22 May Weekly State of the Markets, Crypto and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, CRYPTO AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market Forecasts, Charts, Crypto and Trading Strategies Report

Week of May 22nd 2022

“By the way I want to thank you once again for the amazing service you are offering…Have been a member of SRP for more than 4 years and I really have no words…only huge respect and gratitude…my account keeps growing steadily and consistently…it’s really a blessing for me and my family…The 3xETF service is a huge additional value to my portfolio and I plan to join more of your services very soon…” Bill L. 1/3/22

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt S.- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts:

- Strong volatility during OPEX week last week

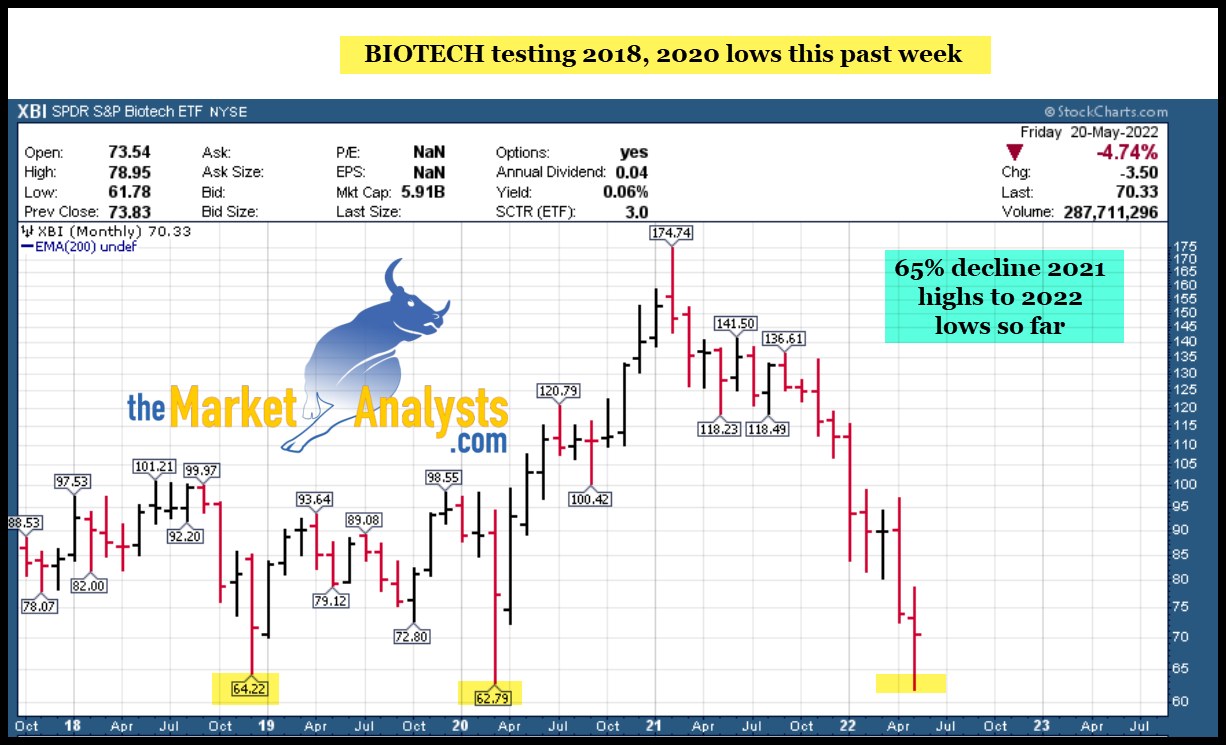

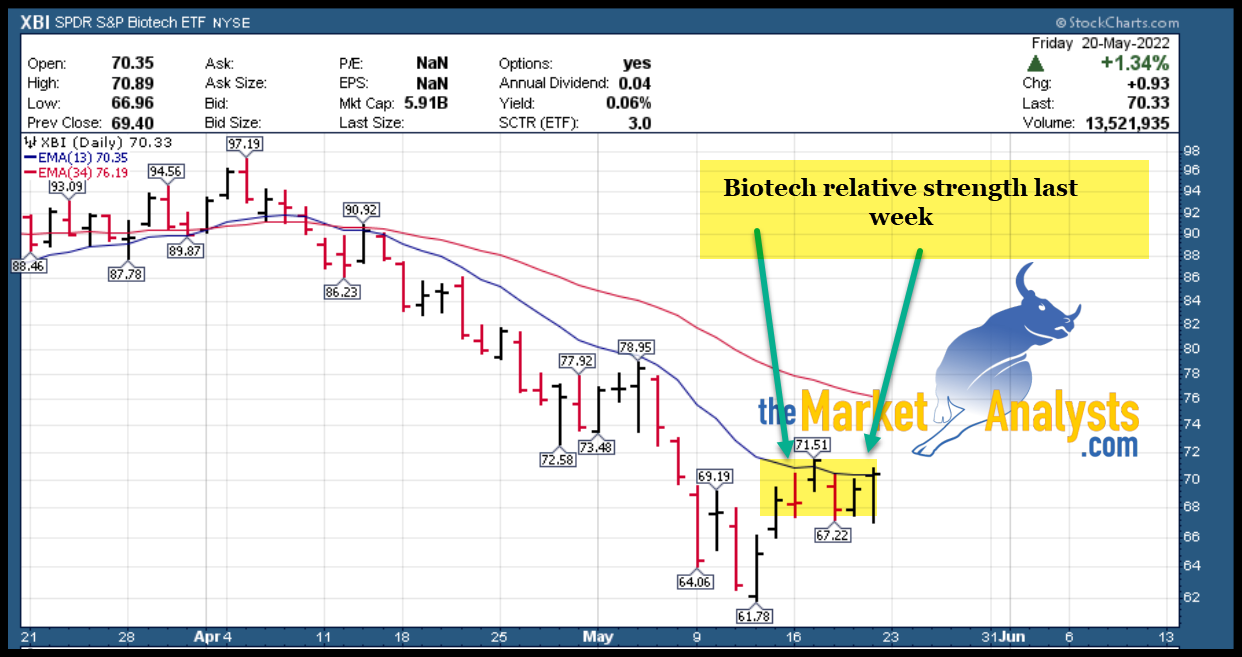

- Biotech holding up on a relative basis better than other sectors after a 65% decline from 2021 highs

- 3815 area key for SP 500 to hold

- Energy Stocks continue to lead on a relative basis

- Multiple charts lay out where we stand, double bottoms KEY TO HOLD this coming week

Recent results: All 3 swing trade services with nice trade gains this past week

- 3x ETF service booked gains early in week on SPXL and SOXL before the reversals lower, long LABU now

- Futures service hit for 40 point profit late in the week and re-opened our Auto Trade Service

- SRP closed out VNTR for nice gains of 8-10%, TWI Sold 1/2 for 8-10%, Stopped out VUZI Friday

- TPS service likely going to have a strong 12 months from here, reminds me of 2018, 2020 market lows

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Market Notes and Commentary: ABC Lows in and now ABC B?

Markets ripped early in the week to upside and gave it back into OPEX on Friday. Charts are updated, a lot of double bottoms are key to hold near term.

See charts:

BIOTECH holding up relatively well- Long LABU late in week in 3x ETF room

Semiconductor stocks possible double bottom on Friday

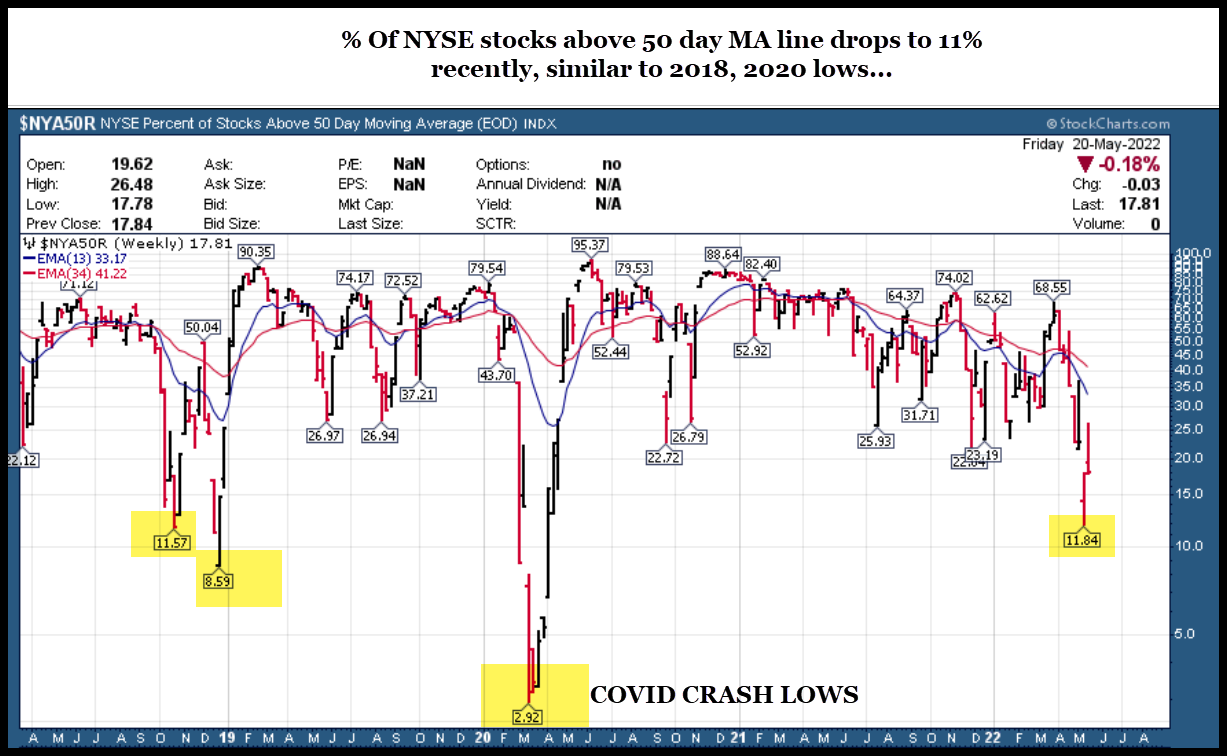

NYSE Oversold in terms of stocks below 50 day MA

BIOTECH long term test of lows this past week

NASDAQ 100 got close to the 200 week EMA On Friday then bounced up some

The Swing Trade ideas list is updated at the bottom of this report and reflects strength in certain sectors based on market conditions we are in now. My method for finding stock swing trades is a combination of top down market projections, sector strength, and behavioral chart patterns that line up with strong fundamentals. This has worked for 13 years now since in the inception of my swing trade services with 70% success rates in all market cycles. Join at srpmembers.com

Consider joining my 3x ETF swing room on Stocktwits, gives you really nice exposure to sector swings based on behavioral patterns. Removes single stock risk and gives you better beta and lower risk with your overall trading plans (SRP, 3x ETF, Futures etc)… 19% gain this past week in SOXL was nice.

Read up at the3xetftrader.com and join on stocktwits at $40 a month.

Futures service is also on Stocktwits and just $50 a month, huge profits last several weeks

Members of all the premium services are updated daily on market maps and forecasts and we strategize accordingly.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020 after Covid Bottom. Bear cycle likely bottoming here May 2022 like 2016, 2018, 2020 bottoms (Every 2 years)

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 5/22/22- Still mostly energy related stocks making the lists each weekend. That said, alot of micro caps are rallying of late and Biotech may have some sharp moves. This list though is based on IBD screens I run with fundamentals and chart patterns both taken into account.

ESTE- Long multi week flat base near highs. Engaged in oil and natural gas exploration and production in North

Dakota. PE 8

PFHC- Recent IPO, only 6 days of trading of trading, in the infrastructure side of Oil and Gas drilling etc. Pressure pumping Co, provides hydraulic fracturing services with equipment, manufacturing and distribution.

NFE- 8 week base near highs. Operates as an integrated gas-to-power company that develops,

and constructs energy infrastructure assets.

CRK- 6 week corrective base. Engaged in the exploration and production of oil and natural gas

reserves primarily in Texas and Louisiana.

CIVI- 9 week base near highs. Engaged in oil and natural gas acquisition, exploration, development, and production in the U.S.

DOW- 5 week base near highs. PE 7 Provides materials solutions to consumer care, infrastructure,

packaging markets worldwide.

DVN- 3 weeks tight near highs. Engaged in the exploration and production of oil, gas and NGLs in

the United States and Canada.

OXY- 12 week base near highs. Buffet just added to his position. Engaged in the exploration and production of crude oil and natural gas worldwide. Typically very high margins.

MRO- 9 week base near highs. Engaged in oil and gas exploration and production, oil sands mining

and integrated gas services worldwide

SD- 5 week base near highs. Engaged in the exploration and production of crude oil and natural

gas in OK and KS

CVE- 3 week ascending base at highs. Engaged in oil/natural gas exploration and production in Alberta

and Saskatchewan and refining in the U.S.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of780% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019-2022 trades online

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on positions and ongoing advice. Bear cycle bottoms in 2018, 2020, and likely 2022 so good time to get involved now in 2022 as we likely trough out in the market.

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com and AUTO- TRADE option with my partner firm where we enter the trades for you

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com and also Auto-Trade option outside of Stocktwits… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)