28 Oct Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of October 28th

Results and Notes: Moving in our favor!

All of our 3 open positions are moving in our favor at StockReversalsPremium.com service, as the market builds up strength in wave 3. The 3x ETF service on stocktwits also on fire as we are long TQQQ and LABU both moving up nicely. We will look to add more positions as the market continues to confirm strength here. We are hitting TQQQ ETF for 8.5% profits as of 10/28 early morning pricing and 7% on LABU as well!

20% off for my SRP Members on the New 3x ETF Trading service. It launched just recently on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will solely trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

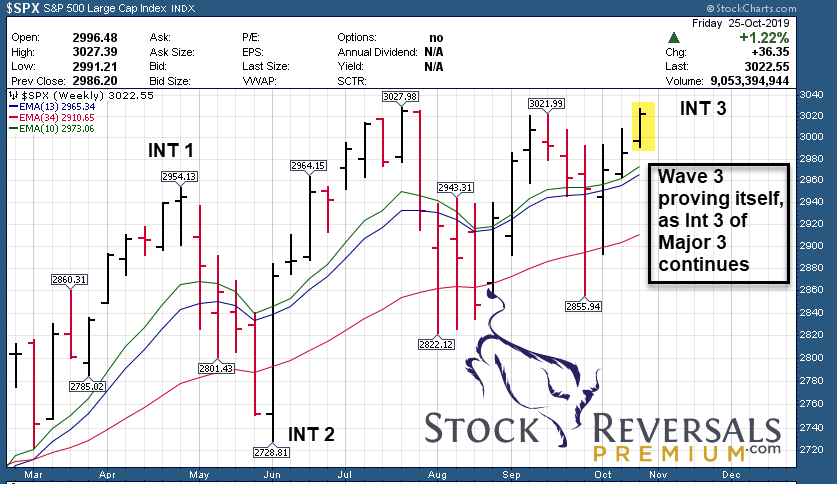

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Last week we talked about a minor 4 pullback and then a Wave 5 surge up likely, we got that surge late in the week. Now knocking on the doors of all time highs as we have been projecting. Also have a nice looking reverse head and shoulder pattern proving out as well.

Long Term: (Wave 3 of Intermediate 3 of Major 3). The long term Primary Wave 5 up from Feb 2016 lows continues, we are in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. After a series of 1’s and 2’s as noted last week, we are moving up and out of that triangle pattern we charted out as well. Market continues up in powerful wave 3 structure.

Long Term View: Int 3 of Major 3 underway to over 3000 made up of 5 waves

Bullish pattern continues to prove itself, we have maintained our long term bullish view all during the recent few months of volatility.

Click to Enlarge

Short Term View: Wave 5 up to all time highs likely

Support area held last week and we are moving upwards as projected. Also a bullish reverse head and shoulder breaking out late in week.

Click to Enlarge

Market Notes and Indicator Charts:

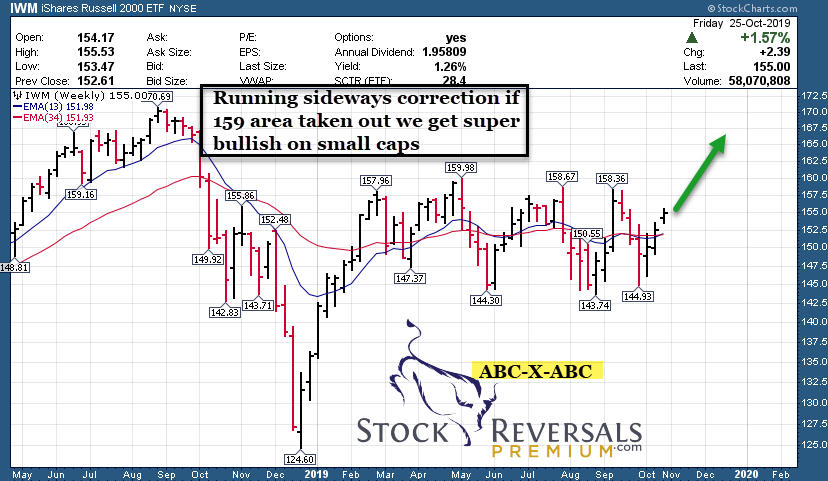

- IWM ETF Chart still showing potential breakout ahead of ABC-x-ABC pattern- Chart Updated

