19 May Weekly Stock Market Forecast and Swing Trading Ideas Report

TheMarketAnalysts.Com

Weekly Stock Market Forecasts, Charts, and Swing Trading Ideas List and Strategies Report

Week of May 19th 2024

STOCKREVERSALS.COM MEMBERS GET AN EXCLUSIVE 25% COUPON OFFER TO JOIN OUR SRP SWING TRADE OR MOMENTUM GROWTH STOCK TPS SUBSCRIPTION SERVICES. ALL MEMBERSHIPS AND OR CASUAL READERS ARE SUBJECT TO OUR TERMS OF SERVICE AGREEMENT

Read up on all 4 Swing Trading and Long Term Research based Subscription Options at TheMarketAnalysts.Com or bottom of this Report

General Market Summary plus Swing Trade Ideas List:

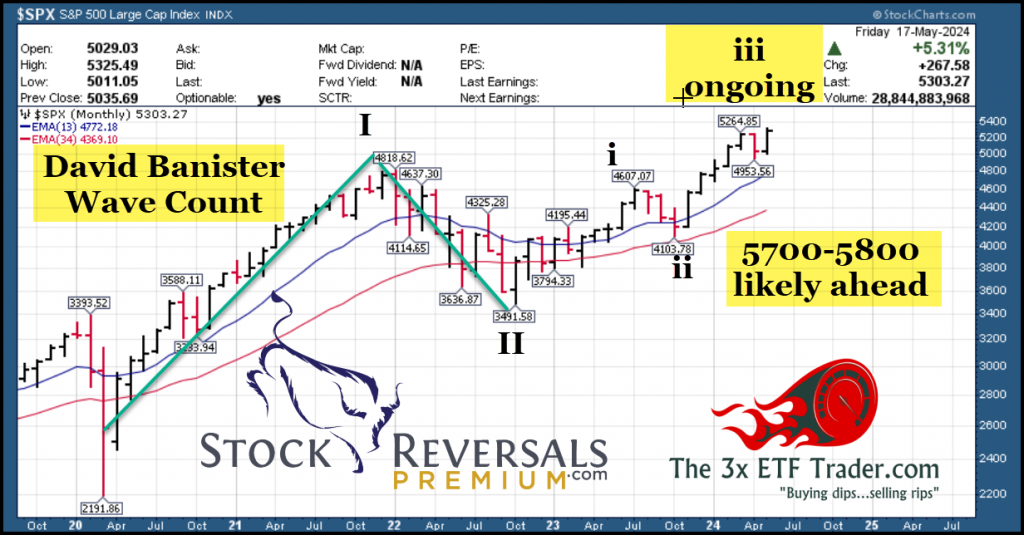

Updated David Banister Market and Elliott Wave Views on SP 500 and more plus the weekly swing trade ideas list is at bottom of this report

Markets, Charts and more:

LAST WEEKS NOTE AND LONG TERM SP 500 UPDATE:

“After a low of 4964 on the ES SP 500 Futures during the correction, we have since rebounded in an Elliott Wave ABC or 1-2-3 fashion. Towards the end of last week the markets were looking more like a 3rd wave up off the lows was or is possible and if so, that would mean a push up to test the March 2024 highs is possible ahead.”

We hit the 5325 uptrend highs last week and up 105 points from the prior weeks close. This is a new high past the March highs as recently projected. Loosely I would say a 3rd wave top is forming or formed and we should have some type of minor 4 correction pattern near term. My 5625 early April 2024 high call remains intact.

I also discussed Bitcoin last week from a bullish viewpoint. To wit, the 3x ETF service doubled up on 200% bull BITX for Bitcoin recently at 36.50-38.50. We saw a spike over 44 late last week which we sold 1/2 our large position into for 8% plus gains, and we are holding 1/2 still. We also sold off our SOXL as it hit my 12.6% profit projection target from our entry and we are waiting for a pullback to start a TQQQ position as well.

SRP Stock Trade Service did well, we booked multiple gains on individual stock swing trades this past week or so and ended last week with just 1 open position for now. I like to sell into strength and if I think we are NEAR a wave top in the markets I like to lighten the load a bit and evaluate.

Swing Trade Ideas list always produces winners, that is updated at the bottom of this report

SRP Recent results

5/16- Sold Final 1/2 VRT at 102.50 for 12% Gains (91.50 to 102.50)

5/15- Sold Final 1/2 CDLA for 22% gains *(9.50 max entry to 11.60)

5/14- Sold Final 1/2 ODD For 14% gains *(36.25 to 41.50)

5/13- Sold 1/2 ODD For 8-9% gains (36.25 to 39)

Long Term Banister Wave Count is bullish. Short term we are a bit extended for sure, intermediately we can stretch my 5625-5800 ranges

The3xetftrader.memberful.com is your spot to join to add ETF swing trading income from the stock market in bull or bear cycles to your arsenal! Stock swing trading can be extremely rewarding in the right wave cycles as we just saw this past two weeks here in the stockreversalspremium.com service, but 3X ETF trading can also be very helpful as an add on and frankly increase your portfolio swing trade returns with LESS risk NOT more…! Consider joining or try the 21 day free trial!

