16 Jun Weekly Stock Market Forecast and Swing Trading Ideas Report

TheMarketAnalysts.Com

Weekly Stock Market Forecasts, Charts, and Swing Trading Ideas List and Strategies Report

Week of June 17th 2024

STOCKREVERSALS.COM MEMBERS GET AN EXCLUSIVE 25% COUPON OFFER TO JOIN OUR SRP SWING TRADE OR MOMENTUM GROWTH STOCK TPS SUBSCRIPTION SERVICES. ALL MEMBERSHIPS AND OR CASUAL READERS ARE SUBJECT TO OUR TERMS OF SERVICE AGREEMENT

Read up on all 4 Swing Trading and Long Term Research based Subscription Options at TheMarketAnalysts.Com or bottom of this Report

General Market Summary plus Swing Trade Ideas List:

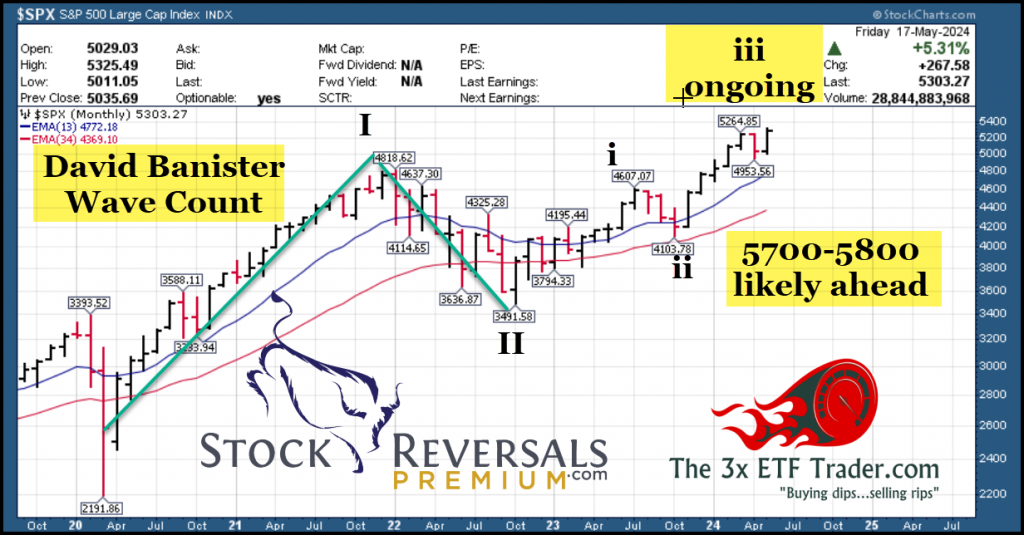

Updated David Banister Market and Elliott Wave Views on SP 500 and more plus the weekly swing trade ideas list is at bottom of this report

Markets, Charts and more:

Notes from last weeks Report:

Intermediately my outlook remains the same for upside to 5700-5800. Often the market can hold up in June and July but frequently August-October is volatile at best and this year we have the early November Presidential Election to add in to volatility perhaps.- 6/9/24 Report

Markets hit uptrend highs and my 5455 ES Futures target I put out to the ES Alerts members sub 5300 played out. We hit for 110 points futures profit from 5340-5450 sale price. We then saw the SP 500 pullback on cue, because Wave 5 was equal in length to Wave 1, or so was my projection on a pullback. Right now I remain intermediately bullish on the weekly chart views, with some short term noise currently. We would look to go long again on the ES (SP 500) futures on push over 5455, I have targets still at 5700-5800 intermediately with June and July often remaining bullish.

NASDAQ 100 (QQQ ETF) also remains with potential to push to 510 area from current levels at 480

The SRP stock swing trade service which has a 70% profitability rate on swing trades since 2009 inception slowed down this week which I do when I think indexes are nearing pivots of resistance. We took nice profits of 30% though on ENVX final 1/2 for trade 10.50-13.50 area and are looking to add some new positions this week.

3x ETF service is close to adding to our bullish Bitcoin BITX position on this pullback. We are also adding to YINN as a new Asian bull position this past week. Gold and Energy are struggling near term and some other bull areas are extended in price right now, making risk reward a little difficult.

Futures service has continued to push out great daily guidance and we were had a 35 point win last week and are up on our current position going into Monday as well

TippingPointStocks.com recently wrote up a Energy Producer/Bitcoin Miner play CORZ at a $4.90 average entry on May 29th, its now at $10.33 up over 100%. We sold 1/2 up 40% and are holding 1/2. A more aggressive but patient service that looks for 50-100% gains and takes profits on the way up and sets stops for remainder to ride. Looking to put out a new recommendation this week. Our other May 29th recommendation was up 33% at this past weeks highs as well before a pullback.

