12 Sep Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of September 13th 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts: SP 500, XBI , IWM

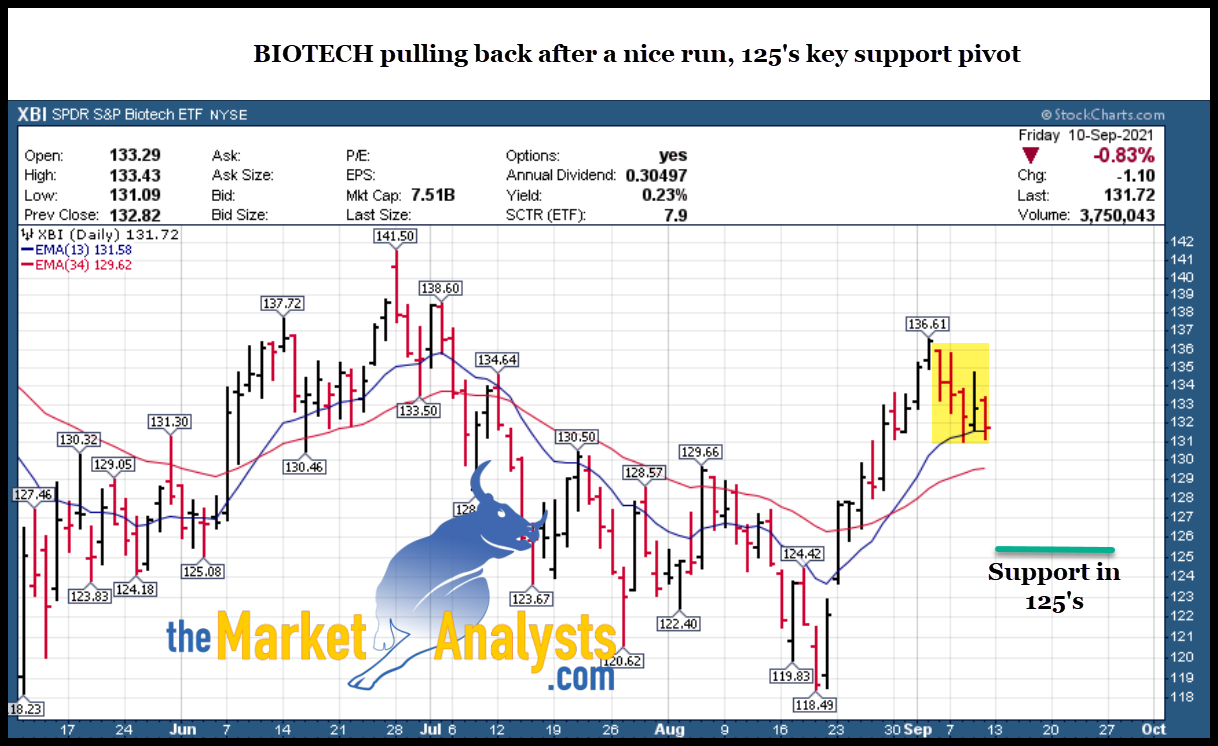

