17 Oct Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of October 18th 2021

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt Shearer- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts: SP 500, XBI , IWM

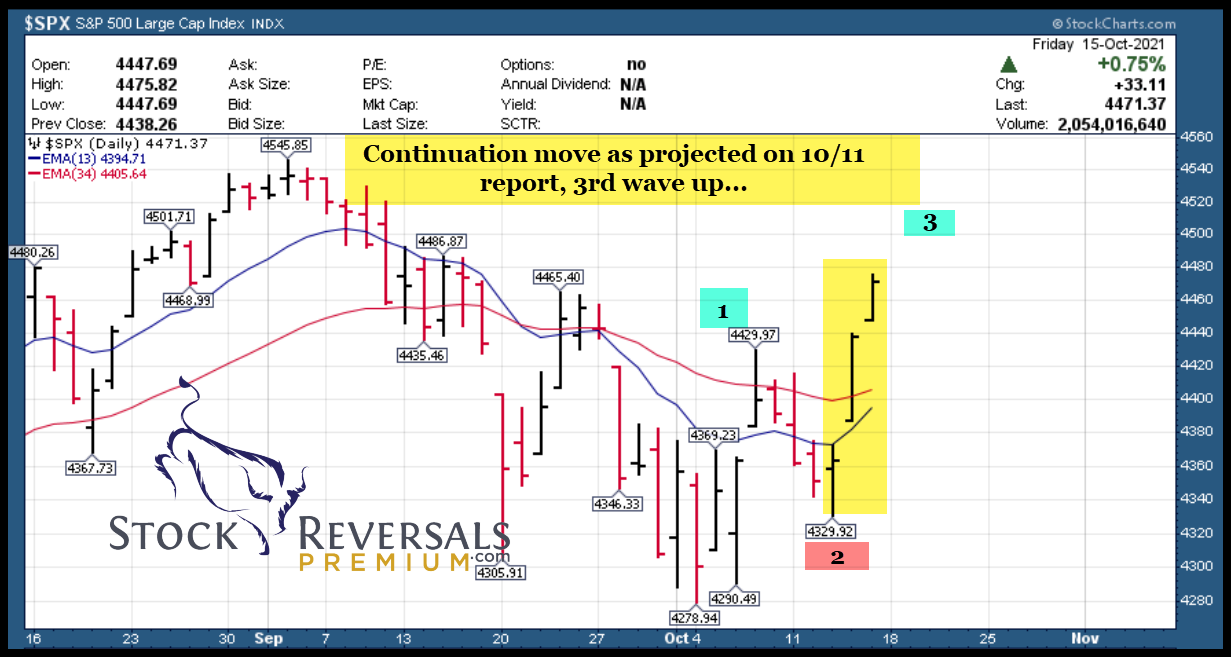

- Markets confirmed ABC lows last week as projected in the October 11th Weekly Report

- “Continuation” move for SP 500 and market to the upside per last weeks chart projection (SP 500 Chart)

