24 Jun Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com

Results:

We closed out 3 more profitable swing trades this past week at SRP. 1/2 our SE trade for 11% gains and the final 1/2 of PINS for 9% gains. We also completed final 1/2 of SNAP trade for 18% gains late on Friday. Finally, issued two new swing alerts as well during the week, one of which rallied 12% on Friday.

Weekly Stock Market and Trading Strategies Report Week of June 24th

Short Term and Long Term Elliott Wave Views for the SP 500 Index

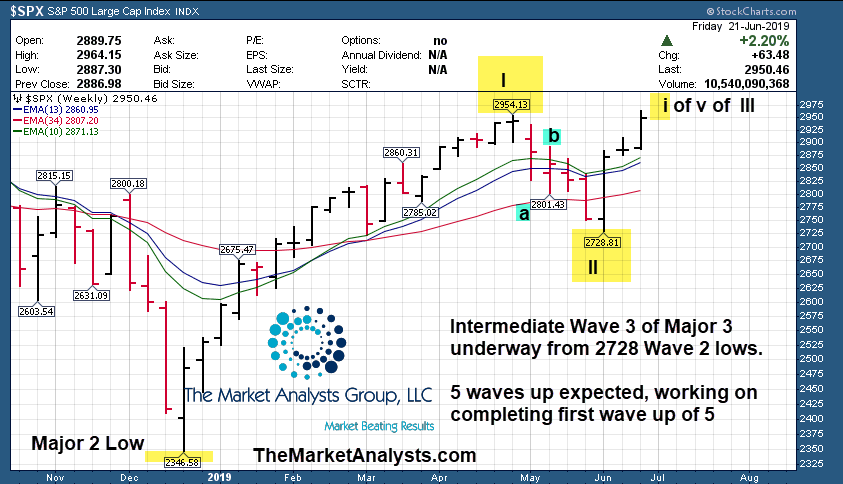

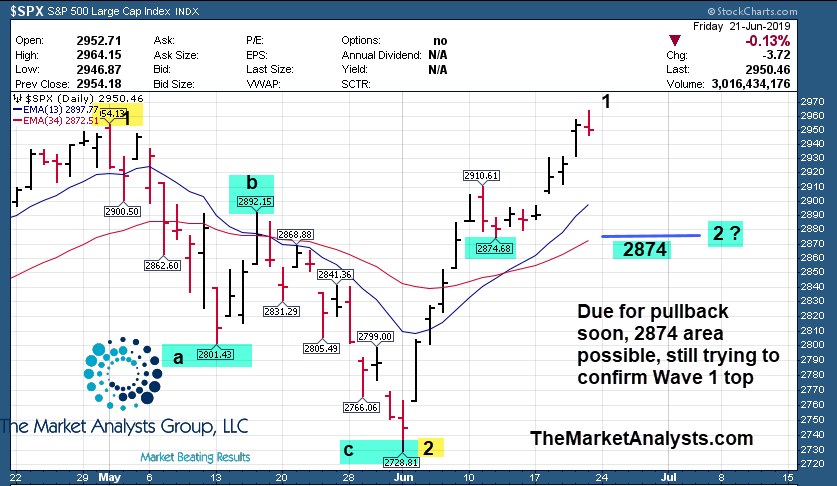

Short Term: Wave 1 of 5 of 3 up so far hitting highs of 2964 on 6/21. Should pullback to 2874 ranges possibly in a Wave 2 correction. Trying to confirm first wave up has peaked.

Long Term: Major Wave 3 to all time highs underway to 3,000 plus, so far 2964 highs on 6/21. Intermediate 3 of Major 3 unfolding which is usually the most bullish of waves (2728 bottom of Intermediate 2)

Long Term View: Int 3 of Major 3 underway to over 3000

We now see the SP 500 in Wave 3 up of Major 3, as projected weeks ago, this took us to all time highs this past week. We should just be in early stages as the SP 500 is completing an overall 18 month base pattern.

Short Term View: Wave 1 of 5 of 3 may be topping

Last week as said watch that possible Bull Flag on SP 500, and sure enough it vaulted higher.

Wave 1 may have peaked in Wave 1 of 3 of 5 up at 2964 on June 21st, but we need to confirm. The most recent pullback to 2868 was very shallow an indicative of a minor 4th wave, this is why we saw a thrust up in Wave 5 of 1 last week. We profited with a 33 point gain in our SP 500 futures services. We may pullback to 2874, but must confirm if we have topped out wave 1.

Market Notes and Indicator Charts:

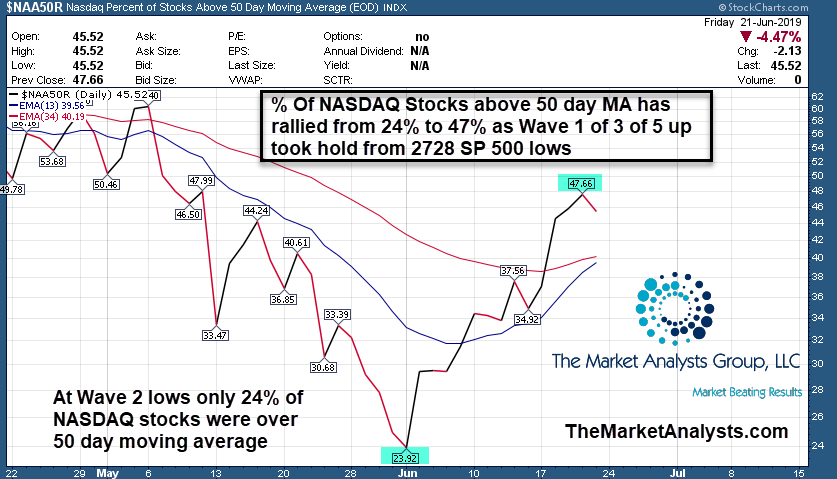

- % of NASDAQ Stocks above 50 day MA line has moved from 24% at lows to 47% this past week

