24 Oct Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of October 25th 2021

“Hi Dave,

It’s been quite a while since I’ve checked in. I hope all’s well with you. Couple weeks ago I re-upped for my 2nd year in SRP. Just wanted to say thanks for all the excellent trade alerts over the past year. I’m really enjoying your service as a valuable component of my overall market approach. I’ve also noticed that you don’t go crazy with new alerts when the market/sentiment is iffy, which is impressive. Great job (not that you need me to tell you that!)” – Matt Shearer- SRP member, 9/21/21“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts: SP 500, IWM

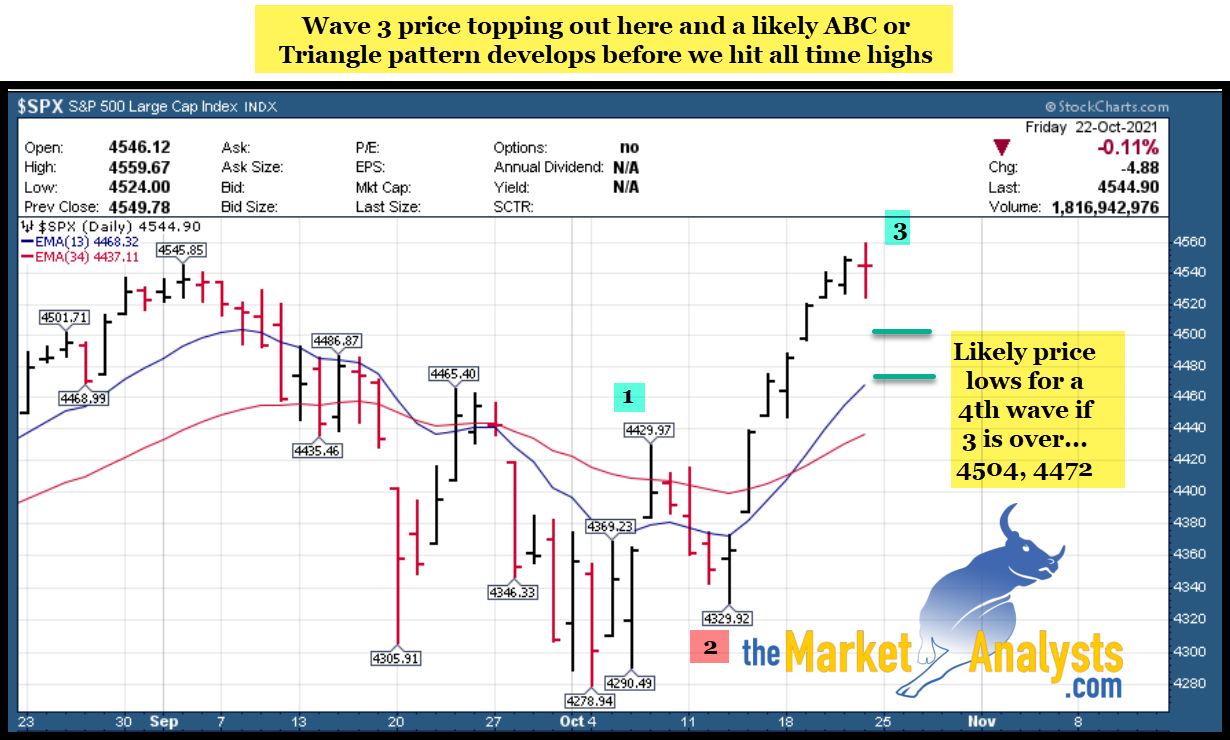

- SP 500 gets very near my 4570 target for this current wave 3, may consolidate in 4 (Chart)

