20 Oct Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 5 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of October 21st

Results and Notes: Booking gains during the week!

We closed out DOCU for small gains before it dropped harder on Friday, also booked 7-12% gains in INMD earlier in the week as it spiked higher. We also booked 10-17% gains in OPRT. Late in the week looks to me like some portfolio managers are doing some tax related selling in some winning names ahead of end of Fiscal Year (October 31). Only 2 open positions coming into Monday trading as we look for more opportunities.

20% off for my SRP Members on the New 3x ETF Trading service. It launched just recently on Stocktwits.com. $40 a month less 20% coupon or $32 monthly. We will trade 3x ETF Bull and Bear pairs as the market dictates. Read up at The3xetftrader.com Use the Subscribe tab to join off your desktop on Stocktwits and use code “Save20forever” verbatim to get 20% off for life.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Short term potential for a bit more pullback towards end of October (Fiscal year end for Mutual Funds) and then a surge in a 5th wave of this current pattern off the recent lows. See the chart.

Long Term: (Wave 3 of Intermediate 3 of Major 3). The long term Primary Wave 5 up from Feb 2016 lows continues, we are in Major Wave 3 up from the 2345 lows of Major 2 in Dec 2018. Consolidation continues, a series of 1’s and 2’s and now a possible Bullish Triangle forming. See chart.

Long Term View: Int 3 of Major 3 underway to over 3000 made up of 5 waves

Recently decline pretty steep from 3022 area, if that was a Wave 2 of 5… then we are in early stages of 3 up here of Int 3 of Major 3. Weekly chart still appears bullish and forming a possible triangle as well as a series of 1’s and 2’s.

Click to Enlarge

Short Term View: Wave 4 correction (Minor) then likely surge to all time highs?

Possible minor 4 correction here, watch 2965 area for support.

Click to Enlarge

Market Notes and Indicator Charts:

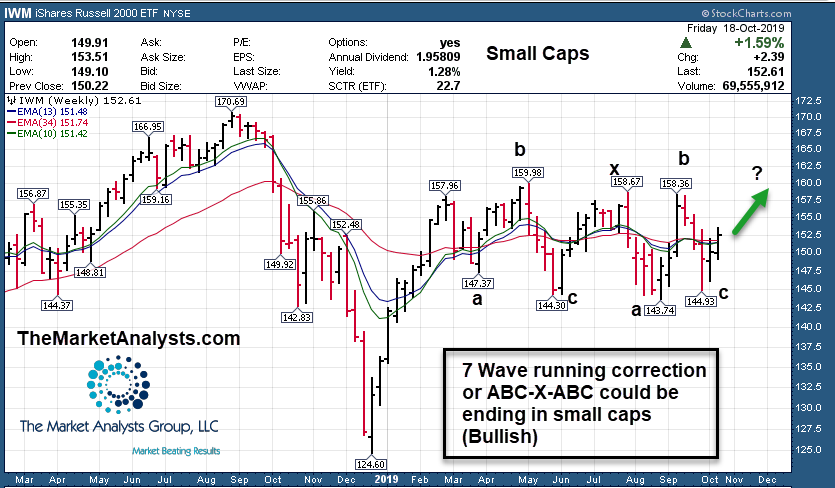

- IWM ETF Chart still showing potential breakout ahead of ABC-x-ABC pattern

- GOLD Chart also in 8 week corrective pattern, if it holds 1450 it can surge again

- Fear and Greed index is at neutral 50 reading (100 super high greed, 0 extreme of fear)

- If we are supposedly at risk of recession, why are home builder and construction stocks on fire?

IWM Chart: Wave 7 of a sideways base completed this past week, could be 9 or 11 waves before done, but typically 7 waves once completed does give an index or sector a change to then break to the upside. Updated chart

Click to Enlarge

GOLD Chart: Possible 8 week correction ending with a surge higher possible if 1450 area holds.

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Selling 1/2 on the way up

Always sell 1/2 of a swing trade position when you are up 8% or more. That is our rule at SRP, and some traders have similar rules or percentages they use. This rule has saved us multiple times from stocks that later turn south and had you not forced yourself to take some off the table, you may have given up all gains or ended up with tiny gains. The best time to take profits is when you are feeling giddy, and using the 8% sell rule forces the issue so you are not a danger to yourself with your emotions. Make sure to follow this rule on all SRP swing trades with or without an actual alert being sent.

Swing Trade Candidates:

Each week we try to provide 5-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list. Some weeks we pick none from the list, but gives us some stock to watch as action unfolds.

MTZ- CHART LINK

8 Week flat base, 2nd week in row on list, moved up nicely last week out of base, but still in reasonable buy ranges. Taking advantage of move to 5g Networks. Installation of networking equipment, 5g installation and more.

UPLD- CHART LINK

19 Week corrective Post IPO base and possible reversal up this past week, 2nd week in a row on the list. Cloud Work management software

ZUMZ- CHART LINK

7 week base near highs. Mens fashion retailer with operations in 50 states and Canada. Retail stocks can be tricky and volatile but a nice consolidation here. 2nd week in a row on the list.

LSCC- CHART LINK

12 week base near highs. Programmable logic devices. Semiconductors have a strong outlook. 2nd week in a row on the list.

CZZ- CHART LINK

6 week base near highs, tight base. 2nd week in a row on the list. Distributor in Brazil of Gas, Fuels to Stations.

EDU- CHART LINK

8 weeks flat base pattern near highs for Chinese provider of Educational tutoring services. This stock has held up very well during the recent market volatility. 3rd week in a row on the list.

STNE- CHART LINK

15 week corrective base pattern. Brazilian company providing financial tech solutions. Carving out right side of base pattern. 4th week in a row on our list as it consolidates.

FRAN– CHART LINK

Multi week triangle base, possible retail business turnaround story here with high short interest. Possible “Reverse Gravity” chart that could double again.

CDLX- CHART LINK

8 week base near highs. CDLX partners with financial institutions to run their banking rewards programs that promote customer loyalty and deepen banking relationships. They take the data and help turn that into high return on ad spend dollars for their clients.

RLGY- CHART LINK

Lower interest rates helping home builders and in this case Real Estate Brokerage. Recent marketing alliance with Amazon may help. Bottoming base.

Read up at TheMarketAnalysts.com for more details

The3xetftrader.com now launching with service hosted on Stocktwits.com. Launched on 9/16/19 ! Use COUPON CODE “Save20forever” (Case sensitive) for 20% off

We are trading 3x ETF pairs in Bull or Bear movements based on my Elliott Wave analysis and more.

We offer five different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading Stocks and ETF’s, 3x ETF only Swing Trade Service on Stocktwits.com, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

The3xETFTrader.com – 3x ETF bull and bear leveraged swing trading using my Elliot Wave and behavioral pattern analysis.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 10 weeks.

E-Mini Future Trading Service -Hosted on Stocktwits.com trading the ES Futures contract (SP 500)

Daily morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month! Use coupon code SAVE20 to try for 20% off.

ESAlerts.com – Auto-Trading SP 500 Futures Service

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@Themarketanalysts.com)