30 May Weekly State of the Markets and Swing Trade Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, Crypto and Trading Strategies Report

Week of May 31st 2022

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…” Bill L. 1/3/22

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt S.- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts:

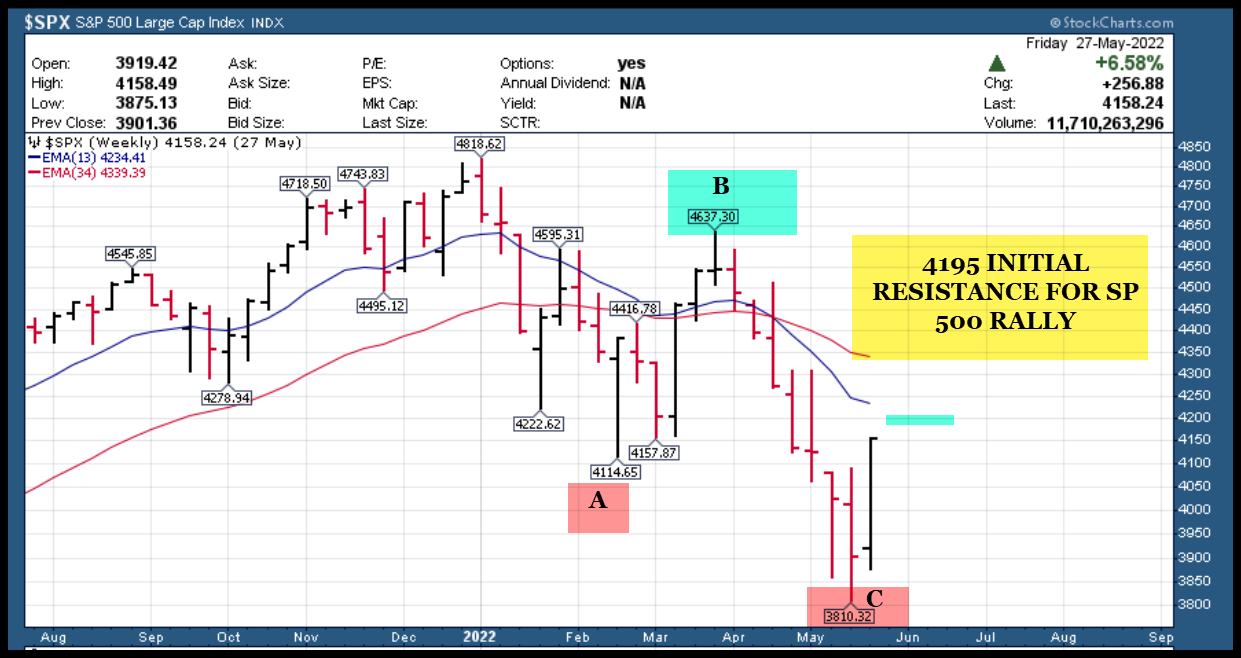

- Markets continue rally off the 38% 3810 SP 500 Fib ABC bottom correcting prior Bull Market from Covid lows

- 3x ETF service hits big on FAS Bull (Financials) and long Biotech 3x Bull LABU still, most oversold sector

- Energy stocks continue their run, most of our swing trade ideas list ripped higher last week

- NASDAQ 100 bottomed on my projected 200 WEEK EMA line and now in a rally just like 2016, 2018, 2020 bottoms in terms of the charts

- Double bottoms held up on SOX index as well per last Sundays report, SOXL Rips this past week (3x Bull ETF)

- QQQ ETF is at initial 311 resistance, a 23% fib bounce of the entire bear cycle move down top to bottom

Recent results: All 3 swing trade services with nice trade gains this past week

- 3x ETF booked nice 8-11% gains in FAS 3x BULL Financials and long LABU still with profits in hand

- Futures service hit for 55-60 point gain during the week

- SRP closed out VTNR for final gains then re-entered, also long AG and a few others including AMD at 94-95

- TPS service likely going to have a strong 12 months from here, reminds me of 2018, 2020 market lows

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Market Notes and Commentary: ABC B rally likely underway in SP 500, NASDAQ etc

Last weeks double bottoms in Chip Stocks, Biotech etc all held and a rally ensued from there. We were positioned for it in all the swing trade services. I opened up the Auto-Trade platform again a week ago for Futures SP 500 Trading where we handle the entry and exits for you with my partner firm. Read up at esalerts.com

NASDAQ 100 is at short term resistance around 311 on the QQQ chart, so watch that as key to take out for BULLS.

