12 Aug Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of August 12th

Results and Notes from SRP Swing Trade Service:

We laid low last week as the Wave 2 took hold with the SP 500 Futures hitting 2776 at the lows from 3027 highs and the SP 500 cash hitting 2820 area a few times, but closing at 2844 at the lows for the weeks closing low. This was right in my 2840’s projection for Wave 2 lows. We stayed in cash until Thursday and put out a Trade on (Reserved for Premium Members) which is in buy ranges. Should be adding more positions this week.

Product Announcement: 3x ETF Trading Service

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements. Likely to debut after Labor Day.

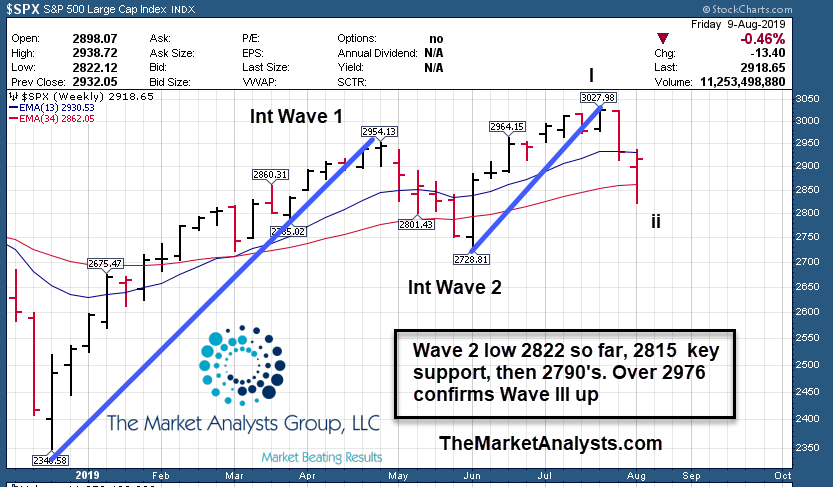

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Wave 2 low so far at 2822 area on SP 500, we are watching 2815 as key support on any pullback and 2790’s comes up after that. If we can pierce through 2976 then Wave 3 is confirmed up from 2822 lows. A break much below 2790 causes concern.

Long Term: Wave 2 of Intermediate 3 of Major 3 is underway from 3028 highs. We are watching 2815 for support. 300 point rally requires a correction, long term still very bullish as the next wave SHOULD be 3rd of a 3rd of a 3rd. (Wave 3 of Intermediate 3 of Major 3). 3100 plus still in the cards after Wave 2 completes and Wave 3 up is confirmed.

Long Term View: Int 3 of Major 3 underway to over 3000

Wave 2 down of Intermediate 3 underway, long term over 3100 still in the projections. 2815 area key.

Click to Enlarge

Short Term View: Wave 2 begins

Last week in this section projected 2840’s for a low, which held on a closing basis. We could pull back again and re-test 2820-2840’s, 2815 is key support. 2976 is overhead resistance to a Wave 3 uptrend.

Click to Enlarge

Market Notes and Indicator Charts:

- Bulls back off to 48% in Investment Advisor Surveys after recent 250 points Futures Washout

- Market likely to bottom in August, 2776 the Futures lows so far, 2820 SP 500 Cash lows

- 90% cash for SRP members coming into this week as we now look to add new positions

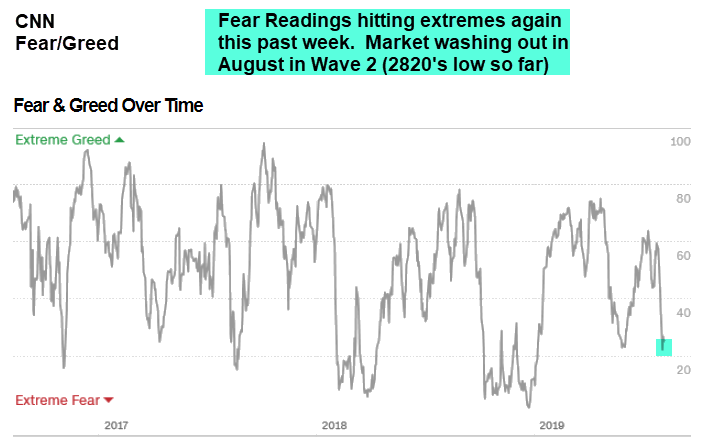

CNN Fear Index hitting 25, nearing 2019 lows as we washed out this past week

CNN Fear/Greed Index

Weekly ideas and tips on Swing Trading Success: Adding Risk ON!

During a Wave 2 correction, market participants will tend to flee to cash and bonds and avoid stocks in general. This is the time to start looking for new entry opportunities both as a Swing Trader and Long Term investor. August is often a great month to buy small cap growth names as I said a few weeks ago. Major market participants take the month of August off and this never helps with volatility, often creating more wild swings than normal. The fact we ran up 300 points in the SP500 during June and July means a pullback is required to clean out the Bulls and wash the sentiment back to negative. This is the time to put some risk on, selectively and that is what we will be doing at SRP. Companies with strong earnings are still being rewarded, indicating the Bull is still strong.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

DOVA- CHART LINK

6 week base pattern for this emerging Biotech, 2nd week in a row on the list.

BZUN- CHART LINK

6 week corrective base and pulled back to test 34 week EMA line this past week again.

SYF- CHART LINK

Held up well this past week in market correction pattern, tested 34 week EMA line. 15 week consolidation. Credit Card provider.

FNKO- CHART LINK

8 week base now, 6% gain this past week off the list, 2nd week in a row on it. Licensed pop culture products maker.

GSX- CHART LINK

3 week base pattern , a recent IPO, China based company operating online education platform.

UPLD- CHART LINK

Pulled back hard this past week to test 34 week EMA line again, 2nd week in a row on the list. If it holds its a better entry. 16 week base, cloud based work management software

PCTY- CHART LINK

13 week break out to all time highs. Providers of Payroll and Human Capital Management software.

ZM- CHART LINK

10 week base. Online Video communications provider, Recent IPO.

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report