20 Mar Weekly State of the Markets, Crypto and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, Crypto and Trading Strategies Report Week of March 20th 2022

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…” Bill L. 1/3/22

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt S.- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts:

- 4102 Futures bottom was my bottom call a few weeks ago, obviously now confirmed with move over 4370 (SP 500)

- Bitcoin still needs to get past 45,000, expect we may see this in April based on behavioral patterns

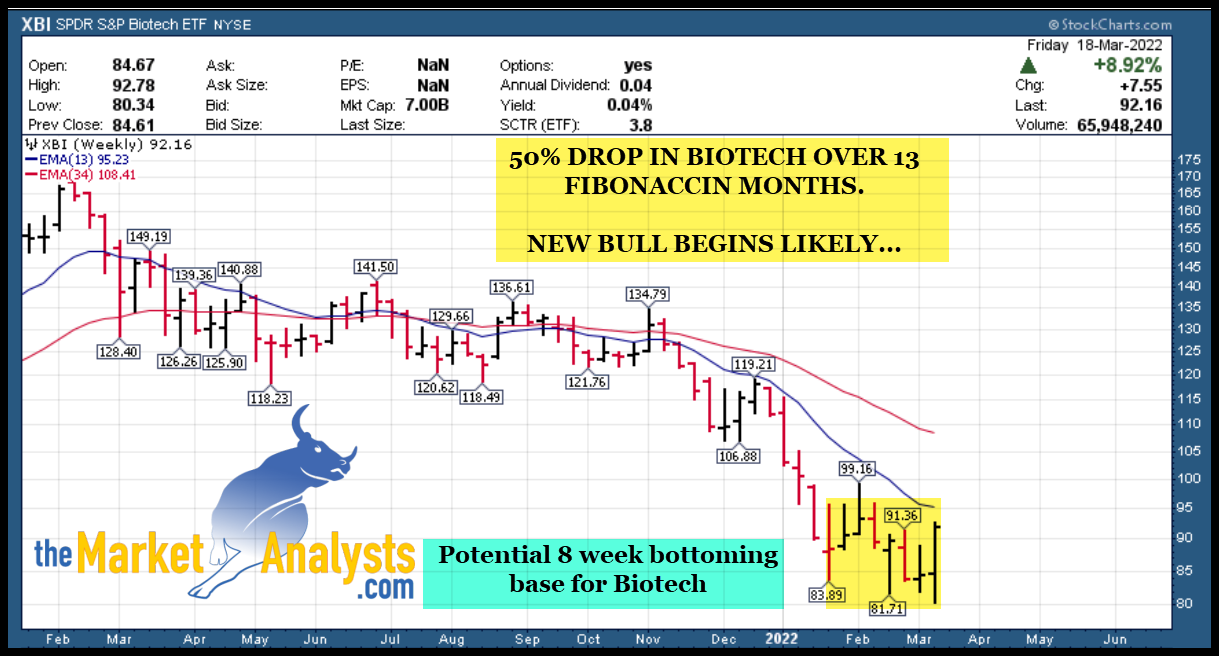

- Biotech ripped at end of last week, may finally start new Bull cycle

- 3x ETF service hit for 19% gains going long Semiconductors via SOXL last week, we are long TNA still (Small caps)

- Looking for markets to get strong footing sustainable after April 18th tax filing deadline

Recent results:

- 3x ETF hit SOXL Bull 3x ETF for 19% gains last week, TNA we are also up and still long (Small Caps)

- SRP hit ZIM for 19% gains in a short window of time, adding new positions last week as well

- Futures service advisories have been spot on, we hit for 75 point win a week ago

- TPS continues to pound table on CARG, GBOX, LUNA to name a few long term plays

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Market Notes and Commentary:

4380 resistance finally taken out last week

The uptrend is confirmed but for a few weeks I was noting that 4102 futures low the day of Russia bombing/invading Ukraine marked a likely price low for the Bear cycle. This cycle was a good 12-13 months really if we go way back to Feb 2021 where many sectors topped out, and then late in 2021 into 2022 we finally saw all the big name tech stocks cave in hard.

