18 Jan Weekly State of the Markets and Swing Trading Ideas Report

TheMarketAnalysts.Com

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND MOMENTUM GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

StockReversals.com Members get an exclusive 25% coupon offer to join our SRP Swing Trade or Momentum Growth stock TPS subscription services.

Read up on all 4 Subscription Options at TheMarketAnalysts.Com or bottom of this Report

SWING TRADING OF 3X ETF’S , STOCKS, E MINI SP 500 FUTURES, AND GROWTH STOCK RESEARCH SERVICES VIA SUBSCRIPTION

Weekly Stock Market and Trading Strategies Report Week of January 19th 2021

“I’ve mentioned it before, but it’s worth mentioning again. I’ve been a subscriber in three of Dave’s services – SRP, TPS and 3xETF for about a year now. Because I feel so highly in regards to Dave’s services and the performance I’ve experienced; my daughter, my brother and another friend have become subscribers to at least one of his services. I’m working on a couple other people as well😉 Dave thanks so much for all you do!” – 1/7/21- @JTD26 on Stocktwits

Notes on indicators and charts:

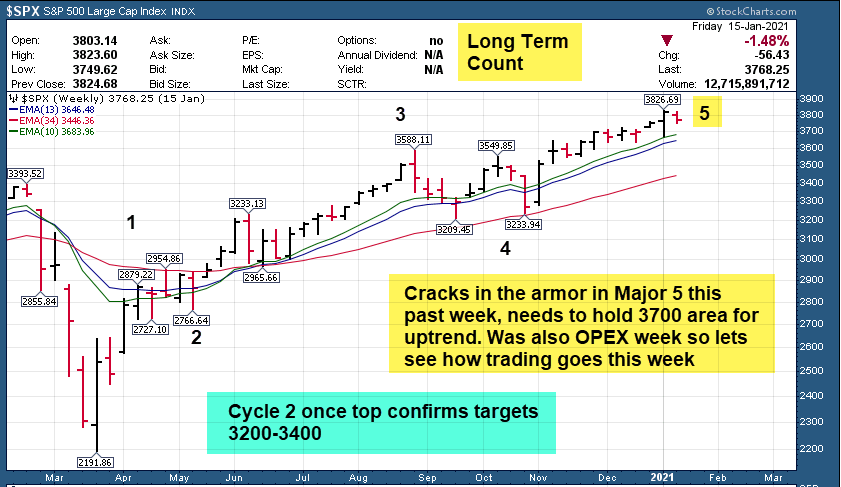

- SP 500 hits 3826 uptrend highs, stalls out on OPEX week. 3700 key support (Chart)

