05 Aug Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of August 5th

Results and Notes:

Ongoing Wave 1 finally caved in with the break of 2957 support we had been watching. We had a high cash position coming into the week and closed out more positions of late without replacing them at our Premium Service. 85% cash coming into Monday morning in our model, this was on purpose as we were due for a Wave 2, and best to be patient for opportunities. As Wave 2 has now hit the first pivot at 2915 area, we could still pull back further in August, setting up some lower risk opportunities. 2840’s on watch for SP 500.

Product Announcement: 3x ETF Trading Service

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

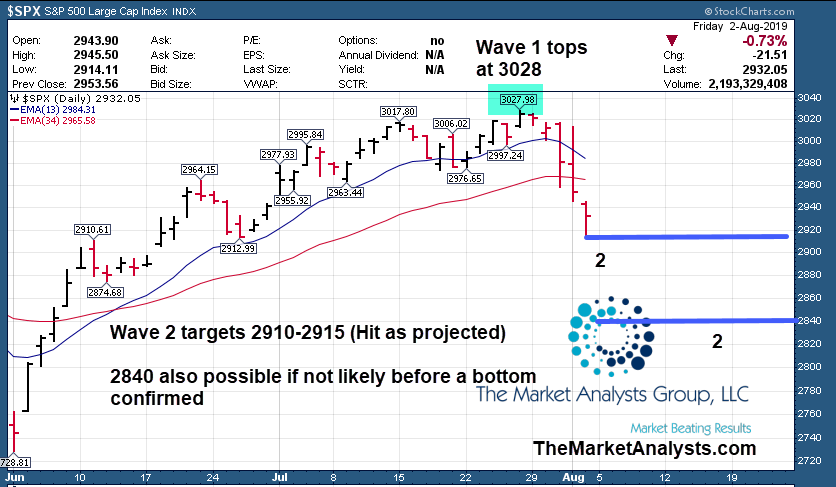

Short Term: Wave 2 down finally confirmed late in week with break of 2957. Futures service warned on Tuesday pre-market of 70 point drop from 3028 highs possible, which we got the next day on FOMC interest rate cut day. This is a normal corrective pattern. I called for 2910-2915 in the SRP service and we bounced off 2914 on Friday. Could work lower to 2840’s by end of August.

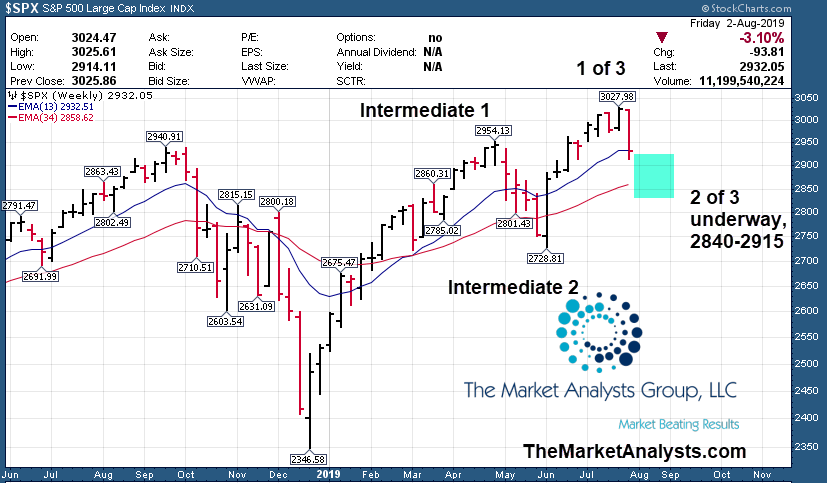

Long Term: Wave 2 of Intermediate 3 of Major 3 is underway from 3028 highs. 300 point rally requires a correction, long term still very bullish as the next wave SHOULD be 3rd of a 3rd of a 3rd. (Wave 3 of Intermediate 3 of Major 3). 3100 plus still in the cards after Wave 2 completes.

Long Term View: Int 3 of Major 3 underway to over 3000

Wave 2 down of Intermediate 3 underway, long term over 3100 still in the projections. See notes at top of report. 34 week EMA line key to watch on chart below, in that 2840 plus area.

Click to Enlarge

Short Term View: Wave 2 begins

See notes at top of report, Wave 2 could hit 2840’s, bouncing off 2910-2915 zone I laid out this past week.

Click to Enlarge

Market Notes and Indicator Charts:

- Correction underway, was overdue after 300 point rally

- August is great time to accumulate small caps and leading names that test 34 week and 13 week EMA lines

Weekly ideas and tips on Swing Trading Success: Holding high cash and being patient

Using Elliott Wave proprietary models on the broader markets helps me in shaping the aggressive or conservative style we may want to deploy at various cycles. With Wave 1 having been a 300 point SP 500 rally and about 50% of the Intermediate 1 of Major 3 length, it was a likely time for that intermediate top to come in. This week we didn’t replace or add any positions for Swing Trades, preferring discretion over valor. Now we can see several names after the last weeks pullback that have come back to 13 week EMA or 34 week EMA lines on their charts. Some of these names are on the Swing Trade ideas list this week. There is no need to force trades just to trade, its best to try to find the best low risk entry set ups where the odds are more in your favor. This is why I started “Stock Reversals” in March of 2013, because its those strong pullbacks or sideways moves, that provide the best “reversal” opportunities. Patience can pay… once Wave 2 is winding down or close, we can then step on the gas and ride the next wave.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

Last weeks top winner was LSCC which was on our list 3 weeks in a row. Up 14% but was up as high as 25%.

FLSY- CHART LINK

Post IPO correction this past week, could test gap at 17.85 and offer better entry. Edge Cloud Platform provider.

DOVA- CHART LINK

5 week base pattern for this emerging Biotech.

BZUN- CHART LINK

5 week corrective base and pulled back to test 34 week EMA line this past week.

SYF- CHART LINK

Held up well this past week in market correction pattern. 14 week consolidation. Credit Card provider.

FNKO- CHART LINK

7 week base now, testing the 13 week EMA line after this past weeks correction. Licensed pop culture products maker.

AL- CHART LINK

6 week base and pulled back this past week to test 34 week EMA line. Leasing and Fleet Management for Airplanes.

ORCC- CHART LINK

Recent IPO in 3 week base. Repeated on list this week. Business Development Company, Mezzanine Secured Loans.

GSX- CHART LINK

2 week base pattern now after this past weeks correction, a recent IPO breaking out breaking out of 7 week base last week. China base company operating online education platform.

AFYA- CHART LINK

Still a good base pattern after this past week, a recent IPO, Brazil based company providing medical and healthcare education through courses in 5 states.

UPLD- CHART LINK

Pulled back hard this past week to test 34 week EMA line. If it holds its a better entry. 15 week base, cloud based work management software

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report