The weekly Swing Trade Ideas list always produces winners, that is updated at the bottom of this report with some new names added this week.

SP 500/ES Futures chart I put out Friday morning repeated:

Repeated for Reference: 5445 highs so far… 5303 at time of this projection

May 17th- Long Term Banister Wave Count is bullish. Intermediately we can stretch my 5625-5800 ranges

3x ETF Track Record: CLICK HERE

Or read up at The3xETFTrader.Memberful.com

Stock Swing Trading Results: See full SRP Stock Swing Trade results 70% success rate since 2009 click below

Swing Trade ideas list is updated at the bottom of this report reflecting current market conditions and relative leaders based on my review of fundamentals and chart patterns both.

In addition to being a member of various services, you can follow my comments during the week:

- Twitter/X @stockreversals

- Stocktwits @stockreversals for daily commentary on various topics

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

- List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down.

- New names added, many names repeated if still in a bullish pattern.

- A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

6/16/24 Updated Names/Notes Etc.

Updated list and updated notes on older names as well- HIMS up 14% last week, CRDO up 6.3%

ONON – $42, a retrace near $39- $40 would be ideal. 4 week overall ascending base with 3 weeks tight closing pattern. Switzerland-based Co operates in 10,000 retail stores worldwide that offer premium sports shoes and apparel.

TWST – Back on list after soaring off the list 2 weeks ago. A $49 support area key. Develops disruptive DNA synthesis platform to industrialize the engineering of biology.

VERX – Could break out of 15 week base and near 52 week highs. Provides corporate tax processing software and consulting services to 4300 customers over 190 countries.

HALO – $49.50 Back on list, this one we profited on at SRP recently when it ripped to 52 from 45 on outlook upgrade from management. Now in a 6 day mild pullback, 48-49 area idea entry.

HG – $16.42— Pulling back 15.75-16 is a great entry if it gets there. Was on this list a while back Post IPO but sat and did nothing for a long time, looks strong now. Bermuda-based insurance company offers diverse insurance and

reinsurance services to clients worldwide.

BROS – $38, Ripped higher last week, but I prefer to wait on the pullback. On the list 6/3/24 Would prefer 36 area entry on pullback. As I said last week, this 4 week consolidation could break to highs and it tested them last week. Operates 831 drive-through coffee shops in 16 states in the United states.

SMFG – 12.62 pulling back. Low 12’s a good entry. 3rd week on list. Moved up recently then pulled back some. Japanese Co provides commercial banking, leasing, securities, consumer finance, and other services in Japan

BZ – 13 week base, needs to hold 19.90. We got stopped out last week at SRP near 20 for loss… but still watching. Chinese-based provider of mobile app BOSS Zhipin, to connect job seekers and enterprises efficiently. Ann. EPS Growth +67% PE 28 Avg.

PDD – Rebounded off my support area, 2nd week on list , pullback recently after breaking out to highs after multi month consolidation. TEMU parent growing rapidly competing with Amazon etc, PE Ratio on forward earnings only about 12x.

SG – 6 weeks tight closing base pattern. Has been volatile up and down of late. Broke out few weeks ago on strong earnings for this greens salad high tech restaurant chain. Entry looking better 31-32 I think.

CLS – Up 6% last week on this list but still attractive. Canadian contract manufacturer of electronic products for healthcare, industrial, aerospace/defense. May need to pull back some near term.

RXST – 5th week on list, nice 5 week pullback. 56 key support. Develops and markets adjustable intraocular lens optimized for every unique eye after a cataract surgery.

NU – 7 weeks tight closing base, 1/2 Remainder SRP position. Strong earnings a few weeks ago pushed this up and now normal pullback. Brazil-based Co operating as a holding Co that provides a digital banking platform and services.

PINS – SRP position 1/2 remainder as we were up 6-8% and sold 1/2. Still like this pattern. As I had said here a few weeks ago it may consolidate some then move higher which it did. Provides a visual discovery platform that helps users to discover ideas for various projects and interests

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com from 2019 to early 2024, and now on our own platform Jan 2024! $395 a year or just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of over 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019 to 2024 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks doubled or or better after bear cycle ended in 2020. With Bear market 2021-2022 now offering many public companies trading below private market valuations Constantly rotating portfolio with deletions and additions as time goes on. Very volatile movements and not suitable for moderate or low risk investors.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits from 2018-2024, now on our own platform along with 3 x ETF service!

SP 500 Futures Trading Advisory service. Formerly hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (reversaltraders@gmail.com)

All services are subject to our terms of use agreement you review and agree to prior to registering.