15 Jul Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Weekly Stock Market and Trading Strategies Report Week of July 15th

Results and Notes:

We issued 3 new swing alerts this past week at SRP for our Premium Members. We are up 15% on one of our open positions and our 5th position rallied 7% on Friday and we are up 11% on that one. We should be active again this week as the Wave 3 up continues in the SP 500 and markets.

Product Announcement: 3x ETF Trading Service

Coming SOON! The 3x ETF Trader, a service hosted on Stocktwits.com with a 20% discount for SRP members, trading 3x ETF pairs in Bull or Bear movements.

Short Term and Long Term Elliott Wave Views for the SP 500 Index

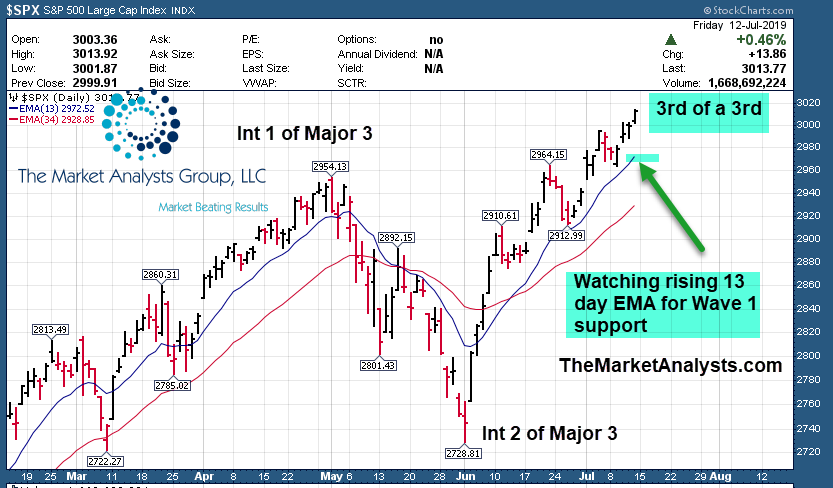

Short Term: Wave 1 of 5 of Int 3 up from 2728 Int wave 2 lows. We hit all time highs again and we have said this will continue with normal pullbacks. For now still in Wave 1 up as all pullbacks have been too shallow to qualify as a normal Wave 2 correction. Watching the 13 day EMA line which is now around 2973 as key support for Wave 1.

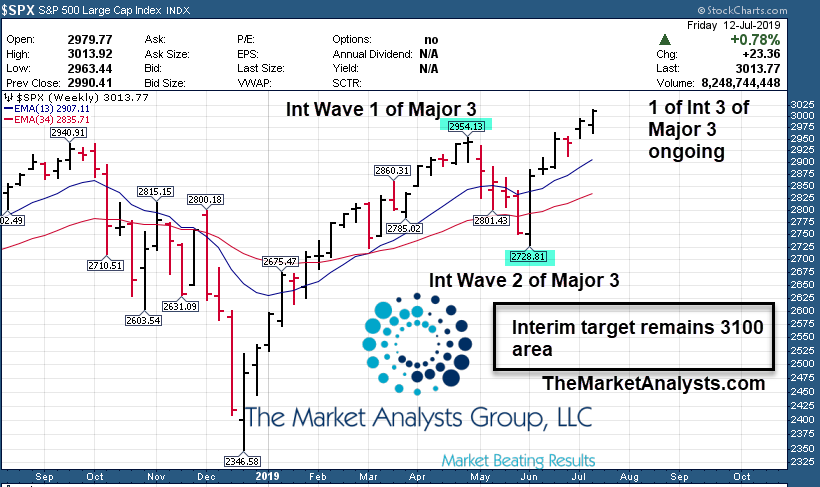

Long Term: Major Wave 3 will continue to push all time highs intermediate to long term, with 3100 initial major resistance on SP 500. Intermediate 3 of Major 3 unfolding which is usually the most bullish of waves (2728 bottom of Intermediate 2)

Long Term View: Int 3 of Major 3 underway to over 3000

Wave 3 of Major 3 continues the most bullish usually of all Elliott Wave patterns. We are looking for north of 3050 as discussed prior with 3100 area likely resistance in time.

Click to Enlarge

Short Term View: Wave 1 of 5 still on going

Watching 13 day EMA Line for key support, Wave 1 continues as part of this powerful “3rd of a 3rd” Elliott Wave pattern.

