08 Jul Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com

Weekly Stock Market and Trading Strategies Report Week of July 8th

Results and Notes:

Last week was a holiday light week with the market closed on Wednesday afternoon and all day Thursday so we did not issue new alerts. Also, a lot of post 2nd quarter adjustments meant a lot of hits to small cap stocks on light volume as money managers re-adjust or take post 2nd quarter window dressing profits to start the 3rd quarter.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: As we said here last weekend the pullback to 2914 was shallow and therefore bullish, we ran to all time highs as projected. SP 500 is riding the 13 day EMA line currently 2946 about 45 points below current levels on this Wave 1 of 5 of Int 3 up from 2728 Int wave 2 lows.

Long Term: Major Wave 3 will continue to push all time highs intermediate to long term, with 3100 initial major resistance on SP 500. Intermediate 3 of Major 3 unfolding which is usually the most bullish of waves (2728 bottom of Intermediate 2)

Long Term View: Int 3 of Major 3 underway to over 3000

Wave 3 of Major 3 continues the most bullish usually of all Elliott Wave patterns. We are looking for north of 3050 as discussed prior with 3100 area likely resistance in time.

Click to Enlarge

Short Term View: Wave 1 of 5 still on going

As we said here last week, 2914 pullback was shallow so we could extend to all time highs again. This is what we saw last week as the SP 500 hit a high around 3000 and then pulled back before popping again to 2990 area on Friday in light volume. As long as the 13 day EMA line holds, the Wave 1 of Int 3 uptrend continues (5 total waves).

Earnings season is upon us and we will see how the outlooks are in the conference calls for the 2nd half and maybe into 2020.

Click to Enlarge

Market Notes and Indicator Charts:

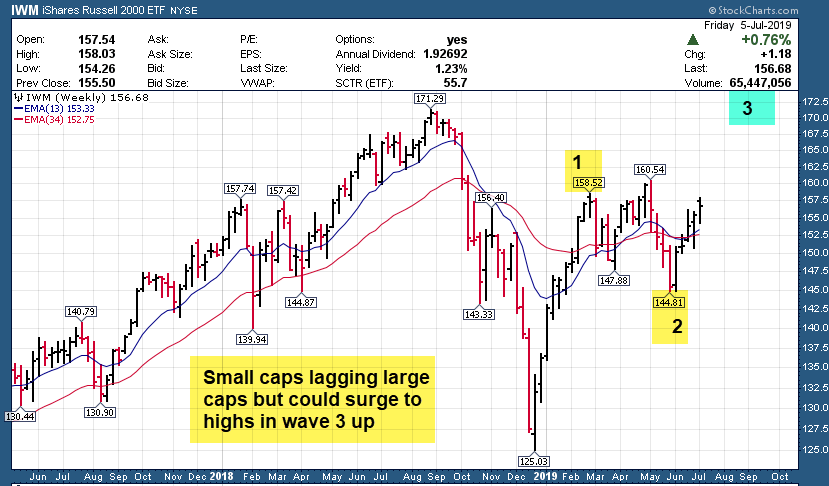

- Chart and notes on IWM ETF (Russell 2000 small caps lagging)

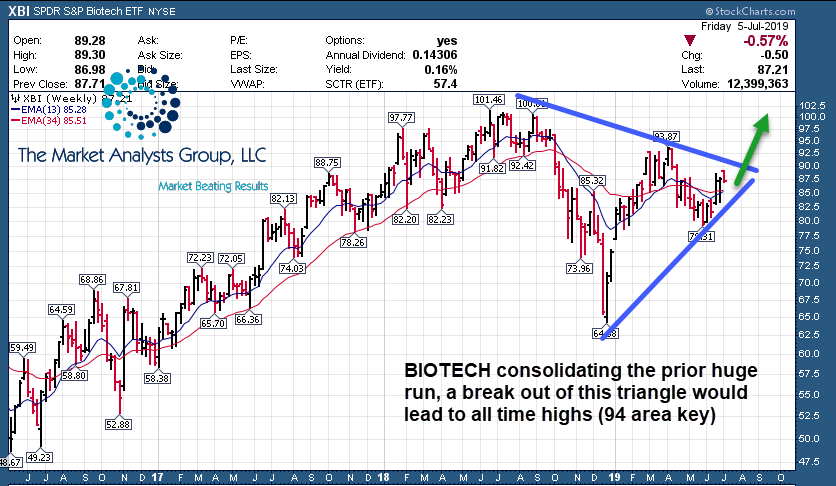

- Chart and notes on XBI ETF (Biotech index forming bull long term flag?)

Russell 2000 lagging, but could surge to highs in 2nd half of 2019

Biotech Index forming massive Bull Triangle after huge run to June 2018 highs. Could run to highs.

Weekly ideas and tips on Swing Trading Success: Taking breaks and keeping level head

Taking a break off and on as a trader is important . It allows you time to reflect, to recharge your batteries and perhaps go over some errors you have made and tighten up your discipline a bit as well. Every trader has slumps during the year, not matter how many years experience or skill levels. By the same token, there are times during the year when you can get on a great roll as well, as I can attest. Its key to keep a level head and not get too high or too low emotionally under either circumstance. There are times when your account takes a hit, and times when you can do no wrong. Just remember The Market is smarter than all of us, respect it and stay disciplined, that means both in profit taking in good times and taking losses in those rough waters.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

Last week BZUN ran up almost 9% off this list, ZS 8.4%, others not so much in a volatile week as post 2nd quarter portfolio profit taking took hold in my opinion.

13 Swing Names with Chart Links and brief notes below.

TEAM- CHART LINK

9 week base near highs. Team management software maker.

ESNT- CHART LINK

10 week base near highs. PMI provider in 50 states (Mortgage insurance)

EDU- CHART LINK

10 week base near highs. Chinese language training.

CPRT- CHART LINK

5 weeks tight pattern. Salvage vehicle auctions etc.

LPLA- CHART LINK

10 week base, could break out soon. Reasonable PE. Brokerage/Advisory services firm.

MNST- CHART LINK

10 week base near highs, breaking out to right side of base. Alternative Beverages.

TWTR- CHART LINK

8 week correction over, may move up on right side. (Twitter)

CAE- CHART LINK

8 week corrective base but nearing highs. Flight simulators and training services.

MFGP- CHART LINK

20 week base, right side may break out soon. Global Technology software and support.

CZZ- CHART LINK

6 week base near highs, 4th time on list. Brazilian chemicals maker.

ZEN- CHART LINK

9 week base near highs. SAAS customer service platform.

ZM- CHART LINK

Post IPO base near highs, Zoom Video.

SMPL- CHART LINK

Post IPO pop and now consolidation. Smart Foods.

Read up at TheMarketAnalysts.com for more details

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)