22 Aug Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of August 23rd 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Market Notes and this weeks charts: SP500 vs XBI ETF, IWC ETF, GDX ETF

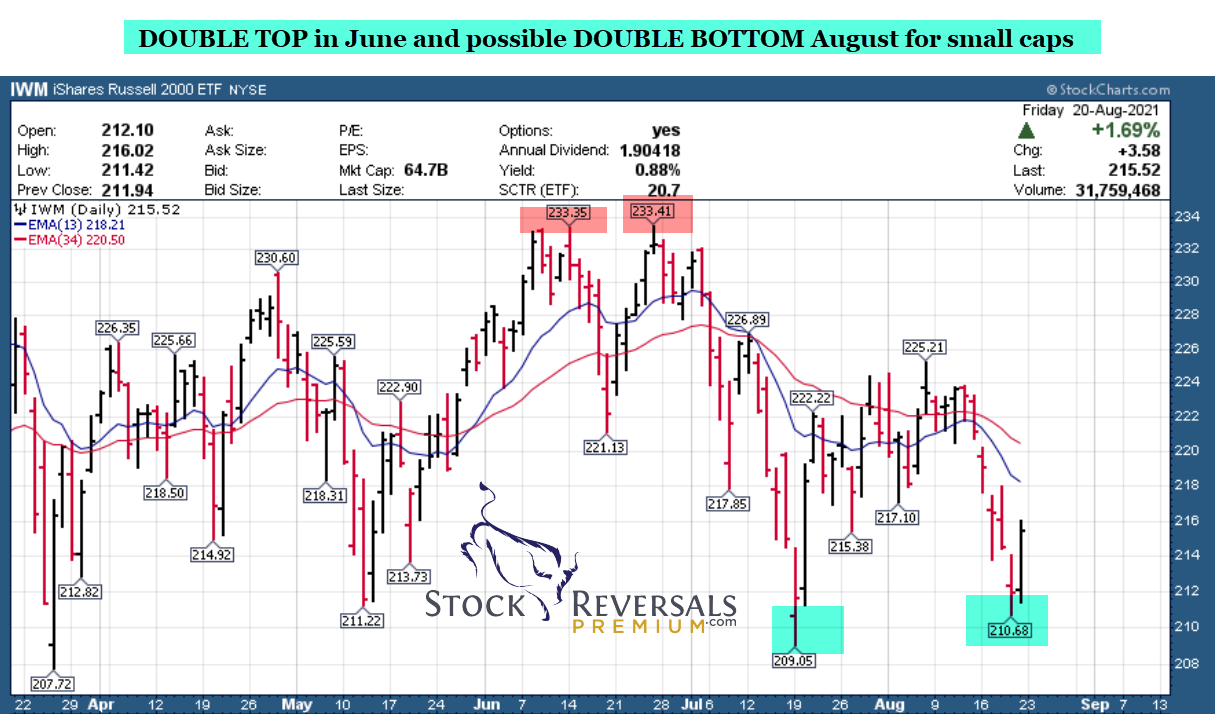

- Small Caps trying to double bottom following double top in June (IWM Chart)

