21 Feb Weekly State of the Markets, Crypto and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, Crypto and Trading Strategies Report Week of Feb 21st 2022

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…” Bill L. 1/3/22

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt S.- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts:

- C wave still underway which is made up of abc-C 4215 is now the target zone area ahead

- Risk to 3800 on the LOW END if we break 4200 hard

- Energy stocks could continue to lead after recent consolidation

- Futures service went short at 4440, now 4290 as of 2/21 4pm EST huge gains (Leveraged)

- Biotech, Small Caps, etc all looking to test recent lows

- Bitcoin pulling back as projected last week, could test lows at 35-36k again

- SRP going slow as usual, we keep high cash allocation during corrective waves (Stock Trading Service)

Recent results:

- 3x ETF flat coming into this week as we watch market Elliott patterns unfold and potential reversal

- SRP going slow as usual, we keep high cash allocation during corrective waves (Stock Trading Service)

- Futures correctly called the downturn below 4440 and we are riding it down for now

- TPS holding off on new research positions until market bottom confirmed or close

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Market Notes and Commentary:

Last weeks notes repeated here:

“There is almost always a C wave after an A down, B up… so this is normal action even though it’s not fun for the Bulls. Keep an eye on the 4350’s area as next support and then 4215 and then if we break that well it can get ugly. Loosely I still think we double bottom above the A wave lows at some point, and then may start a Bull cycle up, but one day at a time.”

So far this is playing out and with futures below 4300 on Monday we should see a test of the A wave lows ahead, maybe worse. Good time to be patient with stock trading in terms of going long on new positions for sure. 3x ETF and Futures can trade bearish positions but again we could be getting close to an ABC Bottom. 4220 area is key for SP 500 ahead. SRP Members and 3x ETF, Futures etc members are updated every morning on market conditions and my maps for the markets.

Read up at the3xetftrader.com and join on stocktwits at $40 a month.

Futures service is also on Stocktwits and just $50 a month, huge profits last several weeks

Not much to add as this move I have mapped out as likely so again key is watching prior A wave lows to hold.

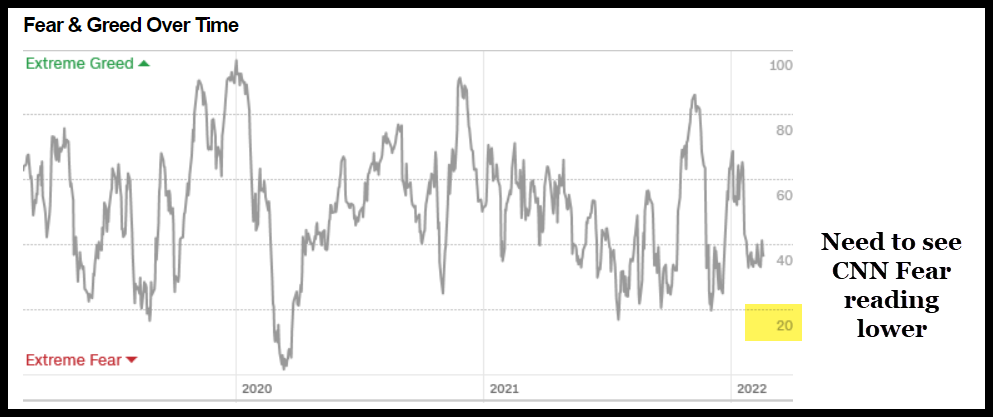

The number of stocks hitting 52-week lows exceeds the number hitting highs and is at the lower end of its range, indicating extreme fear. That said, we need the fear reading to drop to 10-15 from current range of 36 (CNN Fear Gauge)

SP 500:

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. Getting involved in Decentralized Finance Web 3.0 boom now with Stable Coin Play and an ETF Issuer stock play in Europe and will add more soon as Bear cycle winds down in Bitcoin.

Recently three new research reports have been put out. One is a Crypto Equity play that is growing incredibly fast and underfollowed and was up 100% 4 weeks after the report recently. Another is an E Commerce play on a company that is rapidly changing a 100 year old business sector, and very recently in December a Crypto Token/Protocol for Stablecoins which are exploding.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 2/21/22-

MNRL- 3 month flat base, not far off highs. Engaged in the acquisition of mineral and royalty interests in oil and

gas properties in the United States

ZIM- 4 week base, this one has been on the swing trade list often. Hitting 52 week highs again last week then pulled back. Israel-based asset-light container liner shipping co provides cargo solutions for all industries. Needs to hold 65

SKY- 3 weeks tight near highs. Manufactures single- and multi-section homes, modular homes

and park models.

AOSL- 8 week corrective pattern, needs to hold 50.50 area. Bermuda-Based Co designs power discretes and power ICs for

conversion/regulation of electricity

FANG- 6 week base near highs, SRP made profits on this recently but still looks good. Engaged in oil and gas exploration and production of unconventional, onshore oil and gas in Permian.

CMC- 7 week overall corrective base. Manufactures steel/metal products/related materials/services for

construction/manufacturing

RIO- 6 week base moving towards old highs…U.K. based company with global interests in mining metals and

industrial minerals

SBSW- 6 week ascending base towards highs. South African Co engaged in the mining of platinum group metals

and gold in South Africa and United States

NOG- 6 week base close to breakout. Engaged in the exploration and production of oil and natural gas

within the Williston Basin

RHI- 3 weeks tight near highs. Provides temporary and permanent staffi ng services for the

accounting, finance, administrative

STX- 15 week flat base near highs, needs to hold 106. Ireland-based holding Co manufactures hard disk drives for the

enterprise, desktop, mobile computing.

CARG- 2 weeks tight pattern, could move to upside soon. Provides online automotive marketplace connecting buyers and

sellers of new and used cars

HESM- 6 week base near highs. Provides natural gas gathering and processing, and residue gas and

transportation services to Hess.

PLAB- Needs to hold 17 area. Manufactures photomasks used in the fabrication of semiconductors,

microelectronics/flat panel displays

BKR- 3 week ascending base at highs. Provides wellbore products and technology services and systems to the

global oil and natural gas industry

MTDR- 7 week base near highs. Engaged in oil and gas exploration and production in areas of Texas/

Louisiana

NTR- 9 week base breaking to highs. Manufactures fertilizers and related industrial and feed products in

the U.S., Canada/Trinidad.

MU- If it can hold 87 could try another run up. Makes DRAM, NAND and NOR Flash memory, and image sensors

used in computers, servers and consumer electronics

OVV- 6 week base near highs. Engaged in exploration and production of natural gas and oil in British

Columbia, Alberta, and in the U.S.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)