13 Oct Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of October 14th

Results and Notes: Adding positions, China Talks helping out!

Up to 4 positions now from just 1 going into this past week, as the market looks to hopefully get out of this range bound trading pattern. When you have those headwinds of the broader markets and macro issues, it’s hard to be a successful swing trader and sometimes its best to sit on your hands and wait for the weather to change a bit. All of our 4 open positions are looking good technically coming into this week.

20% off for my SRP Members on the New 3x ETF Trading service. It launched just recently on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

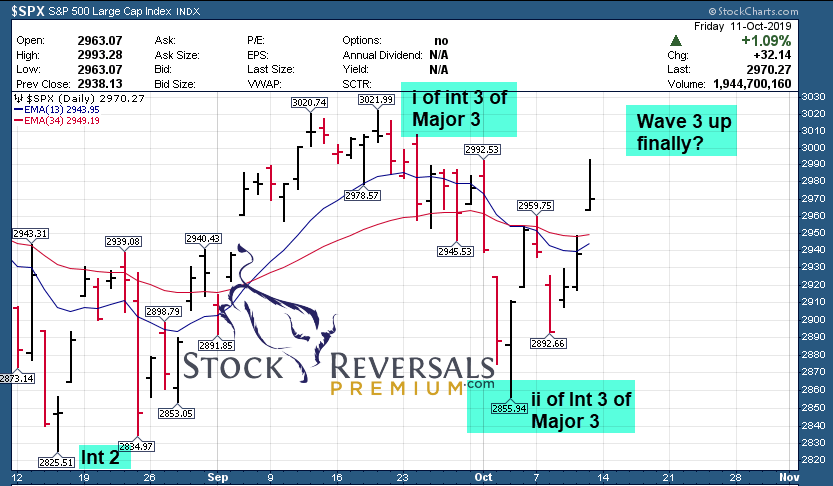

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: We did end up holding the 2865 SPX area this past week and then obviously rallied with optimism on China Trade talks late in the week. Lets see if this is now a Wave 3 up from this past weeks lows and we take a shot at all time highs.

Long Term: (Wave 3 of Intermediate 3 of Major 3). The long term Primary Wave 5 up from Feb 2016 lows continues, we are in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. Updated chart this week shows a sideways consolidation but we should be watching for a big breakout out of this range if in fact this is a Wave 3 up.

Long Term View: Int 3 of Major 3 underway to over 3000 made up of 5 waves

Recently decline pretty steep from 3022 area, if that was a Wave 2 of 5… then we are in early stages of 3 up here of Int 3 of Major 3. Still watching 3022 to get taken out, suspect will see that in the coming weeks barring a major setback in trade talks.

Click to Enlarge

Short Term View: Wave 3 up

We did take out 2960 late in the week which was our discussion point last Weekend in this section. Lets see if Wave 3 can really take hold ahead and move past 3022.

Market Notes and Indicator Charts:

- IWM (ETF) displayed this weekend showing relative underperformance of small caps

- 7 wave rooftop pattern for Russell 2000, we MAY have bottomed in wave 7 this past week- see chart

- LD Micro Cap index is off 26% from the 2018 highs, if you have been trying to make headwinds with microcap stocks you can stop beating yourself up, its been in a Bear Cycle! That said, could outperform big in 2020!

IWM Chart: Wave 7 of a sideways base completed this past week, could be 9 or 11 waves before done, but typically 7 waves once completed does give an index or sector a change to then break to the upside. Updated chart

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Minding Mr. Market

In my work, I try to take my Macro views of the markets via a behavioral pattern perspective, and from that either step on or off the gas in terms of allocation strategy. When I sense a bottom pattern is completed, I will add more swing trade positions and when I think we are not yet done with a corrective pattern, I will step off the gas and reduce positions and raise cash. If ever the market is going to break out of this range, its likely coming near term. So we are adding some positions and now up to 40% allocation to equities and 60% cash coming into this week. That said, its “Trust but verify” as they say, so lets see how the markets act this coming week for possible follow through. You must respect the overall market pattern or at least be aware of it when deploying capital, obviously there are individual stock situations that will cause losses you can’t avoid regardless of market conditions, but for sure Mr. Market should not be disrepected ever. The best time to deploy capital is the hardest time to do so, it’s when everyone is scared and fear readings are high. The best time to reduce positions is when everyone is bullish, once again, easier said than done.

Swing Trade Candidates:

Each week we try to provide 5-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list. Some weeks we pick none from the list, but gives us some stock to watch as action unfolds.

MTZ- CHART LINK

7 Week flat base near highs. Installation of networking equipment, 5g installation and more.

SEDG- CHART LINK

10 Week base near highs. DC Optimized inverters for the Solar industry

UPLD- CHART LINK

18 Week corrective Post IPO base and possible reversal up this past week. Cloud Work management software

ZUMZ- CHART LINK

6 week base near highs. Mens fashion retailer with operations in 50 states and Canada

LSCC- CHART LINK

11 week base near highs. Programmable logic devices.

CZZ- CHART LINK

5 week base near highs, tight base. Distributor in Brazil of Gas, Fuels to Stations.

DOCU- CHART LINK

Up 6.6% this past week breaking out of our 4 week base pattern we like. An SRP position from 63.50 recently and looks good to continue higher. Post IPO rally after months of low end consolidation. Provides online e-signature platform for documents and more.

EDU- CHART LINK

7 weeks flat base pattern near highs for Chinese provider of Educational tutoring services. This stock has held up very well during the recent market volatility.

QIWI- CHART LINK

In a 8 week corrective base pattern. See if this tests that $19 gap area for a reversal before considering entry.

STNE- CHART LINK

14 week corrective base pattern. Brazilian company providing financial tech solutions. Carving out right side of base pattern. 3rd week in a row on our list as it consolidates.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! E-mail me for a 20% off coupon code. Dave@themarketanalysts.com

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 10 weeks.

E-Mini Future Trading Service -Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 26 point win the week of September 9th in 24 hours for $1,300 profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)