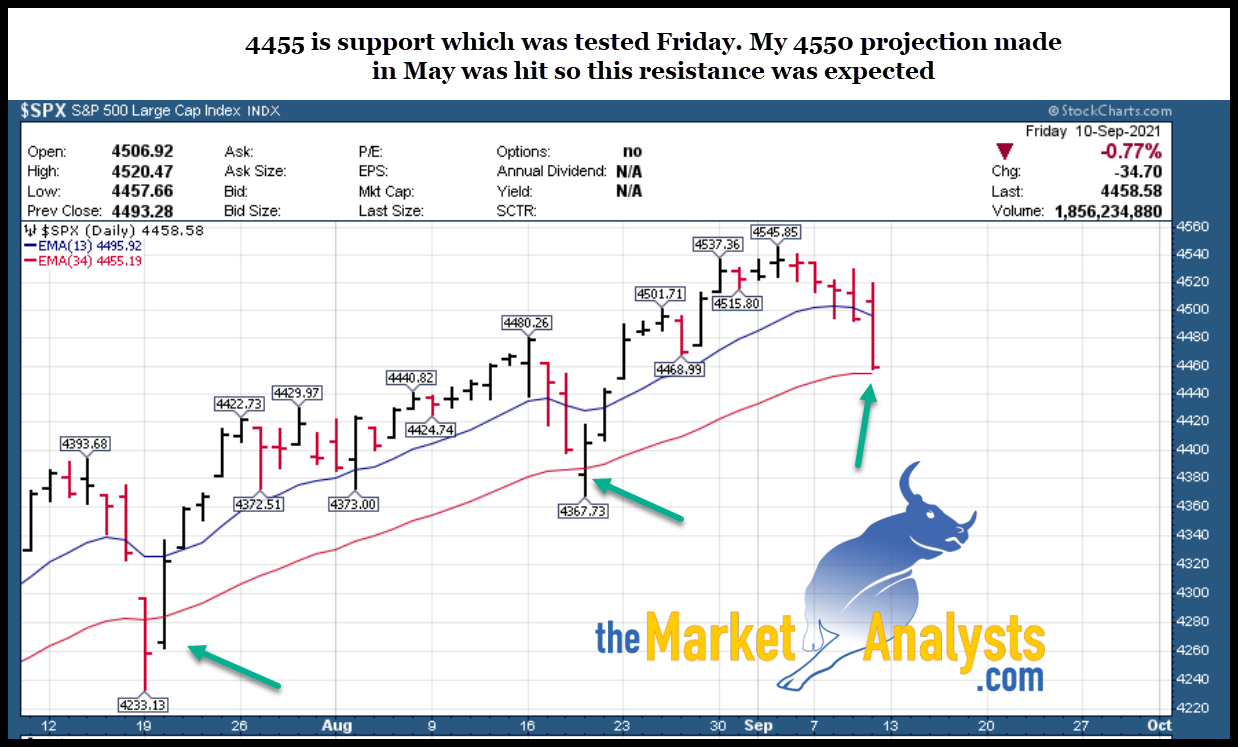

- SP 500 hits my 4550 long standing projection resistance zone now pulling back (Chart)

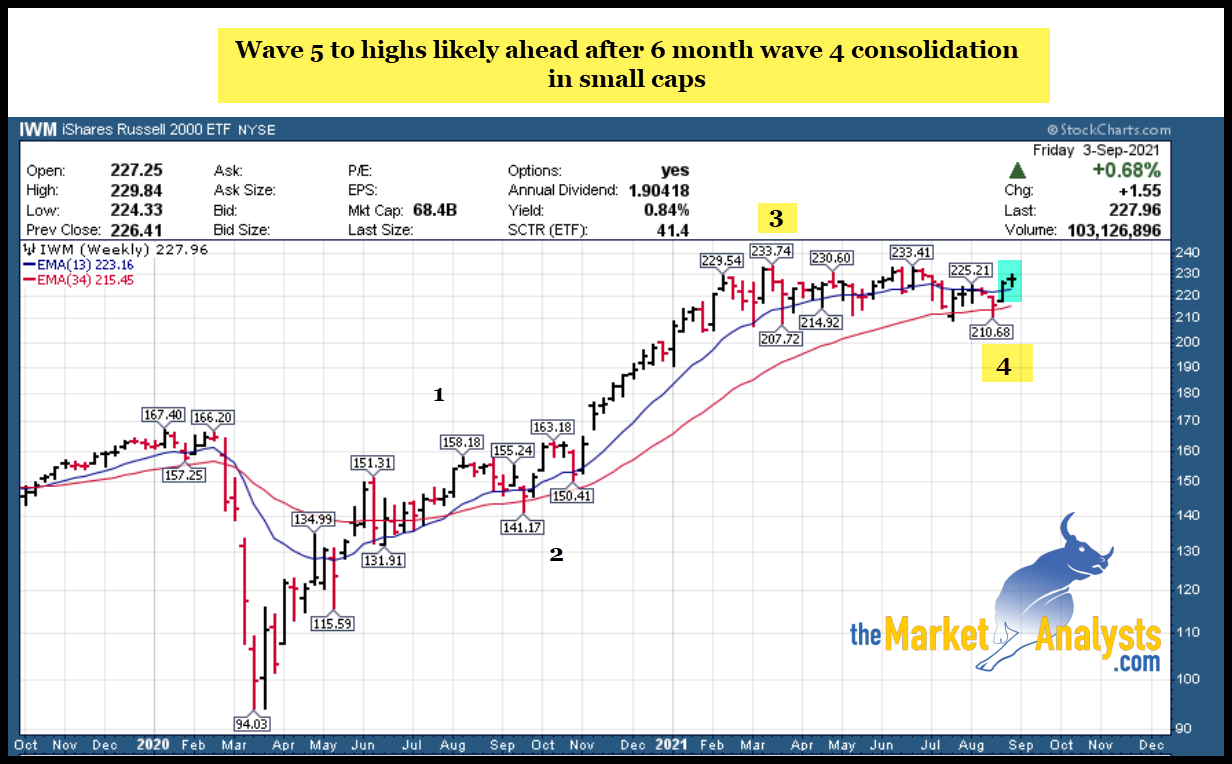

- IWM ETF pulling back after rally off double bottom (Chart)

