11 Mar Weekly Stock Market Forecast and Swing Trading Ideas Report

TheMarketAnalysts.Com

Weekly Stock Market Forecasts, Charts, and Swing Trading Ideas List and Strategies Report

Week of March 11th 2024

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services. All memberships and or casual readers are subject to our Terms of Service Agreement

Read up on all 4 Swing Trading and Long Term Research based Subscription Options at TheMarketAnalysts.Com or bottom of this Report

3x ETF Now on NEW PLATFORM!!!

The3xetftrader.memberful.com SMS Text, Post, Email, Morning Reports and more!! Includes option to add ES Alerts and Stock Options Trading as well

General Market Summary plus Swing Trade Ideas List:

Updated David Banister Market and Elliott Wave Views on SP 500 and more plus the weekly swing trade ideas list is at bottom of this report

Markets, Charts and more:

Markets, Charts and more:

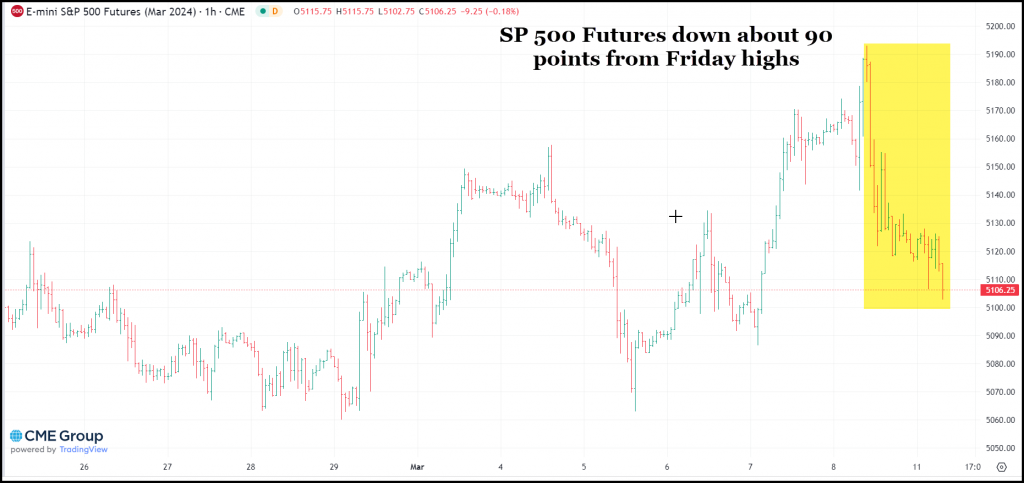

The Nasdaq and S&P 500 hit all time highs Friday morning, but reversed lower as Nvidia staged a bearish outside day. The Dow Jones retreated. The Russell 2000 hit a 23-month high amid solid breath as several non-tech sectors

shined. – IBD 3/9/24 Edition

Sector and investing ideas going forward:

At this stage of the rally we are nearing my 5220 SP 500 target. Markets reversed lower on Friday as Powell indicated no rush to cut rates. Downside correction risks are getting close though again we could squirt a bit higher.

In the 3x ETF service for example, we have closed out MULTIPLE trades for profits in the past 7-10 days or so on purpose. We only currently have one contrarian open position right now. We may be closer to some bear trades for protection but I have not pulled the trigger yet. I never short a wave 3 up… I buy dips. The3xetftrader.memberful.com for details.

I do like Micro-Caps and Small caps the best moving forward on a valuation and risk reward basis. I am spotting a ton of values to “buy right” in my Tippingpointstocks.com service. We have already had multiple 70-120% gainers in the last 18 months as it stands, but I still see values everywhere. New position will be coming out this week related to Crypto and its an extreme value in my opinion the market is overlooking. Sign up at tippingpointstocks.com. Last week we closed out a stock for 130% gains, another 1/2 position for 45% gains, and in the recent past closed out TGTX for over 100% gains for the 2nd time in 12 months, sold COYA For 100% plus gains and took a new position a few weeks ago that is already up 30%.