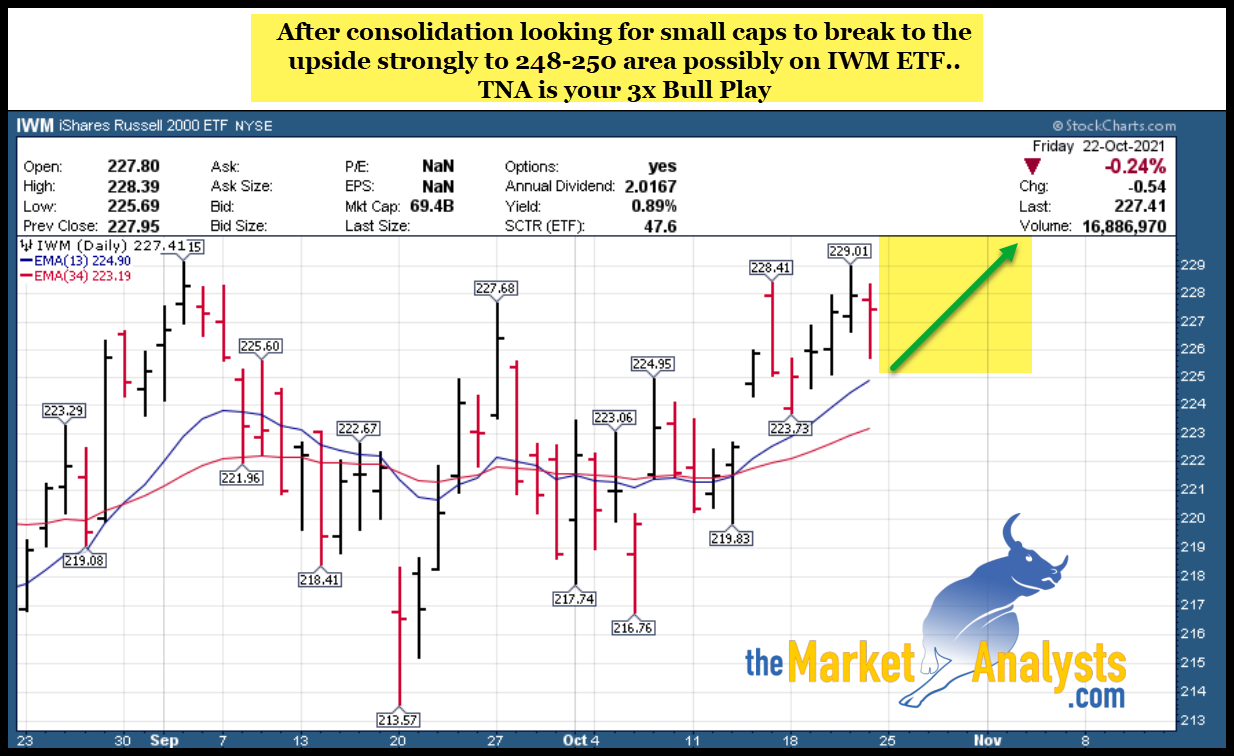

- IWM ETF also continues to look bullish for another move up (Chart)

- Biotech still trying to firm up a bottom

- Are you checking my weekly Swing Trade Ideas list?

- Last weeks big winner was Post IPO Base play BROS up 29%, also OLPX Post IPO Base up 17% an SRP Position, AMD breaking to highs up 7%, TIXT up 8.7% also an SRP Position, PAG up 8%, LOVE up 8%, and DVAX up 7%

Recent results: All 4 services with nice profits last week

- Most recent TPS Long Term Crypto play is already up 35% in just over a week, new Biotech coming soon possibly

- SRP has several stocks rip higher this past week, TIXT, OLPX, JAMF, ZI all nicely up for swing trade members

- 3x ETF cashes out of SOXL for 24% gains on final 1/2, getting long TNA late in week

- Futures service guided for 4570 and we got close this past week

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Market Notes and Commentary:

Short Term wave 3 up to 4570 was my target and we hit 4560 so pretty close. We MAY end up with a Wave 4 consolidation here, the SP 500 chart shows a few pivots to watch on a pullback. Following this consolidation should see another move again to all time highs. 5500 remains my LONG TERM objective for now, SP 500 could test 4638 area after this pause in terms of shorter time frames outlook.

Biotech still trying to confirm a bottom, we remain 1/2 long LABU in the 3x ETF service

IWM ETF (Small Caps) continue to look bullish and we got long initial 1/2 position via TNA on Friday in the 3x ETF service as well.

Charts: IWM SP 500

NEW SERVICE COMING TO STOCKTWITS THIS FALL- Recent IPO plays

I’ve had a lot of success over the years with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Just this past week at SRP we had TIXT and OLPX Pop higher, both Post IPO base plays. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months). The room is getting set up and I will offer large discounts to SRP and TPS Members upon debut. I will be doing “Featured Posts” on Stocktwits in conjunction with them on various POST IPO companies as well.

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020.

Recently three new research reports in the last two weeks have been put out. One is a Crypto Equity play that is growing incredibly fast and underfollowed and within just over a week already up 35%, another is an E Commerce play on a company that is rapidly changing a 100 year old business sector, and the third a Biotech with 5 shots on goal and multi billion dollar upside to share valuations with a winning executive team.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 10/24/21

Last weeks big winner was Post IPO Base play BROS up 29%, also OLPX Post IPO Base up 17% and SRP Position, AMD breaking to highs up 7%, TIXT up 8.7% also SRP Position, PAG up 8%, LOVE up 8%, DVAX up 7%

DVAX- 9 week base near highs. Develops vaccines using immunostimulatory sequences technology

to prevent infections

CELH- 8 week base near highs. Develops and markets functional calorie-burning fi tness beverages

under the Celsius brand in U.S.

PRFT- 8 week base near highs. Provides information technology consulting services to Global 2000

and other large companies.

CFLT- 7 week post IPO base near highs. Offers a cloud-based platform for data infrastructure software

designed to focus on data in motion

FRHC- 19 week flat base near highs. Kazakhstan-based Company provides security brokerage and other

financial services.

ARCB- 4 weeks tight near highs. Engaged in less-than-truckload motor carrier operations in North

America via its 5 major subsidiaries

ARES- 8 week base near highs. Provides investment mngt services to institutional and high net worth

individuals

TASK- 8 week corrective POST IPO Base. Provides digital outsourcing focused on serving tech companies to represent, protect and grow their brands.

ZI- 10 week overall base with recent rally up. SRP position currently. Provides business-to-business data and information solutions for sales and marketing teams.

INMD- 5 week base near highs, we hit this for 15-20% recently at SRP, but still looks good here as it bases again. Israeli seller of radio frequency devices used in minimally & non-invasive cosmetic procedure/women’s health

RVLV- 18 week base near highs. Operates as a fashion retailer for Millennial and Generation Z

consumers.

TROX – 6 weeks tight near highs. Subject to buyout attempt by suitor. Manufactures titanium dioxide, titanium feedstock, zircon and electrolytic and other chemical products. SRP Position

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)