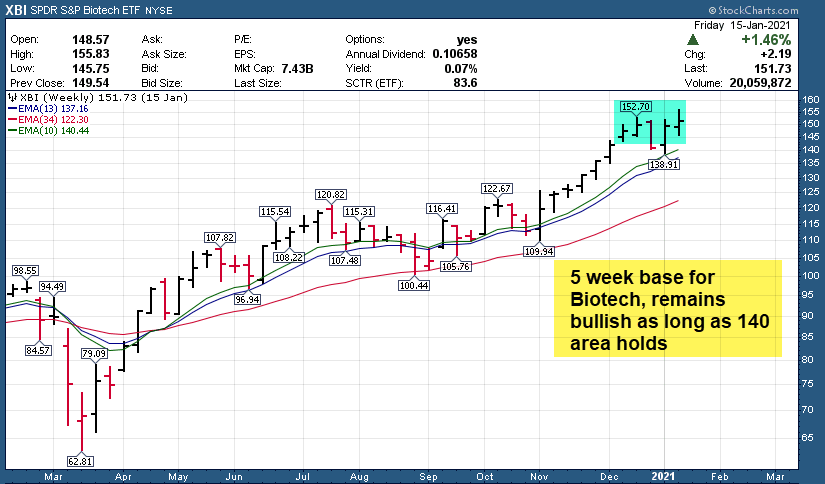

- Biotech XBI ETF in 5 week base, still bullish as long as 140 holds

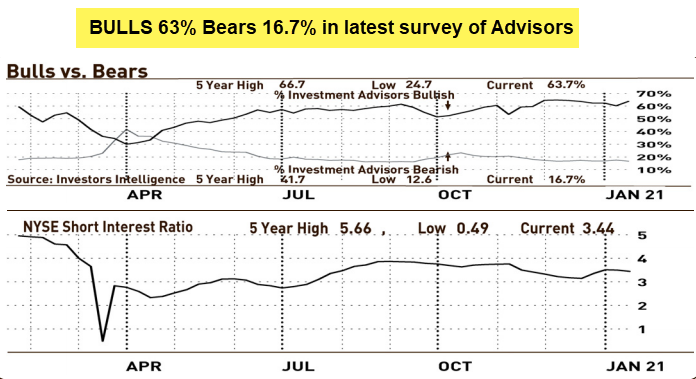

- Advisors at 63% Bullish Views vs 17% for Bears, historically hight

- Major 5 within 170 points of my 3996 upper end top target given out 11 weeks ago

- SRP closing out multiple swing trade winners and slowing down on new alerts as we raise cash a bit for now

- Recent TPS service long term play written up 4 weeks ago is up over a triple already

Recent results:

Stock ,ETF , and SP 500 Futures Swing Trading plus Growth Stock Investing options for members

Read up at TheMarketAnalysts.com for all Advisory Subscription Services and Track Records

It’s best to belong to three or four of my subscription offerings at the same time to have the most opportunities across all market conditions with multiple shots on goal! Asset allocation as a Trader is key for long term success in all environments– Dave

Another great week across the 4 services for members:

- SRP Swing Trade Stocks- LOVE 15% final gains taken, INMD final 19% gains taken, 11% gains taken on 1/2 APPS, TFFP final 15% gains taken

- 3x ETF- Up on LABU again from re-buy alert holding for now

- ES Futures- Futures guidance remains bullish for 3996 possible

- TPS- Latest stock research recommendation up 3x in 4 weeks. ATOM ripping higher and is now up from $7 recommendation to $28-30 area, last chance to join, almost sold out

General Market Summary: Updated Banister Market and Elliott Wave Views on SP 500

SP 500 and General Market Commentary

The SP 500 continues higher in Major Wave 5 and it did falter on OPEX Friday this past week. We may need a breather before attacking a POSSIBLE 3996 high for Major 5 per my projections. 3710 area is KEY SUPPORT for the Major 5 uptrend.

Biotech ETF in Wave 5 move up, consolidating (see the chart)

At the SRP swing trade service when my gut tells me a rally leg or wave is getting long in the tooth, I will move to keep taking profits on our open swings and maybe not replace them quite as fast with new alerts. That’s what I’ve been doing over the last 1-2 weeks. We keep making profits, but I may reduce the number of alerts and positions on purpose, basically trusting my gut. We only have 2 swing trades open right now for example. This happened in Jan/February 2020 as well ahead of the crash. We were 85-90% in cash almost the entire way to March 23 highs. I use a top down approach on stepping on or off the swing trade gas, then I drill down to sectors and individual names in strong sectors.

The TPS service (Long term tipping point stocks based on my research) is hitting the max number of subscribers. We are up a 4 bagger on ATOM since the summer, and have had 6 stocks double or more in last 12 months. New positions coming soon, most recent one is up 3x or 200% in 3 weeks. Read up and join soon at tippingpointstocks.com while you can.

The market could top out in the next few weeks at 3996 area on SP 500, if we go much above that its an “Extension” wave which happens. Those are tough to forecast, so for now watch that near 4000 zone for a possible top with 3710 as key support.

Charts this week , SP 500 Weekly, XBI ETF (Biotech)

Limited to 200 members max, taking final members now in January as we are at 200

Consider joining for powerful upside potential in a portfolio of 7-12 names that is dynamic and moving. We closed out TBIO for 50 and 80% gains on tranches recently. Added a new position 4 weeks ago already up 3x or 200%!! Among recent and ongoing winners TFFP, ATOM, INMB and more!

Email me for a 25% coupon at dave@themarketanalysts.com to try it out.

Read up at Tippingpointstocks.com

In addition to being a member of various services, you can follow my comments during the week:

- Twitter @stockreversals

- Stocktwits @stockreversals for commentary and or in my subscription services to stay up to speed daily.

