30 Jun Weekly Elliott Wave Forecasts and Trading Ideas Report

TheMarketAnalysts.Com

Subscription services for the Active Investor

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade subscription service.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com

Weekly Stock Market and Trading Strategies Report Week of July 1st

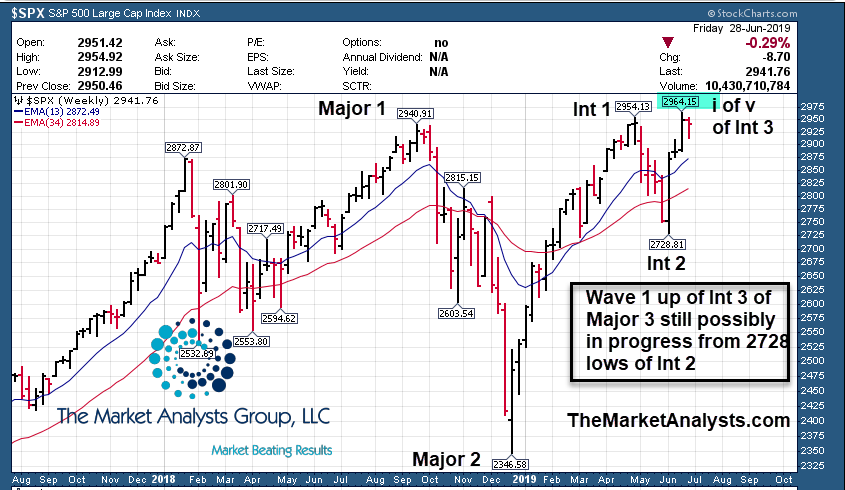

Short Term and Long Term Elliott Wave Views for the SP 500 Index

Short Term: A light pullback to 2914 is still pretty shallow, which is bullish. Unless we pull back soon to 2875 ranges, we may continue to new high again.

Long Term: Major Wave 3 to all time highs underway to 3,000 plus, so far 2964 highs on 6/21. Intermediate 3 of Major 3 unfolding which is usually the most bullish of waves (2728 bottom of Intermediate 2)

Long Term View: Int 3 of Major 3 underway to over 3000

We now see the SP 500 in Wave 3 up of Major 3, as projected weeks ago. We should just be in early stages as the SP 500 is completing an overall 18 month base pattern. Projections are north of 3050.

Click to Enlarge

Short Term View: Wave 1 of 5 of 3 may be topping

We pulled back but only to 2914 area from 2964 highs of this Wave 1 up from 2728. That is pretty shallow and we would expect more along the lines of 2875 area, so if we do not pull back hard soon, this wave may extend to all time highs once again.

Click to Enlarge

Market Notes and Indicator Charts:

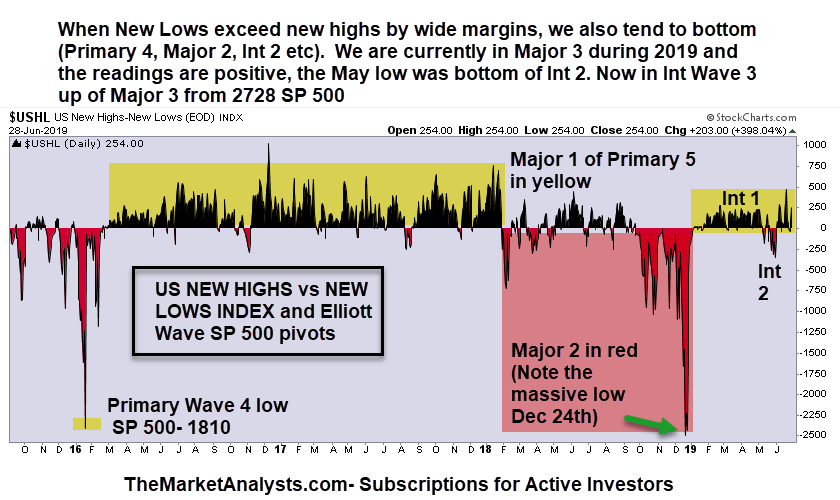

- Update on NYSE New highs vs Lows and Elliott Wave SP 500 Patterns within

- Overall intermediate Wave 3 of Major 3 is super bullish from 2728, all time highs will continue