I do like Micro-Caps and Small caps the best moving forward on a valuation and risk reward basis. I am spotting a ton of values to “buy right” in my Tippingpointstocks.com service. We have already had multiple 70-120% gainers in the last 18 Sign up at tippingpointstocks.com. Our next pick will be out shortly.

2 months ago in March we closed out a stock for 130% gains, another 1/2 position for 45% gains, and in the recent past closed out TGTX for over 100% gains for the 2nd time in 12 months, and sold COYA For 100% plus gains. All of these sales turned out to be great timing, its one thing to pick a stock for 50-100% potential, it’s another knowing when to sell based on market conditions, not easy for sure.

Futures service has been doing great as well we have seen huge moves in reversals in the past few trades, we are currently long the market again… ESALERTS.COM for details, and also hosted on The3xetftrader.memberful.com

3X ETF TRACK RECORD: CLICK HERE

OR READ UP AT THE3XETFTRADER.MEMBERFUL.COM

STOCK SWING TRADING RESULTS: SEE FULL SRP STOCK SWING TRADE RESULTS 70% SUCCESS RATE SINCE 2009 CLICK BELOW

Swing Trade ideas list is updated at the bottom of this report reflecting current market conditions and relative leaders based on my review of fundamentals and chart patterns both.

In addition to being a member of various services, you can follow my comments during the week:

- Twitter/X @stockreversals

- Stocktwits @stockreversals for daily commentary on various topics

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

- List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down.

- New names added, many names repeated if still in a bullish pattern.

- A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

5/20/24 Updated list and updated notes on older names as well

CADL ripped as much as 40% last week off this list and an SRP position as well! Some removed and new names in. VRT also ripped and we sold at SRP as well.

GCT – Back on list after pullback following post earnings pop. 14 week base overall. Insider selling may have given some pause, but could mean nothing. Provides end-to-end B2B ecommerce solutions for large parcel

merchandise.

HOOD – 7 week base not far off highs (Robinhood). Provides a stock brokerage platform that offers commission-free

trading intended to democratize finance.

CLS – Breaking out of 6 week base near highs to highs. Canadian contract manufacturer of electronic products for

healthcare, industrial, aerospace/defense. May need to pull back some near term.

RXST – 3 weeks tight closings near highs. Develops and markets adjustable intraocular lens optimized for

every unique eye after a cataract surgery.

HALO – SRP Position as of last week. could break out of 10 month consolidation to highs. Develops recombinant human enzymes and novel oncology therapies that target the tumor microenvironment.

IOT – Back on the list. Consolidating near 52 week highs. Provides an end-to-end solution that allows businesses that depend on physical operations to harness IoT data

IBTA – New Issue, Post IPO 4 week base building. Provides platform allowing brands to deliver digital promotions to

consumers through a network of publishers.

NU – 9 week base pattern, strong earnings last week pushed this up and now normal pullback. Brazil-based Co operating as a holding Co that provides a digital banking platform and services.

MNSO – 4 week closings tight pattern, some volatility last week. China based Co operates 5,800 stores located in 90 countries and regions under the brand name MINISO.

ARIS – 2nd week on list. 2 weeks tight closings near highs . Provides infrastructure and solutions to directly help customers reduce their water and carbon footprints.

PINS – 4 week ascending base, 3rd week on list. Broke out of long base with strong earnings. May consolidate some then move higher. Provides a visual discovery platform that helps users to discover ideas for various projects and interests

MRX – Post IPO base pattern. United Kingdom based financial services co provides liquidity, market access and infrastructure services.

PAAS – 2nd week on list, moved up and broke out late last week. Nice consolidation and leading sector precious metals. Canadian company engaged in the exploration, and development of silver and other minerals in Mexico.

OSCR – 7 week base near highs. #1 IBD name. Offers health insurance built around a full-stack technology platform focused on serving its members.

TCOM – At or near highs, may consolidate some. Chinese consolidator of hotel accommodations/airline tickets

targeting individual business . Needs to hold 48

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com from 2019 to early 2024, and now on our own platform Jan 2024! $395 a year or just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of over 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019 to 2024 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks doubled or or better after bear cycle ended in 2020. With Bear market 2021-2022 now offering many public companies trading below private market valuations Constantly rotating portfolio with deletions and additions as time goes on. Very volatile movements and not suitable for moderate or low risk investors.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits from 2018-2024, now on our own platform along with 3 x ETF service!

SP 500 Futures Trading Advisory service. Formerly hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (reversaltraders@gmail.com)

All services are subject to our terms of use agreement you review and agree to prior to registering.