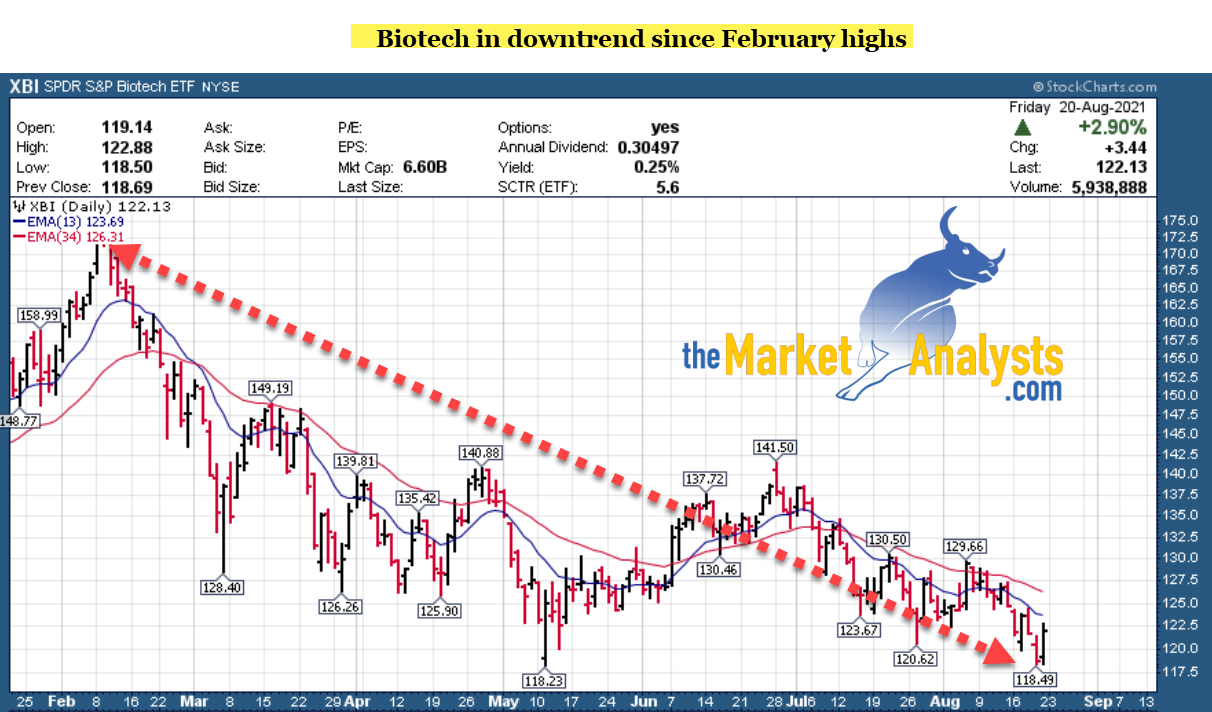

- Biotech continues downtrend, but trying to bottom out (XBI Chart)

