22 Jul Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of July 22nd

Results and Notes:

Mercury Retrograde usually has more volatility during the few times a year it rears it’s head. This lasts into August 1st, and we could see a Wave 2 low around that time in the 2910 SP 500 area from the 3018 highs. Loosely near term watching 2950 as support but could see more correction ahead if that breaks. We took a break from new Swing Alerts this past week due to being patient for pullbacks and we took profits on several names including GH and ZM near their spike highs. Last week SRP Members booked 9%, 11% and 8% gains on 3 names with no losses.

Product Announcement: 3x ETF Trading Service

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: Wave 1 of 5 likely topped at 3018, as it did pierce that 13 day EMA (2983 currently) line I said to watch for clues. I would expect to see 2950 area next and then 2910 area loosely for a Wave 2 target low by end of July possible. One day at a time but that’s the short term road map.

Long Term: Major Wave 3 will continue to push all time highs intermediate to long term, with 3100 initial major resistance on SP 500. Intermediate 3 of Major 3 unfolding which is usually the most bullish of waves (2728 bottom of Intermediate 2). Pullback near term is normal.

Long Term View: Int 3 of Major 3 underway to over 3000

Intermediate Wave 3 (Which has 5 full waves) of Major 3 continues. This is the most bullish usually of all Elliott Wave patterns. We are looking for north of 3050 as discussed prior with 3100 area likely resistance in time.

Click to Enlarge

Short Term View: Wave 1 done?

13 day EMA support broke on Friday and likely we are in early stages of pullback Wave 2. Normal corrective action would be down to the low 2900’s before a possible start back up of Wave 3 to all time highs.

Click to Enlarge

Market Notes and Indicator Charts:

- NAA50R reading peaking out last few weeks on NASDAQ Stocks

- Noted early last week to my Futures Traders that rally looked exhausted, results priced in?

- Wave 2 likely underway as normal correction

NAA50R shows top short term in % of NASDAQ Stocks over their 50 day Moving Avg Line

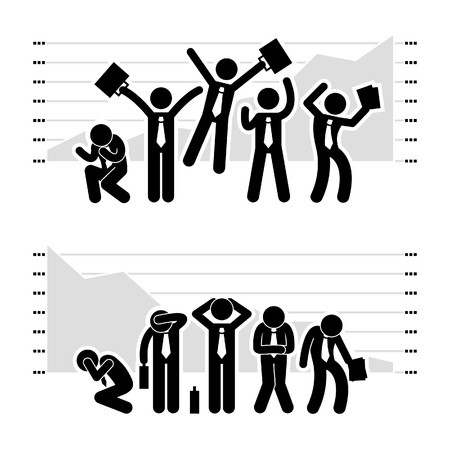

Weekly ideas and tips on Swing Trading Success: Sell when your giddy, Buy when your scared.

You have to trust your instinct on the market if you have one, I use Elliott Wave patterns that I can identify along with some other indicators of Sentiment to gauge where we are in a short, intermediate, or long term Bull or Bear pattern. Right now in a super Bull pattern, but even these get overbought and sentiment must correct. We didn’t issue any new Swing Trade Alerts this past week on purpose, because I just wasn’t seeing as many opportunities or charts that I liked. That was one red flag to take more profits and sell. We sold out of 3 positions using our “Sell 1/2 when up 8% or more” rule and in all cases that worked out as all 3 stocks fell in the short period after. When everyone is high fiving each other at the water cooler over how smart they are in the stock market, your probably near a short term sentiment and stock movement peak… best to take a breather and let stocks come back into better risk adjusted ranges. Sell when your giddy, buy when your scared… hard to do, but that’s what works long term.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

PAYS was up 8.7% last week and was the top performer off last weeks list. FVRR was up near 6% and still looks good, also PSNL, PYPL , LINX, LPLA, MNST repeated from last week.

PSNL- CHART LINK

Recent IPO in the Genetics Testing space, 21 day post IPO base may have bottomed out last week with a nice end of week rebound. 2nd week in row on list.

PYPL- CHART LINK

5 week tight base near highs for Paypal. Earnings due 7/24, 2nd week in row on list

FVRR- CHART LINK

Post IPO smash back to near $21 IPO levels now with JP Morgan as the underwriter. This stock could hit $21 and reverse up. Can look to buy from 21-23 with stop at 20 as an idea. Specializes in contractors who hire themselves out for online projects and more.

LINX- CHART LINK

Recent IPO, 17 day Post IPO consolidation near offering price. Brought public by Goldman Sachs. Linx Core provides business management systems to more than 45,000 retailers in Latin America and started in 1986. 2nd week in row on list. Tight range.

LPLA- CHART LINK

12 week base near highs for this Financial Services provider. On our list multiple times recently. Earnings 7/24

MNST- CHART LINK

12 week base consolidation still looks attractive, 3rd week in a row on the list.

UBNT- CHART LINK

10 week base, on our list again, still looks good from our first suggestion 3 weeks ago.

EDU- CHART LINK

5 week base near highs, pullback last week perhaps entry opportunity. Chinese education provider.

UPLD- CHART LINK

13 week base, cloud based work management software.

LSCC- CHART LINK

Possible breakout of right side of 2 week base near highs, programmable logic devices for chip industry.

Read up at TheMarketAnalysts.com for more details

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple report