26 Sep Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of September 27th 2021

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt Shearer- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts: SP 500, XBI , IWM

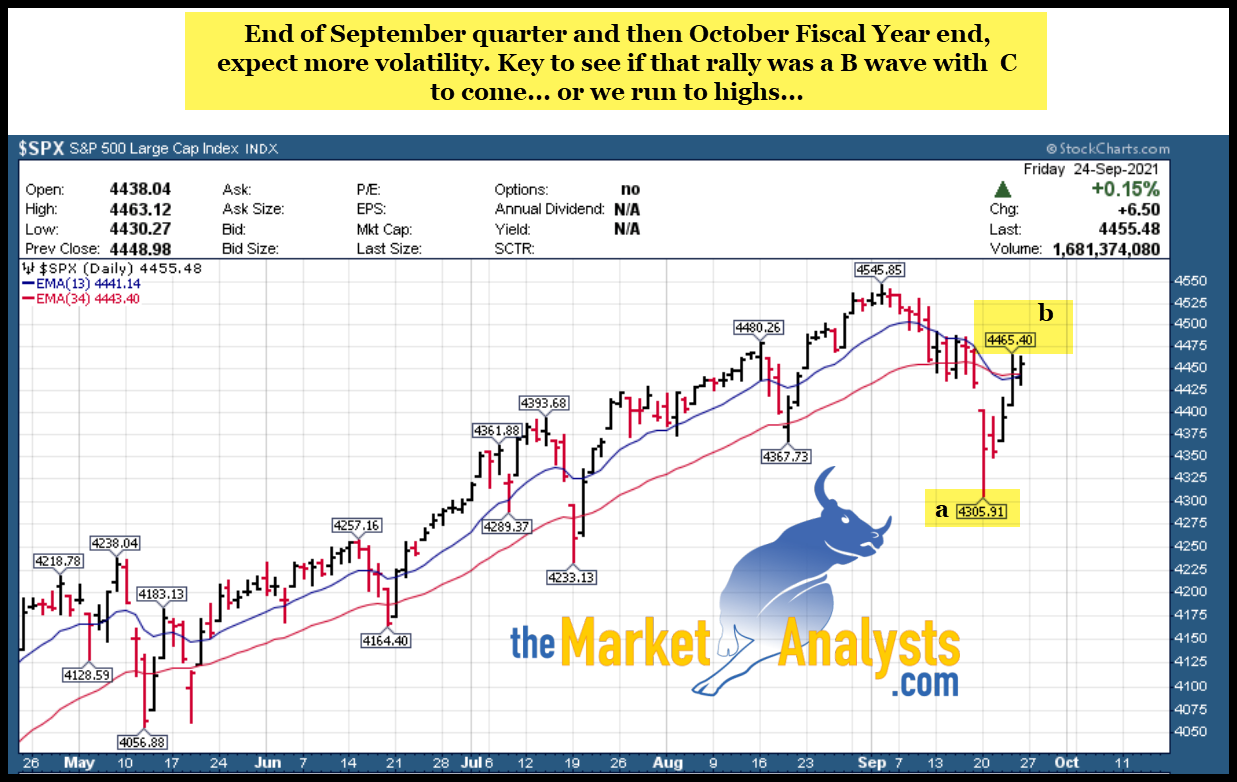

- SP 500 Holds support on closing basis last week. Have to see if Rally is just a B wave (Chart)