SP 500 resistance comes in around 4195, currently in the 4150’s.

Rally could work higher into July time frames I think.

See charts: QQQ ETF, SP 500

Trading Ideas: Swing Trade List… key to watch and use

The Swing Trade ideas list is updated at the bottom of this report and reflects strength in certain sectors based on market conditions we are in now. My method for finding stock swing trades is a combination of top down market projections, sector strength, and behavioral chart patterns that line up with strong fundamentals. This has worked for 13 years now since in the inception of my swing trade services with 70% success rates in all market cycles. Join at srpmembers.com

Consider joining my 3x ETF swing room on Stocktwits, gives you really nice exposure to sector swings based on behavioral patterns. Removes single stock risk and gives you better beta and lower risk with your overall trading plans (SRP, 3x ETF, Futures etc)… 8-11% gains in a few days this past week on FAS currently profits holding in LABU

Read up at the3xetftrader.com and join on stocktwits at $40 a month.

Futures service is also on Stocktwits and just $50 a month, huge profits last several weeks and you can now sign up for Auto-Trade platform again!!

Members of all the premium services are updated daily on market maps and forecasts and we strategize accordingly.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020 after Covid Bottom. Bear cycle likely bottoming here May 2022 like 2016, 2018, 2020 bottoms (Every 2 years)

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 5/30/22- Multiple energy stocks ripped higher last week off of my swing trade list including CRK, ESTE, CIVI and more. This weeks list is now updated again with some shippers now showing up.

ZIM- Back on the list again, PE is 1 and dividend is huge due to high shipping margins.

Israel-based asset-light container liner shipping co provides cargo solutions for all industries. Building right side of base may re-attack all time highs.

PFHC- On list last Sunday, a Recent IPO, only 11 days of trading of trading, in the infrastructure side of Oil and Gas drilling etc. Pressure pumping Co, provides hydraulic fracturing services with equipment, manufacturing and distribution. Could push to highs soon, volatile trader so far.

MUSA- 6 week flat base near highs looks poised to break out. Markets retail motor fuel products and convenience merchandise through retail stations in 27 states.

HPK- 7 week base testing 10 week EMA last week and not far off highs. Engaged in the acquisition, development and production of oil, natural gas and NGL reserves.

NFE- 2nd week in a row on the list. Now a 9 week base near highs. Operates as an integrated gas-to-power company that develops, and constructs energy infrastructure assets.

EGLE- 9 week base near highs. Provides international tanker transportation charter services for

dry bulk goods through fleet of 45 vessels.

GPK- Close to breaking out of multi week base near highs. Makes paperboard packaging products for companies in the food, beverage/household products industries. PE 17 last quarter EPS up 87%

ATGE- Recent 4 week base looks like it MAY break to 38 area from 32 area to test highs. Provides post-secondary education to students via 22 locations in 11 states and internationally. PE 12 last quarter EPS up 45%

VPN- Just now breaking to highs after many weeks of base building .Limited Partnership acquires and develops oil and natural gas properties in Permian Basin in West Texas

GRIN- 3 month flat base near highs. Singapore-based company operates a fl eet of drybulk carriers and

tankers. PE 3 last quarter up 1200% in earnings

SBLK- near 3 month base near highs now may break out. Provides intl tanker transportation services for dry bulk cargo with a fleet of 128 dry bulk carriers. PE 4

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of780% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019-2022 trades online

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on positions and ongoing advice. Bear cycle bottoms in 2018, 2020, and likely 2022 so good time to get involved now in 2022 as we likely trough out in the market.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com and AUTO- TRADE option with my partner firm where we enter the trades for you!!

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com and also Auto-Trade option outside of Stocktwits… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)