China may also be a good turnaround candidate, we are only long YINN right now in the 3x ETF service. China is universally hated and maybe a good time to take some shots. I also expect Japan to continue to be in a new bull market cycle. Gold broke out of a 13 month base pattern I had told everyone about in the 3x service two weeks ago, and took gold stocks up with it. Bitcoin could run into some triple top resistance around 68k for now, but remains a long term favorite of mine since I recommended it at 27,000 last year.

A short to intermediate top in April will not surprise we as we are seeing Greed levels at pretty big extremes but still room for a few of my indicators to indicate a top ahead yet.

Futures service has been doing great as well we got long last week and saw a 40 point move 1 day later. ESALERTS.COM for details

3x ETF Track Record: CLICK HERE

Stock Swing Trading Results: See full SRP Stock Swing Trade results 70% success rate since 2009 click below

Swing Trade ideas list is updated at the bottom of this report reflecting current market conditions and relative leaders based on my review of fundamentals and chart patterns both.

In addition to being a member of various services, you can follow my comments during the week:

- Twitter/X @stockreversals

- Stocktwits @stockreversals for daily commentary on various topics

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

- List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down.

- New names added, many names repeated if still in a bullish pattern.

- A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

3/10/24 Updated list and updated notes on older names as well

Click on Symbol to see Chart for each Stock listed

IOT Ripped last week on earnings off not only the swing list but also was an SRP position. We took profits at 39 plus late in the week from a 33.25 entry average or lower.

OPRA – Strong earnings recently pushed stock into a re-rate move up. Weekly chart could break out. One of the world’s leading browser providers and an influential player in the field of integrated AI-driven digital content discovery and recommendation platforms.

PR – 2 weeks tight closings near highs. Energy play. Focused on acquisition/optimization/development of oil and

liquids-rich natural gas assets in TX, Permian. Breaking out of 6 month base recently.

PRCT – 9 week base pattern, 2nd week on list. Recent SRP position we closed for gains, but still basing near highs. Manufactures medical and surgical equipment focused on the treatment of benign prostatic hyperplasia.

FROG – 4 week consolidation near highs, was on list recently and flew up, but now nice rest here. Provides binary repository management solution for software distribution to software developers.

DXCM – Could break out of near 3 year base. Recent new FDA OTC approval for product line could smash sales higher. Develops continuous glucose monitoring systems for ambulatory use by patients with diabetes

MU – Breaking out of near 3 year cup base pattern to highs. Microns new High Memory 3E chip will be part of new Nividia chip shipping 2nd quarter.

S – 10 week overall consolidation, 27 area key, Back on list, we profited at SRP on this one for a swing but still attractive. 6 week consolidation Provides AI-powered XDR platform to autonomously prevent, detect, and respond to cyberattacks.

CFLT – SRP position as of last week. Earnings are trending up and it has an AI component. Nice consolidation following surge after earnings.

DKNG – 5 week base near highs. Operates an online sports platform that enables users to play

fantasy games and win cash prizes.

BRZE – 14 week base near highs. Provides customer-centric interactions between consumers and

brands in customer engagement platform.

PBPB – Trading near highs. Owns, operates and franchises 429 shops in a total of U.S, Middle East,

U.K, Canada, and India.

ITCI – 9 week bull flag pullback near highs. Develops small molecule drugs to treat neuropsychiatric and

neurological disorders.

NET – Current SRP position. 4 week consolidation following strong earnings near highs. Develops software for firewall, routing, traffic optimization, load balancing, and other network services

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com from 2019 to early 2024, and now on our own platform Jan 2024! $395 a year or just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of over 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019 to 2024 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks doubled or or better after bear cycle ended in 2020. With Bear market 2021-2022 now offering many public companies trading below private market valuations Constantly rotating portfolio with deletions and additions as time goes on. Very volatile movements and not suitable for moderate or low risk investors.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits from 2018-2024, now on our own platform along with 3 x ETF service!

SP 500 Futures Trading Advisory service. Formerly hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (reversaltraders@gmail.com)

All services are subject to our terms of use agreement you review and agree to prior to registering.