03 Dec Weekly Stock Market Forecast and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, and Swing Trading Ideas List and Strategies Report

Week of December 3rd 2023

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services. All memberships and or casual readers are subject to our Terms of Service Agreement

Read up on all 4 Swing Trading and Long Term Research based Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Bill L. Member of multiple services

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…”

–Peter Brandt, CEO, Factor LLC #10 2017 Twitter Favorite Traders Poll and Top Ranked Commodity Trader

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

General Market Summary plus Swing Trade Ideas List:

Updated David Banister Market and Elliott Wave Views on SP 500 and more and weekly swing trade updated ideas list is at bottom of this report

Markets and more:

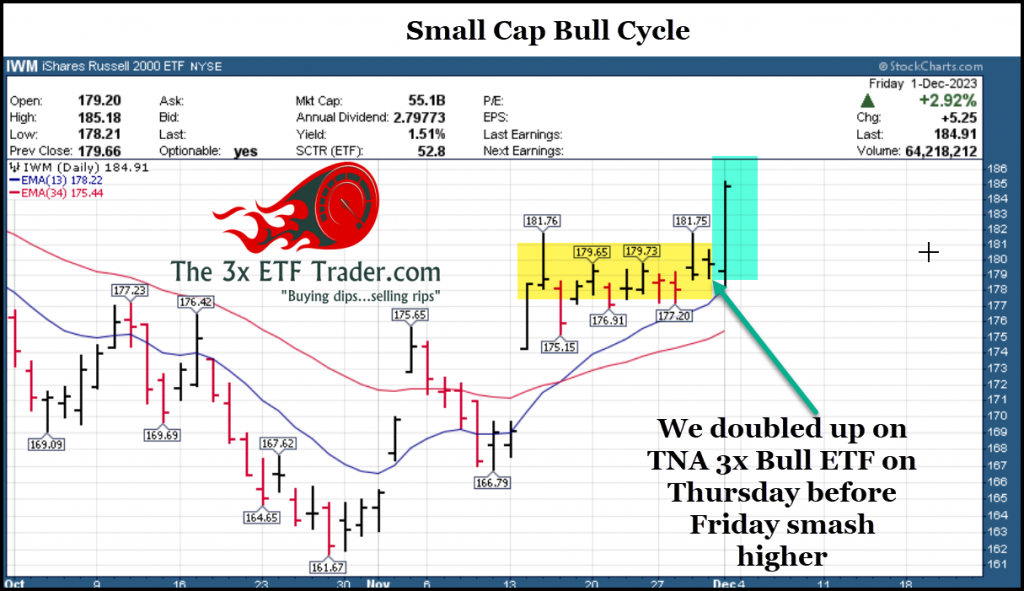

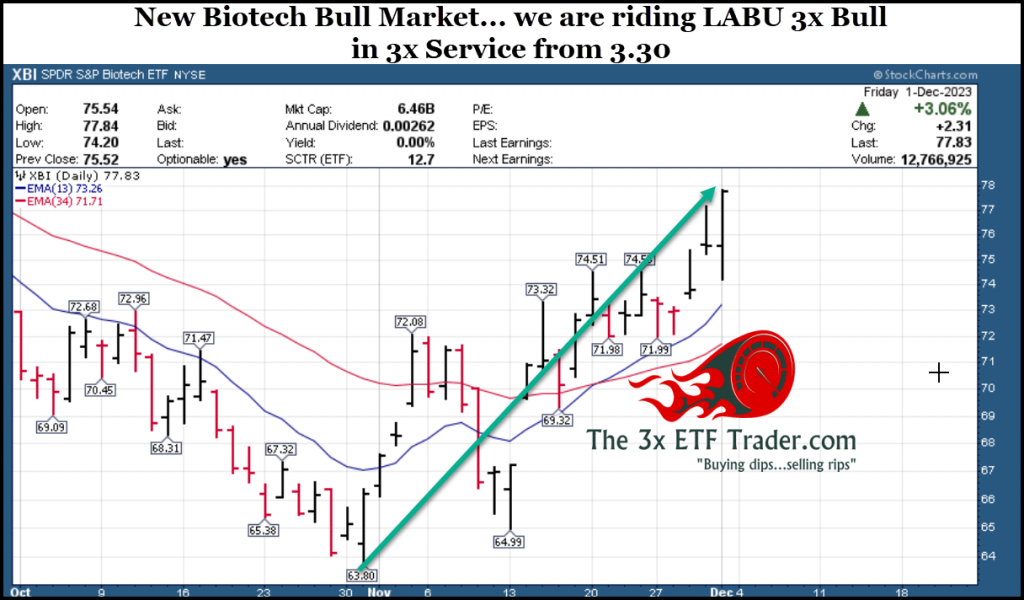

Markets continue to work higher off the October cycle lows. I continue to maintain my 4900 SP 500 target with potential to 5200 in 2024. Small Caps and Biotech are in new bull cycles after long lagging period and Tipping Point Stocks is benefiting along with 3x ETF and SRP stock swing services. NASDAQ 100 in a consolidation but should move higher as well. I went bullish Bitcoin in April of this year at 29,000 area and I have projection of 43,700 near term.