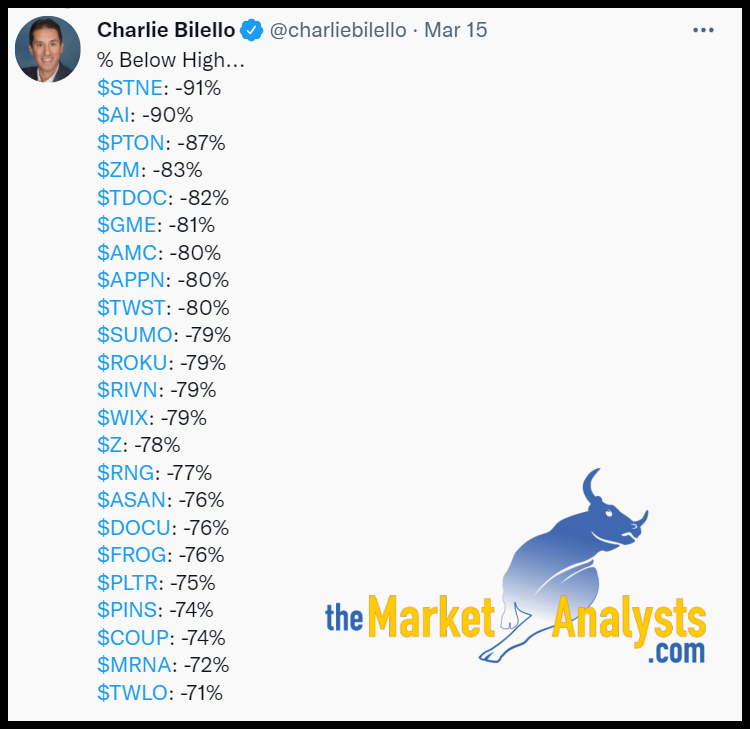

This tweet I re-tweeted below is pretty eye opening, the number of big name companies who fell 60-80% from highs was huge, this is just a small list. (Means everyone wiped out, many down 60% plus in 12 months, and the Fear Gauge got down to 11 where I was looking to confirm that price bottom)

So if you were sitting around lamenting losses or blaming others, you were not alone my friends.

Biotech index dropped 53% over Fibonacci 13 months. Now is a great buy I think (See Chart)

Silver may consolidate another month and then I see a big new bull cycle up again (See Chart)

The recent Astro Cycle was bearish for many things, but the mood was not going to be supportive of a bull cycle in stocks. This has recently completed and will bring a fresh spring bullish mood if I’m right in the weeks ahead. We still obviously have the potential of NATO escalation in Ukraine which would call off all bets, but that is not predictable.

Swing Ideas: Steel, any type of transportation or shipping related plays, Energy, Materials etc still look good for inflation reasons and pricing power. The swing trade ideas list is updated at bottom of report. Last week produced multiple winners again.

Consider joining my 3x ETF swing room on Stocktwits, gives you really nice exposure to sector swings based on behavioral patterns. Removes single stock risk and gives you better beta and lower risk with your overall trading plans (SRP, 3x ETF, Futures etc)… 19% gain this past week in SOXL was nice.

Read up at the3xetftrader.com and join on stocktwits at $40 a month.

Futures service is also on Stocktwits and just $50 a month, huge profits last several weeks

Members of all the premium services are updated daily on market maps and forecasts and we strategize accordingly.

Charts: SP 500, XBI ETF, Silver (SLV)

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. Getting involved in Decentralized Finance Web 3.0 boom now with Stable Coin Play and an ETF Issuer stock play in Europe and will add more soon as Bear cycle winds down in Bitcoin.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 3/20/22-

Last week many names popped with the market from the weekly swing trade ideas list posted Monday for SRP members. This is updated with a few new names and names still looking risk-reward attractive. Steel, any type of transportation or shipping related plays, Energy, Materials etc still look good for inflation reasons and pricing power.

AMPH- 2 weeks tight closing at highs. Develops, manufactures generic and proprietary injectable,

inhalation, and intranasal products

CMC- 3 week ascending base near highs. Manufactures steel/metal products/related materials/services for

construction/manufacturing.

MP- 4 month 0verall base, not far of highs. Could break out. Owns and operates rare earth mining and processing site of scale in the Western Hemisphere.

BX- ABC Correction, now 122 could run back to 144 highs. Provides global alternative asset management and fi nancial

advisory services globally.

WFG- Back on the list again, 12 week overall base and after a shakeout could break out soon. Canadian Co manufactures and distributes wood products for home construction with more than 60 facilities.

AGSG- 3 weeks tight ascending base at highs. Provides airline operations, aircraft leases, aircraft maintenance/

other support services

PCRX- 3 weeks tight near highs. Could break out of range. Develops specialty pharmaceuticals using proprietary drug delivery technology for use in hospitals

CMRE- Close to multimonth cup breakout pattern. Greek provider of intl marine transportation with a fleet of 77 containerships aggregating 555,810 TEUs

SBLK- 5 week base near highs. Provides intl tanker transportation services for dry bulk cargo with a

fleet of 128 dry bulk carriers

NUE- 3 weeks tight closings near highs. Manufactures steel and steel products for the automotive, construction,

machinery and appliance industries.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)