- CHART LINK

12 Week base near highs, Cigarette maker

ELY- CHART LINK

8 Week base, golf equipment maker.

JPM- CHART LINK

4 weeks tight base near highs for JP Morgan Bank, 2nd week on our list.

JCOM- CHART LINK

8 week corrective pattern. Internet, Fax, Voice calling and other online services provider. 2nd week on list.

CDLX- CHART LINK

3 weeks tight base near highs. This was on our list a few weeks back and then it exploded upwards. Now resting but the fundamentals remain strong. Develops intelligent consumer data to help marketers match with buyers. 2nd week in row on list.

CZZ- CHART LINK

5 weeks tight base near highs, on our list a few times of late. Brazilian provider of Gasoline, and various fuels to service stations. 2nd week in row on list, could break out this week.

MOMO- CHART LINK

4 weeks corrective pattern pattern near 52 week highs. Chinese provider of mobile based social networking platform, growing rapidly at reasonable PE ratio. 2nd week in row on list.

QIWI- CHART LINK

7 week consolidation after correction. Online payments provider in Russia with reasonable PE ratio. 2nd week in row on list, could move this week pattern wise.

RDFN- CHART LINK

4 weeks tight base after 6 months consolidation and pop up out of base. Residential real estate database and brokerage services provider.

SNBR- CHART LINK

7 weeks tight base not far from 52 week highs. Reasonable PE ratio. 579 Retail stores offering sleep number bedding.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! Use COUPON CODE “Save20forever” (Case sensitive) for 20% off .

We have hit 5 straight trades over last two weeks through 12/1/19 for gains of 8%, 9%, 8% and so far 8% and 7%, pays for itself!!

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

70% success rate since inception September 2013!

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

$40 a month and only $32 using code Save20forever on stocktwits! Consistent profits without single stock risk!

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 10 weeks.

E-Mini Future Trading Service -Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Up over 355 points since Inception late October 2019. Thats a 155% annualized gain!!

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com – Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)