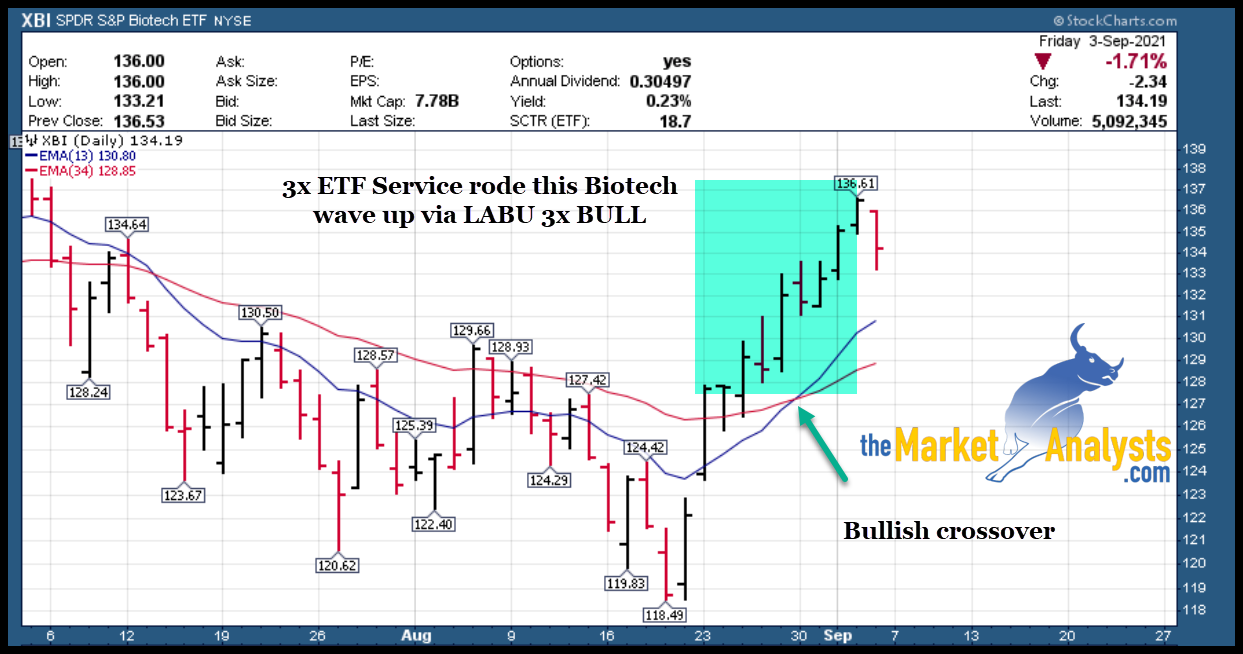

- Biotech also pulling back after big rally (Chart)

- September is end of quarter so will see window dressing at some point

- Small Caps tend to bottom out in September seasonally

Recent results:

- Closed KLIC Final 1/2 for strong gains and new alert issued

- 3x ETF waiting to re-enter LABU and or SOXL on pullback, still long TNA and monitoring pullback

- Futures service guided to wait to get long until pullback following 4550 target being hit

- TPS getting ready to issue new position research soon

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Chart this week on SP 500, XBI ETF, IWM ETF

Last weeks note>>> “Longer term I’m not looking at 5500 on SP 500 as a higher and larger degree Wave 3 potential zone to focus on. Near term a pullback would not surprise as we end the 3rd quarter but overall markets remain bullish obviously at this time.”

We saw a needed and normal pullback last week across the board. That 4550 zone was a natural target for the Bulls when I put it out in May, now that we hit that area a pullback is also normal. Short term looking at 4360 area possible from 4458 current levels we closed at Friday last week. Small caps and Biotech also pulling back after nice rallies off the August lows. Long term remain bullish but we are in September and October and usually gets a bit volatile.

NEW SERVICE COMING TO STOCKTWITS THIS FALL

I’ve had so much success with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months). Last week included DOCS up 21% for example.

Charts: XBI ETF, IWM ETF, SP 500

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. A New position in the Real Estate TECH area was just released on 7/23 to TPS members. Also recently a new re-entry name in the Chip Equipment sector as well.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 9/13/21-

ATKR- 6 week consolidation near highs. Manufactures electrical and mechanical products for the nonresidential construction and industrial markets.

NET- 8 week flat base near highs. Develops software for fi rewall, routing, traffi c optimization, load

balancing, and other network services

SNAP- 8 week base near highs. Operates the popular Snapchat mobile application for Android and

iOS devices.

AMD- Current SRP position. 7 weeks base near highs. Designs microprocessors, embedded media/graphics processors and chipsets for computers and consumer devices.

DDOG- 6 week ascending bullish base near highs. Provides SaaS-based monitoring platform for cloud applications

used by enterprises.

DLO- 4 weeks tight base near highs. We made 37% on this one at SRP recently, but still attractive. Uruguay based Co provides cloud-based payment platform to global enterprise merchants in 29 countries.