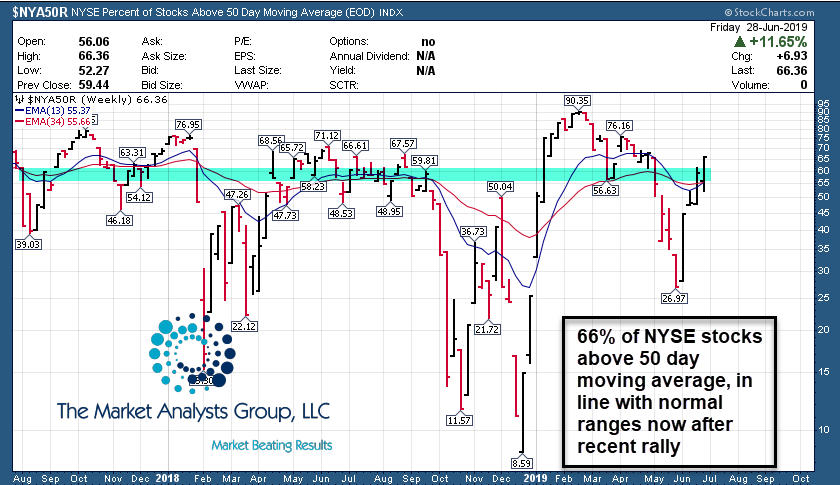

- % of Stocks above 50 day moving average has now risen over 60% in line with Bullish conditions

% of NYSE Stocks over 50 day MA Update

New Highs vs New Lows Index coincides with Elliott Wave SP 500 Patterns

Weekly ideas and tips on Swing Trading Success: Using Stops correctly

We prefer to use “stops near close of market” at SRP when swing trading for the most part. The reason is there can be “stop loss runs” during the day that are largely computerized trading and algo’s kicking in. Many retail traders get stopped out for no reason because they use “Hard” stops. We prefer to let the volatility intra-day take its place and try to avoid those stop loss runs. Often if you stop out say for an 8% loss, and then that same stock rebounds 5% over the next few days, you would have had to replace that position with another right away that went up 5%. That can be tough to do when it turns out all it was was random price movement during the day. If you wait until about 5 minutes before the end of the trading day before stopping out, and you do not put your order in ahead of time, you can often avoid a lot of those washout losers that later turn to winners. Remember, the trading firms make more money when stops are triggered, it also triggers commissions.

Swing Trade Candidates:

Each week we provide 8-15 Swing Trade ideas to consider as part of our SRP service. We often pick a few from the list during the week as actual alerts and or names from our other research that are not on this list.

We have 10 names this week, some repeated and some new. If stock breaks out off our list we usually do not repeat it the next week, as we look for fresh ideas.

BZUN- CHART LINK

9 week corrective base pattern. Right side of base about to break out. China based company providing end to end E commerce solutions

EDU- CHART LINK

14 week base pattern. Right side about to break to highs. Chinese provider of language training and exam prep.

ZS- CHART LINK

Returning to the list and on a 7 week base pattern near highs. Global Cloud security architecture.

EVOP- CHART LINK

5 week ascending base near highs. Merchant acquisition and payment processing services provider.

PRVB- CHART LINK

Repeating again as it soared 8% plus on Friday and is in a 3 week base now, this has room to run over the ensuing 4-8 week period and also long term we think.

CZZ- CHART LINK

Up 3.33% last week, and now 4th week in row on list, 15 week base now near highs. Provides laboratory testing services. Close to breakout.

FNKO- CHART LINK

We like this one to breakout to 52 week highs ahead. 2nd week in a row on list. A Maker of pop culture products (Bobble heads etc)

MNST- CHART LINK

Now on a 9 week base, 2nd week in a row on the list, recent pull back last week tested 10 week line. Maker of alternative beverages.

AL- CHART LINK

Rose 2.5% last week out of the 8 week corrective base, moving up on right side of base now. Leasing and fleet management of Aircraft. This is the 2nd week in a row on the list.

UBNT- CHART LINK

7 week corrective base, second week in a row on list. The right side now close to a breakout. Radios, Antennas, Network Management tools and more.

Read up at TheMarketAnalysts.com for more details

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

StockReversalsPremium.com– 70% 6 year success rate on our Swing Trading… with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes.

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! We cashed out on SOLO for over 200% gains in 5 weeks! SOLY recently up 400% in 8 weeks!

E-Mini Future Trading Service -Hosted on Stocktwits.com… Just closed a 31 point 24 hour gain the week end June 21st! Morning daily charts and guidance plus alerts!

Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using our market map models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more. 24 point win this past week or 24%. Join for $50 a month!

ESAlerts.com – Auto-Trading SP 500 Futures Service

Just hit for a 33 point win the week of June 21st in 24 hours for $1,650 in profit for each $6,000 contract!

Launched in late January 2019 for those who are too busy to wait for alerts to buy and sell and want us to handle executions for you with our Trading Firm in Chicago.

Contact Dave with any questions (Dave@stockreversalspremium.com)