08 Oct Weekly Stock Market Forecast and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, and Swing Trading Ideas List and Strategies Report

Week of October 9th 2023

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services. All memberships and or casual readers are subject to our Terms of Service Agreement

Read up on all 4 Swing Trading and Long Term Research based Subscription Options at TheMarketAnalysts.Com or bottom of this Report

Bill L. Member of multiple services

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…”

–Peter Brandt, CEO, Factor LLC #10 2017 Twitter Favorite Traders Poll and Top Ranked Commodity Trader

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary plus Swing Trade Ideas List:

Updated Banister Market and Elliott Wave Views on SP 500 and more and weekly swing trade updated ideas list is at bottom of this report

Markets and more: ABC retracements may have completed last week in QQQ and SP 500

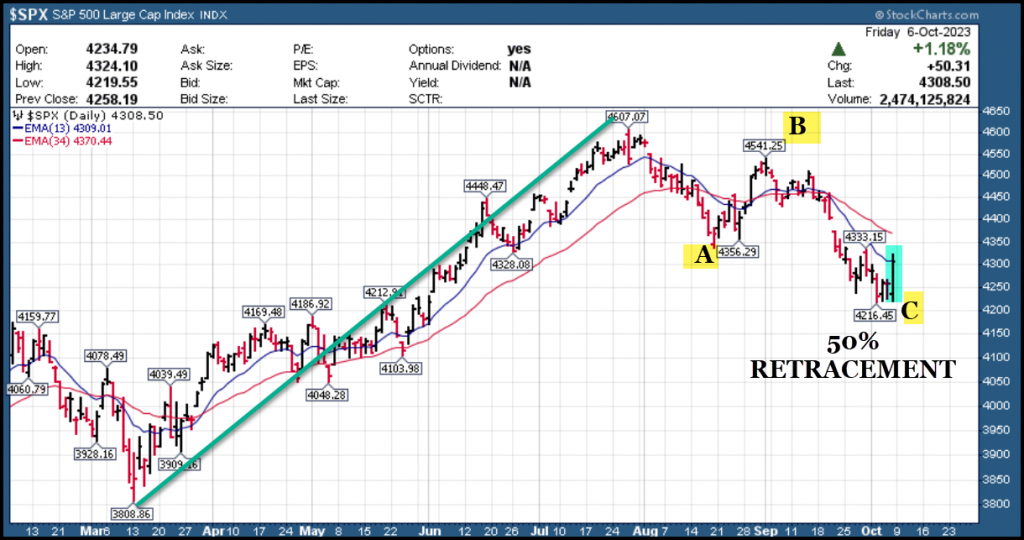

ABC pattern seemingly winding down if not already completed from the July highs. Members of my services have been updated on a daily basis in pre market reports the past few weeks. As we continued to pullback this past week I was seeing several major fear readings using various indicators that I look at. When we have an ABC deep pullback and that is combined with oversold readings and fear gauges getting stretched it helps to pinpoint interim bottoms.

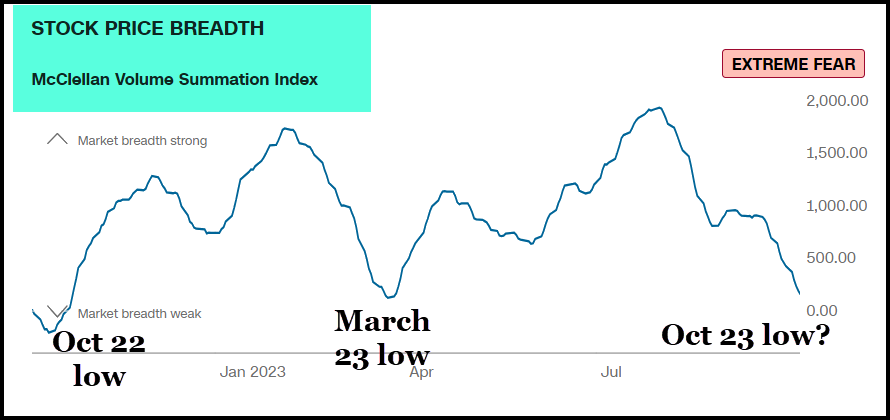

Taking at look at the Nasdaq McClellan Oscillator which I published pre market on Friday when the futures were taking helps to see where we are compared to recent market pivot lows in October 2022 and March 2023. Noting we got a reversal rally on Friday and we will see if this trend can continue. Markets frequently bottom in October from a seasonal pattern perspective.