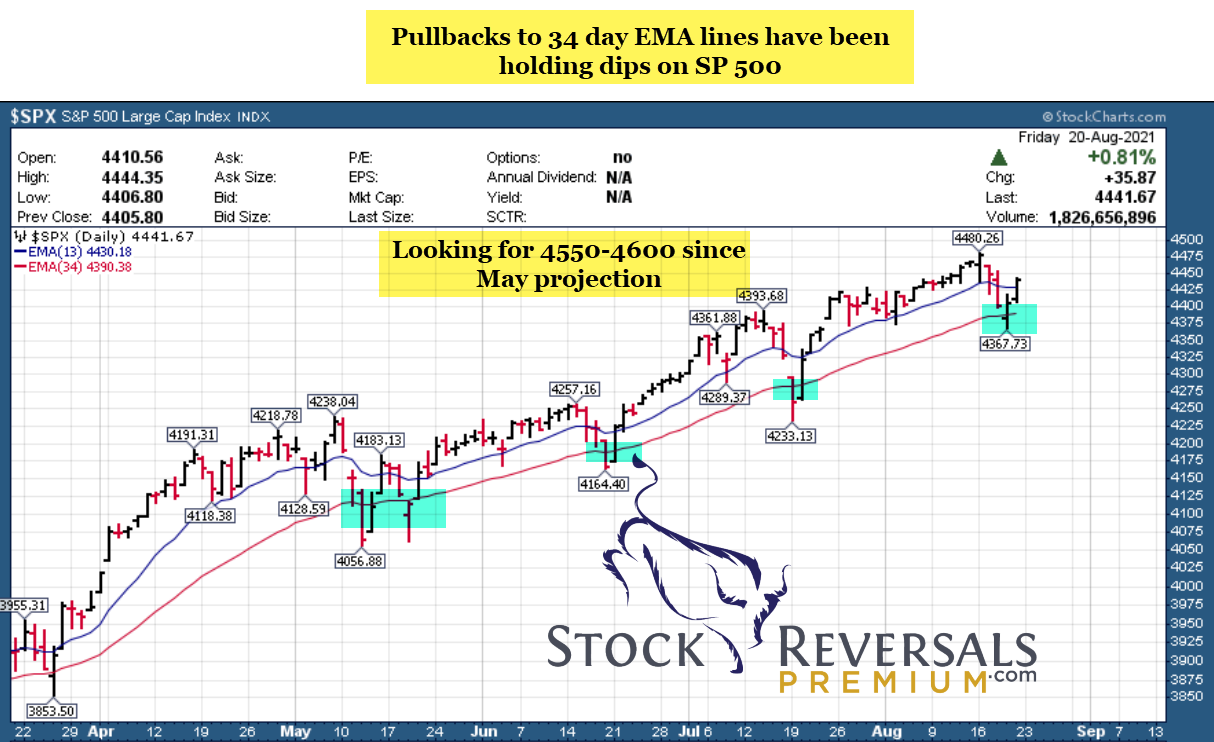

- SP 500 again tests 34 day EMA line and bounces, 4550 still on track (SPX Chart)

- Small Cap values relative to growth rates trading at 1994 levels (Bullish)

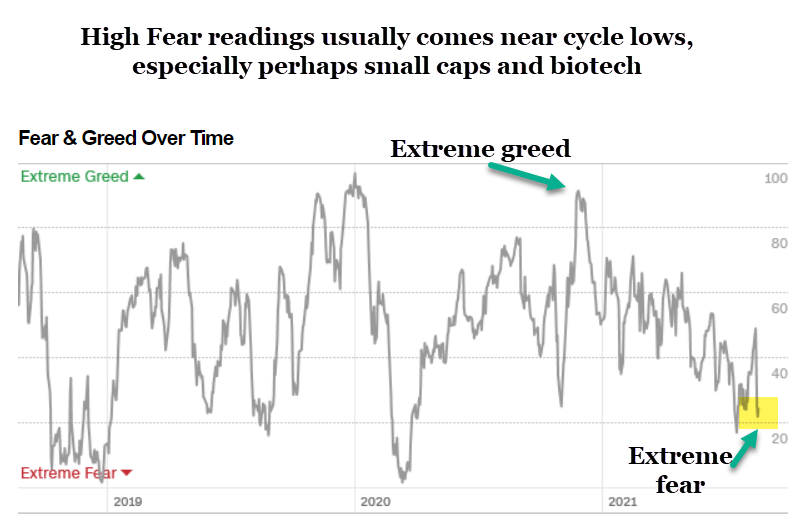

- CNN Fear Gauge running at extremes (25 reading is high fear, contrarily bullish- Chart)

- New POST IPO Swing Trade pure play service coming to Stocktwits this fall!!

Recent results:

- 37% gain on DLO taken after 4 days on final 1/2 of trade , 20% on front half

- 3x ETF took losses on SOXL and TNA, looking to re-set

- Futures service booked gains and sat out rest of week waiting for re-entry pullback

- TPS positions continue to pullback with small caps and biotech wreck, for now… opportunities knock!

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500 and more

Chart this week on SP 500, XBI ETF, IWM ETF, CNN Fear Gauge

Markets and Swing Trading, plus a new Stocktwits POST IPO Service coming this fall!

Not much to add other than OPEX week caused a lot of volatility this past week and its the August vacation season, so moves can be on low volume and difficult to assess or trade. Generally the SP 500 and large caps continue to dominate while Biotech and Small caps lag at best. When you run a small cap growth stock service, that makes fighting headwinds difficult. However, when those small caps finally turn they can run hard and fast for months. Right now I am seeing extreme values across the board in Biotech and Small Cap names, but alas for now money is flowing into Larger Cap and Crypto areas. One of my favorites that I commented on often this summer is Cardano ADA.X in the Crypto sector and it has soared 140% off the lows this summer. Now the 3rd largest coin and actually a proof of stake coin vs proof of mining, which is more desirable in my opinion. Its also a coin with real world utilities and e commerce potential as well as other assets.

CNN Fear Gauge running at high extreme fear readings: Opportunity?

The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month, approximately 8.78% more of each day’s volume has traded in declining issues than in advancing issues, pushing this indicator towards the lower end of its range for the last two years.

The number of stocks hitting 52-week highs exceeds the number hitting lows but is at the lower end of its range, indicating extreme fear.

