26 Aug Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of August 26th

Results and Notes: Gains in a tough week at SRP service (Stockreversalspremium.com)

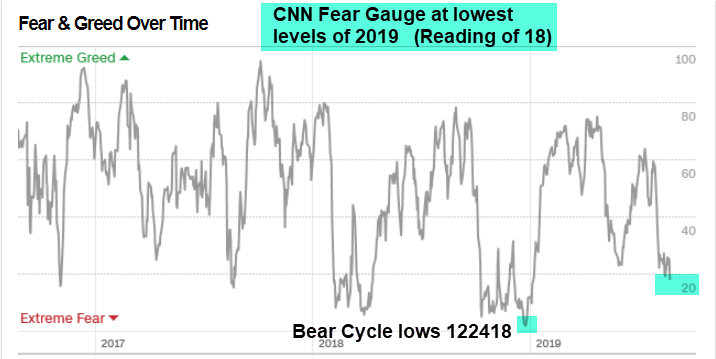

Yet another crazy end to the trading week on Friday as Trump traded barbs with China over Tariffs. This pushed the CNN Fear gauge to 2019 lows of 18 (100 is super greedy and 0 is people jumping out windows). More talks of recession and investors are fleeing into Bonds. Usually August is rough anyways so I’m not going to over react just yet. We closed out GSX for 16% gains on 1/2 and 7-8% on the final 1/2 this past week. Issued swing on XXXX (Reserved for SRP members) which rallied big over 10% from the XX alert price before coming back to fill the gap at XX on Friday, still in buy ranges. We are still high in cash at 80% on a relative basis trying to navigate these choppy waters.

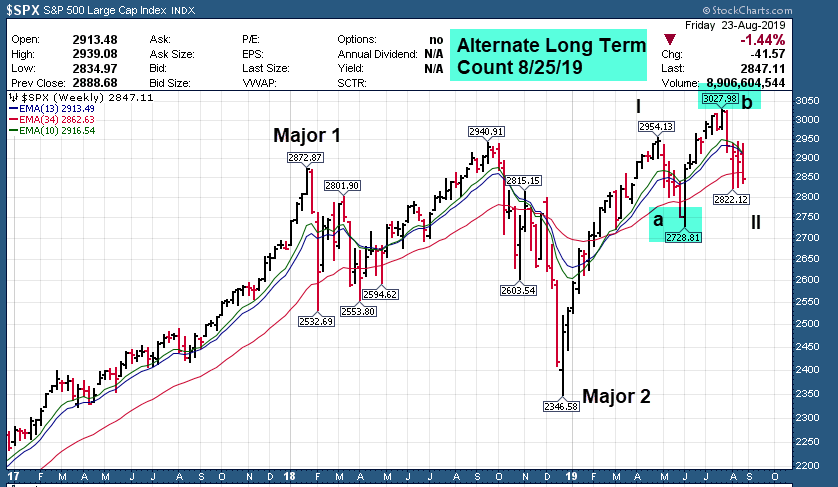

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: After an attempt to break out of the 2940 barrier, the Friday end of week Tariff tweet storm tooks its toll and markets tanked hard. We are testing the 2843 SPX support zone now, and could pull back to 2790-2800 and still be OK for Wave 2. Fear is running very high.

Long Term: Wave 2 of Intermediate 3 of Major 3 should be completed, certainly the futures make the 2776 lows three weeks ago. We are watching 2815 for support, then 2790-2800. 300 point rally requires a correction, long term still very bullish as the next wave SHOULD be 3rd of a 3rd of a 3rd. (Wave 3 of Intermediate 3 of Major 3). 3100 plus still in the cards after Wave 2 completes and Wave 3 up is confirmed. Will need some reconciliation with China though it looks like soon.

Long Term View: Int 3 of Major 3 underway to over 3000 made up of 5 waves

Wave 2 down of Intermediate 3 trying still to confirm a bottom pivot. 2815 key support and 2843 being tested again on Friday. Long term over 3100 still in the projections. 2790-2800 next level support for this count to stay valid.

Click to Enlarge

Short Term View: Wave 2 over?

We pulled back as mentioned last week to test the 2820’s and this should be a regular ABC Flat pattern likely completed. Would like to see 2815 or 2790-2800 hold and a move over 2900 soon to verify Wave 3 underway. This past week we couldn’t quite hold over 2900 but were there until the Friday collapse.

Click to Enlarge

Market Notes and Indicator Charts:

- Alternate Long Term Chart presented (2946 Top of 1, then A to 2728, B to 3030, C to 2728-2750)

- CNN Fear Gauge hits new low, typical of a Wave 2 process

- SRP 80% in cash going into Friday’s trading this past week, booking nice gains on GSX during the week

Alternate Long Term Count for SP 500 (If 2790-2800 does not hold)

CNN Fear Index hit 18 this past week, another new low for Wave 2 and 2019

Weekly ideas and tips on Swing Trading Success: Being Patient but ready to pounce

The last few weeks at SRP we have been keeping high cash balances and only 1-3 positions open at a time in order to stay nimble. During a Correction wave in the market there is no need to try to be a hero, discretion is the better part of valor. Live to fight another day as a trader, take profits quickly, sell 1/2 of any position up 8% or more always (Our hard fast rule), and be patient and let stocks come to you. Be overly discriminate and do not be afraid to have high cash balances for a bit. This gives you ammo to jump on opportunities which we did with GSX this past Monday before taking 16% 1/2 position gains mid week and final 1/2 Position gains of 7-8% on Thursday before it dropped hard. Now likely coming into the end of the August washout, we could see more opportune and lower risk entries near term, high in cash, and ready to pounce. When fear is running high, its the best time to swing trade while everyone is diving out, that’s where you get the big reversal gains if you execute.

Swing Trade Candidates:

KL was our leading play last week as Gold surged and this leader that was on our list popped 7% in a rough end of the week.

Each week we try to provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list. Some weeks we pick none from the list, but gives us some stock to watch as action unfolds.

ZM- CHART LINK

12 week base, ABC Pattern, would like to see it hold 87-90 zone. Online Video communications provider, Recent IPO. Quarterly report due 9/5. $91.63 currently.

INMD- CHART LINK

Recent IPO. Israel based company that provides medical technologies for well being and life changing therapies. Would love to see this from 17.40-18 to consider. Last week I said would prefer pullback, we got 9% pullback for the week after an initial surge. Watching closely. Gap around 19.50 as well could be initial entry.

QIWI- CHART LINK

52 week high breakout in rough end of week in market. Near $23, support key at $21 area on pullback. Electronic online payment systems provider in Russia and Brazil.

AFYA- CHART LINK

Recent IPO, broke to the upside this past week. Brazilian based company that provides education for medical and healthcare professionals via courses in 5 states. Closed at $30.34, a good buy at $28 area.

SMPL- CHART LINK

Broke out of 7 week base to 52 week highs. Defensive play as they develop, market, and sell branded nutritional foods and snacks. $28.54 close, key support around $26

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report