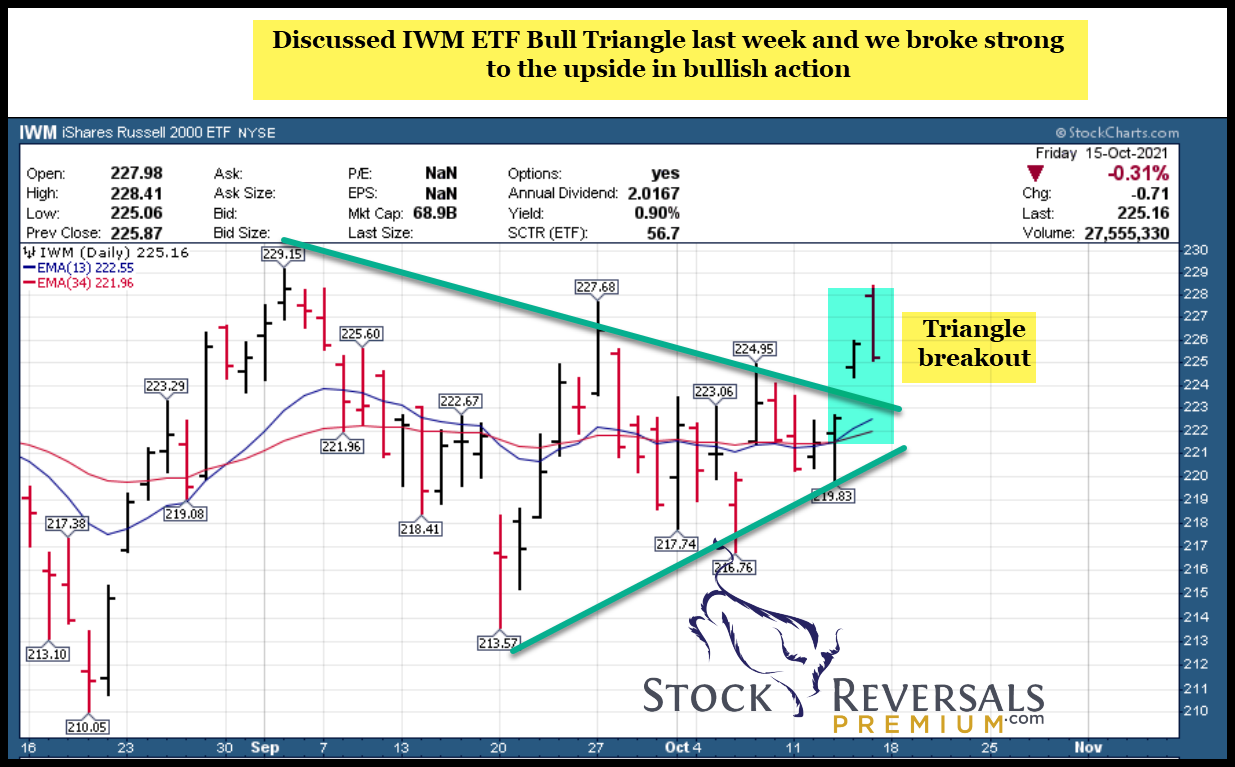

- Small Caps continue to look bullish, last week discussed a “Bullish Triangle” pattern on IWM ETF (Chart)

