19 Aug Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of August 19th

Results and Notes:

Another wild ride week but still closing well above the 2840’s for SP 500 possible or likely Wave 2 lows this past week. We sold 1/2 our GSX for 12% gains and the final 1/2 a break even. We will be looking to add several positions this week, loving the small cap options as well as they are oversold which is typical in August.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

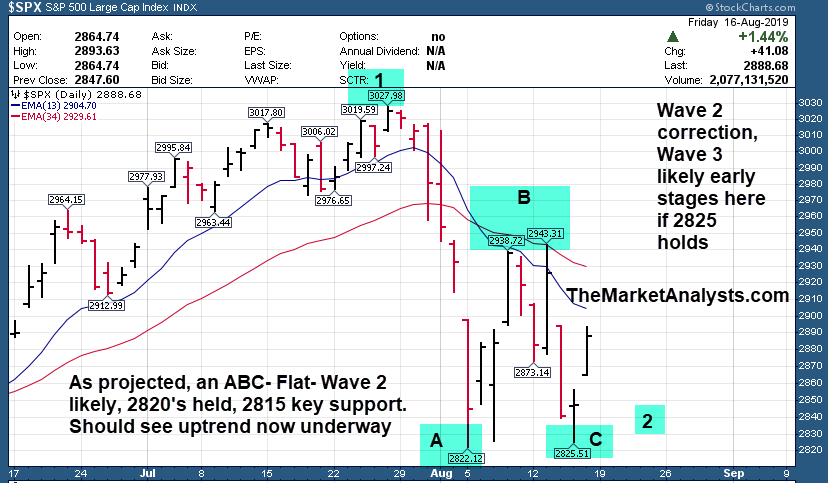

Short Term: Looks like the projected re-test was successful or what we call an “ABC Flat” pattern where the C wave comes back down to double bottom or test the A wave lows. We should be moving up in Wave 3 here, key support at 2815 on SP 500 to confirm this. Higher end resistance at 2975 area.

Long Term: Wave 2 of Intermediate 3 of Major 3 should be completed, certainly the futures make the 2776 lows two weeks ago. We are watching 2815 for support. 300 point rally requires a correction, long term still very bullish as the next wave SHOULD be 3rd of a 3rd of a 3rd. (Wave 3 of Intermediate 3 of Major 3). 3100 plus still in the cards after Wave 2 completes and Wave 3 up is confirmed.

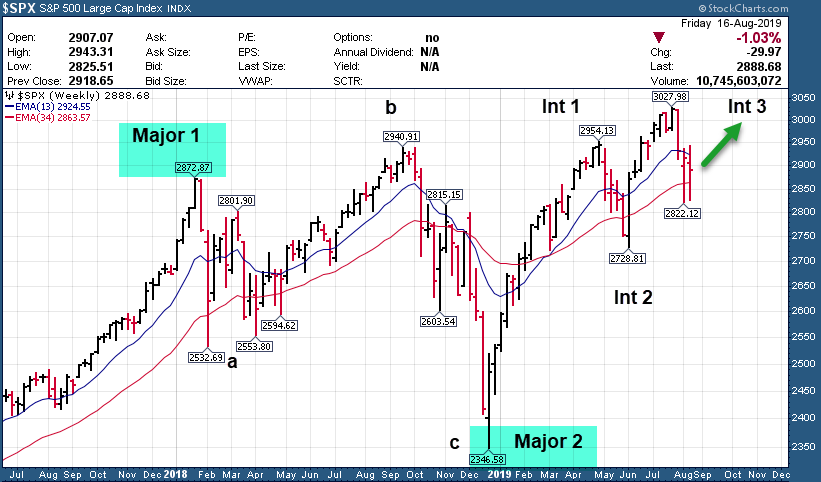

Long Term View: Int 3 of Major 3 underway to over 3000

Wave 2 down of Intermediate 3 underway but looks to be over. Long term over 3100 still in the projections. 2815 area key support for Wave 2. Held double bottom this past week. You’ll note I have an ABC Expanded Flat irregular pattern (For Major Wave 2) I pointed out in December as possible for the Bear Cycle low, this is not what most E Wavers are patterning, but I like to be contrarian. The Bear market if you will was mostly all of 2018.

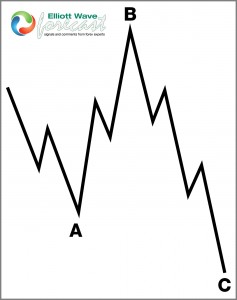

Expanded Flat Sample: (Major 2 above)

Click to Enlarge

Short Term View: Wave 2 over?

We pulled back as mentioned last week to test the 2820’s and this should be a regular ABC Flat pattern likely completed. Would like to see 2815 hold and a move over 2900 soon to verify Wave 3 underway.

Click to Enlarge

Market Notes and Indicator Charts:

- 100% cash coming into this trading week looking to add positions

- Small Caps oversold, should out perform final part of year

- August is the best time to buy beat down small cap growth names (Tipping Point Stocks service)

- Jackson Hole conference is this week, most top economic leaders from the world represented

CNN Fear Index hit 19 this past week, a new low for Wave 2, likely washed out market

Weekly ideas and tips on Swing Trading Success: Behavioral Bottoming Clues

In addition to my Elliott Wave analysis, which is often a bit contrarian in nature… I look at other clues for market peaks or bottoms to help out with the forecast. This past week we saw CNBC headlining Markets in Turmoil, we had Yahoo Finance with the home page flashing a bright red bar about recession fears. The CNN Fear Gauge got down to 19 (0 is absolute extreme fear and 100 is extreme greed), and the Put to Call ratios were screaming high on a relative basis. Billions were flowing into cash and bonds, all hallmarks of washout lows. Often the clues are hiding in plain sight, and not the charts.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

DOVA- CHART LINK

7 week base pattern for this emerging Biotech, pulled back this past week. 13.80-14.30 area good entries with a stop.

BZUN- CHART LINK

7 week corrective base and pulled back to test 34 week EMA line this past week again. 3rd week in a row on this list.

GSX- CHART LINK

4 weeks tight base pattern , a recent IPO, China based company operating online education platform. We sold out early in the week for 12% gains when it ran to 15, but now may be a good re-entry ahead of Aug 22 earnings.

ZM- CHART LINK

11 week base, ABC Pattern, inched up this past week. 2nd week in a row on list. Online Video communications provider, Recent IPO. Quarterly report due 9/5.

KL- CHART LINK

5 week base near highs. Would like to see it hold 42 area, near 44 now. Explorer and Miner of Gold, on list weeks back at $28

HUYA- CHART LINK

ABC 19 week correction ended with this past weeks move up on earnings. Could continue rally. Chinese online gaming platform.

INMD- CHART LINK

Recent IPO. Israel based company that provides medical technologies for well being and life changing therapies. A pullback would be nice to consider entry.

RTLR- CHART LINK

Recent IPO on a 12 week Post IPO corrective pattern. Insider buying this past week as well. Owns, operates, and acquires mid stream energy assets, this sector has been under pressure.

HMSY- CHART LINK

3 weeks tight base near highs. Provides cost containment and coordination of benefits services for healthcare insurers and Governmental agencies.

GH- CHART LINK

We have traded this a few times successfully at SRP in last month or so, now once again firming up for a breakout of 11 week overall base. Spiked up a week ago on earnings to all time highs, pulled back with market, now likely to lead. Liquid Biopsy testing leader.

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report