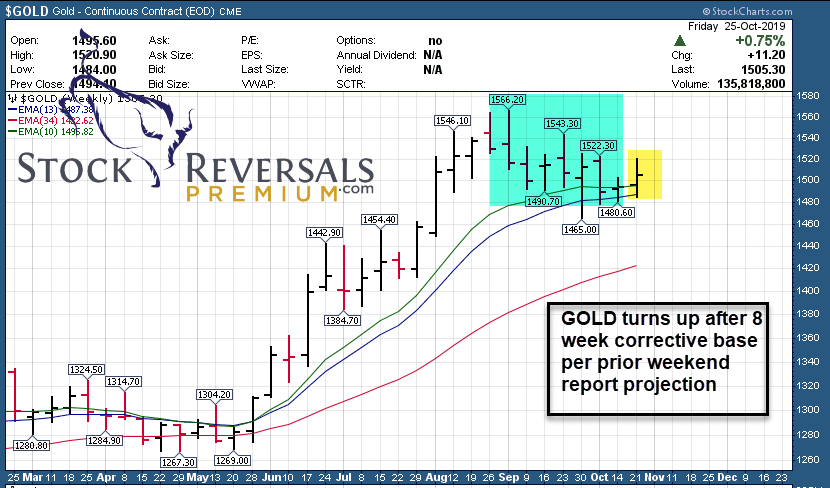

- GOLD Chart updated, moved up after my 8 week correction pattern noted here last week

- TQQQ, LABU a few 3x ETF’s doing well in our 3x ETF service on Stockwits.

IWM Chart: Wave 7 of a sideways base completed this past week, could be 9 or 11 waves before done, but typically 7 waves once completed does give an index or sector a change to then break to the upside. Updated chart

Click to Enlarge

GOLD Chart: 8 week correction pointed out last week looks to have been right. Moving up now.

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Being patient and following discipline

Be patient and discriminate always. Stay in your zone and follow rules, when you start getting cute or cutting corners you will start to make mistakes. Then you get more sloppy trying to make up for them and fall off the trading tracks. We follow strict rules at SRP, sell 1/2 of a position when up 8% or more no questions asked. Enter into positions within a range, never buy an entire position on one trade, work your way in. Look for base patterns that are about to complete and break out, don’t be afraid to buy a strong pullback as the risk is getting wringed out. The list goes on, key being stay disciplined and focused, and don’t be afraid to pass on ideas and wait for one that jumps out at you.

Swing Trade Candidates:

Each week we try to provide 5-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list. Some weeks we pick none from the list, but gives us some stock to watch as action unfolds.

This past week we saw recent stocks on this list break out such as INMD, EDU, RLGY, and SEDG.

MTZ- CHART LINK

9 Week flat base, 3rd week in row on list, pulled back a bit this past week but still constructive. Taking advantage of move to 5g Networks. Installation of networking equipment, 5g installation and more.

ZUMZ- CHART LINK

8 week base near highs. 3rd week in a row on the list, could break out as Retail gets hot. Mens fashion retailer with operations in 50 states and Canada. Retail stocks can be tricky and volatile but a nice consolidation here. 2nd week in a row on the list.

STNE- CHART LINK

16 week corrective base pattern. Brazilian company providing financial tech solutions. Carving out right side of base pattern. 5th week in a row on our list as it consolidates, but was moving up late in the week this past week.

RLGY- CHART LINK

Lower interest rates helping home builders and in this case Real Estate Brokerage. Recent marketing alliance with Amazon may help. Bottoming base.

KL- CHART LINK

Back on the list as Gold stocks may tick up again. This leader is in an 18 week base pattern.

CPRT- CHART LINK

8 week base pattern near highs. Salvaged vehicle auction services.

BOOT- CHART LINK

Another retailer as they may heat up into holiday season. 3 week ascending base near 52 week highs within an overall flat base.

FSS- CHART LINK

7 week base near highs. Manufactures street cleaning equipment and more.

MSFT- CHART LINK

12 week flat base for Microsoft near highs, recent strong earnings report

SNBR- CHART LINK

7 month overall base but last 4 weeks ascending. Sleep Number mattress business, again a retail play heading into holiday season. Close to a breakout of 52 week highs as well.

CMPR- CHART LINK

7 Week flat base near highs, online provider of marketing products, business cards, flyers etc for small to mid size businesses.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! Use COUPON CODE “Save20forever” (Case sensitive) for 20% off .

We are hitting TQQQ ETF for 8.5% profits as of 10/28 early morning pricing and 7% on LABU as well!

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 10 weeks.

E-Mini Future Trading Service -Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com – Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)