29 Jul Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of July 29th

Trading Results and Notes:

We didn’t even test the 2950 SP 500 area last week so the market continues to march higher in what appears to be an ongoing strong Wave 1 up of Intermediate Wave 3 to all time highs. We issued two new swing alerts this past week (Reserved for SRP Members) and also saw TWTR smash higher and we sold for 10% gains and GH and ZM were ripping higher late in the week on the final 1/2 of each of those positions. GH at 97 and we are long from 86 and ZM near 103 and we are long from 92. Looking to add 1-2 new swing alerts this week.

Product Announcement: 3x ETF Trading Service

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

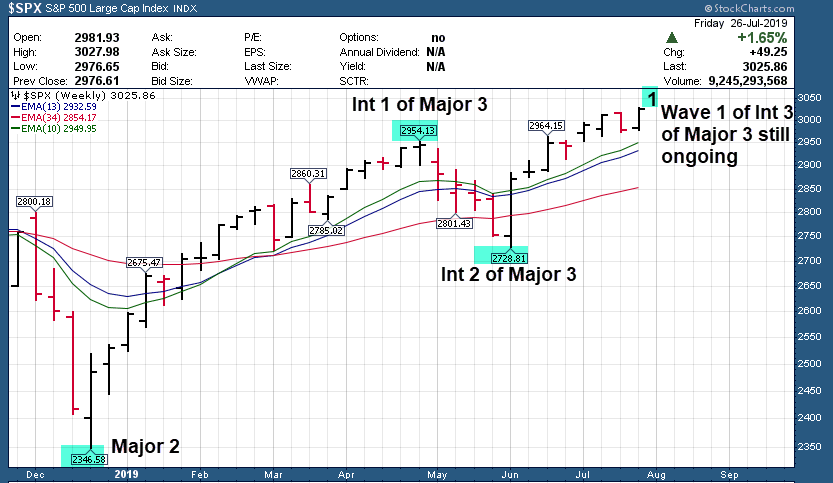

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Wave 2 never confirmed this past week as we never even got close to the 2950 support area for Wave 1, therefore we pushed again to all time highs. 3100 remains the intermediate target.

Long Term: Major Wave 3 pushed again to all time highs late in the week and there are 5 full waves due (1, 3, 5 up, 2 and 4 down) for Intermediate Wave 3. All time highs will continue to appear during this window .

Long Term View: Int 3 of Major 3 underway to over 3000

Intermediate Wave 3 (Which has 5 full waves) of Major 3 continues. This is the most bullish usually of all Elliott Wave patterns. We are looking for north of 3050 as discussed prior with 3100 area likely resistance in time.

Click to Enlarge

Short Term View: Wave 1 still going!

We never broke the 2950 zone for Wave 1 support, so we continued higher later in the week out of a 13 day base pattern. New highs again, Wave 1 still going. We entered a long Futures position at 2912-2915 late in the week, currently 2925.

Click to Enlarge

Market Notes and Indicator Charts:

- Wave 1 up holds and we hit all time highs again… this will continue intermediately as part of 3rd of a 3rd

- IWM ETF chart updated, looks ready to break out (Small Caps)

- Biotech has lagged, but may be nearing the end of a bullish triangle consolidation

IWM ETF Chart: (Small Caps)

Click to Enlarge

XBI ETF (Biotech) Chart:

Click to Enlarge

Weekly ideas and tips on Swing Trading Success: Selling 1/2 , holding 1/2

At SRP we always look to sell 1/2 of a Swing Trade position when we are up 8% or more from average entry. We do this not because we are not shooting for higher results percentage wise, but because we like to lock down some profits on the way up. It also insures discipline is at the top of the priority list as traders. Good examples lately are GH which we entered from 86-87, sold 1/2 at 94-95, watched it drop to 88, and are still long 1/2 at 96 and climbing. The reason to do this is it reduces your stress holding a position, guarantees at least some level of profits, and allows you to ride the rest of a position for potentially higher targets with adjusted stops along the way.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

Last weeks top winner was EDU up 8%, several are repeated this week along with some new names.

BZUN- CHART LINK

4 week corrective base pullback. China based e commerce business solutions provider.

SYF- CHART LINK

Breaking out of 13 week base pattern near highs. Private Label credit card provider.

QLYS- CHART LINK

13 week base, tight pattern. Cloud security solutions.

FNKO- CHART LINK

6 week recent base pattern on top of multi month base pattern. Licensed pop culture products maker.

AL- CHART LINK

5 week base near breakout. Leasing and Fleet Management for Airplanes.

ORCC- CHART LINK

Recent IPO in 2 week base. Business Development Company, Mezzanine Secured Loans.

ZM- CHART LINK

SRP Members are long from 91-93, now 102 area. Recent IPO, 7 week base near highs , right side could break out soon. Remote video and conferencing services.

GSX- CHART LINK

Recent IPO breaking out breaking out of 7 week base last week. China base company operating online education platform.

AFYA- CHART LINK

Recent IPO, Brazil based company providing medical and healthcare education through courses in 5 states.

LPLA- CHART LINK

13 week base near highs for this Financial Services provider. On our list multiple times recently. Strong earnings came out last week.

MNST- CHART LINK

On the list often lately with attractive weekly base pattern. Alternative Beverages.

UBNT- CHART LINK

11 week base, on our list again for 2nd week in a row, still looks good from our first suggestion 4 weeks ago.

UPLD- CHART LINK

14 week base, cloud based work management software. Moved up slightly last week, on our list often of late.

LSCC- CHART LINK

3 weeks tight base pattern near highs, possible breakout of right side programmable logic devices for chip industry. Repeated from last week.

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report