Part of this fear situation means investing in businesses that are micro-cap to small cap ranges has been rough since the February highs. What has worked really well is trading 3x ETF’s and also Stock swing trading at my swing trade service srpmembers.com. I have found pretty consistent swing trade returns at SRP by focusing on Investors Business Daily names and using my own screening methods to break it down to 12-18 names going into each trading week. Then I try to pick from that list and also sprinkle in some names outside of IBD as well. The key being that Fundamentals are extremely important, we do not just trade a chart. I look for strong fundamentals and a proper behavioral chart pattern set up, if they both match up and the timing looks good, we enter.

Last week we pushed profits of 37% in 4 days on DLO, a classic “Post IPO Base” play.

I’ve had so much success with Post IPO stock swing trades over the years that I am starting a new Stocktwits Service this fall just for Post IPO trading only. Details to come as I develop that room. I will continue to incorporate Post IPO trades here and there at SRP of course, but on Stocktwits this will be a “Pure Play” if you will on just Post IPO companies. (Gone public within 2 weeks to 6 months).

Charts:

Tipping Point Stocks- Wealth building looking for multi-baggers before the crowd comes in, 9 stocks have more than doubled since June 2020. A New position in the Real Estate TECH area was just released on 7/23 to TPS members. Also recently a new re-entry name in the Chip Equipment sector as well.

Consider joining for powerful upside potential in a portfolio of 8-12 names that is dynamic and moving.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for daily commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Swing Trade Ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined. List is updated every Sunday, names removed if they broke out to the upside strongly and or broke down. New names added, many names repeated if still in a bullish pattern. A lot of stocks will pull back harshly right before a big breakout reversal, so be advised

Updated List 8/23/21- Last weeks big winner was DLO up over 35%

AMD- 4 weeks tight closing near highs. Designs microprocessors, embedded media/graphics processors and

chipsets for computers and consumer devices.

INMD- 6 week base near highs. Frequently on this list and just a chugger of a growth stock. Israeli seller of radio frequency devices used in minimally & non-invasive cosmetic procedure/women’s health.

NVDA- 8 week base near highs, back on the list again. Designs graphic processing units used in personal computers, workstations, game consoles and mobile devices.

ATKR- 3 week consolidation near highs. Manufactures electrical and mechanical products for the nonresidential construction and industrial markets.

NET- 5 weeks tight near highs. Develops software for firewall, routing, traffic optimization, load balancing, and other network services.

SNAP- 5 week base near highs. Operates the popular Snapchat mobile application for Android and

iOS devices.

BILL- 5 week base near all time highs. Provides cloud-based software that simplifi es and automates

back-office financial operations for SMBs.

BRDG- 2 weeks tight Post IPO Base near highs. Real estate investment and property management fi rm that invests in

real estate equity and debt.

STEP- 5 week base near highs. Provides investment solutions and advisory data services to the most

sophisticated investors in the world

ZI- 3 weeks consolidation and pulling back after hitting highs. Provides business-to-business data and information solutions for sales and marketing teams

TRMR- 10 week overall Post IPO consolidation, 4 week consolidation within that. Israeli based Co offers software platform that enables advertisers to reach relevant audiences and publishers

SPT- 3 weeks tight near highs. Provides a platform for businesses to manage social media

engagement, publishing and analytics.

TPX- 4 weeks tight near highs. Makes temperature sensitive visco-elastic pressure foam mattresses, pillows, and comfort/lumbar cushions

BRKR- 5 weeks tight closings near highs. Develops life science/materials research systems based on Xray, mass

spectrometry/spectroscopy technologies.

KLIC- 3 weeks tight closings after this past week breaking out to highs on earnings. I like the Chip Equipment Sector. Manufactures wire/die/ball/wedge bonders/wafer dicing blades for semiconductor packaging/equipment markets

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below or at Themarketanalysts.com

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of 80% profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in nearly 8 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks and advice with 1x-5x plus upside with our proprietary research! 9 stocks have doubled or more since June 2020! Fresh ideas and research every month as the portfolio rotates with regular updates every week on all positions and ongoing advice. Adding Crypto Trading advisory services summer 2021 to TPS

E-Mini Future Trading Service ESALERTS.COM $50 a month on Stocktwits.com

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)