- Follow me on Linked In as well where I provide periodic updates to professionals

Each week I try to come up with some fresh ideas, repeats as well if they have not broken out yet, or I remove prior ideas if they already ran up.

LOVE and INMD both ripped higher this past week, and were both SRP positions we took profits on, this week list updated. Also nice move last week in ETSY up 16%, HZO up 15%, and frankly nearly the entire list.

Ideas: 12 ideas with a combination of strong fundamentals and attractive behavioral pattern charts combined

RGEN- 11 week nice consolidation near highs for bioprocessing products specialist for life science customers, 4th week in a row on the list, it did move up on a breakout last week, but still looks good.

XPEL- 5 week ascending bullish base at or near 52 week highs. Manufactures and distributes after market automotive products in U.S, Canada, U.K and Netherlands. A bit extended so tight stop if you play.

CHGG- 4 weeks tight base near highs for online education tools provider, 2nd week in row on list, moved up a bit last week but still looks bullish. 2nd week in row on list

BLDR- 4 week base near highs. Manufactures structural and related building products for residential new construction in the U.S.

APPS- 5 weeks base near highs, 2nd week in row on list. Develops mobile software that enables mobile content distribution and transactions

TPX- 5 weeks tight pattern near highs for maker of custom mattresses, 4th week in row on list

SCPL- 7 month breakout possible for spin off from Scientific Games, online gaming etc. 2nd week in row on list, broke out last week then pulled back on profit taking.

HOLX- 6 week base, broke out 2 weeks ago but pulled back this past week to 10 week EMA Line. Develops imaging systems and diagnostic and surgical products focused on the healthcare needs of women

YETI- 6 week flat base near highs. We made money on this at SRP a few weeks back but looks attractive again. Designs, manufactures and marketing innovative and outstanding outdoor products

RCUS- 8 month cup and handle wide base, but looks ready to break to highs. Develops innovative cancer immunotherapies by leveraging underexploited biological opportunities

PINS- 8 week flat base near highs, needs to make a move soon. Provides a visual discovery platform that helps users to discover ideas for various projects and interests

DBX- 5 week corrective pattern after breaking to highs, could reverse back up for storage play, 2nd week in a row on the list

YETI- 5 week corrective base after hitting all time highs. Designs, manufactures and marketing innovative and outstanding outdoor products. 2nd week in row on list, we played this at SRP for gains not long ago.

Read up on my various offerings to take advantage of Bull and Bear cycles in the markets below

We offer 4 different subscription services for our Members, helping you cover the gamut of SP 500 futures trading with tax favorable treatment, Long Term Growth Stocks, Swing Trading, and Auto-Trade execution service for SP 500 futures trading.

Read up at TheMarketAnalysts.com for more details Track Records available for all services!

The3xETFtrader.com– Swing trading Bull or Bear 3x ETF securities only. Hosted on Stocktwits.com for just $40 per month. A great way to trade bull and bear reversals using my behavioral pattern analysis with a twist! Launched in late September 2019 and already establishing a strong track record of profitable trades!

StockReversalsPremium.com– Stock Swing Trading with SMS text, Email, and Post on each alert, morning pre market reports daily on the SP 500 forecasts, position updates, and strategy notes. 70% success rate in 7 years of advisory services! Track Record of 2019, 2020, and 2021 YTD Trades

Tippingpointstocks.com– Growth Stocks with 50-200% upside with our proprietary research! ATOM up 300%!, INMB up 110%, just a few of the recent big winners! Fresh ideas every month.

E-Mini Future Trading Service ESALERTS.COM $50 a month on stocktwits

SP 500 Futures Trading Advisory service. Hosted on Stocktwits.com… Great morning SP 500 Futures trading guidance and alerts! We keep you on the right side of the market direction and trades. Tax Favorable treatment, simple reporting to IRS, eligible for IRA and Regular Accounts both!

This service focuses on the SP 500 using my Wave based market behavioral models and then translates that to Futures Trading advice and alerts. Short term and long term views…morning updates, trades and more.

Contact Dave with any questions (Dave@themarketanalysts.com)