CROX- 6 week base near highs. Manufactures men’s, women’s and children’s footwear made with

proprietary resin material called Croslite

ZI- 6 week base near highs, could continue higher yet. Provides business-to-business data and information solutions for

sales and marketing teams.

BLDR- 5 week ascending bullish base near highs. Manufactures structural and related building products for residential new construction in the U.S.

PGNY- 3 weeks tight closing base off the highs. Provides fertility and family building benefi ts solutions in the

United States for 2.7 mil members.

NMRK- 7 week tight base near highs. Provides commercial real estate services business that offers a full

suite of services and products

TIXT- Post IPO breakout, 3 week ascending base. Would like to see a pullback to enter. Designs, builds, and delivers next-generation communications and information technology solutions

STEP- 7 week base near highs. Provides investment solutions and advisory data services to the most

sophisticated investors in the world

YETI- 7 week base near highs. Designs, manufactures and marketing innovative and outstanding

outdoor products.

NUE- 5 week base pullback to test 10 week line. Manufactures steel and steel products for the automotive, construction,

machinery and appliance industries.

MRNA- 7 week base near highs for now famous Vaccine Maker. Develops messenger RNA therapeutics for infectious, immuno-oncology, rare and cardiovascular diseases.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Chart this week on SP 500, XBI ETF, IWM ETF

Market participation broadened over last two weeks with the former laggards Biotech and Small Caps joining the Bull advance. SP 500 continues to advance to 4550 target which was an interim resistance target I noted back in May and onward. Longer term I’m not looking at 5500 on SP 500 as a higher and larger degree Wave 3 potential zone to focus on. Near term a pullback would not surprise as we end the 3rd quarter but overall markets remain bullish obviously at this time.

Many of the stocks in the weekly swing trade ideas list continue to perform as well as our actual Alerts at SRP swing trade service. This past week DOCS ripped 12% 1 day after my alert to buy the dip in that stock. I love reversal patterns where we can enter a strong stock with good fundamentals after a pullback that follows a rip higher on news or earnings. Those are often the best swing trade set ups and DOCS fit that bill last week. Also of note is to watch for base patterns that I identify where we try to time the end of a long consolidation and catch the wave up that breaks the stock out of a zone.

NEW SERVICE COMING TO STOCKTWITS THIS FALL

I’ve had so much success with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months). Last week included DOCS up 21% for example.

Charts: XBI ETF, IWM ETF, SP 500

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. A New position in the Real Estate TECH area was just released on 7/23 to TPS members. Also recently a new re-entry name in the Chip Equipment sector as well.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 9/6/21- 16 names

Last weeks Swing List winners include ASAN up 21%, DOCS up 20%, CELH up 16%, GLBE up 9% and more!

STEP- 7 week base near highs. Provides investment solutions and advisory data services to the most

sophisticated investors in the world

YETI- 7 week base near highs. Designs, manufactures and marketing innovative and outstanding

outdoor products.

DLO- 3 weeks tight base near highs. We made 37% on this one at SRP recently, but still attractive. Uruguay based Co provides cloud-based payment platform to global enterprise merchants in 29 countries.

BRDG- 4 week base Post IPO Base near highs. Real estate investment and property management fi rm that invests in real estate equity and debt. SRP position as of late last week.

NVST- 18 week corrective base but could rally soon. Provides dental consumables, equipment, and services to dental

professionals and serves customers worldwide.

ATKR- 5 week consolidation near highs. Manufactures electrical and mechanical products for the nonresidential construction and industrial markets.

MRNA- 5 week base near highs for now famous Vaccine Maker. Develops messenger RNA therapeutics for infectious, immuno-oncology, rare and cardiovascular diseases.

CLF- 6 weeks tight base near highs. Producer of fl at-rolled steel and supplier of iron ore pellets in

North America.

SNAP- 7 week base near highs. Operates the popular Snapchat mobile application for Android and

iOS devices.

DDOG- 5 week ascending bullish base near highs. Provides SaaS-based monitoring platform for cloud applications

used by enterprises.

BLDR- 4 weeek ascending bullish base near highs. Manufactures structural and related building products for residential new construction in the U.S.

ZI- 5 week base near highs, could continue higher yet. Provides business-to-business data and information solutions for

sales and marketing teams.

RCII- 6 month overall Cup with handle base that started in March 2021, looks close to breakout. Operates/franchises 1,973 stores offering furniture and electronics in the U.S., Canada, Mexico

AMD- Current SRP position. 6 weeks tight closing near highs. Designs microprocessors, embedded media/graphics processors and chipsets for computers and consumer devices.

KRNT- 6 weeks base near highs. Develops digital printing systems, ink, and associated software and

solutions for the textile industry.

TIXT- Post IPO breakout, 3 week ascending base. Would like to see a pullback to enter. Designs, builds, and delivers next-generation communications and information technology solutions

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)