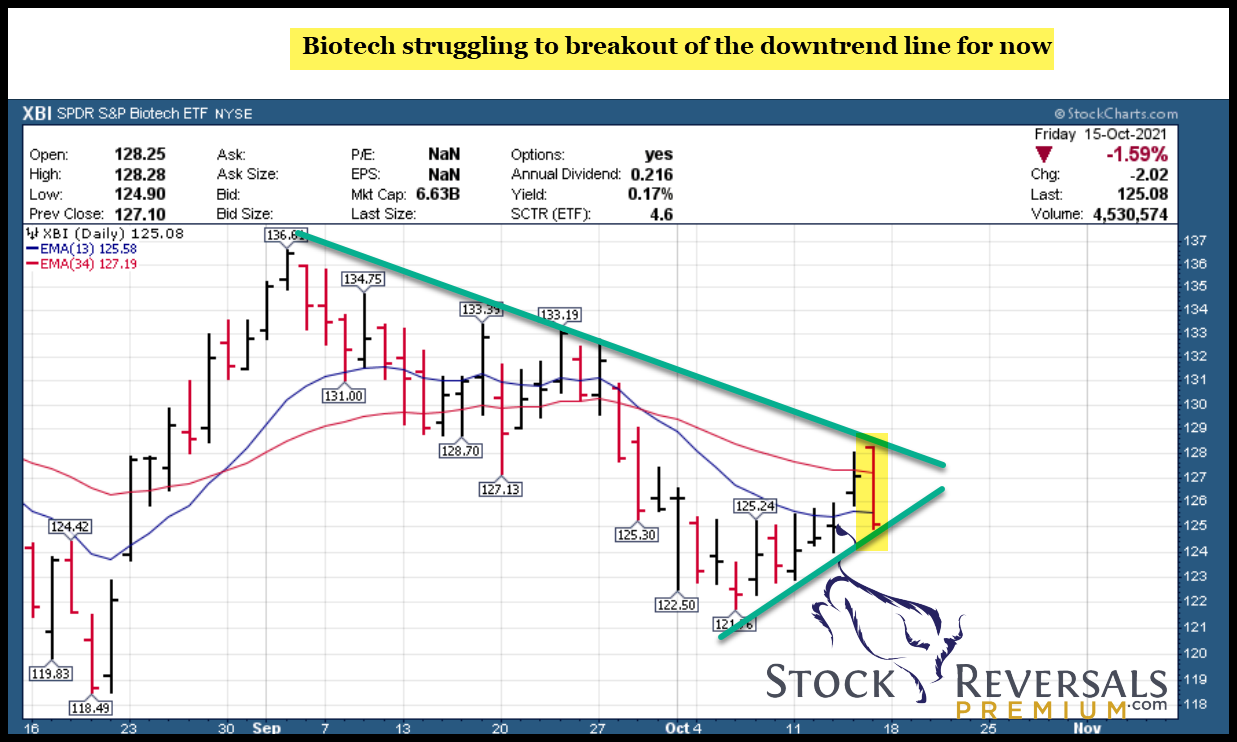

- Biotech trying to get out of the woods still

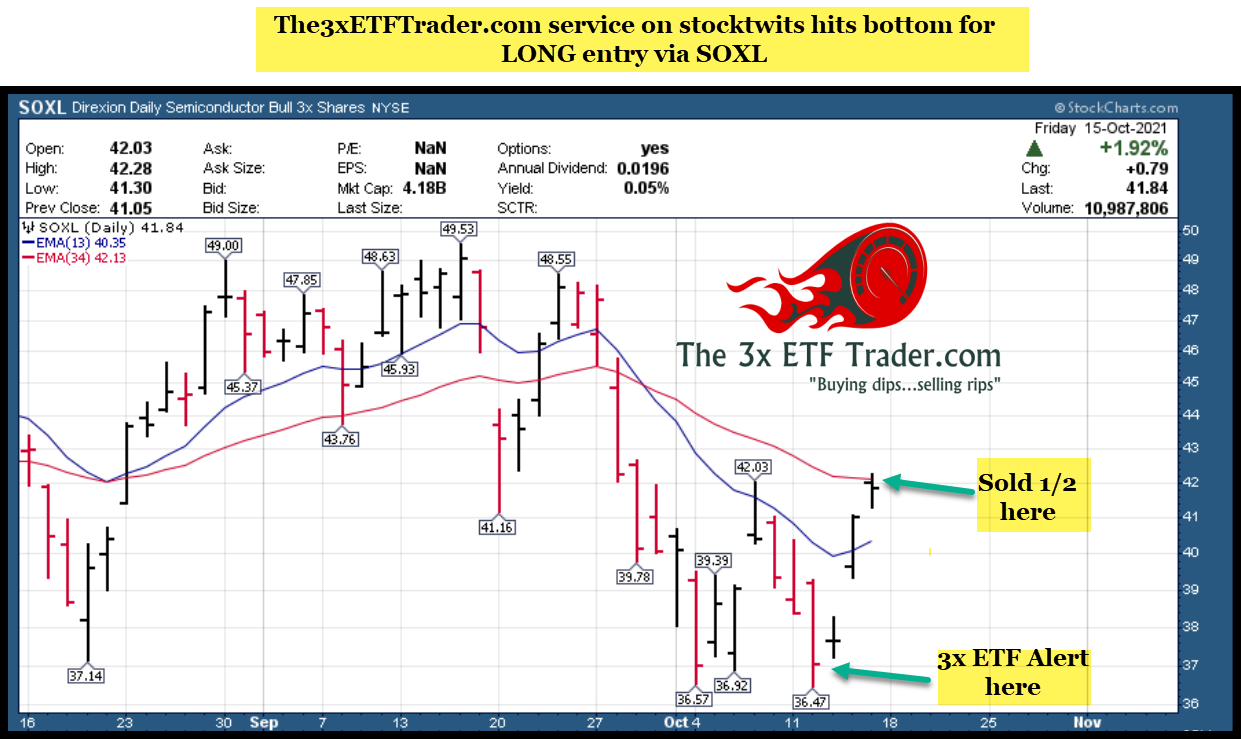

- 3x ETF hit big on SOXL Bull trade on Semiconductors, they can lead the market often

- Mercury goes direct out of Retrograde on Monday, and I had forecasted a move up into that date and onward

Recent results: All 4 services with nice profits last week

- SRP after going slow during correction hits big on 2 trades INMD and JAMF last week, while issuing 2 new alerts