Click to Enlarge

Market Notes and Indicator Charts:

- Chart and notes on IWM ETF (Russell 2000 could break out of 2 week base)

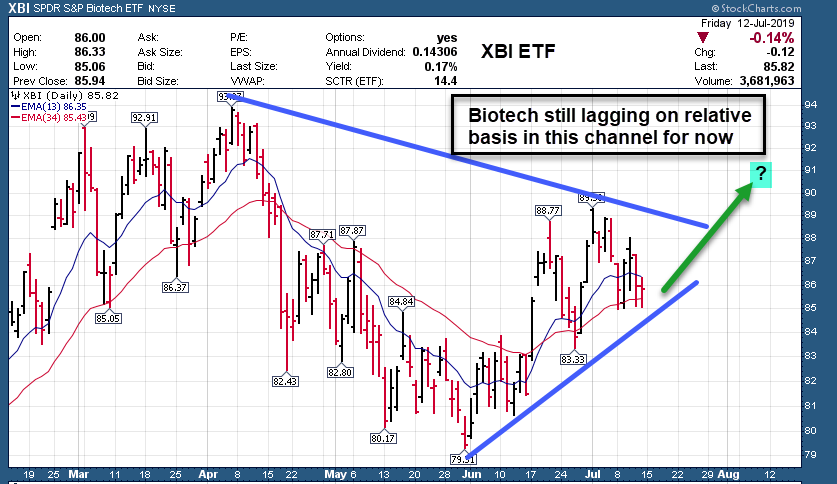

- Chart and notes on XBI ETF (Biotech index forming bull long term flag, still lagging)

Russell 2000 lagging, but could surge to highs in 2nd half of 2019, and near term pop

Biotech Index forming massive Bull Triangle after huge run to June 2018 highs.

Weekly ideas and tips on Swing Trading Success: Fundamentals do count!

Even with Swing Trading, my philosophy is to find the top fundamentally sound ideas that combined with a nice chart set up have higher odds of swing trade profit success. Many traders just focus on the charts, and some just on fundamentals. I try to combine the two to look for the overall best risk adjusted opportunities. This way, if you get caught in a trade and maybe missed a stop loss point, perhaps you can recover with those stronger fundamentals eventually playing out. This has led to a 70% near 10 year swing trade success rate since I started initial online services in 2009. Other keys I have covered in prior reports include selling 1/2 on the way up when up 8% or more, and using stop losses near the close of a trading day to avoid intra-day stop loss runs that are often algo based.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

FND- CHART LINK

Floor and Decor is in a nice 11 week corrective base pattern but the right side of the base is now moving higher.

ESNT- CHART LINK

11 week base, this is close to breaking out. Has been on the weekend list numerous times of late. PMI provider.

PSNL- CHART LINK

Recent IPO in the Genetics Testing space, moving up after correction and gains may continue ahead. 16 day IPO base pattern so far, could re-attack initial highs of 31.88 from 25 area.

PYPL- CHART LINK

4 week tight base near highs for Paypal. Earnings due 7/24

PAYS- CHART LINK

Innovative Pre-Paid Card programs provider. A bit extended but perhaps buy on a pullback towards $15

FVRR- CHART LINK

Post IPO smash back to near $21 IPO levels now with JP Morgan as the underwriter. This stock could hit $21 and reverse up. Can look to buy from 21-23 with stop at 20 as an idea. Specializes in contractors who hire themselves out for online projects and more.

LINX- CHART LINK

Recent IPO, 12 day Post IPO consolidation near offering price. Brought public by Goldman Sachs. Linx Core provides business management systems to more than 45,000 retailers in Latin America and started in 1986.

CHNG- CHART LINK

11 day Post IPO base. Healthcare Payment processing and more. Steady cash flows, in a nice trading range.

LPLA- CHART LINK

11 week base near highs for this Financial Services provider. On our list multiple times recently. Earnings 7/24

MNST- CHART LINK

11 week base for alternative beverages provider. Earnings due 8/6

PGR- CHART LINK

6 week base nearing highs. Auto insurance provider in 50 states.

CAE- CHART LINK

9 week overall base nearing highs breakout. 2nd week on list. Flight simulators.

PRVB- CHART LINK

5 weeks tight base after Type 1 Diabetes results stunned market. Has multi month potential as well.

Read up at TheMarketAnalysts.com for more details

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 150% in 4 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 20% 24 hour gain the week ending May 3rd!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)