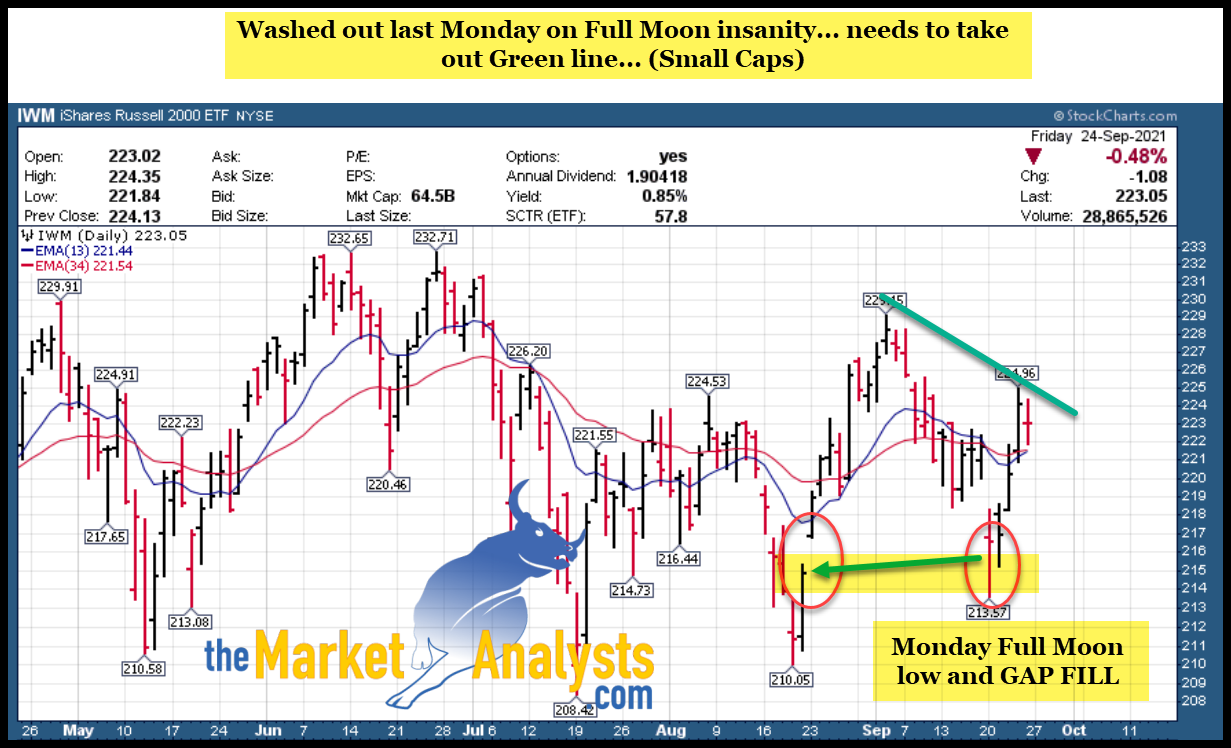

- Small caps also bouncing off Monday washout, need to break out of trend line (Chart)

- Semiconductor stocks often lead the market, they are trying to break out of triangle (Chart of SOX)

- SRP has little to no damage from sell off , took 10% profits in TPX and alerted new position, I move slow during expected correction wave patterns for that reason to protect our capital

- 3x ETF service hangs in there and avoids washout on Full Moon Monday… long 3 positions with strong recoveries last week

- Post IPO Base Stocktwits service soon to open, will offer large discounts to SRP/TPS members

Recent results:

- TPX we take 10% gains on final 1/2, new position alerted late in week. Several close to breakouts

- 3x ETF service remains long 3 positions and did not get washed out on Monday due to lower stops

- TPS service looking to add some recent IPO’s as new positions soon

- Futures service stayed in cash as we just barely missed pullback long entry

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Chart this week on SP 500, SOX ETF, IWM ETF

Continue to watch 4330 area on a closing basis for SP 500 as key shorter term support. Also a possible C wave down ahead to test last weeks lows as we roll into October here soon. That said, unless 4240 area breaks I remain intermediately bullish with a 5500 potential longer term view on SP 500. Small caps tend to bottom in September seasonally speaking and last Monday’s pullback on the Full Moon may have done it, we shall see. The Swing Trade ideas list last week had 3 big winners and is now updated with 16 names at the bottom of this report.

NEW SERVICE COMING TO STOCKTWITS THIS FALL- Recent IPO plays

I’ve had a lot of success over the years with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months). The room is getting set up and I will offer large discounts to SRP and TPS Members upon debut. I will be doing “Featured Posts” on Stocktwits in conjunction with them on various POST IPO companies as well.

Charts: SP 500, SOX, IWM

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. A New position in the Real Estate TECH area was just released on 7/23 to TPS members. Also recently a new re-entry name in the Chip Equipment sector as well. We will be moving towards recent IPO plays going forward to add to our small cap names

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 9/27/21

ATKR, SNAP, AN 3 big winners off of this list from last Sunday, here is my updated list. Several repeated as well as new names every Sunday!

ZI- 8 week base near highs, could continue higher yet. Provides business-to-business data and information solutions for

sales and marketing teams. Current SRP position

TASK- 4 weeks tight closing near highs, former SRP position that ripped higher. May be setting up again. Provides digital outsourcing focused on serving tech companies to represent, protect and grow their brands

DLO- 6 weeks tight base near highs. We made 37% on this one at SRP recently, but still attractive. Uruguay based Co provides cloud-based payment platform to global enterprise merchants in 29 countries. Current SRP position

STEP- 10 week base near highs. Recent pullback a buy opportunity perhaps. Provides investment solutions and advisory data services to the most sophisticated investors in the world.

ZIM- 5 week base near highs. Israel-based asset-light container liner shipping co provides cargo

solutions for all industries.

RVLV- 4 week ascending pattern trying to march towards former highs. Operates as a fashion retailer for Millennial and Generation Z consumers. Profitable and beat estimates as reported early August. Current SRP Position

PGNY- 4 weeks ascending base near highs. Provides fertility and family building benefi ts solutions in the

United States for 2.7 mil members.

JAMF- 5 week ascending base near highs. Standard in Apple Enterprise Management and cloud software platform

for infrastructure and security.

DVAX- A little wild action but could break out soon. Develops vaccines using immunostimulatory sequences technology

to prevent infections.

MRNA- 9 week base near highs for now famous Vaccine Maker. Develops messenger RNA therapeutics for infectious, immuno-oncology, rare and cardiovascular diseases.

DDOG- 8 week ascending bullish base near highs. Provides SaaS-based monitoring platform for cloud applications

used by enterprises.

GLBE- 8 week flat base near highs, tested 10 week EMA Line last week. Israel-based Co provides platform that enables global, direct-to-consumer cross-border e-commerce solutions.

KLIC- Nice 3 week pullback with markets, former SRP winner recently now in better re-entry range. Manufactures wire/die/ball/wedge bonders/wafer dicing blades for semiconductor packaging/equipment markets.

SMTC- Ascending base close to 6 month breakout. supplies analog and mixed signal semiconductor products and advanced algorithms. Its products are used for infrastructure, high-end consumer gear and industrial equipment

ALKS- 5 week base breakout near highs. Develops therapies based on proprietary drug delivery technology to

enhance existing drugs.

NMRK- 9 week flat base just no breaking out. Provides commercial real estate services business that offers a full

suite of services and products. PE 11

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)