Trading: Stocks, 3x ETF’s, and SP 500 futures services

3x Service smashing it with Gold, Biotech, Small Caps, and now Bitcoin ETF’s

In the 3x ETF service we have parlayed this rally into nice gains on LABU (up 37% from first alert), TNA (Ripped over 8% Friday the day after we doubled up), and we had a big gain on NUGT ahead of the Gold rally I projected which we took, and also now are getting long Bitcoin via BITX (2x Bull Bitcoin). Lots of ways to skin the cat in the market as a swing trader for sure.

The SRP stock swing trading service continues to hit the ball out of the park with an amazing 83% gain in 3 days on IMGN position we alerted last Friday, big gains in PDD of 25%, and TGTX and more!

Tipping Point Stocks is have a major resurgence in the past 10-12 months with 50-100% gainers across multiple positions and most recently adding TGTX at 10.50 and HIMS at 6.90 to long term positions along with COYA which is on fire, MEEC and a few others. With a new Bull Cycle in Small Caps and Biotech, this is a window in which we can profit.

The 3x ETF service (Just $40 a month and 70% plus success rate since 2019 inception!)

IWM ETF/XBI ETF new bull cycles (Small caps and Biotech) after long time lagging

Trading Results: See full SRP Stock Swing Trade results click below

Swing Trade ideas list is updated at the bottom of this report reflecting current market conditions and relative leaders based on my review of fundamentals and chart patterns both.

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary on various topics

- Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for membersRead up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

- List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down.

- New names added, many names repeated if still in a bullish pattern.

- A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

12/3/23 Updated list and updated notes on older names as well- – “Needs to hold” pricing given due to difficult stock market of late

Recent swing list ideas: IMGN a new SRP position hit for 83% gains last week as we alerted it Monday last week off this list!! Off the list now with buyout announced. IOT Ripped higher off the list last week also on strong earnings, and we hit PINS at SRP off this list for nice gains as well!

Click on Symbol to see Chart for each Stock listed

GTLB – 5 month base pattern not far off highs. Earnings due Monday 12/4. Provides DevOps platform that allows users to build software with a reduced development lifecycle.

ARM – 2 weeks tight closings near post IPO Highs (Former spinout from Intel). UK-based Co that designs and licenses high-performance, and energy- efficient semiconductor technology.

DKNG – Often on the list and has continued to work. 3 weeks tight consolidation here post earnings and could have another breakout. Operates an online sports platform that enables users to play fantasy games and win cash prizes.

CCL – Forming a bullish right side base pattern as it climbs. Operates cruise vacations with 90 ships under 9 brands servicing North America, Asia, Australia/Europe

DASH – Back on list, 5 week overall ascending base at highs, recent 3 weeks tight closings. Could have another leg up. Provides restaurant food delivery services via online & mobile application across U.S, Canada, and Australia.

MMYT – 3 weeks tight closings near highs within a 7 week overall base, could break out this week. India-based provider of online travel services primarily for individual travelers via www.makemytrip.com.

LMND – Could squirt higher out of this nice consolidation. Strong results early November. Offers homeowners and renters insurance in the United States and contents and liability insurance in Europe

TOL – 3 weeks tight closings near highs. PE 6. Builds single-family detached/attached homes in luxury communities

for move-up/empty nester/active-adult. (Toll Brothers)

RPD – Emerging out of 10 month flat base and hitting highs. Provides security data and analytics solutions enabling organizations to develop cyber security

DUOL – 4 weeks consolidation near highs. Designs and develops digital a language-learning education platform,

suggests lessons in multiple languages. Already reported very strong earnings.

ALKT – New SRP position on 12/1, Has been on list a few week. SRP got long Friday after long consolidation. Offers a cloud-based platform that delivers digital banking solutions to U.S. banks and credit unions

SKWD – 10 week overall base and recent 3 weeks tight closings pattern. Offers commercial property and casualty products and solutions predominantly in the U.S.. 2nd week in row on list.

AMPH – New SRP Position this past week. 3 weeks tight closings near recent highs, but has room to move yet. 3rd week on list. Strong earnings report Still room to run on weekly view. Products include the Primatene Mist asthma inhaler and just reported 203% surge in earnings from the year ago period. Sales jumped 50%.

NVO – Looks poised to continue a break out of recent 7 week base to further highs. Denmark-based developer of insulin analogues, human insulin, and oral antidiabetic drugs for diabetes care.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of over 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019 to 2023 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks doubled or or better after bear cycle ended in 2020. With Bear market 2021-2022 now offering many public companies trading below private market valuations Constantly rotating portfolio with deletions and additions as time goes on. Very volatile movements and not suitable for moderate or low risk investors.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (reversaltraders@gmail.com)

All services are subject to our terms of use agreement you review and agree to prior to registering.