- 3x ETF up 11% on SOXL and also long LABU, we sold 1/2 the SOXL for gains

- TPS put out yet another research report, this time on Crypto related equity play that we think is 2-4x in 6 months

- Futures service made a 31 point scalp long trade and once again hit for big profits inside of 24 hours

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Chart this week on SP 500, SOXL ETF, IWM ETF, XBI ETF

Quote from last weeks report:

“It would appear as we move towards October 18th, when Mercury reverses and goes direct from Retrogade that hte market can resume its Bull Market. This past week ES futures put in a low of 4260 which was 20 points off my LOW END 4240 support or shall I say KEY SUPPORT zone. So far we rallied strong to 4400 which is another natural resistance zone. Barring some really bad news, the price lows at 4278 should be in for SP 500 and we can work through the usual October Fiscal Year end machinations and start the usual Nov-Dec advance. “

Fast forward a week later and we had a nice smash up in the SP 500, Small Cap broke to the upside out of my bullish triangle forecast, and Semiconductors bottomed as the 3x ETF service literally got long due to the behavioral pattern on the day of the low for an 11% pop a few days later. Behavioral patterns are what I focus on, not so much the headlines. Headlines are used to try to explain what is happening in the market or just happened, but what is really going on is investors are deciding if to interpret news as bullish or bearish depending on the Elliott Wave stage of Wave pattern we are in. I try to assess most likely behavioral outcomes in advance and then position accordingly. For example in the SRP swing trade service I will avoid much in the way of new long positions when I think we are in an ABC correction, or I will close positions out on the B wave rally and wait for a C wave low or close. Last week we were able to cash big on INMD as we positioned on an ABC bottom there, and also JAMF both of which rallied for strong profits. INMD 16% in just days.

With Mercury going direct on Monday much of the behavioral negative or confusion bias should be winding down or behind us. Also with October common for market bottoms, we should see a likely strong rally in November and December with a long term target still at 5500.

Charts: SOXL XBI IWM SP 500

NEW SERVICE COMING TO STOCKTWITS THIS FALL- Recent IPO plays

I’ve had a lot of success over the years with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months). The room is getting set up and I will offer large discounts to SRP and TPS Members upon debut. I will be doing “Featured Posts” on Stocktwits in conjunction with them on various POST IPO companies as well.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020.

Recently three new research reports in the last two weeks have been put out. One is a Crypto Equity play that is growing incredibly fast and underfollowed, another is an E Commerce play on a company that is rapidly changing a 100 year old business sector, and the third a Biotech with 5 shots on goal and multi billion dollar upside to share valuations with a winning executive team.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 10/17/21

A few winners from last week included INMD, UPWK, TASK, and APPS amongst others.

DVAX- 8 week volatile base not too far off highs. A little wild action but could break out soon. Develops vaccines using immunostimulatory sequences technology to prevent infections.

TASK- 7 week corrective POST IPO Base. Provides digital outsourcing focused on serving tech companies to represent, protect and grow their brands.

CELH- 6 week base near highs. Develops and markets functional calorie-burning fi tness beverages

under the Celsius brand in U.S.

CLFT- 6 week post IPO base near highs. Offers a cloud-based platform for data infrastructure software

designed to focus on data in motion

ZI- 10 week overall base with recent rally up. SRP position currently. Provides business-to-business data and information solutions for sales and marketing teams.

PAG- 4 weeks tight base near highs. Operates franchised car dealerships in the U.S. and outside the U.S.,

mostly in the U.K.

BROS- 5 week POST IPO Base pattern near highs. Operates 471 drive-through coffee shops in 11 states in the United

states.

LOVE- 6 week base at support. Trying to climb up right side of long term consolidation. Manufactures and sells foam filled furniture, sectional couches, and related accessories

AMD- 12 week base near highs. Designs microprocessors, embedded media/graphics processors and

chipsets for computers and consumer devices.

TIXT- 6 week base, needs to hold 34 area. Designs, builds, and delivers next-generation communications and

information technology solutions.

OLPX- New IPO, only 3 weeks trading but ascending base looks bullish. Operates as holding Co that manufactures hair care products, shampoos, conditioners, oils, and smoothers. SRP Position

TROX – 5 weeks tight near highs. Subject to buyout attempt by suitor. Manufactures titanium dioxide, titanium feedstock, zircon and electrolytic and other chemical products. SRP Position

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)