SP 500 ABC retracement 50%

QQQ ETF (NASDAQ 100) ABC 38% Retracement

Trading Results:

Over the past several weeks during the downtrend I went very slow with new positions on purpose. In a confirmed downtrend you can still make profits on swing trading but the number of opportunities are diminished and the risks are higher. We actually had several winning trades in the past few weeks as well as several positions holding up during the last few weeks of downturn where we did not get stopped out. Stocks like ACMR, NTNX, EDU and RELY among our group of swing holdings all held up and on Friday pushed higher as well. If we get a confirmation of an uptrend, we will be more aggressive. In the 3x ETF service we held onto TQQQ, SOXL a recent pick which is up nicely and we doubled up on Friday, and a small position in TNA which we are down on as of now. Futures service got stopped out a few times on tight stops during the downtrend and advisory on Friday was that risks were to the upside, not the downside ahead.

Consider joining my 3x ETF Swing Trading room on Stocktwits, gives you very nice exposure to sector swings based on human behavioral patterns. Removes single stock risk and gives you a better upside beta and lower risk with your overall trading plans (SRP, 3x ETF, Futures etc)

Consistent trading income in ALL market cycles using Bull or Bear 3x ETF’s and my human behavioral pattern analysis. Strong 70% plus success rate historically and better in 2023.

Just $40 a month and worth it to add to your stock swing trading

Read up at the3xetftrader.com and join on stocktwits at $40 a month.

Futures service is also on Stocktwits and just $50 a month, huge profits last several weeks.

Members of all the premium services are updated daily on market maps and forecasts and we strategize accordingly.

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary on various topics

List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised. This list tends to reflect the stronger sectors of the market at various times and cycles.

SWING TRADING 101– Click to review my 10 plus keys to profitable and consistent swing trading I’ve used since 2009

10/8/23 SWING LIST UPDATED: SWING TRADE IDEAS WITH A COMBINATION OF STRONG FUNDAMENTALS AND ATTRACTIVE BEHAVIORAL PATTERN CHARTS COMBINED

NEW FEATURE: CLICK ON SYMBOL TO SEE CHART IMAGE QUICKLY

ACMR – SRP Position as of 9/26, SRP Members already took some big gains on 1/2 of position. 3rd week on the list, moving up now. #1 on IBD 50 this week again. PE 13 Manufactures and sells single-wafer wet cleaning equipment and products for the semiconductor industries

RELY – 7 week flat base near highs. SRP position pushing higher last week. Looks ready to break to the upside. Provides digital financial services for immigrants through Cross-border remittance and banking services

GLBE – 10 week flat base, could push higher. Israel-based Co provides platform that enables global,

direct-to-consumer cross-border e-commerce solutions.

DUOL – 3 month base could break out shortly. Designs and develops digital a language-learning education platform,

suggests lessons in multiple languages

MMYT – 6 week base near highs. India-based provider of online travel services primarily for individual

travelers via www.makemytrip.com

CWAN – 4th week on list, 5 week ascending base at highs on Friday. Provides SaaS solutions for investment data aggregation, accounting, analytics, and reporting services.

FRO – 4 week consolidation base near highs, pullback could provide nice entry. Provides tanker transportation services of oil and oil products through a fleet of 70 vessels

MOD – 4th week on list, 6 week base near highs. Would like to see 44.35 hold. Ranked #1 in sector by IBD. Manufactures thermal management systems for automotive OEMs and the building, industrial and refrigeration

YY – 5 week ascending base, pushed higher on Friday. PE 12. Chinese provide online voice and video communications services, social networking services and online games. 2nd week on list.

TIGR – 6 weeks tight base pattern for this Chinese online brokerage.

EDU – 10 week base near highs. SRP Position as of two weeks ago, already took 1/2 profits. Chinese provider of language training & test prep courses to 3.7 mil students via 107 schools/637 centers

DLO – SRP Position. 5 week pullback corrective base pattern. Uruguay based Co provides cloud-based payment platform to global enterprise merchants in 40 countries. Held up well in the correction.

FUTU – 5 week consolidation. Needs to hold 56.60 area, 3rd week on list. China based company operates as a holding company that offers an online brokerage platform

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Stock Swing Trading, and Growth Stocks with 50-200% upside plus.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and have established a strong track record of over 70% profitable trades since inception November 2019!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 11 years of advisory services! Track Record of 2019 to 2023 YTD Trades

Tippingpointstocks.com– Growth Stocks aiming for 1x-5x upside with our proprietary research! Fresh ideas every month and ongoing advice! 9 stocks doubled or or better after bear cycle ended in 2020. With Bear market 2021-2022 now offering many public companies trading below private market valuations Constantly rotating portfolio with deletions and additions as time goes on. Very volatile movements and not suitable for moderate or low risk investors.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (reversaltraders@gmail.com)

All services are subject to our terms of use agreement you review and agree to prior to registering.