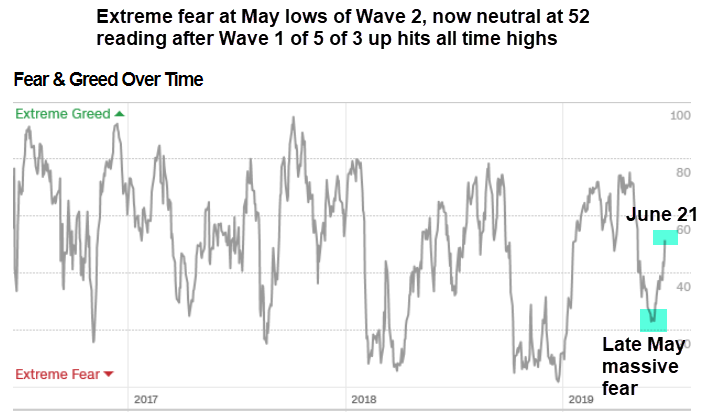

- CNN Fear and Greed gauge has moved to neutral last few weeks from extreme fear readings at bottom of wave2

- Bullish Right shoulder we pointed out last week on Russell 2000 in fact played out to the upside

- Biotech rallied as ARRY taken out

- Market indexes a little stretched short term

- 18 month consolidation in SP 500 looks to be finally breaking out

% of NASDAQ Stocks over 50 day MA

CNN Fear Gauge Update:

Weekly ideas and tips on Swing Trading Success: Staying disciplined

We closed out 3 more profitable swing trades this past week at SRP. 1/2 our SE trade for 11% gains and the final 1/2 of PINS for 9% gains. We also completed final 1/2 of SNAP trade for 18% gains late on Friday. Finally we issued two new swing alerts as well, one of which rallied 12% on Friday.

Some of my management for subscribers is for Swing Trading specifically, and other services are geared to short term as in SP 500 Futures Trading, and or Longer Term growth stocks with longer holding periods. With the Swing Trades, you must not confuse long term with swing trading. Often we will sell a stock for profits on a Swing Trade because that is in fact the objective. Perhaps we had a price target and we have approached it or moved past it a bit, so we move to take those gains.

It doesn’t mean I may not like the company long term, but we must stay disciplined within what our objectives are, and as a trader or investor you should do the same. Some of the stocks you may be holding long term, and others are swing trades from days to 7-8 weeks usually. The SRP service is Swing Trading, we are looking for 8-20% gains on average on each swing alert, and we will take profits on the way up and are not afraid of closing out a position we may like long term, mainly because we must stay focused on the discipline of taking profits and moving on to new positions. Make sure to know what your objectives and time frames are on any stock or ETF you may be involved with and stick with it.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

We have 10 names this week, some repeated and some new. If stock breaks out off our list we usually do not repeat it the next week, as we look for fresh ideas.

Last week SE was the top winner with a 15% gain, and we profited in fact at SRP service as we alerted that one as an official trade. We took 1/2 off the table on Friday. KL was another winner with an 8.8% gain.

NEO- CHART LINK

8 week base pattern near, almost broke out last week and pulled back late in week. Still attractive.

ETSY- CHART LINK

17 week corrective base for this DIY online machine, allows consumers to buy and sell handmade goods. Over $68 looks bullish. Pulled back a bit last week, 2nd week in a row on list.

PRVB- CHART LINK

Repeated after a 4.8% gain last week, most came on Friday. This is a Biotech that announced stunning Phase 2 results in a 9 years study of Type 1 Diabetes on June 9th. Now on a 10 day consolidation after a huge run, this could get some legs in the weeks ahead to as high as $18 plus.

UPLD- CHART LINK

9 week base near all time highs, 4th straight week on this list. Shot up early in the week 8-9% and then pulled back. Cloud based work enterprise work management software provider. Looks poised to break out , 3rd week on the list.

CZZ- CHART LINK

3rd week in row on list, 14 week base now near highs. Provides laboratory testing services. Close to breakout.

ESNT- CHART LINK

8 week base, pullback this past week. Would like to see 47 area hold for this PMI and Reinsurance provider.

FNKO- CHART LINK

Broke out of 15 week base last week. Maker of pop culture products (Bobble heads etc)

MNST- CHART LINK

8 week base, pull back last week tested 10 week line. Maker of alternative beverages.

AL- CHART LINK

8 week corrective base, moving up on right side of base now. Leasing and fleet management of Aircraft.

UBNT- CHART LINK

6 week corrective base, right side now close to breakout. Radios, Antennas, Network Management tools and more.

Read up at TheMarketAnalysts.com for more details

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)